Homeowners are being warned by economists at the country's largest bank that they shouldn't expect the Reserve Bank will intervene to stop house prices falling too much.

In their latest NZ Property Focus publication, ANZ chief economist Sharon Zollner, senior strategist David Croy and senior economist Miles Workman say that relative to the past few business cycles, "this time may be a little different" for housing market participants.

"In the past, a waning demand impulse (and softening housing market) was likely enough to halt inflation pressures and for the RBNZ to achieve its targets," they say.

"But this time inflation has so much strength and persistence that the RBNZ will likely need to continue hiking despite softening housing and demand.

"That is, if housing market participants think the RBNZ have their back and will act to prevent house prices from falling too much, they may be unpleasantly surprised (if inflation remains well in excess of the 1-3% target band for too long that is). It’s all very uncertain, but we think this is a risk well worth outlining."

Inflation hit an annual rate of 5.9% as of December and seems likely to get up around 7% in the first half of this year despite the Government's recent move to temporarily reduce petrol taxes.

The ANZ economists recently forecast that the RBNZ would hike the Official Cash Rate to 2% (from 1% now) by the end of May and see it reaching a peak of 3.5% in April next year. They now see house prices falling 10%.

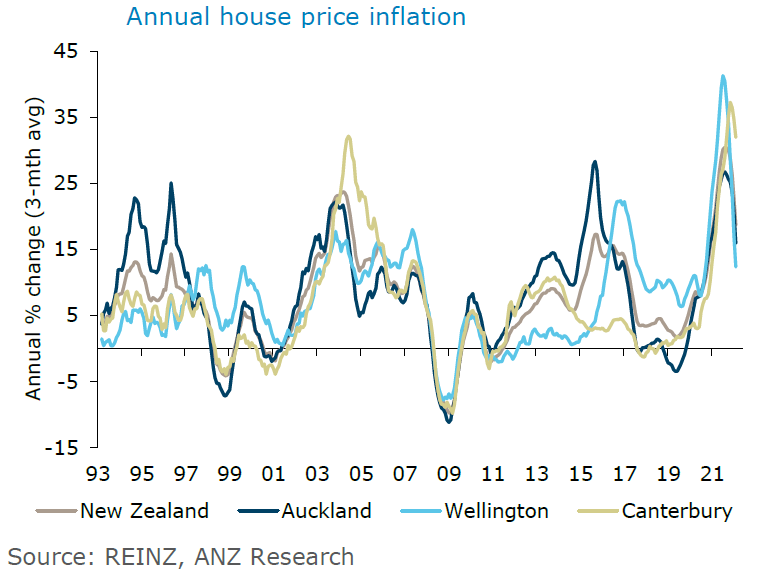

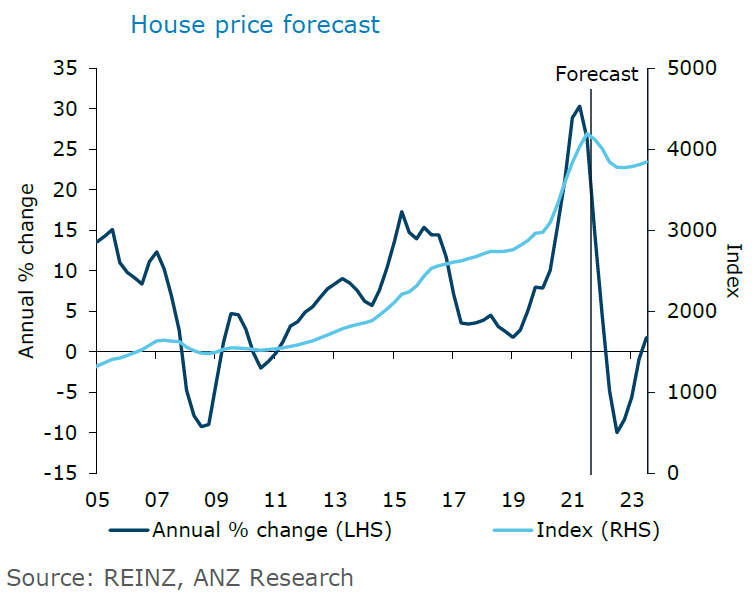

They note in the latest publication that this would be a similar-sized contraction to the one following the Global Financial Crisis of 2008.

"But given the very strong starting point, we’d still call this a soft landing – something that’s quite evident when you look at the implied house price level (below). Indeed, our house price forecast would still leave house prices up a whopping 30% come December 2022 compared to December 2019 (ie pre-pandemic). In that light, our relatively pessimistic forecast seems rather optimistic."

The economists say that household incomes are "preventing" them from forecasting a much greater decline, say 20% or even 30%.

"We’re simply not forecasting a household income (employment) shock that would necessitate the forced sale of properties and exacerbate the downturn."

But they have a 'however'.

"However, it is entirely possible that our outlook regarding household incomes and broader economic momentum is on the optimistic side, and that the path towards taming inflation passes through a more marked economic slowdown than we are forecasting. This is where the RBNZ’s inflation-targeting grit may well be tested over the coming year or so."

Noting the recent slowing in the housing market, Zollner, Croy and Workman say "key indicators" of forward momentum suggest there’s more slowing to come.

"The number of days it is taking for houses to sell is lifting, sales are trending lower, and listings are on the rise. Some of it might be Omicron disruption, but we suspect the majority of it represents a fundamental shift in the market."

