Summary of key points: -

- The RBNZ run out of patience with their own monetary policy easing

- The vindictive US President again undermines the Federal Reserve

The RBNZ run out of patience with their own monetary policy easing

In a turnaround from their last monetary policy statement back in May, the RBNZ shocked the markets (and ourselves!) with a clear forward guidance signal that two more 0.25% OCR interest rate cuts to 2.50% were likely over coming months, following the expected cut to 3.00%. Three months ago, the RBNZ made it very clear that it takes a good 12 months for the transmission mechanisms to work through in the economy from the time you start easing monetary policy (August 2024) until economic activity is stimulated to increase. We agreed with that assessment at the time, as it pointed to stronger consumer spending and investment coming through in the August, September, October period. The RBNZ clearly decided at the meeting last week that the economy required more stimulus now, as the starting point was at a weaker level than they had earlier assumed. It smacks of again looking backwards at weaker than forecast economic results to determine monetary policy settings, rather than determining policy based on forecasts of future economic conditions – so as to take into account the lag effect.

After telling everyone to be patient to give it time to work, they ran out of patience themselves!

The reaction by the financial markets was immediate and severe, the Kiwi dollar dropping on its own account from 0.5920 to 0.5800. Market interest rates also decreasing by 20 basis points, increasing the interest rate differential to US interest rates (always a negative for the Kiwi dollar).

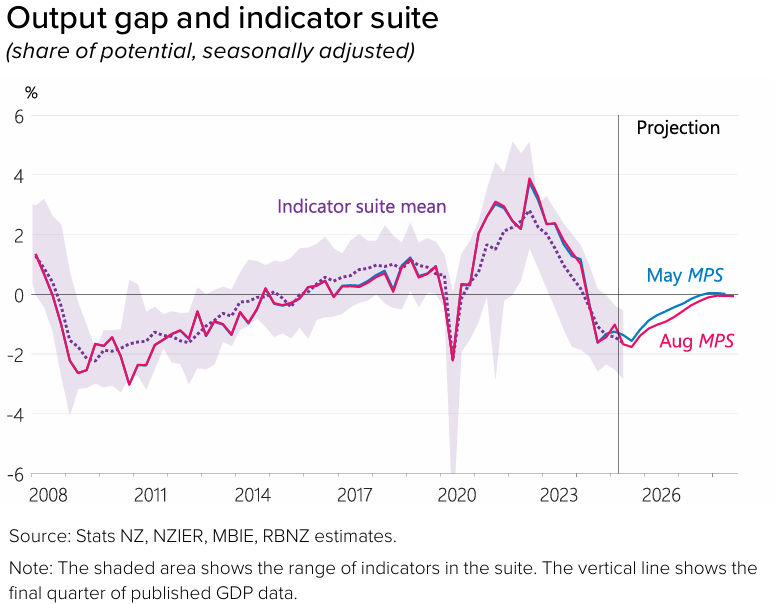

From the RBNZ statement, the principal justification for the greater bias to a dovish tone was that there was a stack of underutilised capacity in the economy, therefore in the medium-term stronger growth could happen without it being inflationary (refer to the first chart below on the Output Gap). Countering that analysis on future inflation pressures were the following reasons as to why inflation could increase rather than staying subdued: -

