Summary of key points: -

- The return of foreign direct investment into New Zealand

- NZ house prices and the Kiwi dollar

- Aussie inflation increase defies the majority narrative

- USD sideways pattern of the last month not expected to last

The return of foreign direct investment into New Zealand

After a hiatus of almost seven years, there are now clear signs of foreign investors returning to buy New Zealand assets and companies.

Former Prime Minister Jacinda Ardern caused enormous damage to our economy when she banned new oil and gas exploration in a draconian decision in 2018. She scarred inwards foreign capital away for many years, as the message was that New Zealand governments could not be trusted as they change the rules overnight without consultation. Thankfully, the current Government has put out the welcome mat for offshore capital to invest here. Thay have been very busy tidying-up and rationalising the law and regulations to make it simpler and more straight forward to invest here.

According to a recent Simpson Grierson survey of 90 foreign investors who are investing in New Zealand, we are about to a see a lot more cross-border merger and acquisition activity over coming years. The Lactalis NZ$4 billion purchase of Fonterra’s consumer business’s, announced last week, may well be the start of a new wave of foreign direct investment. The National coalition government could enhance the level of foreign investment interest in their next term if they sell-off their shares in the electricity gen-tailers, and maybe add NZ Post, KiwiRail and Landcorp to the list.

The implications for the NZ dollar value are obvious if there are large and permanent capital inflows. It appears the Fonterra asset sale is denominated in NZ dollars, therefore Lactalis have some serious Kiwi dollar buying to do (if they have not already pre-hedged the FX risk).

The daily transactions across our FX markets fall into four distinct categories and they have differing impacts on the NZD/USD exchange rate: -

- Carry traders: Global funds and individual investors attracted into the higher interest yielding Kiwi dollar has been a hallmark of NZD/USD movements over the years. The “carry” trade, when NZ interest rates are well above those elsewhere, provides a yield pick-up, as well as FX gains on NZ appreciation if enough foreign investors are attracted in. We have not seen such inflows for more than five years now as NZ short-term interest rates have generally been set below those of the US. As we have stated previously, over coming months we may well see the return of the carry trade as US interest rates fall by up to 1.00% and NZ interest rates remain above 3.00%. At least the interest-gap impediment to buying the Kiwi dollar will be removed.

- Offshore portfolio investors: Global fund managers have been pretty lukewarm on NZ bond and equity markets for a number of years, as our equities in particular, have significantly underperformed US and European markets. As these fund managers progressively shift from over-weight US investment asset classes to underweight, they will be seeking out undervalued equities, bonds and currencies in the emerging and developing markets space. We have seen foreign holding levels of NZ Government Bonds increase this year as at the longer end of the curve our yields are above those in the US. As our export-led economic recovery transfers through into stronger GDP growth results, New Zealand will be back on the radar again for offshore portfolio investors over coming months. Australian fund managers will certainly be eyeing the NZD/USD cross-rate at 0.9000 as a well-rewarded entry point for buying into NZ investment assets. Local fund managers are likely to be re-weighting to lower global and higher NZ investment assets with the NZD/USD and NZD/AUD exchange rates at cyclical low points. If they are not physically re-weighting, they will be increasing FX hedge ratios on their international equity portfolios.

- Foreign direct investment: Traders and fund managers may come and go on a country and currency, however foreign direct investment has entirely different connotations for the NZ currency value, as the inflows are large and permanent. If offshore companies see the opportunity to buy undervalued NZ assets and businesses, now would be an attractive time to make such decisions. The Lactalis/Fonterra deal will not be the last we see in this space, and it points to an appreciation of the NZ dollar as the transactions are settled. Currently, 52% of foreign direct investment in New Zealand comes from Australia, with the US a long way back at 8%. The economics and financials will be stacking up very nicely at present for Australian companies across all sorts of industries to be expanding their footprint into the NZ market.

NZ house prices and the Kiwi dollar

Although this column has often loathed the connection that the economic cycles in New Zealand still seem dependent on the fortunes of residential real estate prices, one cannot ignore the fact that the “wealth effect” on consumer spending plays a significant role.