But they say that with CPI inflation intensifying, it’s their forecast that the RBNZ will continue lifting interest rates even as economic momentum (and housing) fade.

"That’s a dynamic that may surprise some kiwis, but central banks must defend their inflation targets (and credibility) at all costs. It may not take much for our expectation for a relatively soft landing in housing to surprise on the harder side."

In terms of mortgage borrowers the economists say they think borrowers ought to continue to "brace for higher rates".

"Fixing for longer now still costs more, but that may be preferable to fixing at the lowest rate now, only to roll on to a much higher rate later on. But no strategy is without its risks, given heightened global uncertainty."

178 Comments

On track for a 30% Crash in home prices by December this year.

30% "soft landing" :)

Guess what CJ it will be the fastest "soft landing" ever.. blink and you will miss it.

HW2 - Sounds like you are thinking of a Falling Knife, If you try to catch it you will get cut. Thats why no one is buying your rental.

To buy my rental you would need your deposit equity .. sorry about that 2022 :( keep saving

Will be back where they were December last year, no biggie then.

A 30% Crash in home prices by December wipes out almost 50% gains. So no, your maths is wrong !

Nope, going up 30% doesn't mean you end up at the same place if you then drop 30%. If I had $100 and it went up 30% to $130...then dropped 30% I would be back to $91 not back to the $100 where I started.

House price rises and falls are all relative.

We've seen relatively large price rises over the last couple of years but don't expect the same of falls unless, of course, you want to be disappointed - yet again.

TTP

From denial to bargaining...

Ironically TTP has been right consistently over the last 10 or so years. Us pessimists are consistently wrong

All housing market bubbles burst in the end. The hard part is picking the timing, the boom went on about 6 years more than I anticipated. I thought I was buying near the top in 2016 but needed somewhere to live and it was better than renting. It will crash and it will recover but over what time period, who knows.

Yes yet again... I should not laugh at this. Oh well no one is perfect.

Tim's and Houseworks definition of a 'soft landing' is changing by the day. Falling house prices against the backdrop of a rising CPI is producing many a village idiot on this forum.

This is the price of the great money printing experiment. Get used to a persistent high CPI followed by years of high interest rates trying to contain it.

We could rattle off a few people that are looking pretty stupid right now...

Yep Fritz, all of those permabears

Nope. All of you permabulls are going to look really stupid very soon.

You're good comedy value.

Just wondering, having bought a first home (congratulations) but after missing half of the run, exactly where do you place yourself then. Those in glasshouses...

Moderate bear.

Missed half the run? I bought in October 2019 so got the full run

The run started in about 2014. A buyer in 2013 could have made 500k (200%) capital gain in a non-Auckland city between 2013 and 2019. It just went berserk in 2020.

No I would say the run started early 2020. House prices were pretty flat in Auckland from 2017 - 2020.

In 2005 prices in Ponsonby where going up $500 a day.. I bought a 4 bdrm villa for 468k

This boom goes all the way back to before the GFC.....

as we deglobalise lots is going to correct, how much depends on our relationship with China going forward

Certainly should change our attitude to welfare handouts to the poor too, eh, given how much we as property owners have received in handouts from government and reserve bank actions.

Before you bought, you were full of woe of how the market would retract 10 to 15. Afterwards it was "run baby run". Gigantic double standards, I dont expect you will admit that

Not true. I love how you twist and distort what I say.

Back in 18-19 I was saying a correction/ crash would come at some stage, probably in 2022/2023. I said this on multiple occasions, maybe I should try and dig it up if you want proof. Looks like I was very on to it, don't you think?

And that's why I bought in late 2019. I wouldn't have bought if I thought a correction / crash was coming in 2020-2021.

The boom in 2020-2021 was much bigger than I expected, which simply means I have a decent buffer for the correction/crash.

You called for a "crash" ... "on mutiple occasions". So you followed your deep beliefs and you bought a house.

I love it when people are caught out by their own words doing the opposite of the position they say they hold. Then call out others saying they are about to "look really stupid".

You're hilarious, and probably worried.

Time to cook, I will see if I can dig out one of my 2022 predictions later tonight.

Here is one of your Lockdown 2020 predictions.

by Fritz | 10th Apr 20, 10:23am

Good point....Prices would have to fall 20-30%.

That's not a prediction you fool. I didn't say they would fall that much, can you read? BTW, almost everyone thought they would fall when covid hit.

Here's something I said in September 2019, about 7 weeks before I bought, seems almost prophetic ey? Somewhere else I was more specific, talked of 2022/2023, but I'm not going to waste my time trying to find it and prove it to you.

Therein lies where I think where the party will end for NZ and Aus.

The property market might just escape a crash this time, but it won't next time.

My pick is a crash sometime between 2022-2025.

https://www.interest.co.nz/business/101483/big-bank-economists-are-mull…

You are so easily triggered its hilarious. Btw someone else reminded you recently that you made so many contrasting predictions that you have to be right with one of them eventually.... between 2022 to 25 is not a prediction it is just a very vague statement. You were asked to expand on that, but of course you failed there too.

I'm watching and waiting... like I did when everyone else except a ridiculed few said there was going to be a crash during the first lockdown... look how that turned out....

