What goes up, will come down - just not maybe as quickly as we might want and imagine.

After the big interest rate spike of 2021-2023, prompted by high (7.3% peak) inflation, we saw bank mortgage rates start to come down in about the middle of 2024 and then more actively so after the Reserve Bank started (in August 2024) to cut the Official Cash Rate from the cycle peak of 5.5%.

Looking at the bank 'special rate' averages as compiled by the RBNZ, and if we take the one-year fixed rate as an example, it peaked at 7.3% in December 2023, had already dropped to 6.87% by July - ahead of that first August OCR cut - then ended 2024 at 5.78%, and ended 2025 at 4.45%.

So, the drop from the peak, as of December 2025 was nearly three full percentage points.

But of course this is advertised rates for 'new' mortgages and in reality people have to wait for when their rate is up for resetting before they can enjoy a fall in their rate. So, there's quite a big lag.

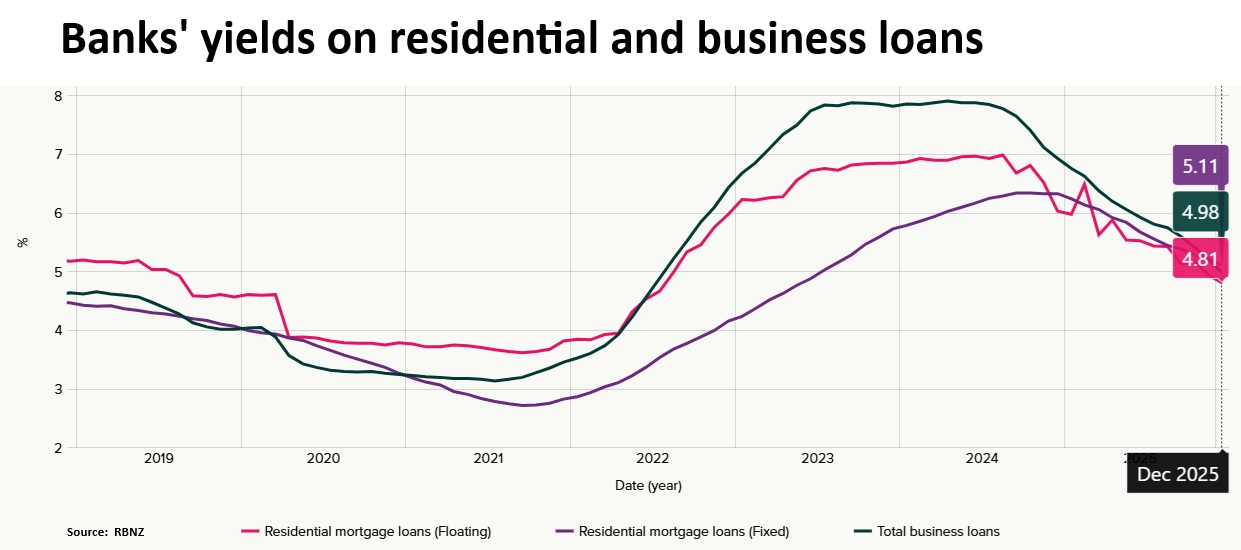

A proxy we can use for what people are paying across the board is the actual yields the banks are making on their mortgage books.

And these are available in another RBNZ data series, with the figures for December 2025 having been released this week.

These figures show a total yield (average of fixed and floating rates), a yield on the floating rates, and a yield on the fixed rate mortgage book.

The total yield (because of those lags we were just discussing) actually kept rising even after the RBNZ had started cutting the OCR in 2024.

This total yield peaked at 6.39% in October 2024, and had eased back to 6.29% by the end of 2024. Last year it continued to fall - though not as swiftly as maybe we might have expected - and ended up in December 2025 at 5.07%.

That's the total yield. If we look at the constituent parts, the floating yield ended 2025 on 4.81% (from a peak of 6.97% in June 2024), while the fixed yield (in which we see the full 'lag' impact) was 5.11% as of December 2025, down from a peak of 6.34% in October 2024.

So, the lower rates have been gradually feeding through. But of course, as we know, mortgage rates are now on their way up again. Thanks to those lags were were talking about, however, the average yields will keep falling for a while yet. But they might not have that much further to go.

Financial markets are currently pricing in an around 75% chance that the OCR will be raised in September. Which means the current OCR of 2.25% is likely to be the low point for this cycle.

BNZ's chief economist Mike Jones in his latest Ecopulse publication, estimated the average mortgage yield will keep falling until around the middle of the year, bottoming out about 4.85%.

Genuine question - did you think it would get lower than that? I have to say I probably thought it would.

And it's interesting to compare the current situation with back before the rate rises kicked off in 2021.

I think we are now starting to fully realise what a historically different period it was prior to 2021, with a long period of drifting lower rates then topped off by the plunge necessitated by the pandemic, with the RBNZ slashing the OCR to just 0.25% in March 2020.

What transpired was a low point in total yield for the banks on the whole mortgage book of just 2.83% (and the fixed yield was even lower, at 2.72%) in September 2021. That was seriously cheap money.

Those figures are around two whole percentage points lower than what we are now possibly talking about as the low point for this cycle.

It does mean therefore that anybody who thought (and look, I'm not sure if people did or not) that rates may 'go back to where they were before' is likely to be disappointed.

What it also means is that the housing market will not get the dosing of petrol that ignited it in the 2020-21 period.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.