FLP

Document reveals Treasury - like National - wanted the RBNZ to put conditions on its Funding for Lending Programme to direct cheap funding to businesses

22nd Feb 21, 9:00am

18

Document reveals Treasury - like National - wanted the RBNZ to put conditions on its Funding for Lending Programme to direct cheap funding to businesses

No changes to the country's monetary policy settings are expected when the Reserve Bank has its first review of the year next week - but everybody will be looking for clues as to what comes next

20th Feb 21, 12:27pm

27

No changes to the country's monetary policy settings are expected when the Reserve Bank has its first review of the year next week - but everybody will be looking for clues as to what comes next

Never mind OCR hikes just yet - ANZ strategist looks for RBNZ guidance on how it'll slow the pace at which it creates money to buy government debt

15th Feb 21, 8:00am

35

Never mind OCR hikes just yet - ANZ strategist looks for RBNZ guidance on how it'll slow the pace at which it creates money to buy government debt

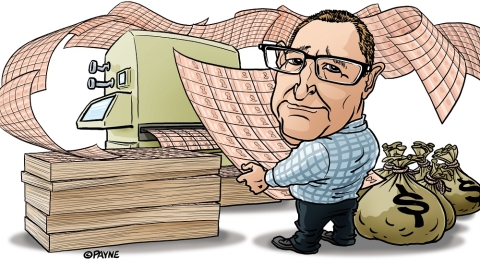

Gareth Vaughan gets lost in a fictional world full of fairies, rainbows and unicorns where banks use cheap public money in ways that make New Zealand a better place

14th Feb 21, 6:02am

83

Gareth Vaughan gets lost in a fictional world full of fairies, rainbows and unicorns where banks use cheap public money in ways that make New Zealand a better place

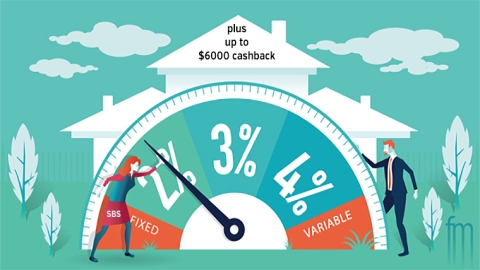

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

12th Feb 21, 4:02pm

15

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

CEO Vittoria Shortt details what ASB wants to do with billions of dollars worth of funding from the RBNZ priced at 0.25%

11th Feb 21, 5:00pm

38

CEO Vittoria Shortt details what ASB wants to do with billions of dollars worth of funding from the RBNZ priced at 0.25%

Treasury says it's too early to tell if the RBNZ's moves to lower interest rates have increased wealth inequality, as Robertson defends his decision not to take more drastic action on housing last year

11th Feb 21, 4:38pm

88

Treasury says it's too early to tell if the RBNZ's moves to lower interest rates have increased wealth inequality, as Robertson defends his decision not to take more drastic action on housing last year

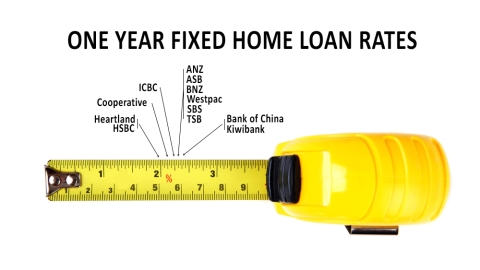

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

10th Feb 21, 10:10am

5

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

David Chaston summarises how the recent run-up in longer-term wholesale interest rates is affecting the cost of money, and for who. He also shows how the FLP is distorting these market moves

9th Feb 21, 11:52am

21

David Chaston summarises how the recent run-up in longer-term wholesale interest rates is affecting the cost of money, and for who. He also shows how the FLP is distorting these market moves

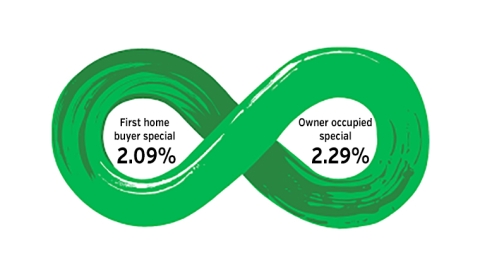

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

27th Jan 21, 3:30pm

6

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

Don't hold your breath if you're waiting for floating mortgage rate cuts from the big four banks. But do haggle with 'em if you want a lower rate

25th Jan 21, 10:48am

6

Don't hold your breath if you're waiting for floating mortgage rate cuts from the big four banks. But do haggle with 'em if you want a lower rate