How Labour COULD Support the Ponzi:

- Increase government buying of existing properties

- Triple Accommodation Supplements

- Triple Working for Families tax credits

- Rent the properties (at or above) the asking rents of landlords on behalf of those in motels and/or on housing waiting lists

- Gift deposits to FBH

- Allow more downlow overseas sales

- Start a clandestine pipeline to funnel potential emigrants into rental properties

- Turn the credit spigot up

- Reimbursements (government guaranteed) for any and ALL property loses

- Slow down new developments

- Reverse property taxes

- Intergenerational mortgages

- Direct cash injections to struggling mortgage holders

- Whatever else you want to add..

The Ponzi MUST Flow

lol :) Good Luck,

buy buy

2022,

Can you outline your reasons for that prediction? What is it based on?

Here on my tray. A little appetizer, an easy warm up, a checky taste , a sneak preview.

Auckland City median house price falls 19 per cent since peak in November

https://www.stuff.co.nz/life-style/homed/housing-affordability/12811007…

"on tray"?? Oh I think you mean Entrè

Fixed the error ... excellent

or even "entrée" ;)

Excellent well spotted... I must say I like the 'On Tray'

A bit like someone I once knew who thought 'prima donna' was 'pre-Madonna'

LOL.

Brilliant!

I would not qualify 30% as a crash, but mainly as a kind of reversion to a pre-Covid housing market, and an event to be entirely expected.

The issue is if house price declines start going over the 30% mark, in which case there is the risk of a dangerous self-sustaining implosion of the housing Ponzi. If house prices decline over the 30% mark, my bet is that the RBNZ will be forced to intervene, inflation or not. The housing Ponzi is way too fragile at the moment so the RBNZ will try to manage an orderly retreat of house prices, rather than a sudden catastrophic implosion.

What happens if the scenario above plays out but the Fed is still raising their cash rate to fight inflation?

We are so linked with the Fed that the RBNZ is essentially their puppet - and the Fed don't care that poor little NZ has a giant debt bubble attached to its housing market.

30% most certainly is a crash.

30% is not even a Briscoes Sale.

Haha

How many have already taken out leveraged loans against that recent 30% paper gain in equity though? Only needs to be a small % of folks overall for that sudden reversal to create a ‘pants-down’ moment.

How many....oh probably just half of all developers building six townhouses in Auckland

Do commenters consider that a 30% reduction in prices will actually unwind the 'housing ponzi' - or will it just damage a number of recent buyers and give some mum and dad investors even more jitters than they already have?

I'm thinking long term. I want my kids to buy their own home in 20 years. The number of people hurt by a crash is a lot smaller than the number who will be shut out forever unless there is a correction.

Fair call. I'm all for that too. It just seems that we're not going to get a market and mindset changing adjustment of prices - but I'm still hopeful.

I made a similar comment last year and got absolutely slammed as a DGM'er by those heavily invested in the ponzi. Feels like there is certainly a shift now that the unthinkable is happening.

Are they not required to report on the impact on house prices when making these decisions? I’m sure Grant made them do that

Is there a strategy to drip feed the bad news so as not to cause a greater shock? Surely the banks could see this coming back in November. It was obviously going to be a double digit correction after the ridiculous price rise of the past 2 years. When I bought in 2016 I thought the market was over priced compared to the UK, will be interesting to see where this bottoms out.

Not just compared to UK, but also compared to most of the developed world, house prices in NZ are ridiculously and dangerously overinflated. It is actually quite scary how current house prices in NZ are out of synch with economic fundamentals and with the rest of the world.

Smaller markets do tend to react to whatever stimulus is applied more dramatically than larger markets, especially when dealing with the overhang of a policy for massive immigration, but..https://www.reuters.com/business/ecb-has-fight-housing-bubble-with-its-hands-tied-2022-02-23/

More and more distressing news for the spruikers..

Love it how RBNZ/ government policies of printing massive wads of cash, suddenly and 'unexpectedly' turn into record house price increases and cost of living inflation...

Which they then charge back to us in the form of increased cost of living... thanks team of 5 million..!

Ineptitude...

It was only a year ago the RBNZ were prepping the market for negative rates, now look where we are. This is catastrophic policy ineptitude by global central banks, how they expected closed borders, shock and awe QE and ZIRP not to result in inflation is beyond me. Now look at them scrambling.

My pick, once the full extent of price increases feeds through there will be widespread collapse in discretionary spending and potentially another recession. Those picking house prices to fall are probably going to be disappointed, 10% to 15% IMO. There is simply no point putting up interest rates for supply side inflation.

Did you not see Powell's statement - that is his intention to solve the supply side inflation issues....raising rates.

IO rising prices will eventually crush demand without rate hikes which are as big a mistake as cutting in the first place.

I agree…the unknown is how high a price will we suffer to get to that point? What if fuel prices don’t fall…and that flows through to food as well…building costs…all these key components of CPI and the supply of which, or almost entirely out of the supply control here domestically.

Do people just stop using vehicles? Stop eating?

Peoples behaviour changes, it already is. Potentially, we are facing at an unwinding of this virtuous period (china/tech/trade liberalisation) where a flat screen tv or car is cheaper than 20 years ago - whether absolutely cheaper or allowing for improvements cheaper.

Perhaps this is no bad thing, some of us will recall when a new car was rare, eating out was a treat and foreign holidays like hens teeth.

That is so true, I remember as a kid going to a Chinese restaurant was a big thing. Dad got a Rambler which was really cool. Going to Gisborne was an overseas holiday for us, someone having a bach at Whangamata was really unusual.

