Summary of key points: -

- US bond market indigestion stymies anticipated USD depreciation

- Dangerous complacency from the RBA on inflation control

- Increasing business confidence at odds with gloomier economic outlook

US bond market indigestion stymies anticipated USD depreciation

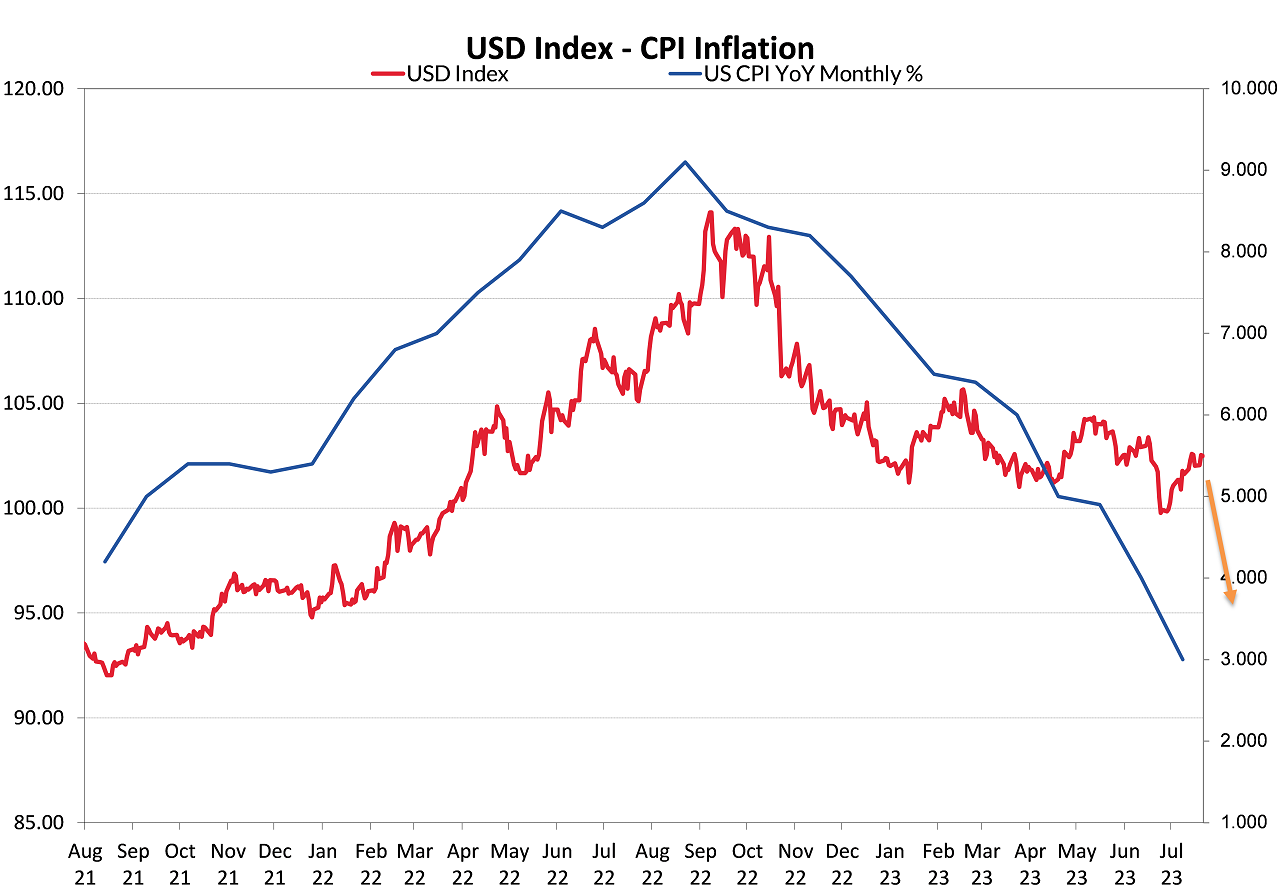

Our long-held currency market view is that the US dollar would follow US inflation lower in 2023 as closely as it followed inflation higher in 2022.

Whilst the trend of the US dollar since October 2022 has been lower, it has not matched the sharp fall in the annual inflation rate from 6.00% to 3.00% over recent months for two prime reasons: -

- Up until June, the US labour market was still strong with higher monthly jobs increases consistently above consensus forecasts. The risk that wages and therefore inflation could be pushed back up again from the robust labour market was not allowing the Federal Reserve to signal any ending of interest rate hikes. However, both the June and July Non-farm Payrolls job increases were lower, and the outlook is for softer numbers ahead as the hospitality/leisure and healthcare sectors have now returned employment levels to pre-Covid levels. Recent increases in US jobs were only from these two sectors, plus Government jobs.