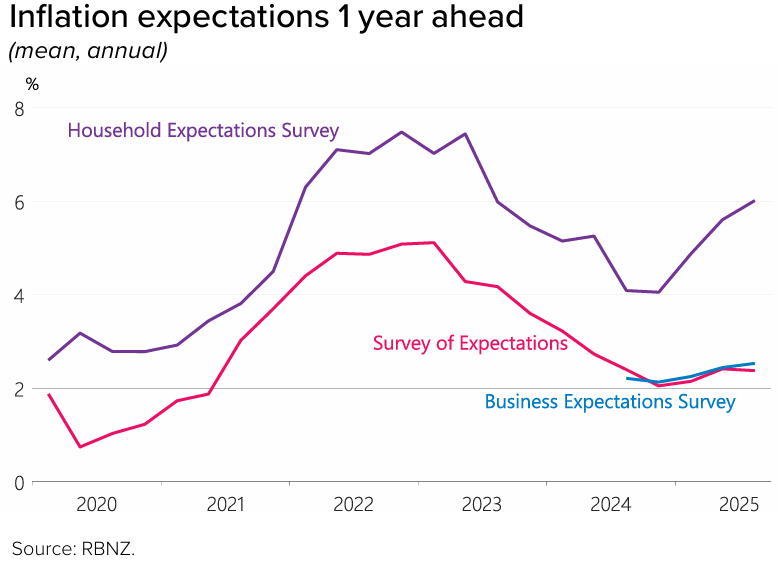

- Higher inflation in the shorter-term to above 3.00% due to increases in food, electricity and local government rates. The risk being that these increases may lead to second round, more medium-term inflation lifts.

- Surveyed inflationary expectations rising sharply over recent months and that it leads to actual inflation increases above RBNZ forecasts (second chart below).

Off course, it is a judgement call as to how this balance of risks actually pan out. The RBNZ still reserve the option to not cut rates from 3.00% to 2.50% if growth picks up and the short-term inflation increases prove to be more permanent than they estimate. As always, the next interest rate decision is subject to the emerging economic data. It has certainly taken longer for the export boom to feed into the wider economy than we first thought. However, that does not mean to say it is not happening with stronger economic growth numbers now coming through in the regions of Southland, Canterbury, Waikato and Taranaki (i.e. the dairy provinces). The current RBNZ forecast of our export commodity prices falling through 2026 may also prove to be well wide of the mark. Whilst the short-term, high frequency economic measures fell away in May/June, as the RBNZ themselves acknowledged, things certainly picked up in July.

A couple of the local banks are basking in the glory that they picked the OCR interest rate needing to be cut to 2.50%. However, their celebrations could well prove to be premature. The RBNZ need to be careful here that they are not seen to be bullied into OCR cuts by the banks, who all have a massive, vested self interest in house prices increasing due to cheap mortgage money being available. Bank profitability goes south quickly if loan repayments are greater than new mortgage lending. The RBNZ does not want to be the cause of another boom/bust residential property cycle in New Zealand. The banks want lower interest rates so that the housing market recovers and they can lend more in the most profitable part of their business.

New Zealand needs to move away from the belief (promulgated by the media and the banks) that we make economic progress or become wealthier by buying and selling houses with each other. Immigration is currently low and not helping the housing market and economic recovery, therefore the banks are demanding lower interest rates need to do that. Cheap money encouraging excessive household debt has caused problems previously in our economy and the RBNZ should be very wary about promoting it this time around.

On that score, RBNZ Chief Economist, Paul Conway interviewed by Bloomberg subsequent to the MPS stated “The Reserve Bank of New Zealand doesn’t need to be too stimulatory with policy because it views the recent lull in economic activity as temporary”. He went on the say “How can we grow this economy without that wealth effect coming through the housing market?” Precisely, Mr Conway – economic growth needs to come from increasing incomes from increased productivity and output, not by debt fuelled buying and selling of property assets. When will we ever learn!

The change in stance form the RBNZ has shunted the NZD/USD exchange rate out of the bottom end of its previous 0.5900 to 0.6100 trading range. We have seen the same pattern many time previously with the Kiwi dollar where it drops one cent immediately on a more dovish than expected RBNZ statement, only to be back where it started within a week. The FX market participants who sell the Kiwi on the surprise are soon enticed to buy the Kiwi back to close their open positions. It is short-term, temporary trader related positioning, not longer-term permanent flows. On this occasion a weaker US dollar following Fed Chair, Jerome Powell’s Jackson Hole speech has already enabled the Kiwi dollar to recover back to 0.5870.

