Summary of key points: -

- Overly-confident RBNZ focusing on wrong sources of inflation

- Overbought US dollar reverses sharply lower

- US housing market another important lead-indicator for the USD

Overly-confident RBNZ focusing on wrong sources of inflation

“Don’t worry, we have got this” was the overly-confident message from the RBNZ last week in terms of tackling the massive increase in New Zealand’s inflation rate.

The RBNZ are demanding respect and credibility in their handling of monetary policy to better align demand to lower supply levels in the economy.

The issue with credibility is that you must earn it, you cannot command it!

The clobbering of households/consumers with higher interest rates is their method to reduce demand.

The problem is that it is not excessive demand that has caused our 7% inflation rate.

The high inflation is the equally-weighted combination of imported oil/commodity sourced inflation (tradable, supply-side) and domestic home-grown sourced inflation (non-tradable, supply-side).

The RBNZ dismissed increased Government fiscal spending as a major source of the domestic inflation.

They are correct with that conclusion; thus the National Opposition MP’s are barking up the wrong tree in accusing the RBNZ of failing to blame the Government for this source of inflation.

As has been continuously demonstrated in this column, the permanent 3% per annum non-tradable inflation we are all paying for stems from our bloated bureaucracy passing on the cost of excessive Government legislation and regulation.

Local Government rates, building regulatory costs and education/health sector costs are the culprits and have been for many years.

The RBNZ have failed their inflation remit as they have not identified this source and taken successive Governments to task for their uncontrolled inflationary behaviour.

It could have been expected that the appointment of external members to the RBNZ’s Monetary Policy Committee may have brought some real-world, pragmaticism to identifying sources of inflation in the economy.

Worryingly, the three academics on the committee have seemingly not ever challenged or questioned RBNZ officials on this matter.

What is also concerning is that the RBNZ stated in their last statement that the depreciation of the NZ dollar to the low 0.6000’s was due to other countries increasing their interest rates and the interest rate gap to NZ closing up.

Interest rate differentials have not been a factor driving the NZD dollar direction for quite some time. We had no carry-trade funds parked in the NZ dollar to suddenly depart. The Kiwi dollar dived from 0.7000 to 0.6200 due to tumbling equity markets and the PBOC suddenly devaluing the Yuan which the NZD is linked to.

The RBNZ used to have their own specialist financial market executives monitoring the big buyers and sellers in the NZ dollar FX market and they would gather intelligence and insights on these currency forces. They do not seem to do this anymore.

The RBNZ also used the publish all the companies they had visited over the last three months to gain first-hand information on issues at the coalface of industries and the economy. That information has disappeared as well.

It is not the institution it used to be. What we get nowadays is an econometric model that spits out a result that the OCR will need to get to 3.90% to bring inflation back below the 3.00% maximum limit given current exchange rate and GDP levels. As we have seen over the last two weeks, the exchange rate can change rather quickly and therefore the model results become out of date.

Overbought US dollar reverses sharply lower

As US equity markets snap out of their longest weekly losing streak for decades, the tide also appears to be turning for the US dollar currency value.

The mighty US dollar, as measured by the USD Index (often referred to as the “Dixie” – a basket of only major six currencies against the USD, dominated by the EUR/USD at a 58% weighting) topped-out at 105.0 on 13 May as stocks on Wall Street tumbled.

Since then, as investor risk sentiment has recovered, the USD turnaround has been dramatic with the Dixie Index reversing back down to 101.6. The US dollar bulls in the forex markets are rapidly running out reasons as to why the USD should continue to appreciate.

Currency speculators who aggressively purchased the USD in April and early May on the back of a more aggressive Federal Reserve monetary policy and US inflation worries have been busy unwinding their long-USD positions over the last two weeks as evidence emerges that US inflation may have already peaked.

The first signal that the USD gains would not be sustainable came from the U-turn in direction in US Treasury Bond yields (as highlighted in last week’s report). The 10-year bond yields have continued to decrease over this last week to 2.74%. Foreign exchange markets continuously price-in to today’s exchange rate all future economic/financial market expectations.