ANZ economists forecast an OCR cut to 0.10% in May, but no longer see the RBNZ making the leap into negative territory

13th Jan 21, 4:57pm

27

ANZ economists forecast an OCR cut to 0.10% in May, but no longer see the RBNZ making the leap into negative territory

Jenée Tibshraeny on the billion dollars a bank has just borrowed from the RBNZ, the Chris Liddell saga, banks writing riskier mortgages and cafés closing during peak season

12th Jan 21, 11:29am

46

Jenée Tibshraeny on the billion dollars a bank has just borrowed from the RBNZ, the Chris Liddell saga, banks writing riskier mortgages and cafés closing during peak season

Jenée Tibshraeny has spent the year scrutinising the seismic government and central bank interventions made to keep the economy (and house prices) afloat. She shares her observations on the NZ Everyday Investor podcast

18th Dec 20, 1:51pm

47

Jenée Tibshraeny has spent the year scrutinising the seismic government and central bank interventions made to keep the economy (and house prices) afloat. She shares her observations on the NZ Everyday Investor podcast

Mortgage brokers say most banks have had their struggles keeping up with demand in a red hot housing market

16th Dec 20, 10:51am

3

Mortgage brokers say most banks have had their struggles keeping up with demand in a red hot housing market

Reserve Bank provides details of its Funding for Lending Programme, which will launch next Monday, December 7 offering banks cheap, three-year funding

1st Dec 20, 2:50pm

95

Reserve Bank provides details of its Funding for Lending Programme, which will launch next Monday, December 7 offering banks cheap, three-year funding

Gareth Vaughan argues the Reserve Bank's COVID-19 response is tilting the playing field in favour of banks at the expense of non-bank deposit takers

23rd Nov 20, 12:01pm

8

Gareth Vaughan argues the Reserve Bank's COVID-19 response is tilting the playing field in favour of banks at the expense of non-bank deposit takers

RBNZ accidentally sent a 'small group' of firms a letter about its Monetary Policy Statement 45 minutes before the document was published

18th Nov 20, 4:47pm

18

RBNZ accidentally sent a 'small group' of firms a letter about its Monetary Policy Statement 45 minutes before the document was published

How National's call for $28 billion of newly-printed money to go into productive assets is cornering Labour politically, and sparking necessary debate over RBNZ independence

17th Nov 20, 6:19pm

76

How National's call for $28 billion of newly-printed money to go into productive assets is cornering Labour politically, and sparking necessary debate over RBNZ independence

National's new Shadow Treasurer Andrew Bayly says the Government should be 'mandating' the RBNZ to ensure the new Funding for Lending money doesn't just flow into the housing market

17th Nov 20, 10:04am

40

National's new Shadow Treasurer Andrew Bayly says the Government should be 'mandating' the RBNZ to ensure the new Funding for Lending money doesn't just flow into the housing market

With the Reserve Bank's Funding for Lending Programme set to offer banks very cheap funding, there's plenty of scope for banks to cut floating mortgage rates, Kiwibank's economists argue

17th Nov 20, 9:00am

18

With the Reserve Bank's Funding for Lending Programme set to offer banks very cheap funding, there's plenty of scope for banks to cut floating mortgage rates, Kiwibank's economists argue

Economists expect the RBNZ will consider what impact its $28 billion Funding for Lending Programme has on interest rates before taking a knife to the OCR

12th Nov 20, 7:30am

25

Economists expect the RBNZ will consider what impact its $28 billion Funding for Lending Programme has on interest rates before taking a knife to the OCR

RBNZ says a Funding for Lending Programme will be launched in December; no changes made to either the Official Cash Rate or to the Large Scale Asset Purchases (QE) programme

11th Nov 20, 2:19pm

46

RBNZ says a Funding for Lending Programme will be launched in December; no changes made to either the Official Cash Rate or to the Large Scale Asset Purchases (QE) programme

Economists have differing views on whether the cheap money lending programme for banks to be announced this week will be specifically aimed at lending for businesses or will be available for banks to lend wherever, including on houses

9th Nov 20, 3:19pm

35

Economists have differing views on whether the cheap money lending programme for banks to be announced this week will be specifically aimed at lending for businesses or will be available for banks to lend wherever, including on houses

Why banks believe a Funding for Lending Programme wouldn't do enough to protect their profits in the face of a negative Official Cash Rate

30th Oct 20, 10:58am

7

Why banks believe a Funding for Lending Programme wouldn't do enough to protect their profits in the face of a negative Official Cash Rate