But the good thing back then we were generally always happy. Its the reason I have moved back to the countryside away from the city. So my kids grow up with less expectations. Not sure it will work, but seems to be.

They thought that years of money printing and of ultra-loose reckless monetary policies would not ultimately cause massive devaluation of fiat currencies with significant inflation. Idiots. Now they will have to butcher the housing market and potentially damage the real economy in order top put the genie back into the bottle. Combating inflation is no fun, as anybody who had to live through the periods of high inflation can readily confirm, and very painful to the economy.

I agree, complete ineptitude. The RBNZ actively encouraged spending by making a number of commitments to ultra-low rates and consumers reacted rationally.

If only economics wasn't so closely aligned with astrology.

Astrology is probably more accurate than economics.

yes, they will let property prices fall, but the minute that bank solvency becomes an issue, they will be back in to save the housing market. It will be interesting to see if the banks really are as strong as last year's stress tests suggest. I think it may be a little different in the event of real life contagion in a complex system.

governments will always save the banks, not people - as evidenced throughout the US and Europe.

In the cases of Cyprus, Ireland etc it's partly because the banks threaten the governments. An imbalance of power, in the end. But we should perhaps play hardball and make any rescue contingent on equity not handouts, or something along those lines?

Any bank rescue must only come after the owners have given their all. An no rescue at all for foreign creditors.

And who would then be willing to lend to a NZ bank at 2% so that its funds get exposed to the NZ property market which is now known as high risk?

The risk premiums will be much higher = higher mortgage rates.

ANZ have got this wrong.

If the RBNZ hike the OCR as much as ANZ think they should/will, then the house price falls will be much worse than 10%, and so will the economic repercussions.

ANZ has the most skin in the housing game. If they spook the horses too much the 20% deposits (OO) and 40% equity deposits (LL) will evaporate, making things a bit dicey for them. So 10% is a comfortable drop to predict, as that would increase ANZ's equity in a whole bunch of houses without putting everyone (including ANZ) into negative equity.

Yeah that's what I think too. But it's not particularly credible, if correct, is it?

For what it's worth, if the OCR is hiked as much (or even 80% as much) as ANZ is picking, I think the house price falls will be 20-30%, and we'll have unemployment north of 8% in a year's time.

Which is why I don't agree with ANZ's forecast, especially given RBNZ's employment mandate.

I generally agree with you on this HouseMouse.....but if the inflation doesn't stop when they start raising rates, they will just have to keep hiking.

The question will be how quickly do we see deflation in the face of such a violent market slowdown? Some people are sitting on a hell of a lot of cash....and they will still want to buy goods and services.....and lifting rates give them even more cash to play with! (

We assume we will suddenly see deflation because that it what we have witnessed the last few market cycles.....but what if this is like the 1970's and inflation is now persistent? Will the Fed keep raising rates to 5 or 10% to combat inflation...because what happens if they don't get inflation under control?

So who are sitting on so much cash? Just curious as I though most people were sitting on a bunch of debt or assets?

Have a look at the other current article on this site

Let us not forget who is on the board there and if Nats are in power next year... well i suspect there will be some nice meals out between Luxton and a certain someone on the ANZ credit card.

I think they actually realise that (or they should hand back their degrees) and are hedging their forecast bets. I.e. they will almost certainly be correct on one count or the other.

Auckland City median house price falls 19 per cent since peak in November

https://www.stuff.co.nz/life-style/homed/housing-affordability/12811007…

Only 9 days since we've opened our borders to all overseas Kiwis without the need for MIQ or quarantine, and yesterday more people left the country than arrived. So much for the hoards of Kiwis in MIQ queues waiting to buy property!

https://www.customs.govt.nz/covid-19/more-information/passenger-arrival…

The stats NZ numbers in the middle of the year will be very interesting to see the difference in long term departures vs arrivals.

I expect net migration won't be much more or less than zero over the next 6 months.

I personally know a few high skilled, high-income relatively young individuals who have just left or are about to leave for overseas, especially Australia. I can see a real drain happening in the near future.

Don't worry. We will see a hoard of arrivals from India. Chorus technicians etc. All self employed.

We are some of them (well, to the UK, with young family in tow!). Contract signed and everything.

Highly educated friend of mine has come back recently and they were struggling to get moving companies and shipping because there were so many people moving to NZ from Aus. Suspect some will leave, some will arrive and it'll pretty much balance out

We never seem to hear about the ones that tried Aussie and "failed" for want of a better word. I went there as a young man and so did about 80% of my friends. Many were on a stepping stone to London etc. I would say two thirds of them have all returned to NZ.

Australia might become an expanded rental market for those unable to find a suitable property here in NZ.. or whatever we're calling the country today.

Australia is clearly a better option than homelessness for those able to make the move. Many people might find themselves pushed out of NZ, rather than having a strong desire to go.

The team of 5 million has not been kind to everyone.

4 young ICU nurses just went to sydney from North Shore -- 30K plus pay rises for the same job -- they have simply been waiting for MIQ to end before leaving -- another couple - he is a chemist just completed Doctorate -- heading to USA or Japan, have offers from both just deciding -

As ever its our best brightest and young people leaving -- and many simply wont come back except for holidays!

and cant say i hear of too many nurses let alone ICU nurses to fill the 1000 yes 1000 nurse vacancies across the Auckland region - over 750 of those in DHB's

Screwed is the word

Good on them, I would do the same.

