ASB economists say the volatility of our quarterly GDP data (produced by Statistics NZ) means they gauge other 'high frequency data' closely.

Our most recent GDP figures, for the September quarter showed a rise of 1.1%, while the June quarter figures were a drop of 1.0% (revised from a first announced 0.9% drop).

In a 'GDP Special Topic' economic note, ASB economist Wesley Tanuvasa says one of the downsides with GDP data in New Zealand is the long lag between the release date and specified quarter.

"For example, the next release of GDP for the 2025 December quarter is on March, 19, 2026 – almost 12 weeks after the December quarter ended. Conversely, the United States publishes preliminary GDP estimates approximately four weeks after the quarter, providing a more timely gauge of economic activity."

Tanuvasa says the idea is that a longer lag provides Stats NZ more time to deliver a more accurate read of the real economy, with less volatile revisions or quarterly movements.

"Recently, this has not been the case. Part of this is because of how the seasonal adjustment is being handled," he says.

"It's low-hanging fruit to keep blaming Stats NZ for everything. So, we won’t."

Tanuvasa says some of the volatility is also due to the "granular data" that underlies GDP becoming less reliable, reflecting things like declining survey response rates.

"Overall, while data availability may be higher now than yesteryear, data reliability is probably a bit worse, particularly following the Covid-19 pandemic period," he says.

"The implications of ‘worse’ GDP for policymakers are that it is now doubly bad, rather than a tradeoff – i.e.: it’s lagged, and the read isn’t that great."

This heightens the need to weight high-frequency indicators of economic activity, Tanuvasa says.

He says the Reserve Bank (RBNZ) has been transparent about weighting timely (but partial) activity indicators.

For example, the RBNZ's cut to the Official Cash Rate in August 2024 - a sharp deviation from its May 2024 guidance that signalled the chance of a rate hike in the OCR projection - was supported by judgement surrounding broad-based deterioration in a variety of high frequency data.

"There is a lower signal-to-noise ratio in high frequency data. But collectively and directionally, the data can provide economic signal."

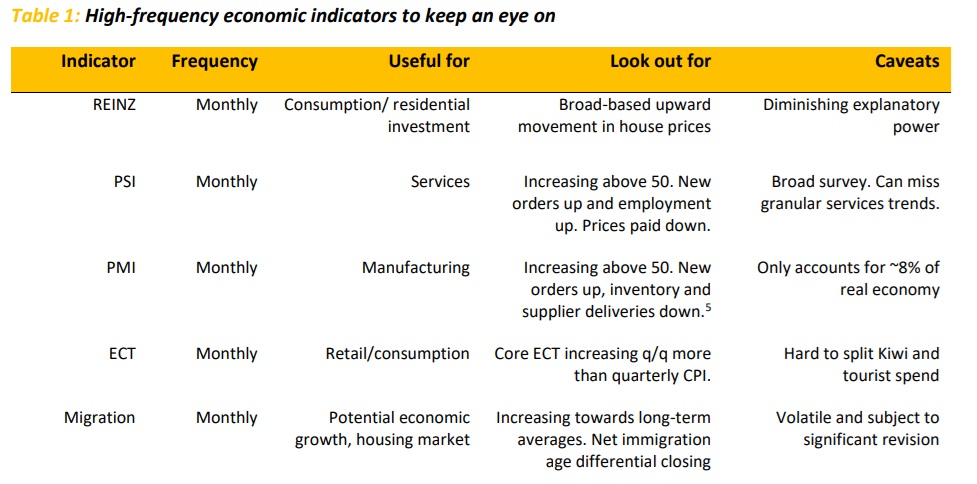

The high frequency data Tanuvasa suggests tracking includes: the REINZ monthly sales figures, the monthly BNZ-Business NZ Performance of Manufacturing and Performance of Services (PMI and PSI) Indexes, Stats NZ's monthly electronic card transactions (ECT) data and Stats NZ's monthly migration figures. He includes the following table:

Tanuvasa said since the September quarter GDP figures were released on December 18, there has been "a variety" of high frequency data that has improved.

He says the more recent data "have shown more of a tailwind than a headwind".

"...Our judgement is that the economy is in a better spot relative to the RBNZ’s November MPS [Monetary Policy Statement] projections."

With CPI inflation now outside of the RBNZ’s 1% to 3% target band at 3.1%, there is evidence that the downwards trend in "stickier" inflation segments is slower than previously assumed.

"This suggests that the speed limit of the NZ economy is lower than currently thought."

While an appreciation in the value of the New Zealand currency may work to lower tradables (imported) inflation, "much of this is contingent on a volatile US policymaking environment maintaining USD weakness".

"We think this judgement is too uncertain for the RBNZ to hang its hat on. We do not give credence to the view that the NZ General Election will prevent the OCR increasing before November 7 if the inflation outlook calls for it – the central bank is independent, so too is its assessment of policy settings.

"Taken collectively, a stronger economy and higher inflation move forward the timing of policy normalisation. An underlying issue around the timing of the hiking cycle depends on whether the RBNZ would prefer to jawbone the market to tighten financial conditions in a way that delivers on-target inflation (OCR hikes later) or if they would prefer the use of its blunt interest rate tool (OCR hikes sooner)," Tanuvasa said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.