Summary of key points: -

- The crystal ball gaze ahead into 2023

- Some “tongue in cheek” 2022 Awards

Season’s Greetings to all our readers – the next column will be on January 8th 2023

The crystal ball gaze ahead into 2023

Following a tumultuous year in equity, bond, commodity and currency markets it is timely to gaze ahead and make some bold predictions on how the markets will play out in 2023. (The 2021 final column is here.)

US Equity Markets: As movements over recent weeks suggest, the stock market will continue to be buffeted both up and down in 2023 from the two major counteracting forces: -

- Decreasing US long-term bond yields lifting company valuations and therefore positive for share prices.

- The US economy sliding into a shallow recession reduces company earnings and therefore negative for share prices.

The NZ dollar value is therefore unlikely to suffer a major “investor risk off” sell-off that it experienced in 2022. Expect the industrial stocks to outperform the tech stocks.

US Bond Yields: A US annual inflation rate decreasing back to 3.00% as fast as it increased to 8.00% in 2022, coupled with the time-lagged slowdown in the US labour market, creates the scenario for continuing reductions in the 10-year Treasury Bond yields to below 3.00% from the current 3.50%. Fixed interest investment portfolios can look forward to positive returns on bond revaluations in 2023 following two years of negative returns from rising market yields.

US Dollar Value: Measured by the USD Dixy Index, the USD value appreciated 20% over the first nine months of 2022 (from 95.0 to 114.5), it then depreciated 10% in value through October and November from 114.5 to 103.0. Over the first six months of 2023 the US dollar is forecast to remain under downward pressure from the inevitable Fed pause/pivot on monetary policy, weaker US economic data and investment funds selling out of the US and switching capital back to Europe as the US no longer offers an interest yields return advantage. A further 8% USD depreciation to 95.0 will leave the NZD/USD exchange rate at 0.6900.

Commodity Prices: Constrained supply sources and unchanged global demand suggests that food commodity prices will hold their own at current levels. Iron ore prices have returned lower to be closer to long term averages. However, it is copper prices that many see as the bellwether leading indicator for the global economy. Renewed Chinese demand for copper, as they stimulate and open up their economy after the Covid lockdowns, points to stable to higher copper prices in 2023.

Oil Prices: The disruption to global oil supplies caused by the Russian invasion of Ukraine was behind the oil price spike and therefore higher inflation around the world in 2023. Over recent months the oil market has concluded that supply will outstrip weakening demand in 2023, therefore the return of crude WTI oil prices to US$75/barrel. Geo-political tensions always plays a big role in the oil market; however the reality is that OPEC+ producers (including Russia) cannot curtail production as they need the cash. The forecast is for oil prices to drift lower to US$60/barrel in 2023.

The Euro Currency Value: The widely forecast energy crisis has not turned out to be the economic catastrophe most predicted. Therefore, the ECB no longer need to hold back on addressing their debilitating 10% inflation rate and can now get on with the job of tightening monetary policy with higher interest rates. At 2.50% official rates the ECB are only just starting, whereas at 4.50% the Fed are nearing the end of their tightening cycle. As the EUR: USD interest rate differential closes up, the Euro can only head one way and that is higher to $1.1500 (currently $1.0600).

Australian Dollar Value: The Aussie has been a serial underperformer in recent months as the RBA become both more cautious and slower with interest rate hikes. Therefore, the AUD stands out as an undervalued currency (vis-à-vis economic fundamentals) that should attract hedge fund attention in 2023 as flows coming out of the USD look for an alternative currency that has plenty of upside.

New Zealand Dollar Value: The USD side has dominated this currency pair for the last two years and that domination can be expected to continue over the first half of 2023. The potential is for a “double-whammy” impulse higher through both a generally weaker USD value and a NZD 2% interest rate differential to the USD attracting the offshore investor “carry-trades” back to the Kiwi dollar. The NZD/USD rate can move above 0.7000 if the USD weakens more than another 8% from here. Political risk has never been a material influence on the Kiwi dollar and the prospect of a change of government later in 2023 to a more business-friendly version certainly will not be negative for the NZD. Relatively weaker economic performance compared to Australia may take some gloss of the Kiwi dollar towards the end of 2023. An additional NZD negative in late 2023 will be the inevitable cuts to interest rates by the RBNZ as more labour supply brings down the wage-push inflation.

Some “tongue in cheek” 2022 Awards

To round out the year, it is timely to make some awards.

Paul Volcker Award for Monetary Policy Mismanagement: Joint winners – Jerome Powell and Adrian Orr (too late, too slow and then too hard tightening policy).

