- Local economic data continues to be irrelevant for the Kiwi dollar’s direction

- Current largest contributor to US inflation about to reverse?

Local economic data continues to be irrelevant for the Kiwi dollar’s direction

Last week, the better than generally expected NZ GDP growth number for the June quarter of +1.70% very briefly stirred the NZD/USD exchange rate 20 pips higher, however it was very soon pushed below 0.6000 by yet another surge in the US dollar value.

The week before, dairy prices increased for the first time in four months, in years gone by that would have resulted in a higher Kiwi dollar as FX traders viewed dairy commodity prices as a proxy for the NZ economy. The Kiwi dollar found no buying support from the dairy lift as the offshore FX traders have for more than two years now dismissed the NZ currency as a trading opportunity. The evening up of international interest rates at 0% through the Covid pandemic period and now as they are all around 3.00% (except Europe and China), the Kiwi dollar offers no advantage, interest or opportunity for the currency punters. The GDT dairy auction this Wednesday morning will most likely see a continuation of price increases as European supply to export markets dwindles (due to their energy crisis), however do not expect NZD gains as a result.

Given the clear evidence that New Zealand economic news releases and trends are having absolutely no impact on the NZD/USD exchange rate (and have not for two years now), it is somewhat surprising and very odd that the regular local bank FX reports only ever cover NZ factors in their NZ dollar commentary section.

The outlook for the NZ economy is subdued at best, given chronic labour shortages, higher mortgage interest rates, low business investment and low business/consumer confidence levels. However, that does not mean that the NZD dollar cannot recover form 0.6000 and move substantially higher when the US dollar turns around on the global stage. Credit rating agency, Standard & Poor’s delivered a reasonably positive report card on the NZ economy last week. They said our economy performed better than others through the Covid shock. A cynical response to the S& P report is that they only spoke to Treasury and RBNZ mandarins in Wellington, business folk in the regions would have given them a different message!