They have been screwed over by this country, and this country will suffer because of it, once tonnes of nurses, doctors, teachers, police leave...

Would Australia employ New Zealanders considering the sub-standard education they've received from our hopeless education system? I believe New Zealanders now have to attend special education two-year courses to bring them up to the levels necessary for employment. A New Zealand degree is now considered to be a lower qualification than one from Upper Bengal or Botswanaland.

There's also a requirement to initially put New Zealanders to front-line work in those areas where many residents have died in the recent floods or in those many areas where wild-fires are rampant.

Australians now look upon New Zealanders as a whole as an inferior and poorly educated species and increasing numbers of racial slurs are being met with by New Zealanders.

Average annual temperatures in Australia are expected to be 40 degrees by 2025.

Interesting, while local education standards have definitely slipped from previous world class, I wouldn't have thought by so much that remedial training would be required for employment. Any details on what that might entail? Are we talking school leavers taking vocational training, or more like experienced professionals requiring some gaps filled?

"Australians now look upon New Zealanders as a whole as an inferior and poorly educated species and increasing numbers of racial slurs are being met with by New Zealanders"

This bit is definitely not new. I experienced that way back in the 90s in Sydney. Not sure about the "racial slurs" - NZer isn't really a race. But certainly slurs.

This talk of a soft landing, assumes they know where the ground is. We've lost too much speed and altitude, haven't deployed the flaps, and are flaring too early. Stall indicator activated...

"Don't worry, we cannot possibly crash! We're at 3000 feet, still a long way to-" -crashes into a mountain

What's that intermittent rattling sound...

Come on, don't be such a DGM! Just ignore it!

"terrain, terrain" ...... Shut up gringo!

DGM Zollner - wonder if she's in the comments section on interest.co.nz?

Bear in mind she works for a bank that has a huge "long" on NZ residential property. Her real thoughts are possibly more pessimistic than what her employer would allow us to contemplate.

They did nothing to stop the crazy house price increase and arguably caused it. It would not be consistent or rational for the RB to now change tack and to try to stop prices falling. They are supposed to act in a disciplined and consistent manner and if they inconsistently start picking and choosing how they will react, they will quickly loose any control and end up chasing their tails and phantoms.

Having said that I believe that their control model is deeply flawed and by design is causing many of the problems that we are experiencing. However, should we decide to change it, we need to wait till we are in a period of economic neutrality and stability. I.E. we need to wait until the natural correction of past excesses have played out.

I bought 5 VideoEzy franchises at the peak...should the Government bail me out?

No!! That would be like feeding a dying animal instead of ending its suffering, then using its meat and pelt.

Someone just scored 5 Souvlaki Shops, yo'll !!

Does the NZ economy revolve & survive on Video Ezy? Either way, get ready for a blockbuster staring Orr...

Well,as many in here say,a correction will only take prices back to a few years ago and unfortunately there is always some collateral damage,some will be underwater for a while.

You pays ya money,you take your chances,there are people out there underwater (excuse the pun) from leaky building rebuilds,sh*t happens.

The barbecue conversations may be back to small talk about the weather.

And there are AMI/southern response and South Canterbury Finance amongst others who experienced things differently.

OK Boomer

YES. The govern must bail out your Video Ezys. It's the new way Grant Robinson has found. Individuals and businesses on benefits. Magic Grant. Wonderful.

New way? You may want to look a bit deeper.

Yeah, unforeseeable according to finance minister

Housing in NZ is an eye-roll.

When average house prices are in the 7-digits, the housing market becomes an abstraction - not quite real.

It's no secret that house prices are driven by credit creation, which of itself is a bit abstract.

Such credit creation benefits property owners disproportionately - again NO secret there!! :) Perhaps people will seek better rulers, and we are seeing a bit of that. Perhaps people will seek countries more advantageous to their financial situations, and we are seeing people LOOK to that.

Like living in a traffic-light-colour; living in an abstract-housing-market is also very avant-garde - who's to say what will happen?..

Who will stick around to find out?

Skilled young people can't be blamed for leaving a cadre of inter-generational wealth thieves.

This subtle scare mongering has been going on for sometime now, be it from banks, Adrian Orr or the Govt. A series of 'warnings' that will no doubt give them a "We did warn you" moment in the very near future. It's just a maneuver to shift blame away from their long term incompetence.

It does read like the slow acceptance of a train wreck already in motion. They may be trying not to panic the passengers in the end carriages, who've not yet figured out what's going on, but the result will be the result.

I think Orr has given warnings about rate rises and being over-leveraged; it’s possible that he thinks he’s done enough to warn the punters and he can raise without responsibility. Problem is that no one listens outside weirdos like us, so the warnings were essentially worthless. Majority of NZ public still believe property can only go one way.

Exactly, your average punter would have no idea who Orr is. And it's not like main stream media were posting anything negative about the housing market last year...

Exactly, your average punter would have no idea who Orr is

Last year I knew of two people that were looking at 'jumping in' to the property investment market. I was interested to know their reasoning so over a period of time and casual conversations I gathered some information. Reason for investing "Everyone is doing it and making heaps of money". Neither of them knew who Adrain Orr was, what the current OCR was and where it was trending, what the current CPI was and where it was trending, any overseas economic trends or indeed developing NZ trends ie QE, housing supply, lending rule changes etc. The only two pieces of information they were relying on to borrow over half a million dollars was that "Everyone is doing it" and "The bank will lend us the money".