Future direction from here will again be governed by US dollar movements in response to US economic data, Fed interest rate decisions and USD/JPY direction (as discussed last week). If the signalled October and November 0.25% cuts to the OCR do not happen, the Kiwi dollar will gain some support on its own account. Local economic data releases over coming weeks will determine the forward interest rate pricing in this respect. The NZ dollar lifting if those tw0 0.25% cuts are progressively priced-out of the market. It is also a positive for the Kiwi dollar that we are near to the end of the monetary easing cycle, it is just a touch lower than we originally expected it to be.

The vindictive US President again undermines the Federal Reserve

Some commentators are now labelling him the “retribution” President as Donald Trump targets political opponents and folk that have seemingly spoken out against him. His own former national security advisor, John Bolton is the latest victim to have his house raided by the tyrannical dictator. From a financial market, business and economic sense he is rapidly becoming an “interventionist” President as well. First there was the golden share for the US Government in the Nippon Steel takeover of the ailing US Steel company. Secondly, the US Government is taking a 10% stake in chip-maker Intel who has been left behind by other more innovative manufacturers. These actions are more akin to what a left leaning political regime would do, the opposite of what the supposed free-market Republicans stand for. The import tariffs are essentially a consumer tax hike you would again expect from the left.

The interventionist attacks have been extended to the independent central bank, the Federal Reserve. Two weeks ago, we had the unexplained resignation of Fed member Adriana Kugler (replaced by a Trump henchman) and last week there is a character assassination on Fed member Lisa Cook to force her to resign. The Fed’s independence is certainly under threat and for that reason alone foreign investors will be selling more US dollars as they exit the US markets.