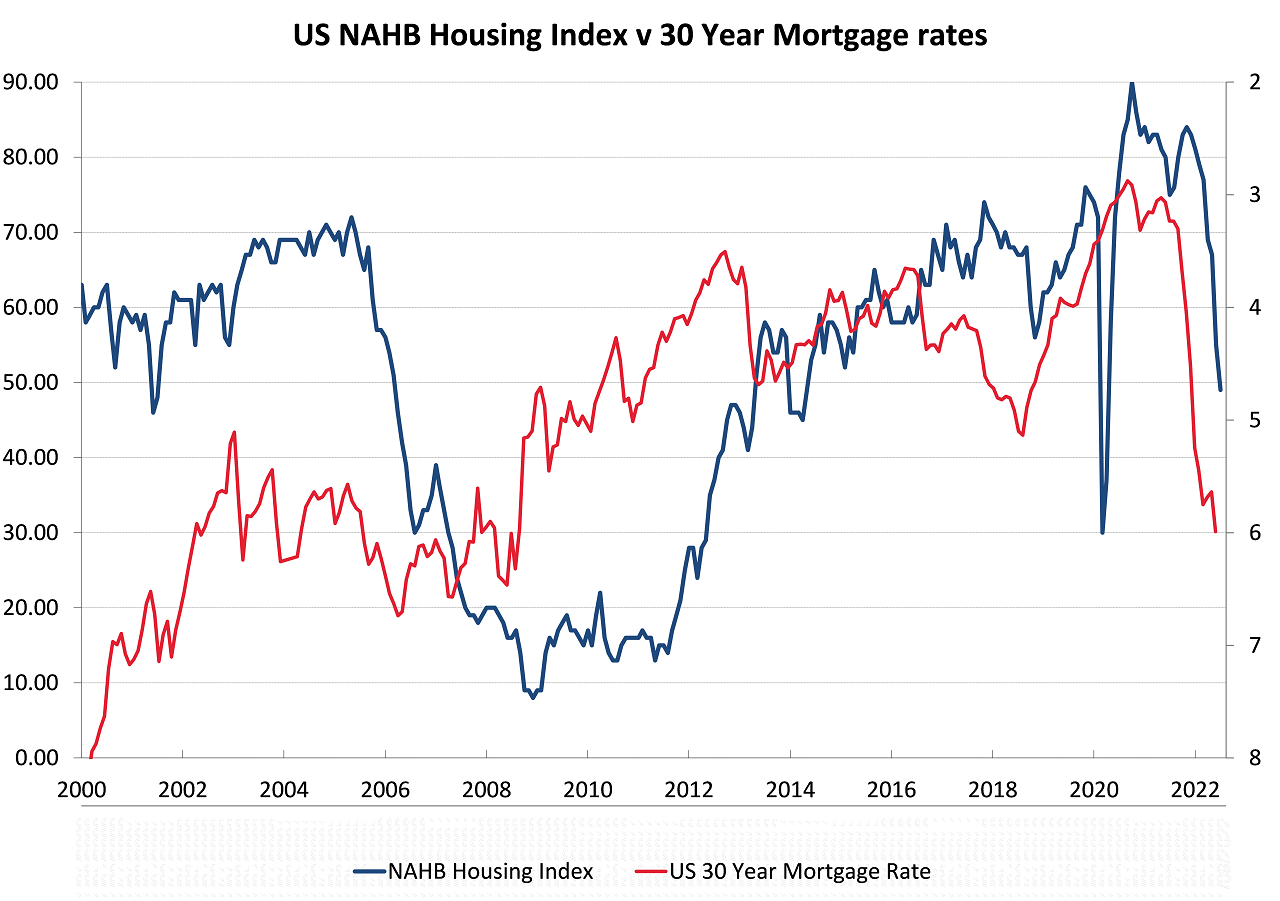

US dollar gains against the EUR and AUD caused another flirtation below 0.6000 to 0.5945 for the NZD/USD rate last Friday, however it has again recovered back to 0.6000. Ahead of the Fed meeting this week, the FX markets will be eying up US housing data with the NAHB Index for September on Tuesday morning and August housing permits/starts on Wednesday morning. The NAHB Index is forecast to reduce further from 49 to 47. Weaker housing figures in the US will not be positive for the USD as the following analysis addresses.

Current largest contributor to US inflation about to reverse?

On Thursday morning (6am) this week we hear form the US Federal Reserve with a 0.75% increase in their official interest rate, “dot-plot” 2023 interest rate forecasts from the individual voting Fed Governors and updated economic forecasts. They will predictably tell the markets and the world that US interest rates have to be maintained higher for longer to bring down the high inflation. All that hawkish rhetoric is already fully priced-in to bond, equity and FX markets.

The following series of four charts suggest that the rapid tightening of US monetary policy over recent months has already smashed the US housing market and it is only a matter of time (within the next three or four months) before the consequences of their actions will force the annual inflation rate to move sharply lower. The bond, equities and FX markets must soon start to anticipate the analysis below and price-in the Fed nearing the end of their tightening cycle i.e the job they needed to do is done!

Chart 1: The rapid increase in US home mortgage interest rates from 3.00% to over 6.00% over the last six months (red line, right-hand inverted axis), has sent confidence in the house construction sector (NAHB Index blue line, left-hand axis) plummeting, with further decreases highly likely. The tighter monetary policy from the Fed is already having a massive negative impact on housing.