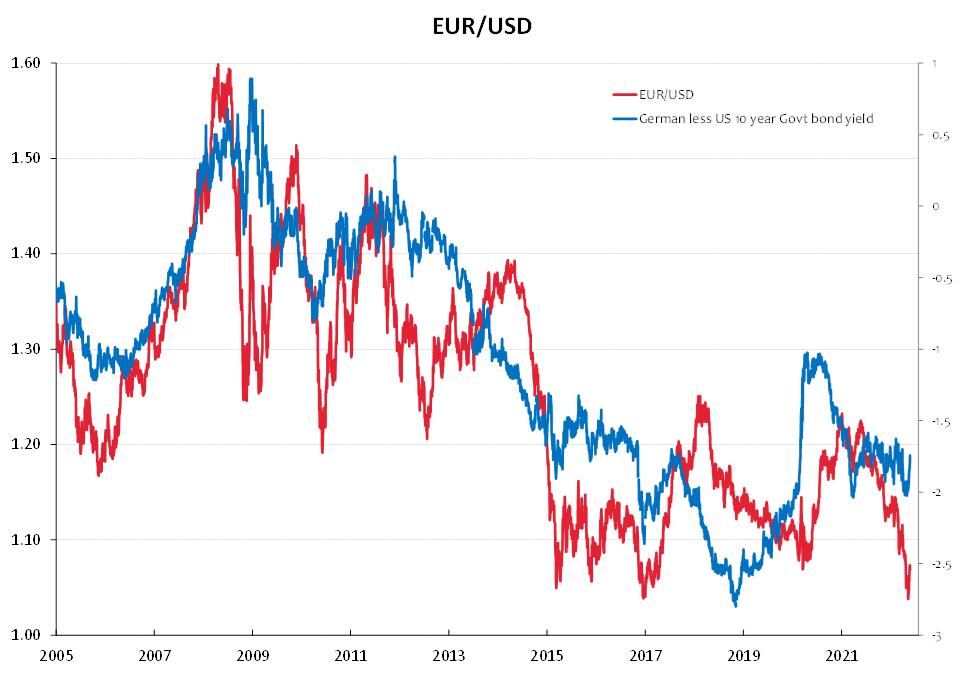

Therefore, it cannot be too surprising that the US dollar has started to weaken against the Euro as European bond yields increase in anticipation of the upcoming ECB lifting of interest rates, whereas US bond yields are now falling as the Fed are well into their interest rate hiking cycle. It has been the long-held view of this column that the Europeans would be six months behind the US Federal Reserve in timing in respect to reversing loose monetary policy to a tightening cycle.

The ECB has been clearly signalling in recent weeks that they will be increasing their interest rates in July as they must deal to a 7.5% inflation rate, despite the economic clouds from the Ukraine/Russian war.

As previously stated, the monthly releases of US inflation data has now become the key economic lead-indicator for the US dollar’s direction.

The US annual inflation rate will now trend downwards as the big monthly price increases of 12 months’ ago drop out of the annual figures.

Last Friday’s second US inflation measure, the PCE price index for April (core index) increased by just 0.30% which was lower than the prior consensus forecasts of +0.50%.

The USD weakened as a result, the EUR/USD rate lifting to $1.0735. The next key inflation number in the US is the May CPI release on Friday 10th June. A significant decrease in the current 8.30% annual rate will be further evidence that US inflation has peaked and therefore be negative for the USD value.

The chart below of the differential between US and German bond yields points to the EUR/USD exchange rate returning all the way to the previous $1.1500 to $1.2000 region.

A further 7% depreciation of the USD against the EUR to $1.1500 would result in the NZD/USD rate returning to 0.7000. Our view has been that the selling of the Kiwi dollar in April/May was short-term speculative in nature and would reverse back upwards just as rapidly as it dropped.

That anticipated “V” shaped recovery is already taking shape with the NZD/USD rate up to 0.6540 and there is a lot more to come as the USD currency buyers reverse their positions.

