FLP

Deloitte report details how the Reserve Bank could improve its handling of sensitive information after information breaches

2nd Jun 21, 9:22am

3

Deloitte report details how the Reserve Bank could improve its handling of sensitive information after information breaches

Kiwibank economists, who are forecasting a first Official Cash Rate rise in May next year, now see a 'risk' of three rate hikes in 2022

1st Jun 21, 1:26pm

53

Kiwibank economists, who are forecasting a first Official Cash Rate rise in May next year, now see a 'risk' of three rate hikes in 2022

RBNZ Chief Economist says the central bank might continue buying government bonds for some years, even once its LSAP programme ends in 2022

1st Jun 21, 8:30am

53

RBNZ Chief Economist says the central bank might continue buying government bonds for some years, even once its LSAP programme ends in 2022

The Reserve Bank has provided the 'Go' signal for financial markets to start pushing up interest rates and the Kiwi dollar

27th May 21, 2:47pm

53

The Reserve Bank has provided the 'Go' signal for financial markets to start pushing up interest rates and the Kiwi dollar

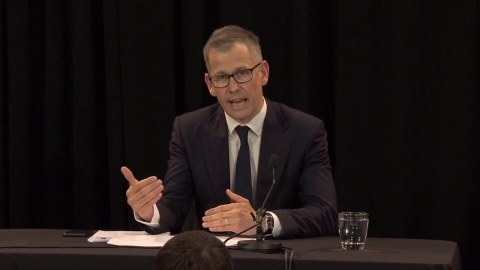

RBNZ leaves monetary policy settings unchanged, but reintroduces forward interest rate forecasts suggesting a first Official Cash Rate rise in the second-half of 2022; Kiwi dollar jumps

26th May 21, 2:07pm

110

RBNZ leaves monetary policy settings unchanged, but reintroduces forward interest rate forecasts suggesting a first Official Cash Rate rise in the second-half of 2022; Kiwi dollar jumps

Businesses urge the RBNZ not to remove the punch bowl that is low interest rates; Economists recognise the party will have to start winding down mid-next year

25th May 21, 7:00am

66

Businesses urge the RBNZ not to remove the punch bowl that is low interest rates; Economists recognise the party will have to start winding down mid-next year

Grant Robertson delivers a 'peak Labour Party' Budget, committing to spending more than expected, including on benefit increases

20th May 21, 2:00pm

231

Grant Robertson delivers a 'peak Labour Party' Budget, committing to spending more than expected, including on benefit increases

BNZ economists say any relief for the current input price pressures 'will not be coming soon'

18th May 21, 10:22am

35

BNZ economists say any relief for the current input price pressures 'will not be coming soon'

Economists at the country's largest bank now see an Official Cash Rate of 1.25% by the end of 2023 - compared with just 0.25% now

17th May 21, 4:03pm

53

Economists at the country's largest bank now see an Official Cash Rate of 1.25% by the end of 2023 - compared with just 0.25% now

ASB launches a home loan for new-builds with a 1.79% floating interest rate, using cheap RBNZ funding. In addition it is offering a cash incentive if the new home has a high energy efficiency rating

17th May 21, 8:42am

115

ASB launches a home loan for new-builds with a 1.79% floating interest rate, using cheap RBNZ funding. In addition it is offering a cash incentive if the new home has a high energy efficiency rating

RBNZ concludes - based on 'inconclusive' international research - that it doesn't know what impact low interest rates have had on inequality

12th May 21, 5:00pm

113

RBNZ concludes - based on 'inconclusive' international research - that it doesn't know what impact low interest rates have had on inequality

BNZ posts big rise in interim profit boosted by a positive turnaround in credit impairments, solid revenue growth and a major drop in expenses

6th May 21, 10:24am

6

BNZ posts big rise in interim profit boosted by a positive turnaround in credit impairments, solid revenue growth and a major drop in expenses

RBNZ leaves monetary policy settings as they are, noting it'll take 'considerable time and patience' to reach its inflation and employment targets

14th Apr 21, 2:07pm

61

RBNZ leaves monetary policy settings as they are, noting it'll take 'considerable time and patience' to reach its inflation and employment targets