This mentality is large part of the reason we are now in the predicament we are, and why unfortunately some people will pay heavily for their naivety.

"The bank will lend us the money".

This is why I think it was very, very stupid to remove the LVRs for investors when Covid hit. I can see the argument for lowering interest rates, I can even see removing it for owner-occupiers, but I cannot for the life of me think of a justification for removing LVRs for investors.

Scary, but common.

Evolution at play?

And these people deserve everything that is coming to them.

We are pretty on to it weirdos though... :)

A "neutral" arriving point is supposed to be when a mortgage free house offered in rent gives a yeld that is a bit more than inflation + term deposit return.

so let's pretend inflation 7% td ~2.5% => yeld should be 9.5%, otherwise is a bad longterm investment.

with 0-ish% inflation you needed much less

To have a yeld that is almost 10% on a rent that is 600$ per week, that same house cost should be 312,000-330000

600*52 = 31,200 which is the the 10% of 312000

That is, again, to be considered neutral. You are making just enough to cover inflation and having back the same amount of td, but assuming more risks.

I live in an house that "costs" circa 2M, and my rent is less than 700.

How crazy is it?

There is a looooong way down

Assuming the investment property has a large % mortgage then they don't really need to worry about inflation as their debt is being inflated away too.

Debt changes all the calculations, I think it is the main reason why property investment makes so much sense compared to others. But a correction has a lot more negative effect of course, you might lose more than just your own money.

Debt makes all calculations more complex, cause is adding variables, that is why my case is about a mortgage free house, yes.

Yeah, debt get's inflated away in normal scenarios.

But also that is true only if you can keep the yeld constant => rent goes up every year by at least the same amount of inflation => disposable income as well => your income too.

lots of if..., too many variable, very risky.

investment "safe as house" will became a meme

Doesn't that only work if the rent increases match inflation, which, given some of the returns on rental investment, is not the situation we're in?

It also assumes that wages increase at the same rate as inflation - if not there could be widespread debt defaults and people have to chose to either pay for food and utilities or their rent/mortgage.

If wages don't increase at the same rate as inflation and mortgage costs there is a gap across the balances/income sheets of all rentals and houses that have large mortgages that can't be covered (i.e. there is an increase in expenses that isn't balanced with increased income). That is fine temporarily, but if it gets large then someone will have to default.

This isn't probably a valid scenario as I doubt the bank would lend in this way, but let's assume so for simplicity:

- Joe Bloggs borrows 1mil from bank interest only fixed rate for 5 years

- He buys a $1 mil house where the rent covers the interest and other expenses exactly

- House prices increase by 2% a year, rent remains static, and inflation runs at 7%

- After 5 years he sells.

In theory he has made a 5% PA real loss on the capital and a 7% PA real loss on the rent. Yet he would walk away with ~$100k capital gain having never put a cent of his own money in.

of course.

but it means we need to imply 2% price increase per year, which is, well, unlikely :D

if the inverse happens? Dear Joe will receive a call from the bank way before the 5 years...

For sure, I wouldn't want to be Joe right now. All I am saying is that saying a property is making a loss after inflation is not always true.

yup, that's true, is a convenient generalization

Good stuff lucenera. But the real business model (keep it quiet now) is about capital gain.

That works without rent even. Until it doesn't. Oh dear.

That was the only thing making it viable, correct.

But now the situation is so un-balanced vs the extreme that the possible "correction" has an apocalyptic distance to the actual longterm viability.

That will be very interesting to watch... from the correct distance

I am not sure your logic is correct but the general thrust of your argument is valid i.e net rental yields are pathetic. But not as pathetic as lower risk TDs. So the point is, property valuations are hugely sensitive to real, risk free interest rates which TDs rates are a punter's proxy for. At the moment, TD rates exhibit negative real returns.

To compare apples with apples, I think you should be estimating required real yields relative to TDs since the land, at least, is inflation protected. i.e. you don't require inflation protection from your net rental in the same way as a nominal TD or bond investor does from their coupons (since the bond;s principal component is nominal not real).

Also, more appropriate to use a longer term inflation estimate e.g. average inflation over the next 10 years, since this more accurately captures the longer term nature of the asset.

I agree with what you say in terms of comparing apples to apples.

I am saying that with this yeld real estate is a bad investment.

Problem is that, without counting in capital gain, it is a very really strogly bad one,

Even if I am only half right, and you double my numbers and half the inflation and pretend that the housing price are not going down. Even in that case the numbers don't sum up.

I am not sure what you mean when you say the land is inflation protected...

The process of freeing land for new development is inflationary.

Costal erosion makes some land worthless.

Earthquakes.

Fashionable new developments not far from you.

Political disorders.

Negative demography.

There are so many reasons why land might cost less or more.

Land is not devalued by inflation but is of course vulnerable to other real value declines as you mention, some of which are more prevalent in inflationary settings.

Take a simplistic example of a nominal bond. You purchase for $100 with a coupon of 10% and get back $100 principal plus $10 interest. If inflation is 5%, then your real return is 5%. Or I can buy an otherwise identical inflation linked bond. Using the same facts, I would get back $105 in principal but what coupon can I expect? It's not 10%, it's 5% (the real yield) since I cannot expect to get more from an inflation protected security as a nominal one. NB: I am ignoring inflation or liquidity premia for the sake of simplicity.

