Summary of key points:

- US inflation has not peaked yet, however it is not far away

- Lower oil prices seem more likely

- Australian economic data continues to impress

- A despondent New Zealand not a reason for a lower NZD value

US inflation has not peaked yet, however it is not far away

Picking the peak of the US inflation increases is proving tricky, both May and June monthly inflation results have printed above prior market expectations and propelled the US dollar value even higher.

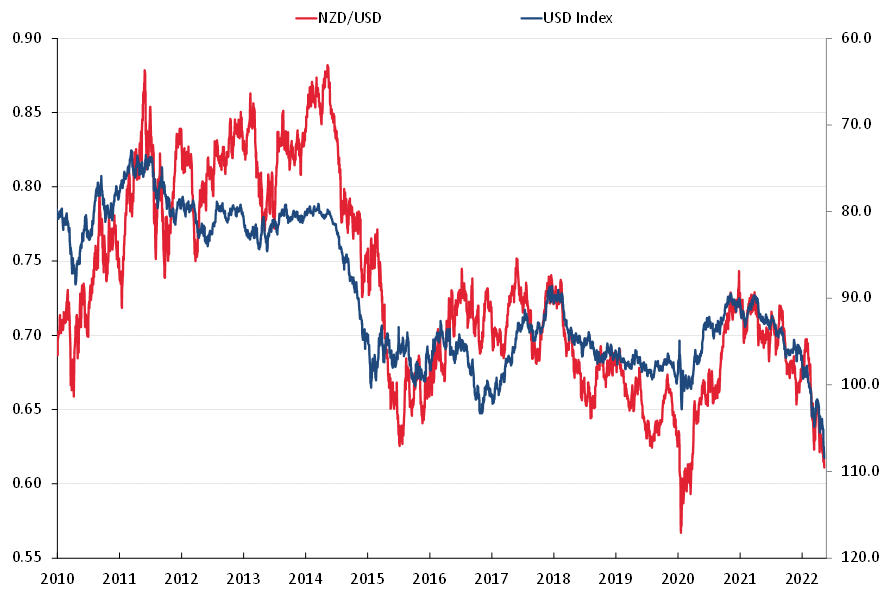

Our view has been that the US dollar will peak-out on its strengthening trend of the last six months when the US annual inflation rates peaks and starts to trend downwards. We are not there yet. However, the evidence continues to gather that we are not far away. What is different today to three or four week ago is the fact that oil prices and most commodity prices are now reversing to a downward direction. As these prices continue to go lower the prospect of the July and August US inflation increases being lower than the same two months increases 12 months ago increases. When this occurs the annual inflation rate will be lower than the previous month, causing both the Federal Reserve and the markets to reassess how high and when US interest rates will have to peak. From that point, the rationale to continuously bid the US dollar currency value higher will dissipate.

The US bond market is already starting to price-in the prospect of US inflation peaking with the 10-year Treasury Bond yield reducing from 3.50% to 2.93% over the last two weeks. What this tells us is that US bond investors see a stronger likelihood of lower yields in the future and are buying. The buying is outweighing the selling of bonds by investors and borrowers who see yields higher in the future. It seems inevitable (based on close historic correlations) that the US dollar Index, currently at 108, will follow the bond yields lower. It requires the FX speculators who are sitting on long USD positions to be convinced that the Fed’s rhetoric will change when the peaking of US inflation seems more certain. Further decreases in bond yields to 2.80% over coming weeks, would suggest that the USD Index shifts lower to the 102 area (equating to a 0.6500 NZD/USD exchange rate).

Important dates are on the horizon for US bond and FX markets, the Federal Reserve meeting on the 27th of July and US GDP growth figures for the June quarter the day after on the 28th. The US interest rate markets started to price in an 80% chance of a 1.00% interest rate increase last week, however that forward pricing reduced as quickly as it ramped up. Therefore, another 0.75% hike seems more likely. Consensus forecasts are for the US economy to expand by +1.00% annual rate in the June quarter after contracting 1.60% in the March quarter. A growth outcome well below +1.00% would send both US bond yields and the USD currency index lower.

Lower oil prices seem more likely

The key lead indicator for the bond and FX markets will be movements in the crude oil price from the current lower level of US$97.50/barrel. Ever increasing energy and freight costs has forced US annual headline inflation to above 9%, however these prices reversing the other way could pull inflation back down as fast as it went up. The global supply and demand outlook for oil is changing rapidly with lower GDP growth forecasts all over the place reducing industrial demand and the real prospect of the Saudi’s amping up supply volumes following President Biden’s visit last weekend. The Americans forcing a price-cap on Russian supplied oil seems less likely, but good on them for trying. Falling oil prices, together with falling bond yields starts to change the picture for the US dollar value against all currencies.

Australian economic data continues to impress

Despite US inflation printing above forecast and the last US jobs number being considerably stronger than expected, the Kiwi and Aussie dollars have held their own over this last week. The NZD/USD dipping to a low of 0.6060 on 15 July, however recovering to 0.6170 at the time of writing. New Zealand economic news is not exactly stellar these days, however our economic performance and outlook is having absolutely no influence on the NZD/USD exchange rate. Our CPI inflation figures for the June quarter being released on Monday 18th July are not expected to shift the dial for the Kiwi dollar. However, the Australian economic news remains very strong with employment numbers for June three times estimates at +88,400. Australia also recorded a massive A$15.9 billion trade surplus (exports greater than imports) for the month of June, well above prior forecasts of A$10 billion.

Another leg down in US equity markets, over and above the sell-offs in April and June, still stands as the major downside risk for the NZ and Aussie dollars. Bond yields going lower, not higher, removes one of the negatives for US equities. The question after that is how much the prospect of a recession dents corporate earnings and lowers share values.

A despondent New Zealand not a reason for a lower NZD value

A very sobering international survey report released last week that rated New Zealand near the bottom of attractive countries to immigrate to, rather succinctly summed up where we stand in the post-pandemic era. At a time when we have a chronic labour shortage severely restricting productive output, there seems little hope of the labour crisis abating. The Government’s immigration policy and process is cumbersome and difficult, adding to the reasons why immigrants are attracted elsewhere. The survey result made grim reading on top of local surveys of confidence for consumers, farmers and business that are all plumbing the depths of record lows. Add on the fact that the All Blacks have lost four out of the last five rugby tests, the nation’s mood and spirit is all but broken.

In normal global economic times the above factors and a weaker NZ economic performance would suggest further depreciation in the NZ dollar in its own right. Global investors have been reducing their weightings to NZ bonds and equities, which would also suggest a weaker NZ dollar value.

However, we are far from normal times.

As a result of the Russian/Ukraine war, inflation has spiralled up and out of control, causing sharply higher US interest rates and a US dollar value at 20-year highs. Perversely, and in our view, the NZD/USD exchange rate has a greater probability to increase as the USD weakens back against all currencies on natural market profit-taking. In addition, the analysis above points to lower oil prices ahead, inflation peaking/falling and all the recent reasons to buy and hold the USD are reversed.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.