Kiwis invest a lot in housing. We know that. But the Reserve Bank has found that based on returns available we could have been justified in investing EVEN MORE into housing.

New Reserve Bank research and modelling shows that in past decades NZ investors could - from a strict risk-return portfolio perspective - have actually allocated ALL of their portfolio investments into housing.

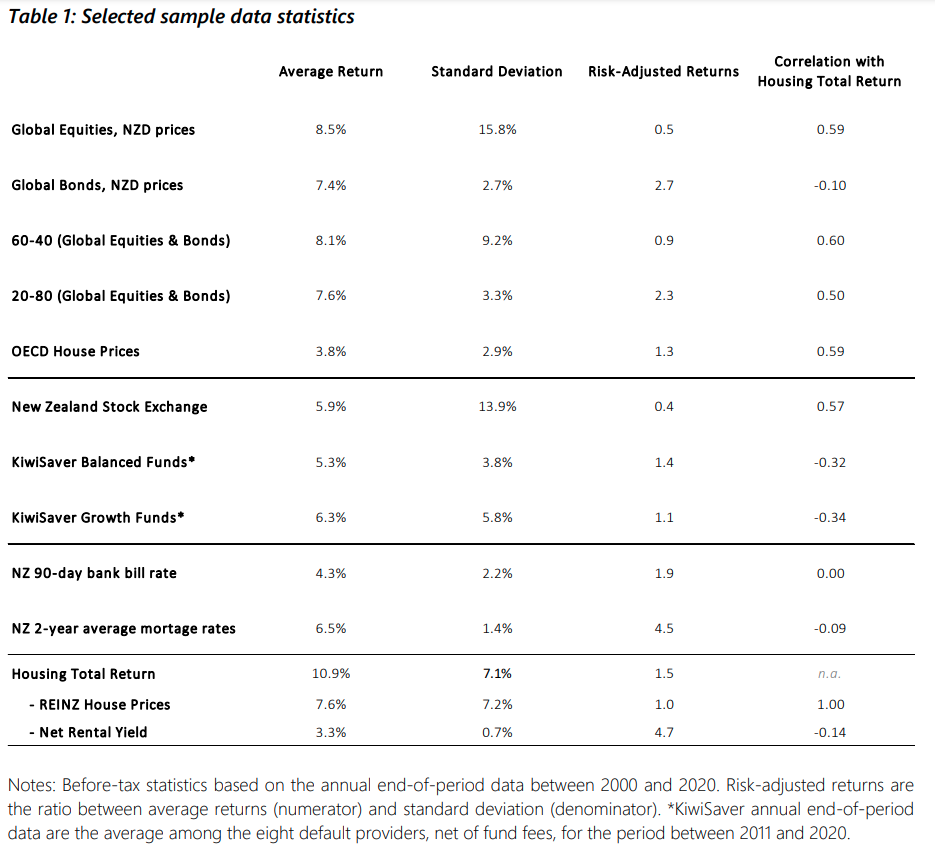

The research/modelling found total returns on housing as an investment averaged 10.9% over the period from 2000-2020, which was higher than any other asset returns in their sample.

The paper, titled: Housing as an Investment Asset in New Zealand, authored by RBNZ's Patrick Aguiar Carvalho, Ben Baker and Ashley Farquharson, is part of research undertaken by the Reserve Bank (RBNZ) to better understand the sustainability of house prices in New Zealand. RBNZ chief economist Paul Conway gave a speech last Thursday that summarised some of the research.

Both that speech and the analytic note outlining housing as an investment asset point to the fact that as of March, 2021, some 57% of New Zealand household assets were tied up in housing.