- The debt ceiling limit the US Government ran into earlier in the year when they could not issue any new debt for several months has resulted in an avalanche of debt issuance (increased supply) coming onto the bond market during July and August. The debt ceiling deal struck in June by Congress has caused a massive catch-up in issuance and sent bond yields sharply higher (bond prices lower).

The increase in US 10-year Treasury bond yields from the 3.50% area in May to 4.16% today has been entirely due to the market indigestion from the increased issuance and does not reflect any change with US inflation, the Fed’s stance, and the US economic direction generally. The credit rating downgrade from AAA to AA+ by rating agency, Fitch for US sovereign debt has also contributed to the negative sentiment in the bond market. The volume of bond issuance does ease off a little in the December quarter and we must be close to the point where bond investors will see great value in buying bonds at 4.00% yields against inflation heading to 2.00% pa - a “real” return of over 2.00% that has not been available for many years.

The implications for the US dollar value from the rising bond yields is that offshore investors in US bonds will be holding back from selling those bonds, therefore not selling the USD proceeds, and returning their money to home markets at this time. European investors in US bonds will not be selling out of US bonds until the interest rate gap between their own bonds and the US closes to within 0.50% to 0.75%. Currently at 4.16%, US 10-year bonds are 1.50% above German bunds at a 2.66% yield. It seems inevitable that US bond yields will reverse lower over coming months as annual core and headline inflation goes lower again and the Fed officially end their monetary tightening cycle. The USD will then re-commence its downtrend, the USD Dixy Index falling away towards 95.00 from its current 102.70 level (orange arrow on the chart below).

The recent gains by the USD due to the higher bond yields, coupled with a Reserve Bank of Australia induced sell-off in the Australian dollar, has driven the NZD/USD exchange rate out the bottom end of its 0.6100 to 0.6400 trading range to just below 0.6000. However, when the USD has another leg downwards to 95.00 on the USD Index, the NZD/USD equivalent of that level is 0.6800.

Dangerous complacency from the RBA on inflation control

The Aussie dollar has been slammed down hard in the global FX markets over recent weeks as a result of the RBA adopting a “go slow” approach to raising interest rates to drive their high inflation back down. The AUD/USD rate has reversed from pushing up above 0.6900 just four weeks ago to now trade at nine-month lows of 0.6500. The four cent AUD sell-off has sent the NZD/USD rate also four cents lower from 0.6400 to 0.6000.

Three events over the last month have caused the AUD selling in the forex markets: -

- A lower than forecast CPI inflation rate for the June quarter released on 26 July started the AUD sell-off.

- The RBA meeting on Tuesday 1st August paused again on any interest rate increase from their current level of 4.10%. The pause was expected by the markets, however what was not expected was the very “dovish” accompanying commentary from the RBA. They seemed more concerned about not causing a recession than getting inflation down.

- The appearance of outgoing RBA Governor, Philip Lowe before Members of the Australian Parliament on Friday 11th August wherein he outlined the trade-offs between interest rate hikes, inflation and the economy.

The RBA appears to making another classic mistake on monetary policy management. Governor Lowe is taking his so-called “middle path” of not returning the annual inflation rate to their 2.50% target until 2025. He thinks that additional interest rate increases to get to that inflation target in 2024 will be too damaging to the economy. What he appears to be missing is that the sooner inflation comes down, the sooner the finances of all Australian households benefit. By “going slow” on interest rate hikes he may help home mortgage borrowers temporarily, but it prolongs the inflation pain on all households. The RBA approach is in complete contrast to the Fed and the RBNZ who have hiked interest rates more rapidly to 5.50% to get inflation down as quickly as possible.

The probability of another RBA U-Turn on monetary policy over coming weeks is high. They have been consistent with their inconsistency with pause/increase/pause interest rate decisions all year. What could force their hand to increase interest rates further at the September or October meeting is higher than expected wage increases and jobs growth. Aussie wages data for the June quarter this Tuesday 15th August is forecast to see an increase to 3.80% per annum. Employment data for the month of July on Thursday 17th August is likely to be a third month in a row of above forecast increases in jobs. Expect a rebound in the AUD back up again against the USD from 0.6500 should these key economic variables add pressure on the RBA to change their tune (once again!).

Higher crude oil prices and the lower AUD value will be pushing Australian (and New Zealand’s) inflation rate back up again in the September quarter, the opposite to what the RBA require. However, their own ponderous complacency has caused the lower AUD value and higher inflation.

