Summary of key points:

- US bond market votes with its feet on economy and inflation

- “Burgernomics” and the theory of purchasing-power parity

- Another leg down in equities remains as a Kiwi dollar risk

US bond market votes with its feet on economy and inflation

The message coming from the US bond market about the future for US inflation trends, the timing of the Federal Reserve pivot on monetary policy, the direction of the US economy and therefore the direction of the US dollar value cannot be any clearer.

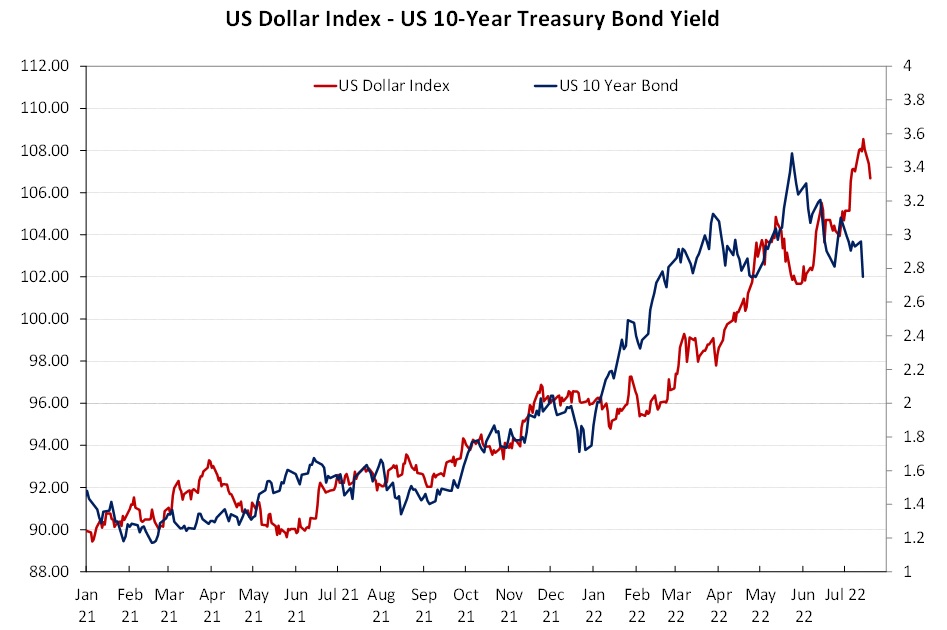

The dramatic reversal in US 10-year-bond yields from the highs of 3.50% in mid-June to 2.75% at the market close on Friday 22 July is telling us that the sentiment and expectations from both bond investors and borrowers is that they see lower inflation and lower interest rates in the future. The turnaround in view and direction has been rapid, however well justified by the evidence of lower oil prices and weaker US economic data.

In last week’s commentary we mentioned that further decreases in US bond yields to below 2.80% (2.93% at that time) would suggest a following weaker USD value on the Dixie Index towards 102. The US dollar has weakened back over this last week, however only to 106.40 on the Index, so it still has a lot of catching up to do (refer to the chart below).

US economic data released last week continues to paint the picture of a rapid slowdown in the US economy in June and July. The S&P Global Composite Manufacturing PMI Index for July was a sharply weaker 47.5 against prior consensus forecasts of 52.1. A result below 50 signals a very negative forward outlook with manufacturer’s order books falling away. Housing data earlier in the week for June was also considerably weaker than expectations. The Federal Reserve may not officially temper their rhetoric about the need for higher and higher interest rates to reduce demand in the economy until they update all their forecasts in their September statement. However, the financial and investment markets will anticipate the pivot in advance and adjust pricing now. We are seeing this play out in the bond market already as they vote with their feet and the US dollar value surely has to follow the bond yields lower (in its lagged fashion).

