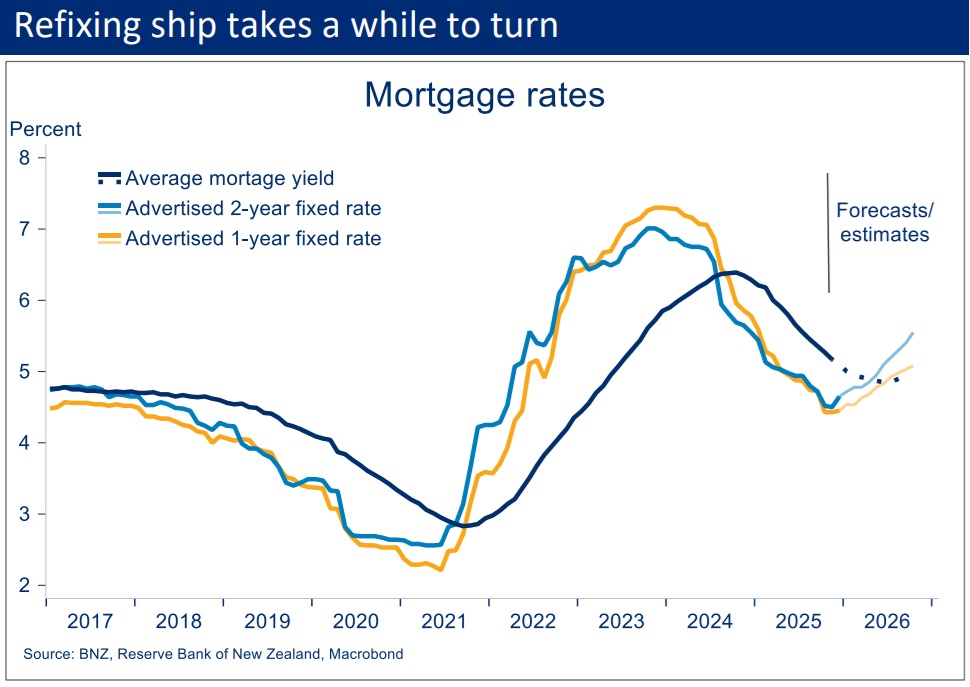

BNZ's chief economist Mike Jones says the average mortgage rates paid will continue to fall in the first half of this year, despite the end of the falling interest rate trend signalled by the Reserve Bank in November.

In his latest Ecopulse publication, Jones says he estimates the average mortgage yield will keep falling until around the middle of the year, bottoming out about 4.85% (chart below).

"That’s a slightly smaller fall compared to what we had prior to the shift in the interest rate outlook."

BNZ economists have brought forward the time they expect rate rises from next year and now forecast that the RBNZ will begin raising the Official Cash Rate (OCR) in September of this year.