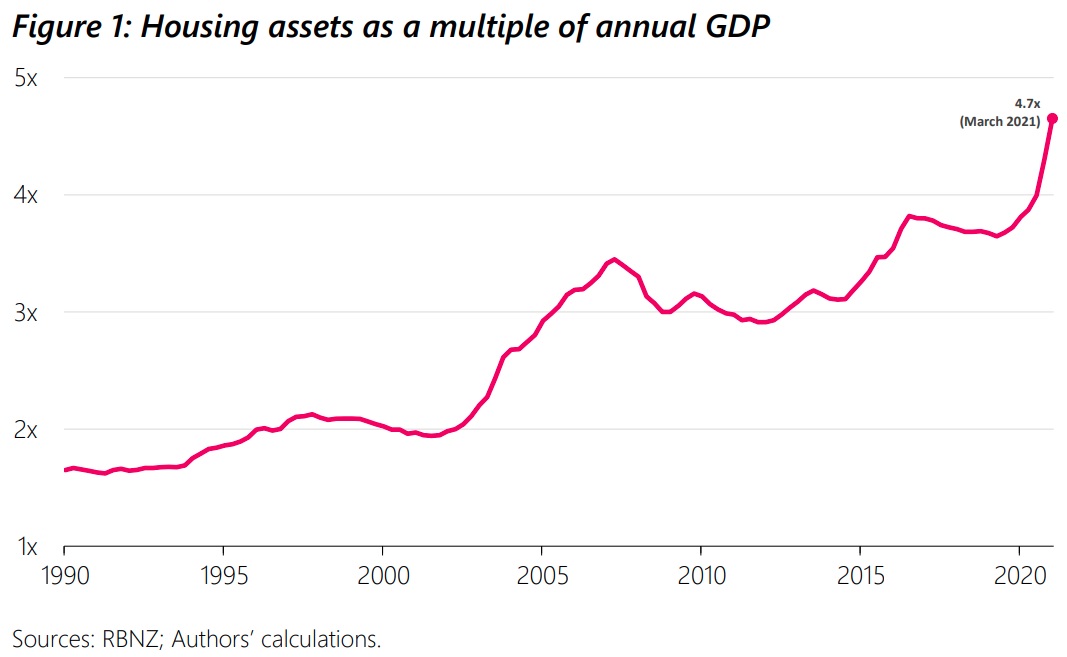

"The domestic housing market plays a pivotal role in the New Zealand investment landscape. The aggregate value of land and housing in New Zealand, including rental and owner-occupied properties, is currently around $1.5 trillion. That is close to five times the size of New Zealand’s annual gross domestic product (Figure 1) and over seven times the value of all companies listed in the New Zealand stock exchange," the authors say.

"From a balance sheet perspective, housing constitutes over half of all domestic household assets. Likewise, financial institutions too have a significant exposure to housing, with close to two-thirds of all domestic bank lending in the form of mortgage debt. As kaitiaki (guardian) of the financial system, the Reserve Bank of New Zealand – Te Pūtea Matua therefore has a close interest in how the domestic housing market evolves, being an important driver of both price and financial stability."

The authors say a key feature determining housing investments regards their favourable tax treatment in the New Zealand context.

"Work by the Treasury and the Inland Revenue Department shows that for a representative investor, housing marginal effective tax rates can be close to five times lower than other investment strategies such as foreign shares and domestic superannuation funds, they say.

"Importantly, once these marginal effective tax rates are taken into account, our model results suggest that, from a strict risk-return portfolio perspective, investors could have allocated all of their portfolio investments into housing in past decades.

"Therefore, one could argue that actual housing allocations in New Zealand household balance sheets could have been even higher than already-large present levels."

The authors say, however, there are some features of housing investment not captured in their modelling exercise that could explain why this has not occurred: the prevalence of credit constraints (which may have reduced the number of aspirant borrowers who could obtain mortgage approvals), the discrete nature of home ownership (i.e. the nature of the housing asset being lumpy, whereas stock market shares can be bought in smaller value fractions), and other potential motivations for portfolio investment other than a risk-return framework (e.g. rental-property investors vs. homeowners).

"...All of which would be a prominent addition to the current modelling work in future research streams."

(Sources of information in the table include: MSCI ACWI Index, NZD prices (Global Equities, including net dividends); Hedged Bloomberg Barclays GlobalAggregate Bond Total Return Index, NZD prices (Global Bonds); Organisation for Economic Co-operation and Development (OECD); Financial Markets Authority New Zealand (KiwiSaver data); Bloomberg, S&P/NZX All Index (New Zealand Stock Exchange—NZSE); Real Estate Institute of New Zealand (REINZ House Prices); Reserve Bank of New Zealand (net rental yield estimates); Authors’ calculations.)