US housing market another important lead-indicator for the USD

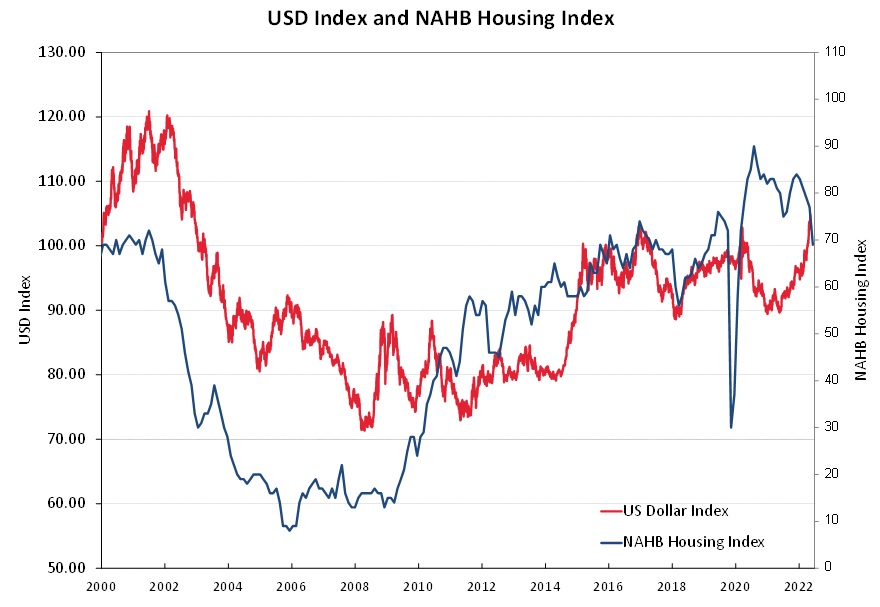

Whilst bond yield differentials suggest an over-valued US dollar, recent developments in the US residential real estate market point to a similar conclusion. US housing mortgages are priced-off their 30-year Treasury bond yield.

Mortgage interest rates have almost doubled from 2.9% to 5.5% over the last five months. Historical interest rate/housing confidence correlations would suggest that the NAHB Housing Index could decrease a lot further from 70 to near 40 (blue line in chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

12 Comments

"No pain no gain"

We did not take any pain in 2020 and 2021, just some inflation in 2022.

The fundamentals of inflation are too much money chasing too few goods. Less goods, reduce the money supply. Straight forward. Whilst they will never admit their mistakes, pumping economies with QE and leaving interest rates at the floor for almost a decade has finally reached its tipping point.

"The clobbering of households/consumers with higher interest rates is their method to reduce demand." -

People with no mortgage, mortgage free or a low mortgage will now have more money to spend in the economy without having to save every dollar toward a deposit, and they'll be better off with a half decent savings rate.

Very well said. I agree 100%.

It is time to debunk the delusional thinking of the fools who thought that an ultra-loos monetary policy was sustainable and it could continue. It is finally time to stop using excuses such as Covid and most importantly it is high time to accept reality, and to accept that the rates normalization process is structural and well overdue. And if this involves a potential implosion of the housing Ponzi, so be it - the longer it is allowed to fester, the more damage its inevitable demise will create to the real economy.

Anyone out for dinner over the weekend? I think it will be a long winter.

I couldn't agree more about your point of excessive legislation & regulation,..and consequent bloated bureaucracies, being a significant cause of inflation.

I feel our Parliament sits for too long and the wider range of political viewpoints attendant on MMP, results in far too many, waffly statutes long of "inspirational" hope. In many ways we ordinary citizens are our own enemy, wanting legislation that avoids "one size fits all", ie we demand flexibility to allow for different individual circumstance. The result is many statutes are lacking substance and authorise some ministry to exercise discretion through vast volumes of departmental tertiary rules. In other words we avoid infexibilty by creating jobs for hordes of bureaucrats.

The Resource Management Act 1991, touted as "permissive" rather than the "prescriptive" Town & Country Planning Act it replaced, is a case in point. The well meaning waffly RMA has created huge numbers of bureaucrats with too much discretionary authority, vast quantities of "plans" at every level, extremely expensive court judgements ( to work out what the legislative waffle actually means) and clouds of individually funded, "experts" to guide applicants through the jungle.

The RMA was drafted hurriedly by non-government agencies in the dying days of the then Labour government and most unwisely pushed through Parliament by a new and naive National government. It has clearly cost the country billions of dollars to produce little environmental or productive gains.

It continues its destructive path and results in huge costs, not only in directly accountable government (central & local) costs, but in massive impact on private firms or individuals seeking "approval" for their projects.

Add in the nonsense of Health & Safety, the educational sector in a state of permanent change, etc., etc., & the result can only be a wimpering "bang" for expenditure of hugely unecessary "bucks"! Inflation on steroids.