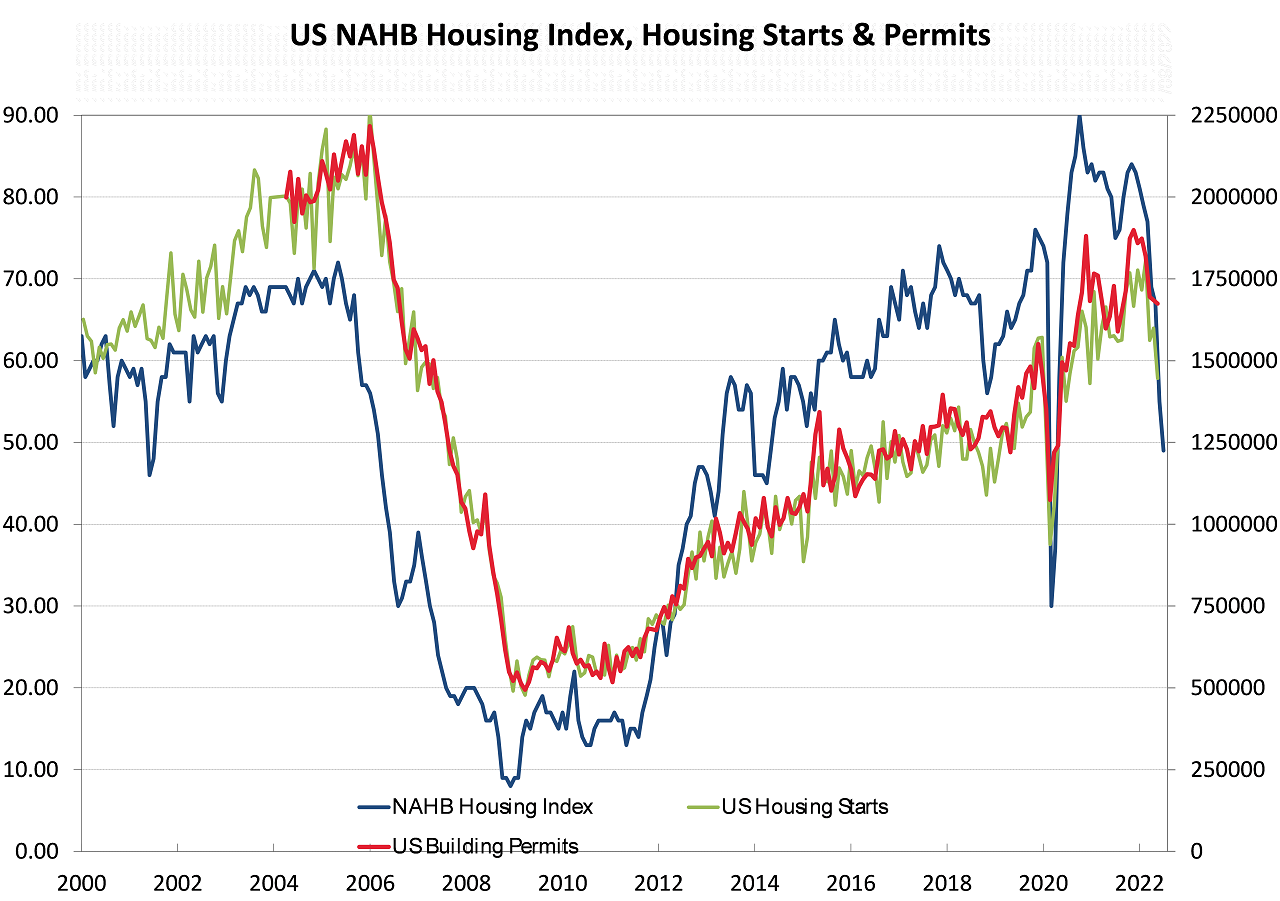

Chart 2: Historical corelations inform us that US house building permits (red line) and housing starts (green line) will follow the NAHB Index (blue line) sharply lower over coming months.