Carvalho, Baker and Farquharson say the results of their modelling do not validate house price growth path in the past two decades as sustainable or rational, "as the modelling exercise purely takes past asset price changes as given in order to estimate portfolio allocation shares".

"Past performance is no guarantee of future results. There is no surety that future housing returns will keep up with past rates. If anything, there are plenty of emerging factors pointing to the opposite direction. That includes tax and regulatory changes, approaching limits to the decades long decline in global interest rates, as well as already stretched housing sustainability measures.

"As such, retail investors in New Zealand should beware of placing their bets on seemingly 'forever rising' house prices. Housing may be a valid asset class to invest in, but it is not without risks and needs to be considered as part of a broader, diversified and well-informed wealth portfolio strategy."

The authors say the large role of residential property investment has come at the expense of diversification in household’s balance sheets.

"For many New Zealand families, housing is the largest — if not the sole — investment asset. That intensifies the exposure to both individual property and housing market risks of unfavourable events eroding the value of lifetime savings.

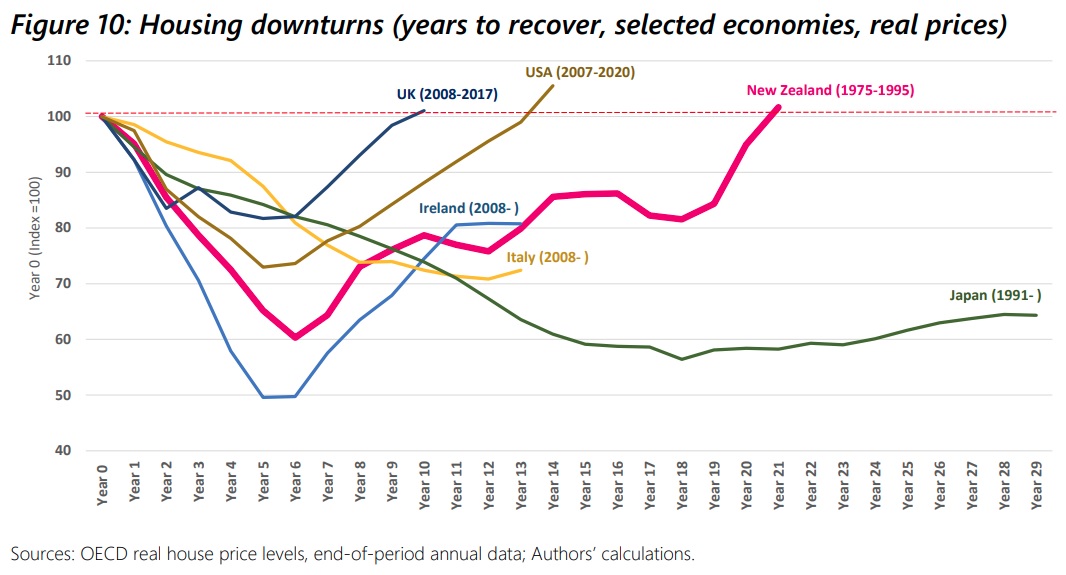

"In addition, such a prominence of New Zealand’s housing market comes with unintended risks and costs. That includes the wider social costs of the potential financial stability risk from having such a very large investment egg in our national wealth kete. Housing downturns can have a severe and prolonged impact not just on individual portfolios, but also feature wider social costs in terms of aggregate financial stability risks, particularly the impact of housing demand on the likelihood and severity of macroeconomic boom-bust cycles.

"For the seasoned retail investor, international and domestic experiences provide a cautionary tale. Figure 10 depicts how many years it took for housing markets in selected economies to recover — or are still falling short of previous house price peaks. Of note, the New Zealand house price levels took twenty years to recover following a downturn in early 1970s."

Going forward, therefore, there are reasons the portfolio share in housing should decrease, the authors say.

Favourable tax arrangements, strong migration intakes, declining neutral interest rates, and binding zoning restrictions have all been documented as forces behind the observed rise in house prices over an extended period.