Increasing business confidence at odds with gloomier economic outlook

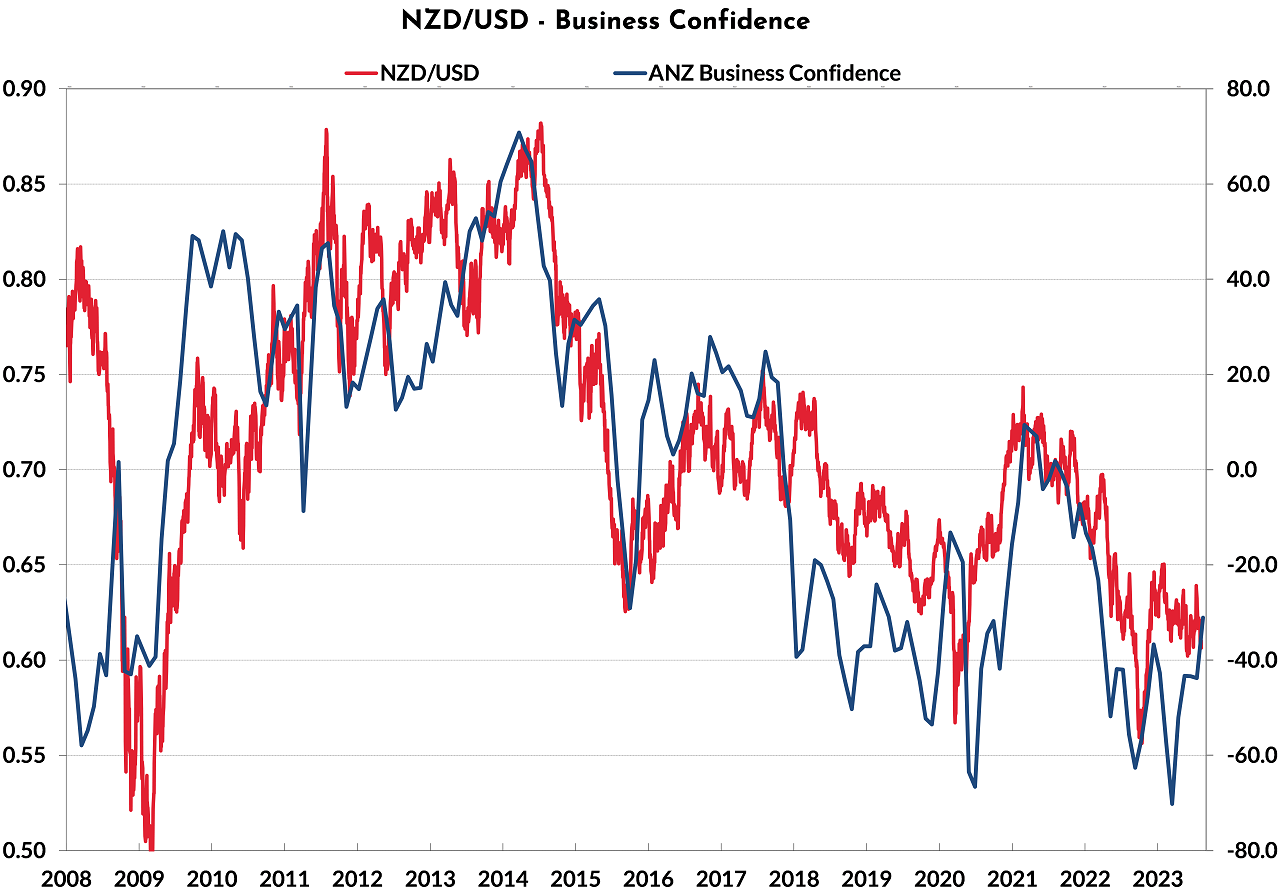

Falling rural sector incomes (dairy and meat prices lower) and economists forecasting a double-dip economic recession do not sound like the pre-conditions for increasing business confidence in New Zealand right now. However, over recent months business sentiment has improved dramatically (albeit from record low levels). There are a number of possible explanations for the more optimistic outlook, the most plausible being that business firms can now employ the workers they need as immigration inflows solve the previous frustrating labour shortages. Along with that reason, the CEO’s house price no longer falling in value or the potential for a more business-friendly government after the 14 October general election may be adding to the more positive vibes.

Whatever the reasons for the increasing confidence, the NZD/USD exchange rate has maintained a close correlation to business confidence for many years (refer chart below). Local NZ factors have not driven the NZD/USD exchange rate movements in recent years, however the remarkably close connection should not be ignored. Further confidence gains do not suggest a lower NZ dollar value below 0.6000 against the USD.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.