Land is really like an risky inflation linked bond, you can't expect to get compensation for inflation from the rental component since this protection is inherent in the assets value - it is a real asset. So rentals should not rise because of inflation other than for those components (management costs etc) which are not land related.

Make sense?

Yup, makes sense, I think I share (at least partially) most of your points, and I admit I made it too simple.

Still... I think that a good investment should give you at least that (nominal): expected inflation + td.

Realestate was doing it only because of cg expectations, but that doesn't work with rents.

anyways :D

this is old news now, let's see how this extravaganza ends up in few months :)

So many "economists" on this website, lots of comments based on assumptions instead of based on the actual data..

Who says NZer's have an education problem,everyone is either an economist,epidemiologist or a public health expert.

I'm also guilty of international relations and military strategy

I dabble in history and philosophy!

How does that differ from the "expert" economists. Economic theory is based on assumptions/beliefs and accepted as truth. The data models are then developed based on these theories and interpreted to fit the theory. Economics is a dismal science.

It's as if these beliefs are so embedded in the collective psyche, humans have become a product of the narrative.

Maccy B across the Tassie had a little take down of the NZ property market y'day. From an Aussie housing DGM perspective, their narrative is pretty consistent.

Biggest takeaway for me:

Mortgage demand has tanked hard in New Zealand, falling 21% in the year to January 2022, led by a 51% collapse in investor mortgage commitments

https://www.macrobusiness.com.au/2022/03/new-zealand-house-prices-about…

We are no longer in a benign inflation environment. Ordinary people understand that every time they go shopping or fill up the car. Even in the ivory towers of Reserve Banks they must realise that monetary policy must eventually reflect the real economic environment.

In truth the source of deflationary forces where never that well understood.

Yes. I'm not sure if people get the contradiction of people living in million-dollar suburban bolt holes but fretting about not being able to afford to fill up their gas tank.

Erm, curiously missing from this article is the impact of lifting interest rates in the face of stagflation (inflation + lower econ activity... which they are predicting). Generally this is a big no-no. You weaken economic activity too much. RBNZ has financial stability goals (and max sustainable employment) to consider too. Article is written as if price stability is only goal.

I understand it's been a while since any of them have been at uni but did they not have some freshly minted masters grad on the project to point this out to them?

Correct.

Retail spending down massively in latest figures. 25%-35% down year on year. How many small business owners use the house as security to fund business activities? A lot.

OCR works on demand side only (and demand has already plummeted) , doesn't do anything to the supply side which has been strangled and is underlying most of the inflation we currently see.

OCR won't touch anything close to 3.5%

Simon,

"OCR won't touch anything close to 3.5%"

That makes 3 of us-you, me and HouseMouse.

I doubt it will even get to 2.5...

As much as I hate making predictions on things like this... Make me a 4th.

Plenty of us think the same, just not everyone comments on it.

If the RBNZ had financial stability goals they wouldn't have dropped LVR's, dropped interest rates to zero and orchestrated 30% rises in house prices in 12 months.

Clearly its not a real goal. If it is, they are the cause of financial instability, not the moderator or assessor of it.

Also, I don't think it says anywhere in the econ text books that you should leave monetary policy in deflation fighting crisis mode at 0% when in the face of stagflation.

So if your argument that interest rates should stay in emergency deflation fighting mode while stagflation gets out of control - simply because house prices might fall?

If you don't fight stagflation you get recession. If you do fight stagflation you get recession.

But this was almost certainly the risk central banks have been kicking down the road post GFC and now it looks like they have no option but to take their medicine.

Yeah, the comment is more along the lines of 'monetary policy is impotent in the face of stagflation'

i.e high inflation, strong econ growth -> raise rates

high inflation, recession (stagflation) -> don't raise rates.

Fiscal policy has to fix the recession there before monetary policy can fix the high inflation problem

How does fiscal policy fix the recession when we've just had 2 years of insane fiscal policy/intervention? Do we reverse the situation and start taking money back from people to reduce demand for the reduce supply of goods? As opposed to giving people more money to chase lower quantities of higher priced goods?

Yes financial stability and employment, key factors in OCR decision making.

So why aren't ANZ taking that into account?

Presumably they think inflation is so out of control that it trumps those other considerations?

If they are right, then our economy is in big trouble.

The article assumes our micro economy has lots of strategic options at its disposal. The Fed today has declared war on inflation, despite the actual one in progress. 50bp in the US means that’s what must happen here to avoid currency instability. We’re just going to shadow them every step if the way.

It gives Adrian an easy out doesn't it?!

To think that they have the influence to protect against a greater fall, would be to assume that they also have control over the past increases.

We give them far too much credit in the wrong areas, and not enough stick in others.

The reality is, because of their macro policy settings, they have very little micro-control.

If you build a car without any brakes, it doesn't matter how much you pump the brake pedal.

Threads like this just shows how greedy people are. Life in NZ is not easy. And the number one reason is house prices that make the average worker poor and never have any hope to better their situation. A single person just can't survive anymore. I'm on more than the average wage and I am feeling it. I'm considering moving to Australia and let the speculators have their overpriced houses to themselves. 10x income to buy a bottom 25% quartile dump of a house is not a good investment for me. I can pickup a 2brm unit in a city in Queensland for $200k. Oh and be financially free.

Yep and a PM who thinks there is no cost of living crises. Two of my kids have left home but we are finding we are having to help them pay some bills (they lucky we can) now as inflation spirals out of control, one is looking going to OZ with is mates as well.