"However, there are many caveats leaning against these factors going forward."

First, tax arrangements and regulatory constraints can, and do, change. The elimination of interest deductibility and extension of the bright-line property rules may dampen future returns for housing investors. On the regulatory front, for instance, new intensification rules will enable greater supply of housing in urban areas, they say.

Second, several indicators already point to unsustainable house price levels in New Zealand, potentially leading to years of subpar price growth or to a sudden correction in New Zealand’s housing market. This includes the approaching limits to a decades-long trend of declining global interest rates, which has supported a high degree of international synchronisation in house price growth.

Third, the retail investor must accept the fact that a house price index, although an important proxy measure, does not capture idiosyncratic risks inherent to buying a particular house.

"Put simply, in the face of random events negatively impacting a low percentage of houses, national house price indices do not necessarily reflect the risks that individual investors face once they realise their housing assets are depreciated by, say, bad tenants, unexpected leaks, earthquakes, or floods — particularly as climate change risks increasingly exposes parts of the New Zealand housing market in coming decades."

78 Comments

Damn, if I was smart I would have gone all in on stable doors as well.

The stable was too unaffordable to build so the horse can just walk around the doors. Nice doors though.

We are gonna be one of those historic examples of irrational speculation and delusion like the Tulip Mania, the South Seas Bubble, the Mississippi company, the railroad mania and the stock market bubble of 1929.

You forgot the ol' rat poison

Everyone will soon wish they had forgotten it. Plenty got rich on it but most lost money on it.

Everyone will soon wish they had forgotten it. Plenty got rich on it but most lost money on it.

The ol' rat poison? Not correct. Even if they had been dollar cost averaging weekly or monthy since the peak, that's only an approx 5-6% loss.

In late 1987 people felt the same way about the NZ Share market darlings ......

Some where...Over the Rainbow...way up high :)

Well that does not make sense but housing sure made dollars in the last 20 years and why not ride a good horse when it has a great track record. Like all good thoroughbreds they need to be rested for a period before the big race. It is a big race now so the pure thoroughbreds will stand out relative to the not so pure ones - much like equities and crypto - good luck picking winners this time around when things will be very ugly - the interest rate market is telling you how ugly - 3 year IRS dropped from 4.60% on 15th Jun to 3.90% on 1 July (don't hold your breath for mortgage rate cuts) and the market is now pricing the OCR peak at 3.91% (high of this pricing was 4.73%) and the RBNZ's May Projection for a peak was 3.95% - wait until this backs off to circa 3.50% and longer term yields are lower as a result - will banks be able to justify 2.5% - 4.0% margins in fixed rate area?

3 year IRS dropped from 4.60% on 15th Jun to 3.90% on 1 July

What is the 3 year IRS?

Agreed. We are about to experience the 87 Share market moment, but for property speculators.

You are going to get two for one..... Property and Equities, Equities have way further to fall.

Yep. Got my equities list ready as well.

Lol averageman, the hope is writ large in your comment. Envy is writ large. Tragic that you either (a) didn't have the income or the cash to join in or (b) didn't have the investment sense to join in.

Here's a tip for you, when Labour get voted in, house prices go mad. Bank it next time Averageman. And on your wish for "speculators" (whomever they may be) to take a bath, there are plenty out there that have taken a long horizon and have made shit ton's because they know that the housing market ALWAYS goes up (in case you haven't noticed, they aren't making land anymore). If it takes 20 years, it still goes up. Just like the sharemarket.

Bloomberg has us as the world's bubbliest housing market: https://www.bloomberg.com/news/features/2022-06-21/cooling-real-estate-…

No wonder we have such a low wage structure and the country as a whole is so poor. And no wonder so many of us leave NZ for better jobs and incomes.

Little room for productive enterprise. Everyone's onboard the SS NZ Housing.

That years to recover chart sort of kills the "Property doubles every ten years" adage.......

But the narrative also supports the 7-10 year prophecy. The RBNZ might have a Christian faith alongside the Maori spiritually framework.