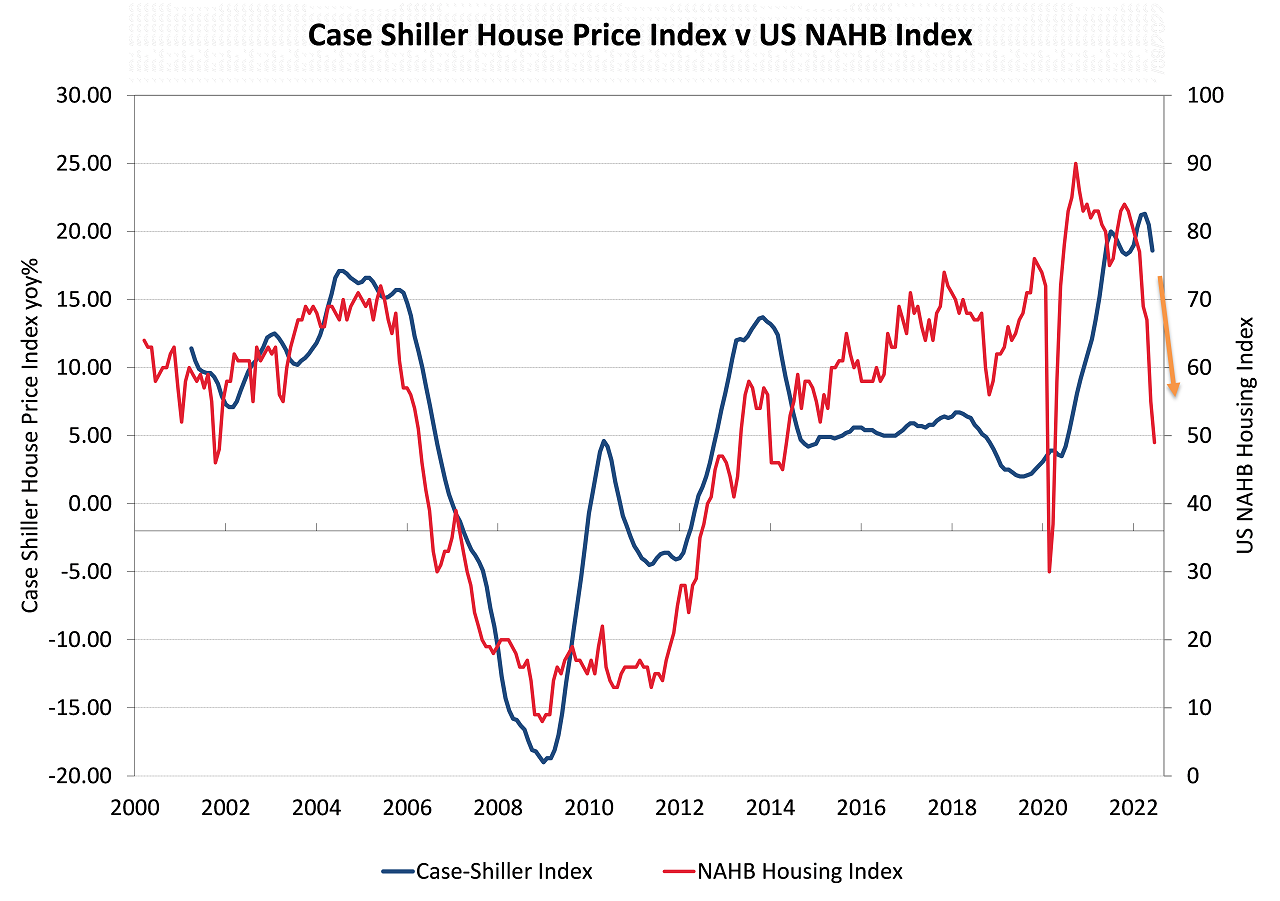

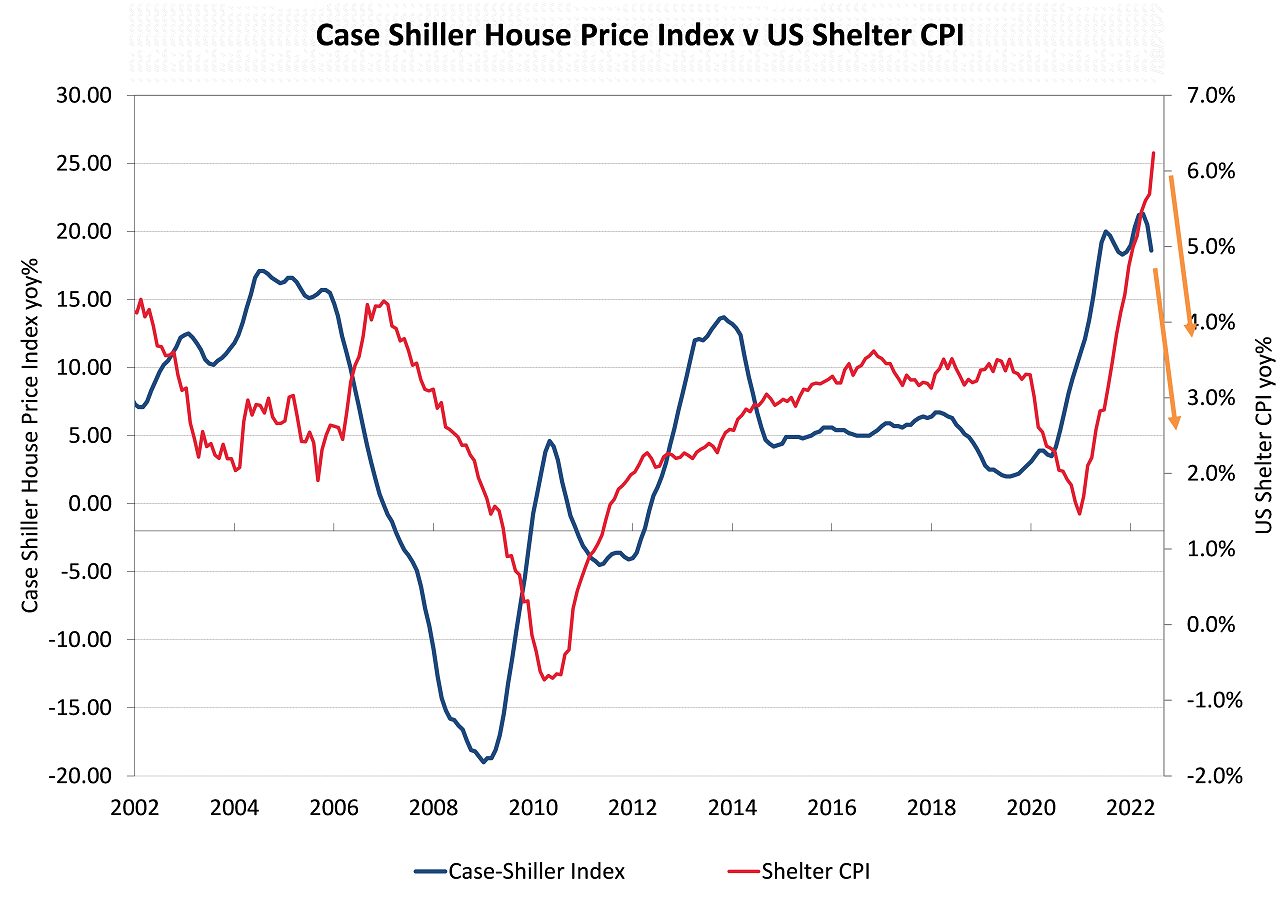

Chart 3: The dramatic increase in US house prices (due to excessive Covid-related loose monetary policy in 2020 and 2021) has started to turn down. The Case Shiller House Price Index (blue line) appears to have peaked and has started to turn lower. The historical correlation of house prices to the NAHB Index suggests that house price increases will quickly reduce to 0% from the current +18% (yellow arrow down).

Chart 4: Historical correlations and “cause and effect” also tells us that falling US price prices inevitably leads to decreases in house rents (US Sheter CPI, red line, right-hand axis). What we do not know with precision is the time-lag between decreasing house price and falling rents. The Federal Reserve must know the expected lag and for that reason they should be anticipating that the current rising house rents (the current largest contributor to US core inflation) are unsustainable and when they just level off, the annual inflation rate will reduce as fast as it went up from 3.0% to 8.5% over the first half of 2022. The Fed need to look out the front window of the car, not the rear-vision mirror of economic data.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

27 Comments

Excellent piece.

I am gobsmacked that local economists and this website haven’t picked up on the very strong correlation between surging interest rates, construction confidence and housing starts.

All you need to do is go back to 2006-2008 in NZ….

2023 is going to be an ugly year for residential construction in NZ.

Is anyone really pretending that higher interest rates don't correspond to less activity?

Late 23 will be the worst, early 23 will still be completing legacy projects, many weren't even started this year due to gib shortages and the complications of having lots of half sites sitting around.

Bad from mid 2023.

lots of projects in Auckland will be completed around April. Tonnes are currently in framing stage, so about 5-6 months from completion.