Having had 3 kids and surrounded by others,I'm pretty sure this has always been the way.

Shock,horror...young kiwis thinking of going to Oz.

Headline from Australia:

Aussie battler nurse breaks down revealing she can't afford clothes for her kids amid country's cost of living crisis and experts say it will get MUCH worse in just a few weeks - here's what it means for you

- Single mother finding it hard to make ends meet despite having a full time job

- Price of staple goods such as spaghetti set to soar by 10 per cent within weeks

- There has been a rise in demand for goods and services after Covid lockdowns

- But a rising demand also eventually leads to higher prices and greater inflation

- Automotive fuel has risen by a huge 32.3 per cent in the past year in Australia

Totally agree QG. I have often posted that my concern is for my kids, the next generation, they have been royally screwed. Greed is the major driver in our current situation. I think even relatively young people have now been around long enough to see the rapid decline of the quality of life for average Joe in NZ. It is absolutely heartbreaking when you see where we came from just a few decades ago.

The occurrence of the Parliament Protests is going to become more common as the middle class continue to get used to bankroll the wealthy and social unrest and division is our future until there is a realisation that healthy, equal and balanced communities equate to a healthy country.

This Weeks Hutt Valley Update ( for those who have seen my weekly updates)

616 houses on the market- increase of 6 on this time last week. There does seem to be less houses coming to market in March – this however is quite normal – once summer id over the number of houses does decline. That said more houses are still coming to market than selling.

Based on the REINZ data - 96 properties sold in Feb – 616 houses means there is 6 months stock on the market

Using the 20/21 data where 40 houses a week sold then there is 16 weeks of stock on the market

261 houses have a listed price and again this week prices have continued to fall with 60% of the houses with prices having marked down their price in recent weeks by an average of 75K. Again a number of houses have dropped prices by 100-150K in the past week- mainly in the $1M plus mark.

interestingly the top of the market is taking bigger price decreases (10% reduction on listed price ) than the bottom of the market – which are decreasing by about 5%

The data continues to show the majority of houses listed are under 900K. The Median house price for all 616 listings is 855K. (up 5K on last week)

Most sales on the market continue to be at the 800K-$1 Million mark – the bottom of the market is very slow with a large number of houses that have been on the market since Nov languishing there.

- 405 of the houses have been on the market for over 30 days - 65% (last week it was 380)

- 210 of the houses have been on the market for over 60 days - 34% (last week it was 196)

Rental Market

Meanwhile the rental market has 176 properties for rent (up 5 on last week). 5 months ago on the 18th Oct there was just 97 houses for rent – on the 17th Jan there were 125 houses for rent. The peak period for Wellington rentals of late Jan/ Early Feb has now passed.

There are a large number of new builds in the Lower Hutt market currently been rented for the first time and a large stream of property currently in work. The 96 houses on the British Tobacco site in Petone is well advanced and due to be delivered in the back half of 2022- the majority of which will be added to the rental stock.

It sounds like FOMO has faded, there is no longer a big fight to get one of those almost affordable Hutt Valley houses.

Almost exactly 24 months ago I was expecting 30-50% housing crash...still waiting. My kids wanting to buy. Maybe they should keep waiting ... I'm thinking mid winter maybe good buying time?

Always a good time. Sellers are depressed - perhaps its the lack of vitamin D. Also good to see the property at its worst and any latent flooding etc. Rain also keeps some away from open homes.

Yeah mid to late winter there could be some good opportunity.

I don't rate much of what comes out from the ANZ economists - Bryan Easton took them to task for getting it so wrong on the effect of COVID.

I don't rate them much either. Lots of bravado and self-confidence, but they don't think deeply, like most economists.

I actually think Topliss at the BNZ is comfortably the best bank economist.

From "What happened Today" on this site;

MORTGAGE RATE CHANGES

HSBC raised all their fixed rates today. Basecorp changed their floating rate +55 bps. Check the swap rate section below. The leap up was huge today. It's only a matter of [a short] time for banks to push fixed rates higher again. Any rates with a 3% on it are about to disappear. Rates with 6% on them are about to appear.

It's like boiling a frog. Many mortgage holders haven't even noticed yet.

12 months ago we fixed 5 years for 3.05%. In December (9 months later) we traded up, fixed for 5 years for 4.95%. Same bank etc, below 60% LVR.

Despite lurking on this site every day, I hadn't noticed the magnitude of the shift.

Always fun to watch the mud slinging on every housing article. Nothing like people calling a crash that has not happened yet. Not sure some of you have worked through the logic of existing home owners properly. Unless there are huge job losses its BAU. People will just hold, why would you ever sell at a huge loss, to do what go renting ? The thing to be looking at is the unemployment figures and pay increases.

What about highly leveraged investors on interest only mortgages. Some of these are on very low yields or even topping up each month hoping for capital gain. How long will they hold on for?

I find it fun too, but for different reasons :D

Just one thing: house prices are set by what is sold, not what is hold.

You only need a small amount of sales to set new benchmarks (and to make everybody very concerned)

So we will have people panicking and moving to cash. It will be expensive to borrow money. No one will want to borrow it and buy depreciating assets. Sounds like a supply and demand issue. In a situation where there is lots of money and no borrowers, the answer should be cheaper money. Perhaps this has been the problem for many years. All the wealth the Baby Boomers have built up is looking for a place to go.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.