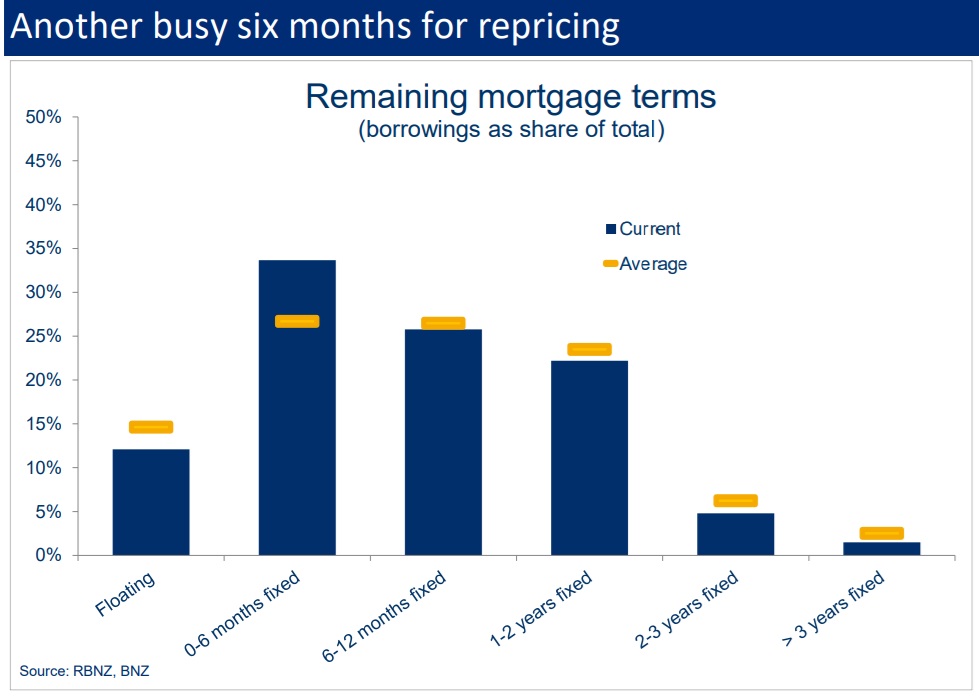

Jones's latest crunch of the mortgage market follows on from a detailed examination of refixing at the start of last year, with him describing 2025 as the ‘year of the refix’ with 81% of fixed rate mortgage borrowings repricing – a 13 year high.

He says for the coming 12 months, the "run rate" slows but is still above average with 68% of fixed rate loans due to reprice. For all borrowings, i.e. including floating, it’s 72%.

Jones says it’s the coming six months in which mortgage term expiries are most pronounced relative to average. There’s approximately $132b worth, or 34% of total borrowings. The long-run average is 27%.

"In short, the process of mortgage borrowers refixing on to lower rates is roughly 80% complete. There’s another 25bps or so of easing coming down the refixing pipeline, spread over the first half," Jones said.

The Reserve Bank produces monthly figures on the yields banks are getting from their mortgage loan books. Jones says this data series can be though of "as a proxy for the average mortgage rate being paid".

"As of November, this average paid rate was 5.17%. It’s been a slow, 14-month descent from the 6.39% peak in October 2024. That it’s been a grind reflects the usual gradual resetting of the fixed rate mortgages that dominate NZ mortgage borrowing (85% of the total). But also, and more so this cycle, occasional bouts of demand for floating exposure, at the higher rates involved, as borrowers have sought to position for continued declines in interest rates."

In November there was a big surge in the amount of new mortgage money on floating rates - over 49% of the total that month.

"...Rather than signalling a change of intent, we think this was temporary, related to positioning ahead of the November RBNZ OCR cut. Moving into December, and the sudden spike up in wholesale rates, all of the anecdote was about strong interest to term out mortgage borrowings. We’ll find out for sure when the December data are released next week," Jones said.

Most borrowers soon to experience a mortgage rate reset will face a menu of rates more favourable than previously. Advertised rates can obviously move, but the current mortgage curve is around the lowest in recent history.

"A quick example illustrates the potential cash flow relief. A hypothetical one-year $300k loan locked in a year ago at 5.74% could currently be refixed for another 12 months at a rate of around 4.50%. That would result in an interest saving of a little over $300/month," Jones says.

He says there are a range of areas in which mortgaged households might apply the windfall.

"There does appears to be a trend toward additional principal repayment as mortgage rates have come down. Some of the extra cash flow will also inevitably be soaked up by the additional costs facing households.

"But at least some of the rate relief will be spent. We’ve seen evidence of such in the slow reflation of retail spending appetites over the second half of 2025. This trend should continue."

The implication, Jones says, is that the cash flow release from mortgage repricing will remain a support for the economic recovery, albeit a dissipating one.

"It’s nonetheless important to remember that a slowing pace of cash flow changes doesn’t disavow the assistance from a sustained lower level of mortgage rates.

"...All told, and even with our earlier forecast OCR hikes, monetary policy looks set to remain stimulatory for all of 2026."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.