I agree with your thesis Roger that inflation will soon be smashed in the USA, through demand destruction.

The same thing will happen here.

If the US on shores significant industry ex China, high US employment and inflation may be the main drivers for some years.

Fully agree; See the FedeX chairmans report from last Thursday.

Also when you use the AIS system and the main shipping line schedules (Maersk; ONE; Evergreen, HMM, MSC) you will discover that they only carry 2/3 thirds of their loads and steaming 40% more slowly compared with March/April this year on the Europe - Asia trade. On top of that most of these containerships are parked up (anchored down) for up to 4 weeks every time they start a new Voyage.

Demand destruction is already happening in full force, so buckle up!

At $3,896/Forty Foot container, Asia – US West Coast rates have fallen by nearly 75% since the start of the year and are at their lowest level since May of 2020.

As a comparison China to NZ is still high USD 8k per 40' container. Due to more intense shipping line competition rates ex China to Australia East Coast have fallen to mid 3k per 40'. Rate for both was over USD 12k at peak.

This is supposed to be peak season for shipping with highest rates of the year ahead of China Golden Week holiday and Christmas inventory requirements. Demand is just not there.

I take it Roger is 100% convinced a deflationary recession is ahead of us with 0% chance of an inflationary recession?

Is this the case Roger?

My only argument would be, that the Fed may not be making the assumption that a deflationary recession is around the corner - which Roger is. He could be right, but if he's wrong, then it would mean the risk of unacceptably high inflation and the end of the USD and the US global dominance (and every advantage geopolitically that goes with this) - something I'd imagine the US isn't willing to risk.

My personal view is it 75% chance of a deflarionary recession, but there is a 25% chance it is not, and being wrong on that 25% would be very costly for the Fed if inflation were to become entrenched in the economy. Hence why unlike Roger's view they aren't willing to take that risk yet because the cost of being wrong would be far too high.

I can see the possibility that the Fed pivots next year, because asset prices are falling, there is no real economic growth, and unemployment is rising to an unacceptable level (not because inflation is below the target band).

But by doing so, they pivot and pump more money into the system and just create even more of the problem they already face.

That is the money supply is increasing far faster than the productive capacity of the economy, and they just end up with even more inflation!

In my view, to fix the inflation problem, we need to cut fiscal spending and increase productivity so that the amount of goods and services produced within the economy matches the increase in money supply from 2020-2021. That will bring inflation down and avoid a severe recession/depression.

A repeat of 2020 where central banks and governments go crazy with their monetary and fiscal responses might just make the problem we face even worse. But my faith in the current thinking with the Fed, at the RBNZ and political institutions of the US and NZ, mean that they will probably make the situation worse, not better.

And that would mean the only lever left in the tool box might be even higher interest rates! That is if we don't cut fiscal spending, and we don't increase productivity, then the only remaining way to crush inflation would be to continue to destroy aggregate demand via higher cost of capital.

It’s quite the conundrum.

Moderate hiking may be ineffectual and full

of unintended consequences.

Aggressive hiking may be effective (wrt inflation) but also result in a very deep recession and soaring unemployment.

Yes and it doesn't necessarily mean it will be a deflationary recession. If people lose jobs and we reduce the production of goods and services in the economy while money money is pumped in via monetary and fiscal stimulus (quite possible next year), you just increase the inbalance between money supply and productivity even more - which equals even more inflation!

Crazy stuff.

We need to reduce fiscal spending and increase productivity to get the excess aggregate demand out of the economy - i.e. we produce more to absorb the increased money supply - that will flatten out prices.

But instead we appear to want to create rising unemployment, while flooding the economy with more money, while producing less, then expect inflation to come down!

We have totally snookered ourselves. There’s no painless way out.

But the sheeple carry on regardless, blind to what lies ahead. Sylvia Park was jammed in the weekend!!!

Yeah reading Dalio's 'Chaning World Order' in conjunction with 'The 4th Turning' has put this stuff into more perspective for me.

What could come next might be a real surprise to everyone involved (and it may look nothing like the last 40+ years).