The Fed meets this week on Thursday morning (6am NZT) and a further 0.75% increase in their interest rate to 2.50% is already baked into market pricing. US GDP growth data on Friday morning 29th July for the June quarter is forecast to come in at an annual growth rate between 0.40% and 0.60%. An actual number below the forecast, or a negative number, would send the US dollar value sharply lower as the need for further increases in US interest rates to reduce inflation recedes. US jobs data for July on Friday 5th August will also be a key signpost for the markets. Consensus forecasts are for a lower 260,000 increase after the better than expected 372,000 increase in June.

The NZD/USD exchange rate direction continues to be totally dominated by the USD side of the equation. Not even a 5% fall in dairy commodity prices last week stopped the Kiwi dollar from advancing higher to 0.6250 as the AUD posted gains and the USD weakened on global FX markets.

“Burgernomics” and the theory of purchasing-power parity

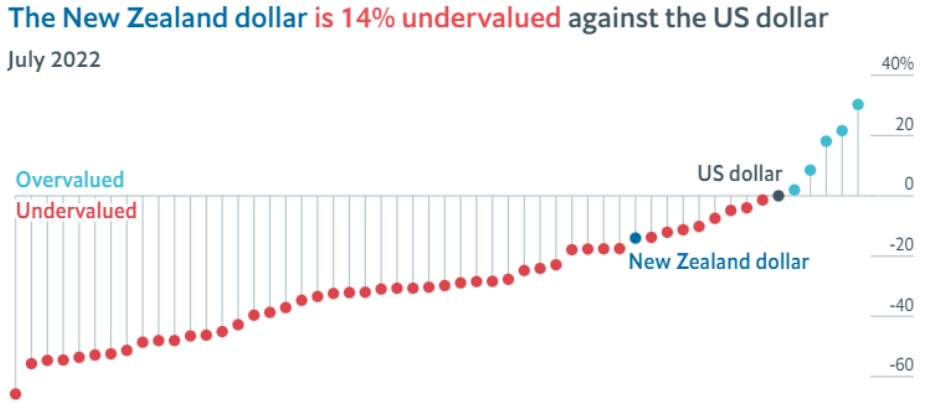

The Big Mac Index was invented by The Economist magazine in 1986 as a light-hearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods (the Big Mac burger was chosen) in any two countries. It is not precise; however it is a standard measure that is better than most.

According to the Economist, a Big Mac burger costs NZ$7.10 in New Zealand and US$5.15 in the US, therefore the implied exchange rate is 0.7250. The current market NZD/USD rate is 0.6250, therefore the Kiwi dollar is 14% undervalued against the USD. The Australian dollar comes in at 10.2% undervalued and the Euro 7.5% undervalued. The Swiss Franc is 30.3% overvalued (a Big Mac costs SFr6.50 in Zurich) and at the other end of the scale the Venezuelan Bolivar is 66% undervalued.