Houses (not apartments) have increased by at least 100% of the initial purchase price every 7-10 years on average as long as records have been kept. It's not a forecast or investment criteria, it is an irrefutable fact. Also note, no one says they double the current price every 10 years, that would be a parabolic extension. We can all have our own views, but do not deny reality.

TK - what countries and records are you referring to? I suspect you are only looking at more recent NZ history, which is very misleading. Records kept for 400 years of prices for the same street of houses along a canal in Amsterdam showed that prices had remained about the same over the whole period in real terms. While there were periods (sometimes quite long), where prices rose faster than inflation, they have always reverted back to the mean.

And here in NZ, prices have shown the same tendency. As the article above shows prices took nearly 2 decades to recover from their peak in real terms after the 1970s bust. That bust was masked by high inflation. There were also big drops during the 1930s depression. House price increases since the mid-1980s were enabled by deregulation of banking, which enabled very easy access to credit. Our latest wild speculative boom was driven by high net immigration pre pandemic and record lows in interest rates coupled with supply constraints. This boom has probably come to an abrupt end, toppled by the overwhelming weight of housing debt and increased interest rates. History would indicate prices will take years, maybe decades to recover.

It is also an irrefutable fact that wages/salaries have not doubled every 7-10 years.

Fun little Excel exercise: If a house costs $1 and doubles in price every 7 years, in 147 years it would cost $1,048,576.

Year 0 must have been 1875 for a 7 year doubling, or 1822 for 10 year doubling. Checks out.

Oh and to be true houses would need to cost $2.1m in 2029.

- If house prices double every 10 years, in 50 years time a $1m house will be worth $32m.

- Wage inflation at 3% p.a. will turn a $60k median salary into a $260k median salary.

- The house price to income multiple goes from 17 to 120

- 20% deposit on $32m = 25 years salary. 10 years into saving, the house is now worth $64m. Need to save for another 29 years for that 20% deposit.

Sounds doable.

NZD, did you read what I wrote? I explicitly said the original purchase price. If I buy a house today for $1m in 50 years that would be $5m not $32m if it doubles the original purchase price every 10 years. This is conservative as well.

It's 32 Mill if it doubles every 10 years

Yr 1. 1M

Yr 10. 2M

Yr 20. 4M

Yr 30. 8M

Yr 40. 16M

Yr 50. 32M

You might want to check your numbers Yvil... Unless I'm missing something you've doubled them every 10.

House built in 1990 for $100k. +100% = $200k in 2000. $300k in 2010. $400k in 2020. That doesn't work?

Yes, it's too conservative isn't it!

Houses (not apartments) have increased by at least 100% of the initial purchase price every 7-10 years on average as long as records have been kept.

This is not doubling every 7-10 years - this is linear.

Multiply by the number of years since sale divided by 7 or 10 (take your pick).

Whose initial purchase price are we talking? The initial build price, or the homeowner's purchase price?

E.g. in 2000 I buy a house for $200k. In 2010 I sell that house for $400k (100% increase). It's now an initial purchase for home owner B, so 100% increase on $400k is $800k. Doubling every 10 years.

Or house built in 1990 for $100k. $200k in 2000. $300k in 2010. $400k in 2020. That doesn't work either?

And, great example. My parents first house was very close to your example: $107k in 1989 (4 bedroom, built by one man in 6 months).

Same house today is estimated 'worth' around $1.1M. But, $428k would be quite a reasonable estimate of it's true value, if DTIs were the same.

So perhaps yes, he should have specified initial build price.

Can someone who is not the initial purchaser make the initial purchase? Or are they simply buying into/taking over an existing legacy?

Or in Real Estate agent parlance:

- Perfect for first home buyers!

- Don't miss out!

The people who use that as an investment rule probably haven't thought hard about what 'real prices' means.

The adage is a recent anomaly caused first by high inflation and later by consistently falling interest rates. Recent meaning a few decades - not a long time in the cyclical meanderings of asset classes.