J M Keynes Award for Economic Policy Mismanagement: Grant Robertson and Jacinda Ardern (employment and immigration policies that caused the high wage-push inflation that damaged the economy and everyone in it).

J M Keynes 2nd Award for Fiscal Policy Mismanagement: Successive UK Prime Ministers and Chancellors of the Exchequer.

Boris Johnson Award for Burning Political Capital: Ardern again!

OPEC Award for Crude Oil Price Forecasts: Citicorp who picked US$75/barrel by year-end when the price was US$120/barrel mid-year. The Booby prize goes to Goldman Sachs who forecast US$150/barrel by year-end!

FTX Award for Cryptocurrency Forecasts: Mike Taylor of Pie Funds (12 months ago he called out the demise of cryptocurrencies as a credible investment asset class and identified the croc that it always was).

NZX Company of the Year: Mainfreight (if only the NZ Government could manage its operations and people as well as this great NZ business).

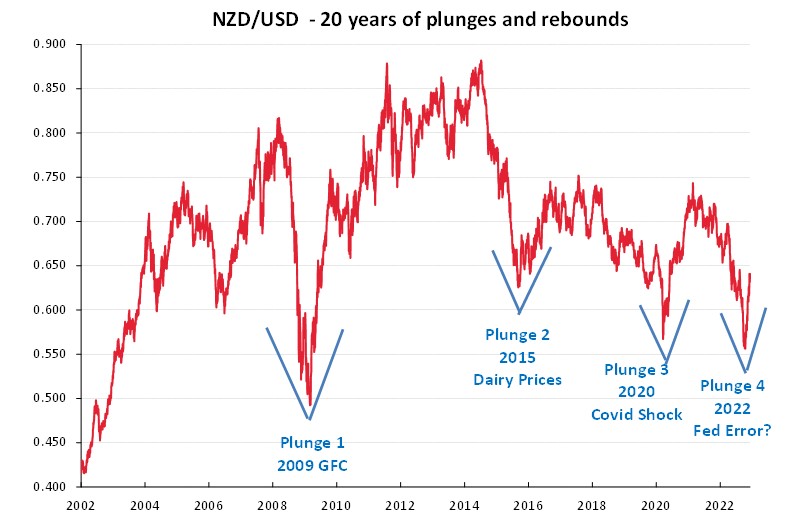

A J Hackett Bungy Currency of the Year Award: Our own Kiwi dollar (the plunge from 0.6500 to 0.5550 and immediate bounce back up to 0.6500 again was as impressive as you would see).

NZ Politician of the Year: David Seymour (payday for David is coming when he calls-in some necessary bottom-lines (e.g. Government bureaucratic overhead costs) in the coalition negotiations with the National Party later in 2023.

Overseas Politician of the Year: Anthony Albanese, PM of Australia (called a summit meeting between business, trade unions and his Government and agreed a solution to their labour shortages).

BBC Media Award for World-Leading Climate Change Policies: The Ardern Announcement Government (turning the NZ agriculture economy into a Sri Lankan basket-case).

Our 2 October 2022 FX market report was published when the NZD/USD exchange rate was trading at 0.5600. It included the chart below that highlighted the historical pattern of Kiwi dollar plunges and recoveries.

Once again the pattern has repeated ...

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

So Kerr is an out and out climate change denying libertarian. Glad we have that sorted. I am not entirely sure how he can have a pop at the recent disasters in the UK Tory party (as they are pretty much a libertarian lite, climate change denying rabble too). Wasn't Truss just espousing the sort of policies he'd be keen on?

The awards are spot-on! Especially the ones to Ardern and Grant Robertson. Another term for them will put NZ in the same economic basket case as Zimbabwe. Watch them bribe the electorate with "free" dental care. Only once they put in place the wealth tax demanded by the Greens, most of the dentists will flee to Australia.

So plenty of deflationary pressures in 2023.

Predicting the future is for the very bold and Roger is bold with many of his 2021 predictions near enough to count as correct, I suspect 2022 out turn will be similar and his awards are 100% and overall compared with Labours actual results of close to zero in terms of things valuable to most NZers Roger is a prophet.

Interesting graph. I'd forgotten our dynamic Kiwi dollar was in the low 40's (USD) early in the new millennium. 20 years ago already. The other one I noticed was the two drops from the mid 70's to the mid 50's under the watch of 6th Labour Govt of NZ. They might get a third one in next year before they depart. Mind you, it has to go up first so that could be an issue.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.