I think RBNZ has made the right decision. From the past a few months, we've seen how weak NZD has been. It reflects on our petrol price. But now finally it's getting some traction. I kind of understand why RBNZ has become this hawkish, because without it, just 25bps or 50bps every time wouldn't be enough to get down inflation soon, the inflation expectation is starting picking up its speed from the previous survey.

I reckon RBNZ has to be super strong in its stance now so people have 110% belief that they will do whatever it takes to stop this.

Its the perception that they will go slow, change course to protect housing and other parts of the economy that seem to be causing the problems? Personally i would like to see them drop a 'higher than 50bps' hike in to underline this.

I agree with Roger, which isn't that common.

20 months ago, banks were being told to prep for negative rates and yet here we are fighting supply side inflation due to supplychain disruption, energy prices, greenflation and a closed border (all policy choices and not demand). The OCR was 1% pre-covid, now at 2% and forecast to 4%. The whole point of the least regrets policy and cutting the OCR to .25% and implementing QE was to prevent a recession, but here they are now almost certainly plunging us back into one. Wages are not going to keep up with these rises and inflation will slowly but surely ebb.

Why aren't the RBNZ selling the LSAP and engaging QT so that the OCR does not need to rise so fast?? No doubt because of the headline of crystalising the $7.5b loss.

My view on Orr and Hawkesby has changed a lot, they are out of their depth. This level of incompetence should be headline news but no one is going to challenge them publicly because to do so would be career suicide,

"Supply chain disruption, energy prices and greenflation are policy choices"

Not sure what you mean by that? They don't appear to be policy choices, but you may be defining it differently

Bullseye Te Kooti, keep em coming

The RBNZ has no credibility. An AI robot would do better.

a) Inflation too low for too long

b) Then they over stimulated the economy allowing mortgage rates to fall to absurdly low levels causing a blow off in the housing market (noting that asset values are proportional to 1/interest rate)

c) And finally they are having to play catch by raising interest rates so fast its going to cause significant economic and housing pain.

Central banks should not be allowed to drop interest rates below about 3-4%. The blow off in asset values is too much, and the pain on the upside when raising interest rates again too much as well. We would be far better off with helicopter money and fiscal policy below those levels.

The RBNZ knows we have a very tight housing supply market, yet it chose to ignore it.

Implied asset value with mortgage rate on the bottom.

1/(1%) = 100

1/(2%) = 50 - one year fixed mortgages bottomed close to here (housing peak)

1/(3%) = 33.3

1/(4%) = 25

1/(5%) = 20 - one year fixed mortgages are about here now once banks raise their rates this week.

1/(6%) = 16.7

etc

The implied asset value of a house (based on constant rental return, everything else being equal, ignoring taxes & other costs) has already fallen to 20/50, i.e. 60%, from the very peak (not that many people took out mortgages and rentals right at the peak)

Amongst many I have long held the view that Socialist Governments are totally incompetent, Reserve Banks marginally competent and National Govts competent sometimes. The current comments on inflation busting using interest rates is historically what has been done to tame inflation with varying degrees of sucess in varying timescales so assuming Orrful follows this path I did some research on what level of interest is required to tame inflation. Anecdotally I have heard many times its current interest rate plus 2% - but is that OCR in NZ or a basket of bond rates or the 3 year mortgage rate, I choose OCR as it is a single rate and accurately recorded.

In Mar 2017 just before ardern & clowns were inflicted on NZ OCR was 0.25% and 2.0% in May 2022, this article - www.chicagobooth.edu/review/what-makes-it-hard-to-control-inflation - suggests the rate is 1.5 times the increase in interest rate. So at 2% and an increase from 0.25% that is 2.625% which equates to an OCR now of 4.625, and will increase as RBNZ increases OCR so if they achieve an OCR of 3.9% the new rate is 9.375% ( 3.9% -0.25 x 1.5) if 2% is correct then its 8.9% (6.9 +2%) based on inflation rate.Either way the current views of economists and the RBNZ is out by a little or a lot and interestingly these figures are quite close - a coincidence - perhaps.

So far since 2017 our govt and financial bureacrats have been wrong on most important measures so I have little confidence in the demonstrated ability to be correct or deliver anything of real value to most Kiwis. Well done Roger you and I may both be wrong but at least we use facts rather than the word salad been served by Liam Dann and his equally left wing, biased, incompetents.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.