RBNZ expected to put the property investor crackdown, trans-Tasman bubble, slowing growth and higher inflation expectations aside, and take a breather before changing monetary policy

11th Apr 21, 6:00am

110

RBNZ expected to put the property investor crackdown, trans-Tasman bubble, slowing growth and higher inflation expectations aside, and take a breather before changing monetary policy

Kiwibank becomes the first bank to access the Reserve Bank's Funding for Lending Programme for a second time

31st Mar 21, 4:00pm

2

Kiwibank becomes the first bank to access the Reserve Bank's Funding for Lending Programme for a second time

ASB borrows $500 million through the Reserve Bank's Funding for Lending Programme after pledging to use the money 'in a purposeful way'

26th Mar 21, 5:00am

27

ASB borrows $500 million through the Reserve Bank's Funding for Lending Programme after pledging to use the money 'in a purposeful way'

Fourth drawdown made from RBNZ's Funding for Lending Programme; RBNZ plans to buy larger volume of bonds via its LSAP again this week as markets continue betting on rising inflation

15th Mar 21, 4:21pm

22

Fourth drawdown made from RBNZ's Funding for Lending Programme; RBNZ plans to buy larger volume of bonds via its LSAP again this week as markets continue betting on rising inflation

Gareth Vaughan looks at a rare occurrence of the National Party and the E tū union being on the same side against the Labour government, and why we should reframe the discussion on government spending

14th Mar 21, 6:01am

41

Gareth Vaughan looks at a rare occurrence of the National Party and the E tū union being on the same side against the Labour government, and why we should reframe the discussion on government spending

RBNZ Governor says it's too early to decide whether to get worried about rising bond yields, as ANZ Chief Economist warns a 1% mortgage rate rise would chew up 5% of Aucklanders’ disposable incomes

5th Mar 21, 9:28am

82

RBNZ Governor says it's too early to decide whether to get worried about rising bond yields, as ANZ Chief Economist warns a 1% mortgage rate rise would chew up 5% of Aucklanders’ disposable incomes

RBNZ Assistant Governor Christian Hawkesby observes 'pockets of dysfunction' in bond markets, saying the RBNZ could do more to put downward pressure on interest rates if necessary

2nd Mar 21, 4:47pm

87

RBNZ Assistant Governor Christian Hawkesby observes 'pockets of dysfunction' in bond markets, saying the RBNZ could do more to put downward pressure on interest rates if necessary

Lots of words, not much action - Jenée Tibshraeny on what making the RBNZ consider house prices means for you

27th Feb 21, 9:02am

179

Lots of words, not much action - Jenée Tibshraeny on what making the RBNZ consider house prices means for you

RBNZ Governor Adrian Orr tells banks to lower interest rates more, noting that if offshore funding costs increase, the RBNZ can offer cheap freshly-printed cash

25th Feb 21, 9:31am

22

RBNZ Governor Adrian Orr tells banks to lower interest rates more, noting that if offshore funding costs increase, the RBNZ can offer cheap freshly-printed cash

Reserve Bank leaves key monetary settings unchanged and says it will keep conditions stimulatory till confident of achieving 2% inflation and meeting its employment targets

24th Feb 21, 2:14pm

52

Reserve Bank leaves key monetary settings unchanged and says it will keep conditions stimulatory till confident of achieving 2% inflation and meeting its employment targets

RBNZ's Funding for Lending Programme not a good fit for Heartland Bank, CEO Chris Flood says, as group continues mulling splitting Marac out as a standalone subsidiary

23rd Feb 21, 9:08am

RBNZ's Funding for Lending Programme not a good fit for Heartland Bank, CEO Chris Flood says, as group continues mulling splitting Marac out as a standalone subsidiary

Former RBNZ chairman Arthur Grimes says the Reserve Bank should tighten monetary policy gradually and continue this tightening till house prices return to 'a much more affordable level'

22nd Feb 21, 4:01pm

129

Former RBNZ chairman Arthur Grimes says the Reserve Bank should tighten monetary policy gradually and continue this tightening till house prices return to 'a much more affordable level'