Another leg down in equities remains as a Kiwi dollar risk

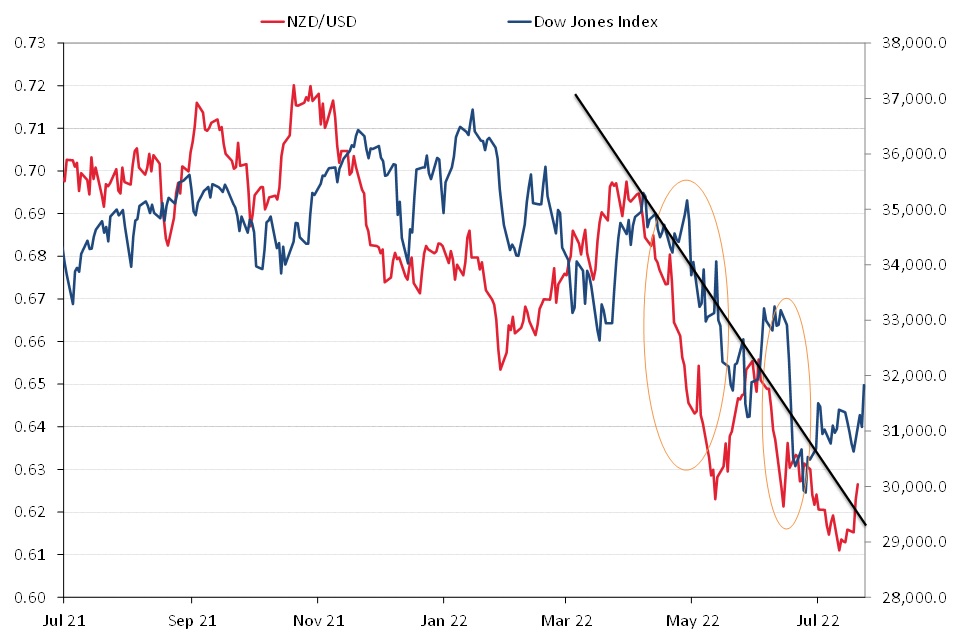

The big sell-offs in US equities in April and again in early June hit the Kiwi dollar hard (circled areas in the chart below) as the investor “risk-off” sentiment caused hedge funds to sell the risk sensitive currencies (NZD and AUD). Equities have recovered in recent days as US corporate earnings have not yet been adversely affected by a slowing economy. The sudden reduction in the risk-free, US Government Treasury bond yields to 2.75% has been more favourable news for the technology stocks that sold-off when the bond yields were rising sharply in April and June.

The close correlation between the Dow Jones Index and NZD/USD exchange rate cannot be ignored. Some market commentators suggest that the equity markets could have a further 10% leg lower on top of the 20% fall in the Dow from 37,000 in January to a low of 30,000 a few weeks back. If this was to happen, the Kiwi dollar would be vulnerable to fresh selling. However, given the greater probability of the Fed pivoting earlier than most believe on a weaker US economy and lower oil prices (now US$95/barrel), the likelihood of another equity market sell-off appears to be reducing. Even a modest recovery in the Dow Jones Index from 32,000 to 34,000 would propel the Kiwi dollar higher to .6800.

The NZD/USD rate at 0.6250 has now decisively broken upwards to be above the downtrend line that it has traded below since 0.7000 in late March (black line in chart below). Our forward view remains unchanged, the NZD will follow the AUD higher over coming months.

USD importers should be at minimum hedged levels and USD exporters continuing to hold maximums by replacing all maturing hedges. USD exporters with bank credit constraints due to existing hedges being in an unrealised loss position on marked-to-market revaluations, are advised to buy NZD call options (that do not use bank credit). Buying NZD call options with strike rates two cents above the 0.6250 spot (i.e. 0.6450) indicatively have a premium cost of 80 exchange points.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Another excellent article from Roger Kerr. Imagine, though, what will happen to the NZ dollar if Jacinda gives the vote to 16 year olds. Labour/Greens will get in again as school teachers lead their kids to the ballot box. The Greens will insist on their wealth tax to form part of the government. Those who invest in NZ will leave for Australia and take their money with them. There will then be only one direction for the NZ dollar. Downward.

The confidence in the NZD is as low as it is in our confidence in the current All Blacks. Low confidence also describes a lot of peoples attitude towards our current govt, as seen in their over-printing during their over-hyped emergency & now our having to over increase the interest rates to try & balance things out. As an example our interest rate will go from 2.5% to 5.5%. That's a 100% PLUS increase.

When talking monthly mortgage repayments, we're not a FHB but a doubling in the largest household cost is going to take some adjusting to. We'll get through it by probably doing the shortest term we can 'in the hope' that the rates will come down a bit next year (election year). But who knows?

With respect, this is twaddle with no perspective of history or the US geo-political agenda.

The NZD/USD will hit .55 before it ever returns to .70.

DXY is highly probable to increase from 106 to 120 before end of year.

The trade is to hold USD to .50NZD and then assess what out narcissistic government and the fat kid at the RBNZ Tuck shop will do.

Kwaddle

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.