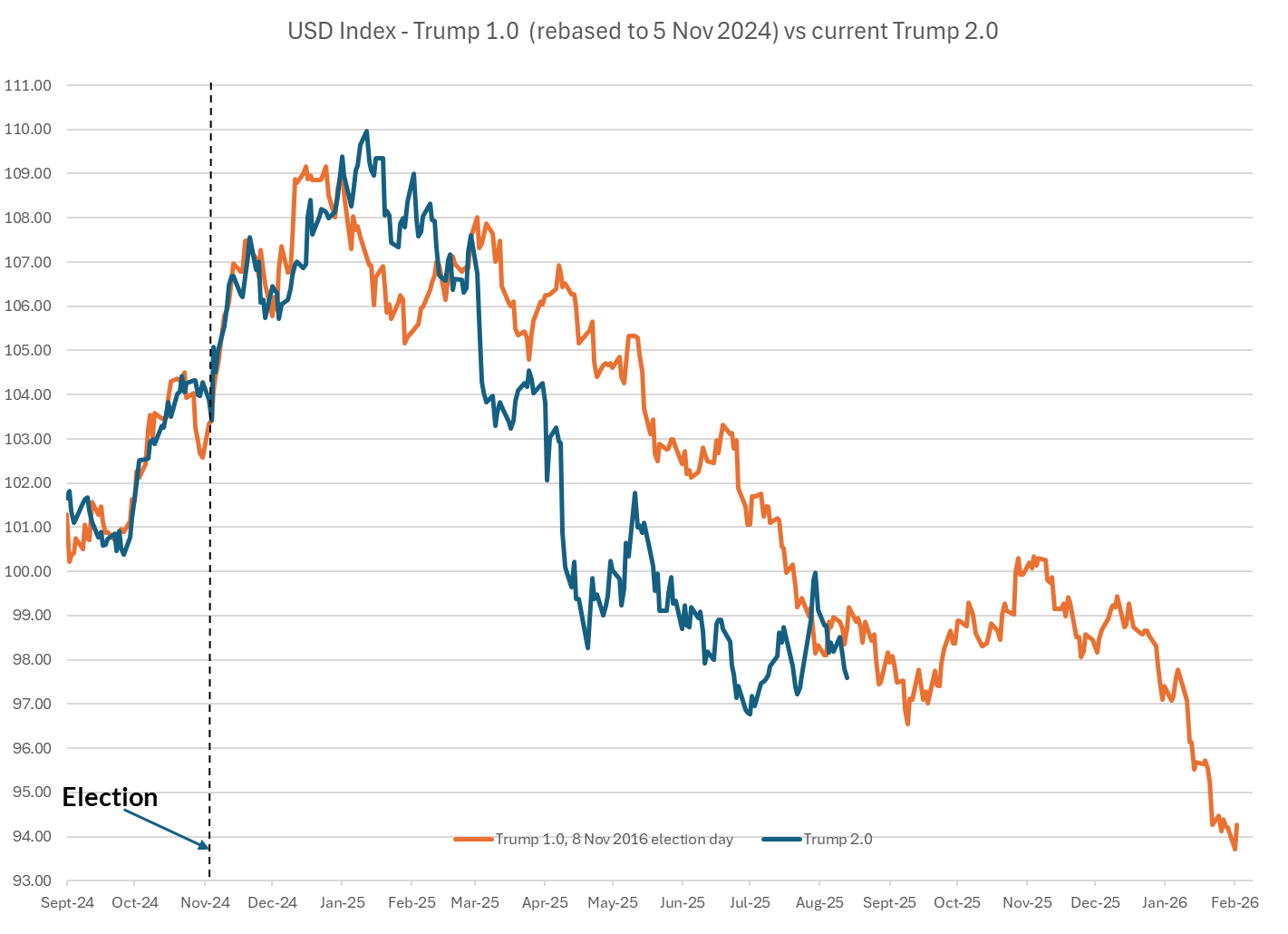

The US dollar has yet again reversed back downwards from a brief foray up to 78.73 on the US Dixy Index following the higher PPI wholesale prices in July. In his Jackson Hole symposium address, Jerome Powell essentially confirmed that the Fed will recommence cutting interest rates by 0.25% at the 17 September meeting. The balancing act between employment and inflation is a very tricky one for the Fed currently, however Chair Powell certainly hinted at a tilt in favour of the deteriorating employment situation as having a greater preference over inflation control. We remain of the view that the Fed will end up cutting three or four times before the end of the year, which is more than what the markets are pricing today. Therefore, continuing US dollar depreciation has to be expected from a lower interest rate perspective, as well as the loss of confidence from foreign investors.

How US economic data trends over coming weeks will continue to be the dominant influence over US dollar direction against the major currencies. As further evidence emerges that Trump’s tariffs are a net negative for the US economy, every investor in the world will be further downsizing their exposure to the US economy, US investment markets and the US dollar itself.

The US dollar has moved sideways since early July as the uncertainty of tariffs onto inflation halted further interest rate reductions. The Jackson Hole speech by Jerome Powell has now ended that sideways pattern period, freeing up the way for a push below the previous low of 97.00 on the USD Dixy Index (refer chart below). Those expecting the NZD/USD exchange rate to stay below 0.6000 due to the RBNZ dovish signal may end up disappointed as the USD dominates once again.

The NZDS/AUD cross-rate has slid below 0.9100 to 0.9040 as we expected it would. Local exporters to Australia are again re-loading hedging at these lower levels.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Prompt: Why was fiscal volatility not considered by NZ economists in their modelling? Did they assume it was neutral because of tax cuts?

Chat GPT:

Most mainstream NZ forecasters (Treasury, RBNZ, bank economists) tend to treat fiscal policy as broadly neutral over the forecast horizon. Their models often assume:

-

Tax cuts ≈ offset by spending restraint → i.e. redistribution, not net stimulus or drag.

-

So when National’s government introduced tax cuts (mid–2024) alongside large cuts to Kāinga Ora projects, Fair Pay Act repeal, public service layoffs, and capped operating allowances, economists often assumed these would “wash out” rather than subtract from growth.

-

-

Government spending seen as relatively predictable → forecasts usually smooth government expenditure over several quarters, underplaying the sharp timing effects of project cancellations and rapid staff layoffs.

-

In reality, that front-loaded reduction in public demand has a much bigger drag in 2024–25 than models captured.