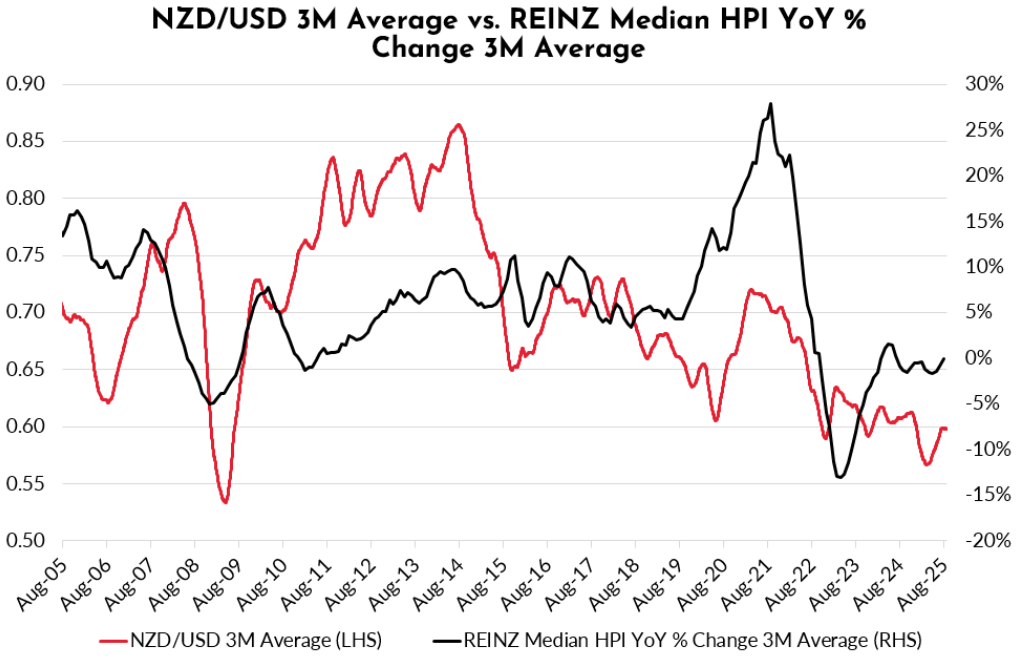

The chart below plots the housing market cycles with the fortunes of the Kiwi dollar. The residential property boom/bust cycles since 2005 are summarised as follows: -

- The 15% house prices increases in the 2005 to 2007 period prior to the GFC produced higher inflation, higher local interest rates and a stronger Kiwi dollar value to 0.8000 against the USD.

- Both house prices and the NZD exchange rate plunged over the GFC years.

- The strong economy in the 2012 to 2015 period was good for house prices and the currency; however, the NZD/USD rate plunged in 2015 due to lower dairy commodity prices and a stronger USD.

- Unprecedented super low interest rates over the 2020 to 2022 Covid years delivered spectacular house prices gains of over 25%, the Kiwi appreciated to 0.7300.

- Increased interest rates and a weaker economy through 2023/2024 caused a housing bust. A stronger USD sending the Kiwi down to 0.5500 briefly in 2025.

- Lower mortgage interest rates over the next 12 months and stronger economic growth in the regions spreading into Auckland, should combine to be mildly positive for house prices and the Kiwi dollar from current levels.

The second chart indicates that a move in the NZD/USD rate back above 0.6050 would break the downtrend line over the last four years. The Kiwi dollar is back to 0.5900 within a week (as anticipated in last week’s commentary) of the RBNZ inspired sell-off to 0.5800.

Aussie inflation increase defies the majority narrative

Australian inflation and employment trends in 2025 are proving to be less predictable and more volatile than what most would have imagined. Expectations that the Reserve Bank of Australia (“RBA”) would cut interest rates again in September now seem to be off the table as July inflation figures came in sharply higher than forecast. The AUD/USD rate was boosted to above 0.6500 as a result, contemporaneously a languishing Kiwi dollar, has driven the NZD/AUD cross-rate to 0.9000.

Annual Aussie CPI inflation jumping back up to 2.80% as previously subsidised electricity prices returned to market levels. There was no surprise with that well signposted change, however the financial markets seemed surprised.

If Australian GDP growth numbers this Wednesday 3rd September come out above the +0.50% forecast, the Aussie dollar will be in for another propulsion higher against the USD. Speculative FX market positioning still has the AUD heavily short sold, a situation that is hard to see remaining for too much longer.

USD sideways pattern of the last month not expected to last

The USD Dixy Index has travelled sideways over the last month as thin/illiquid northern hemisphere FX markets have not been prepared to sell the US unit lower, despite the pricing of a Fed interest rate cut later this month markedly increasing. The currency markets will be back to full noise this week and the continuing undermining of the Fed’s independence by the Trump regime will start to be more fully recognised and priced by the markets i.e. the US dollar sold lower.

US PCE inflation for July was precisely on prior market consensus forecasts. However, the real surprise in the data was that goods inflation was zero for the month (despite tariffs), the services side accounting for the total 0.30% increase. The markets now await the August Non-Farm Payrolls employment data on Friday 5th September, wherein a soft 75,000 increase in jobs over the month is expected. Such a low outcome will firmly add to the argument that the Fed now need to cut interest rates aggressively as the labour market has abruptly weakened, which the Fed were totally not expecting to happen. The dramatic employment slowdown is a game changer for the Fed, therefore significant shifts lower in the individual member’s dot-plot interest rate forecasts can be expected at the next meeting on 17th September.

The USD Index has returned to below 98.00 and another push below the previous low of 97.00 must be on the cards over coming weeks. Another spike lower in the USD Index will have the NZD/USD exchange rate pushing above the 0.6050 resistance line mentioned above.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

IN-vestment?

Surely this is foot-in-the-door-for OUT-vestment?

"The National coalition government could enhance the level of foreign investment interest in their next term if they sell-off their shares in the electricity gen-tailers, and maybe add NZ Post, KiwiRail and Landcorp to the list."

FFS...have we learned nothing?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.