The US has too much debt relative to GDP to continue to effectively be the global reserve currency and the is going to be a problem for everyone around the world until it is resolved.

DGMs!

I think 2023 and 2024 are going to be a lot uglier than most are predicting/ assuming.

Good points. And I agree with your probabilities.

As ever, I disagree with Mr Kerr - though I'm glad he's finally accepted that the movement of the NZD is driven more by risk sentiment in the US than any domestic factors.

The argument for continuing inflation:

-Energy prices have fallen slightly from their panicked peaks, but the structural features that pushed them up in the first place remain. They are unlikely to fall further, and there are a multitude of 'events' that could push them back up.

-The shelter component of US CPI is, as above, a lagging indicator that will take many many months to play out in CPI. The rapidity of rent rises is also beyond any historical norms.

-There is no sign of deglobalisation stopping, and that is a continuously inflationary process.

Inflation will keep pressure on the Fed, and continued fear and instability will keep the $US rising.

And as for ourselves, I don't see a single factor that could prop up the $NZ. We are unproductive and overpriced. I pick the $NZ to continue falling, pushing our own inflation continuously higher and forcing us to start front-running the Fed instead of vaguely falling in step. We can choose between a massive housing-led recession, or the destruction of the $NZ and material poverty for all. Politically, I suspect the second will be chosen.

Choosing the second will induce the the first.

Agreed. All these puff pieces that fail to see the catastrophe coming. There is no way out of this this time. GFC printing got land banked/ended up in corporate coffers due to a utilisation surplus. Yes we will see crazy erratic moves in prices as inventory control goes haywire but the spiral will be downwards. How quickly is the question.. Market can stay wrong longer than I can stay solvent. Which hot potato to hold. property, cash, stocks? When to jump.. What will protect my value.

Our leaders are doing all the right things to make it happen quickly. Literally. Makes one ask some questions.. Bills of Attainders coming I suspect

Lot of companies will close down, because of the mortgage(ocr) , rent.

not because of some industry issue , just because people have no money to spend.

real estate agents, investors , banks and rbnz to blame for what ever happened and is happening.

what business can give u such good return , no hassle at all right mr governor?

I mostly agree regarding the premise that external factors are the most prominent of variables impacting the NZD and the economy at large.

The Consensus, under this golden age, has forgotten the fact that the barbarians are ever at the gates (internally and externally). That everything, all events, including markets are the tools and expressions of power. Everything needs to be viewed through the lens of power. What are the plutocrats competing over (their are loose groups) other than power? My guess around a lot of the current chaos is that this is the West plutocrats (chiefly a certain set of bankers with extreme wealth levels hidden offshore) are trying to pull the rug out from under the Chinese plutocrats as they return to the former global preeminence as the world's money sink. Too late for such a move I suspect, greedy for too long. Momentum is now there.

I ever wonder at our experts grip on it all. The cathedral consensus is blinded by it's own hubris and a deeply held and what seems subconscious inability to see that this economic system has been a teetering house of cards since the GFC and those rounds of QE 1, 2, 3, 4.

Our experts don't seem to read any history, western intellectual philosophy or economic history. They all seem to drink from the same fountain and I really struggle to understand why.. Why are we repeating so many of the same mistakes. This looks very much like pre WW1 right now. What will Europe look like with populism on the rise and internal strife from all these policies? How hard is it to see civil wars etc coming to europe? We roll the dice right now.

That GFC QE caused economic strife (e.g. basic food became unaffordable as the west exports its inflation ever) in the third world which led to the Arab spring, which led to the migrant crisis now hitting Europe and the US via the southern border.

The nanny state covid printing binge was the GFC response on steroids. I've yet to see any of our mainstream media really fight this idiocy. NONE of our current set of tools can predict what this will do. We should be screaming alarm bells. Making strategic decisions now that protect our small nation from what's coming. But yeah nah.

What will those steroids do to an already teetering house of cards?

Add this to the supply constraints caused by the ongoing grey war of decoupling from factory China and Biden's policies regarding energy are like rocket fuel to this already unstable system.

Add to this, in NZ and elsewhere in the west, it looks like overall societal wide utilisation is at high levels. Meaning resource constraints in the form of labour shortages and material shortages.