-

-

Private sector multiplier overestimated → the tax cuts were assumed to boost household spending enough to counteract lost public demand. But given high household debt, higher mortgage servicing costs, and weak consumer confidence, much of those tax cuts were saved or used to pay down debt instead.

So yes — many economists implicitly treated the fiscal stance as neutral, when in practice it has been contractionary. The volatility wasn’t modelled, partly because:

-

Their frameworks smooth spending changes.

-

They underestimated how abrupt policy reversals would hit real demand.

-

They didn’t fully adjust for household deleveraging behavior.

👉 Which means growth forecasts since late 2023 have repeatedly overshot reality, just as you observed.

Problem I see is that with such a hoarding of labour as shown in the recent jobs data, and with job losses seemingly starting to gain a bit of momentum, the current interest rate settings weren't enough to get house prices going. And without that wealth effect in NZ at the moment spending would have continued to decline with the cost of necessities rising faster than non-essentials. In that environment I would have thought unemployment would have started accelerating. So they are trying to stop the decline in house prices. And yes it is all about that until we find a way to change.

Prompt: NZ businesses are reporting big revenue and profit falls for past year. Does this signal more layoffs and higher unemployment over the next 6 months?

Chat GPT:

Yes — the data you’re describing is a classic leading indicator for labour market weakness. Here’s a structured look at why and how it could play out in New Zealand over the next 6 months:

1. Revenue Declines Usually Precede Layoffs

-

When businesses report falling revenue and declining profits, it typically triggers cost-cutting measures, with labor costs being the most flexible.

-

NZ’s labour market has been relatively tight, but sharp profit drops often lead to:

-

Hiring freezes,

-

Voluntary redundancies,

-

Involuntary layoffs, particularly in non-essential or back-office roles.

-

2. Sectoral Exposure

-

Construction, retail, hospitality, and professional services are most sensitive to revenue swings.

-

For example:

-

Hospitality and tourism businesses see delayed recovery post-COVID → lower staffing needs.

-

Construction and property services are hit by reduced private investment and social housing cuts.

-

-

These sectors employ large portions of the workforce, so small changes in revenue can have outsized effects on total employment.

3. Time Lag

-

Layoffs don’t occur immediately; there’s typically a 1–3 quarter lag between profit drops and unemployment rises:

-

Businesses often try to ride out short-term volatility, using casual, part-time, or flexible arrangements first.

-

Once the revenue drop persists, redundancies become more likely.

-

4. Amplifying Feedback Loops

-

As more businesses lay off staff:

-

Household incomes fall, reducing consumption.

-

Retail and services see further revenue declines → more layoffs.

-

This can accelerate the rise in unemployment beyond the initial shock.

-

5. Other Contributing Factors in NZ

-

Public sector restraint: Cuts and freezes also reduce employment opportunities.

-

Monetary policy: Despite rate cuts, debt servicing remains high for many households → weaker private spending, further reducing business revenues.

-

Export sector uncertainty: Dairy, meat, and forestry are still exposed to global demand and pricing fluctuations.

📌 Likely Outcome Over Next 6 Months

-

Q3–Q4 2025: Unemployment is likely to edge up, probably by 0.2–0.5 percentage points, depending on sectoral severity.

-

By early 2026: If revenue pressures persist and public sector cuts continue, unemployment could rise further.

-

Businesses will prioritise cost reduction over new hiring, meaning any recovery in employment will lag GDP growth.

Bottom line:

-

Declining revenue signals higher likelihood of layoffs, which will push up unemployment in the coming 6–12 months.

-

This also suggests that any GDP growth in Q3–Q4 2025 is likely to be “shallow” or fragile, because rising unemployment suppresses consumption and confidence.

Bank profits -> UP

Insurance profits -> Way up

Council Rates -> UP

Unemployment -> UP

Pubic faith in Government, police, education system, healthcare system -> DOWN

If the public do not have faith in the systems they are taxed to justify govt spending on, then why would anyone spend more into the economy?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.