“At the end of every seven years you shall grant a release. And this is the manner of the release: every creditor shall release what he has lent to his neighbor. He shall not exact it of his neighbor, his brother, because the Lord's release has been proclaimed. Of a foreigner you may exact it, but whatever of yours is with your brother your hand shall release. But there will be no poor among you; for the Lord will bless you in the land that the Lord your God is giving you for an inheritance to possess— if only you will strictly obey the voice of the Lord your God, being careful to do all this commandment that I command you today. ...

Blessed is he who, in the name of charity and good will, shepherds the weak through the valley of the darkness, for he is truly his brother's keeper and the finder of lost children. And I will strike down upon thee with great vengeance and furious anger those who attempt to poison and destroy My brothers.

Is CWBW still in the basement?

Ireland's house prices actually doubled over the last 10 years. Just don't zoom out too far on the graph, or you'll see the 70% fall that preceded it. Prices are still 10% off where they were in 2007's peak.

it is not how much you crash, or how fast you crash, it is about how long you are underwater. Some can hold their breath for a period of time but no one can hold their breath forever

Hi Miguel - can you plot your chart with Fig.10 please.

Would love to see it. Many thanks!

I think NZ will continue to be mismanaged very badly in the next decade, and GDP and wealth per capita will decrease.

Yes. Don't be surprised if they double down on the bubble.

Yes. As ridiculous as it sounds, this card is on the table. In my humble opinion, this would be the final chapter in a lifestyle we have known since our birth. The following, crash or cyber attack on markets will be the final move to usher in the Great Reset (or Great Con).

A one way ticket for you Xi. Back to the land of your fathers.

What a huge waste of resources and time. Imagine if we had invested in clean energy. We'd be carbon neutral and wouldn't need to plant a billion pine trees in the next x years.

We might even have a second harbour crossing in AKL.

TimeToPuke.

Massive waste of a generation of productivity shovelled across to bank CEO's bonuses.

Yup! The dam across the Clutha at Tuapeka Mouth which was meant to be done with the Clyde Dam workforce next, but which Dave Lange's government chickened out on, is looking more and more attractive, especially with the 20/20 hindsight we now have.

TimeToPuke

I see what you've done here; underrated comment :))

Be quick!

So, 2 years before we know anything about the direction of this puppy. Look how consistent the fall gradients are in this sample

No crash in the example has started as quickly as ours, not even Japan or Ireland

Or from such heights detached from people's incomes.

Or in a time of such strong inflation globally (= sustained interest rate rises).

Land owned by households as a % of GDP at the end of 2021.

-Japan 130% (peaked at 325% in 1990)

-Australia 330%

-New Zealand 520%

Nothing will stop the debt deflation spiral in NZ after the RBNZ's 100 bps rate hikes in the next 45 days until the rock bottom is reached.

I've seen this before and discussed with others. Some of the rebuttals included 'but Japan doesn't have immigration and they have an ageing popn'.

There's little point responding.

Plenty of parallels with Ireland (didn't they have a whole lot of migrant builders head home?).

As for Japan, we also have an aging population they're called Baby Boomers and many may want to release their wealth that's tied up in housing equity in the near future.

A literal "swan dive"...lets see the soft landing after that, or am I Taking the Piss...?

RBNZ will NOT hike the OCR by 100 bps in the next 45 days. They are seeing what is happening in markets and so they will tread lightly, or as lightly as they can to be seen to be attempting to fight the inflation dragon. They will come with another 50 point move and at the same time acknowledge that the incoming data is pointing to a more challenging landing for the economy than their pilot Governor Orr had previously thought possible. They will advise that weather conditions are going to cause a little more turbulence than what they had previously thought. The might even hand out sick bags which will be needed by many. The moment they move to 25 bps cuts, ie expect the total of the next two moves to be 75 bps, the markets will have had enough information to understand the world economy is in big trouble and interest rate markets will be reflecting that so a period of pause will be coming. I'm almost hearing the truck reversing beeping sound....

Exactly. If they pause at 2.75 before cutting some time early / mid next year the preciseness of my prediction will be out but the spirit of it won't be.

I reckon this time next year it will be somewhere between 1.25 and 1.75

Exactly, just like the Fed. We like to follow America for some ungodly reason. Rates will fall again because Wall Street threatened to throw the toys out of the cot.