Add to this the fertiliser shortage coming from the ongoing Ukraine conflict

Add to this the coming supply constraint of food in many places as a result of fertiliser shortage.

I say nothing of the coming elevated conflict the plutocracy inflict on us in Ukraine. This reeks of Machiavellian manipulation and anyone with a tiny amount of historical understanding will know the narrative presented isn't the reality. (what is up with our cathedral consensus mainstream media not reporting on this?)

Basically. We didn't get out of control inflation in the west from the GFC for some reason. I can hazard a few, such as we never maxed out societal wide utilisation (we had surplus). All that new hot money went to speculative markets and property. Hence the massive property boom here and elsewhere as the wealthy looked for landbanks, knowing what's going to come post print binge.

This time. Our Societal Wide Utilisation is at around 65-70%. Which is danger levels. When you add irresponsible spending to it.

We just poured kerosene on everything with our selfish printing. But hey we were being kind. So the media kept telling us.

Utilisation 70% + Steroid printing + conflict + hunger + energy shortages = Being Kind

What's coming is either we get a Volker in the Fed doing the right but hard thing (which may not work this time).. You can do the math on the consequences here in NZ. Many people lost their homes when rates hit 26% here. This event we are facing makes that look like nothing.

Or we have that supposed reset of the currencies globally. Hence NZ's Department of Internal Affairs is working on such with teams of developers and whole leadership structures, costing millions, nothing to see here. Not even worth reporting on aye mainstream media.

And to any media that bother to read my rant.. Your vaunted position is quickly becoming worthless as you continue to propagate the hazing blindly (I have no other way to explain this). Have you, as journalists, ever considered why your roles are protected so strongly? Because you are supposed to serve the people. Not the government. You are meant to be against the government at all times, needling, picking at them. Ever holding them to account.

And ditto with our police and judicial systems. When our institutions stop doing this. The only thing left for the people is rebellion and Bills of Attainders on all who participated.

Pain is coming. How much pain depends a lot on how quickly we arrive at the truth so we can make the correct steps to mitigate and worse case adapt when it lands.

Be Kind New Zealand

Ping, I'm with you - on the bits I understand anyway, but what do I do? At 63, unemployed, with a house and minor savings (460k in TD's). Buy Roubles? Yuan? A$?, Baked beans? How to preserve the value of limited savings?

I've never been so at a loss regarding future trajectories. Friends keep asking and I can't even say "buy gold" lol. Expect 3 maybe 4 really painful rate hikes and likewise dead cat bounces in the markets.

Till we see these things happen none of the rhetoric coming out of our intellectual elite market think tanks (such as the author here) is be taken without a large grain of salt. They simply don't know and trying to create certainty from an incredibly complicated chaos system. Graphs and pictures provide readers with the sense these people know what they are on about..

I'm waiting for a Volcker. Until that happens we can't really predict much because the current soft attempts to deal with this are only going to aggravate the situation.

A Volcker will bring on a hard recession where we wash out the new money and get rid of weak hands.

Can only hope you have cash on hand to buy the discounts and time those bounces..

the only alternative i see is that dystopian technocratic dream of the global digital currency the WEF and co (AND OUR OWN NZ government truly is working on, with DIA (department of internal affairs) having teams of developers and analysts working on it. Don't want to say the budget number as I dont have that figure handy. But it's tens of millions at least (i think circa 100mil).

So yeah currency reset and wealth transfer, or Volcker and wealth transfer. We peasants navigate the mainstream misinformation and try to pick up the crumbs

hardly minor savings you are close to super and interest rates have quadrupled you are hardly going to be poor. Stay in TDs it's all going to turn to shit. If you own the house you are sweet.

Cash will burn the least in the comming inferno?? Assets are detached from any sane valuation - principally stocks and property.

When this long conjured house of cards built on perma-swamp quicksand (obvious in the rear view - as it comes into the backwards vision just now) crashes down globally.

- Maybe convert some cash into a stockroom filled with cheap canned baked beans and tomatoes - I always love a bargain and a useful gas generating hedge!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.