Everyone's addicted to welfare

Cut and paste from the actual summary of findings:

With more than half of all household wealth in land and houses, New Zealanders have one very large egg in their wealth kete (basket). We investigate if this housing egg is oversized from a risk-return portfolio perspective

Tha analytical notes are a little embarrasing. The researchers apply Markowitz model estimations to justify / support the idea that people are making prudent portfolio investment decisions. No idea what they're trying to suggest, but I think they're trying to downplay the idea that a bubble exists. Most people would never use 'Markowitz model estimations' when investing in any asset.

I am trying to understand the HPI correctly, is it that over a 20-year period 1975 - 1995 that house prices fell and then returned to the same price as 1975? (which doesn't make sense). However, over the 20-year period, 2000 - 2020 houses rose with an average return of10%. 2020 - 2022 the returns have skyrocketed, however, they are now significantly dropping. How far they drop, then the timing of the stagnate period and rise period...are the questions.

The 75-95 period is consisent with the fact that bank dereg happened in the early 90s and the banks across the Anglosphere move towards the magic-money-machine-through-house-lending model. Up to that time, the idea was that housing was primarily shelter.

Some folk were very fortunate of birth year

The key word in the title of that graph is 'real prices'. High inflation masked the long slump in house prices.

Seriously they have taken this long to figure it out !!! The average punter had this sussed long ago . The treasury and reserve bank should have realised this decades ago and been incentivizing change to more productive investments and reducing our vulnerability to exactly what is now occurring, talk about asleep at the wheel. What are these people paid for .

Look like Masters-level / PhD-level graduates applying their skills to their working lives. No real insight for me here. But that's the nature of research. Findings do not necessarily mean insights.

Don't be too harsh. The RBNZ, and Bankster economists can only express opinions their bosses pay them to produce. Hardly their fault.

It Validates that only economy in NZ is housing.

Breaking News, RBNZ research show that if you knew the winning Lottos numbers before the draw, you would have a better chance of winning.

I would have thought their role was foresight, not hindsight.

How about them telling us how great an investment it is going to be over the next couple of years,

Yes. And they say "As kaitiaki (guardian) of the financial system, the Reserve Bank of New Zealand – Te Pūtea Matua therefore has a close interest in how the domestic housing market evolves, being an important driver of both price and financial stability".

So they say house prices are an important driver of price and financial stability, but they previously didn't accept any responsibility for house prices.

Is it just me or are they contradicting themselves?

It is quite a few of us as well, and yes.

They didn't want the public blame.

We went through 87-91 recession/depression. It was grim. It put me off shares for life. Probably cost me plenty. I remember the 70's-80's but only as an employee. I remember my mates dad who ran his own business doing it bloody hard. It was sometimes safer to leave the room.

It goes up & it comes down. That's life. Learn to be happy either way then it doesn't matter.

A great article with an even greater graph of inflation adjusted house price falls and time to recover. Thanks

Figure 10 is a great graph. Gee real prices fell in NZ 40%, and took 20 years to get back to where they started (in real terms). Pre financialisation of our economy, and pre mass immigration.

Interesting to see that in real terms the quickest recovery back to where things started was the 9 years, in the UK 2008-2017.

What was the time period for NZ post GFC? Probably 4-5 years? Quick by usual standards.

I reckon it will be 6-7 years this time.

I mean, even if houses fall 30 percent from peak we’re only back to where we were 2 years ago… surely it won’t impact that many people?

It would destroy the residential construction sector.

Apart from a fairly small and unfortunate number of people who bought last year and will be in negative equity, it's the wider economic impacts that are the bigger concern.

at the same time, there's mid - long term economic benefit in house prices crashing too.

There would also be a large chunk of people at near zero equity, over and above the people who actually touch negative.

They'd be wiped out as well, and basically starting all over again. Not quite underwater, but incredibly stressful for young adults who spent years saving up huge deposits and getting chided for not working hard enough, only to see their equity vapourised through no fault of their own.

Given I now have a family, there wouldn't really be a chance for me to recover at any point, without just selling down and leaving NZ for higher wages and lower costs. Economic refugees in your own country, for the crime of being born too late.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.