Summary of key points: -

- Impatient and ill-informed economic doomsayers hold too much sway in New Zealand

- RBA execute a perfect “Adrian Orr” wrong-footing of the financial markets

- Global fund managers continue to hedge against further USD depreciation

Impatient and ill-informed economic doomsayers hold too much sway in New Zealand

It is a sad commentary on New Zealand’s ambition as a nation that the majority of economic commentators and business journalists in the mainstream media constantly talk the economy downwards. It is like there is a competition to see who can be the most negative and pessimistic on the current state and outlook for our economy. Many seem to hold this weird predilection to convince everyone that we are headed for another recession. All and sundry are blamed for our economic underperformance, from the Government to businesses greed, to Trump, to poor productivity and to over-regulation. We did suffer a double-dip recession in 2023 and 2024 due to the RBNZ over-egging the monetary stimulus in 2020/2021 and then subsequently and consequentially being forced to shove the monetary policy brakes on too hard. An economic “own goal” for New Zealand was inexcusably scored, as all other western economies did not experience the same post-Covid economic downturn.

We are very good at making it extra hard for ourselves. However, rather than wallow in economic self-pity and despair (as the media would have everyone believe), the world and our own economy is moving on in a more positive manner in 2025. There remains constantly repeating commentary that there are still major uncertainties to the New Zealand and the global economic outlook due to Trump’s import tariffs. The uncertainty and the unknowns are supposedly holding back business investment and expansion. That may have been the case back in April on Trump’s “liberation day” announcements, however today tariffs are no longer an unknown risk factor in financial and investment markets. The only unknown is the final tariff percentage (10%, 20%, or 30%) and how the cost of those tariffs is divvied up between participants along the supply chain from the offshore manufacturer to the end US consumer. It seems highly likely that New Zealand exporters into the US will end up with a tariff at 10% or 15%, below that of most other competitor countries, therefore not losing any competitive price advantage. Indeed, maybe even gaining some advantage. Offshore economic forecasters such as the OECD, the IMF and the World Bank are revising global growth forecasts downwards and highlighting tariff risks as the reason. However, history tells us that these forecasters are typically six to nine months behind the eight-ball when it comes economic conditions and the outlook.

Whilst currencies such as the Japanese Yen the Canadian dollar and the UK Pound Sterling may have weakened slightly against the US dollar over this last week as Trump upped the ante on getting trade deals and tariffs agreed, the overall impact and volatility from tariffs on foreign exchange markets is deescalating through time. The focus of the FX markets is now rightly coming on the divided US Federal Reserve as to their likely timing of recommencing the cutting of interest rates. The debate on how much and for how long tariffs will push up US inflation will continue, however the two dominant components of the US CPI index (rents and healthcare) are declining every month. The forward outlook on the US dollar value must remain negative as the Fed are now primed to slash interest rates three of four times 0.25% before the end of 2025. The US is well behind Europe, New Zealand and many other countries in respect to the timing of removing tight monetary policies and stimulating economic activity with much lower interest rates. The reasonably high probability of further USD depreciation from the current 97.50 on the Dixy Index toward 90.00 by December 2025 has not diminished.

The local doomsayers just appear to be overly impatient and not understanding the transmission/ timing mechanisms in the NZ economy from when the RBNZ cut interest rates until domestic spending picks up as a result. It takes over 12 months to have an impact from the time monetary easing is commenced. The RBNZ started easing policy last August, so from next month it is highly likely we will see an improvement is the retail and residential property sectors. The export sector is already on fire and business confidence levels are close to record highs. We remain with our forecast that New Zealand’s annual GDP growth rate will be over 3.00% by year-end.

It does seem that if house prices are not rising, the majority of the local economic commentators do not think the economy is performing. These are jaundiced and ill-informed attitudes that do not serve the public well.

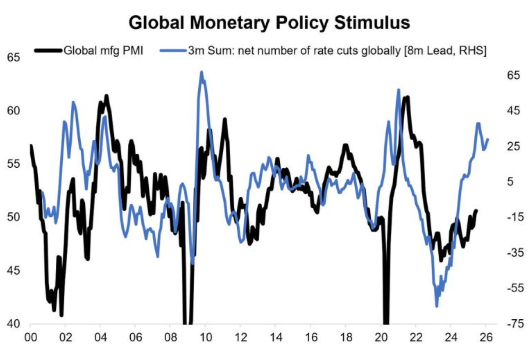

The chart below from Topdown Charts plots global manufacturing PMI survey results (black line) against the net number of interest rate cuts globally (eight-month lead - blue line). It does not take rocket science to conclude that global manufacturing PMI’s are set to increase from the current average of 50 to above 55 (just as they have done in the last 25 years). Stronger global GDP growth will follow, the opposite of current OECD, IMF and World Bank forecasts. Monetary stimulus takes time; however, it is pretty reliable is causing the intended economic response.

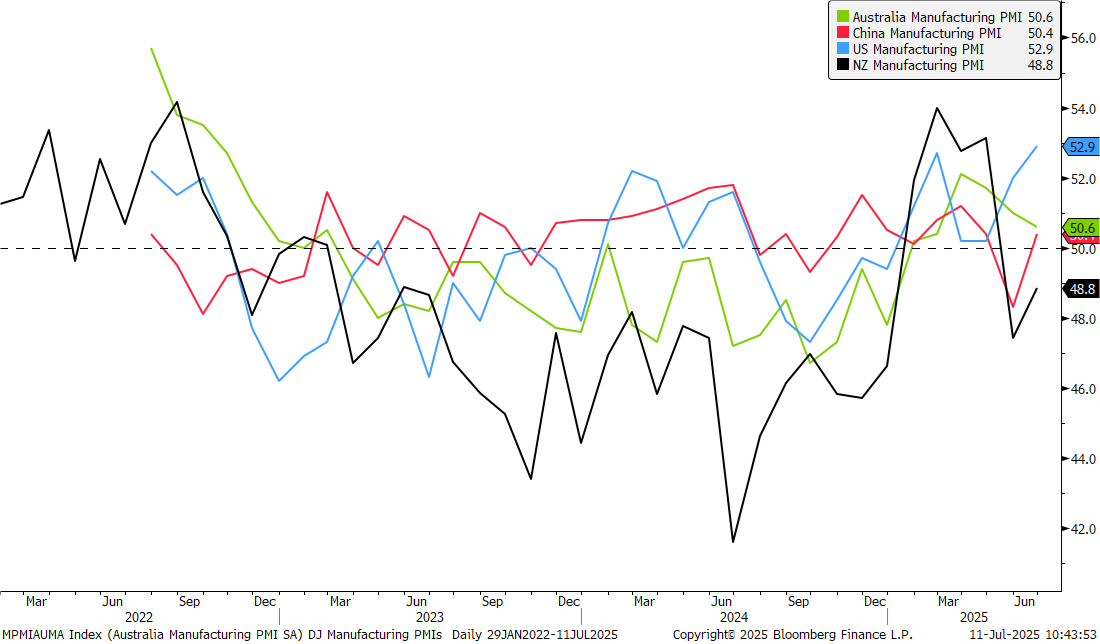

The second chart below shows the overall improvement taking place over the last 12 months in the manufacturing PMI surveys in the US, China and Australia. The New Zealand manufacturing PMI fell away in April and May to a low of 47.4 (fears of Trump’s tariffs), however it bounced back a little in June (released last Friday) to 48.8. Reassuringly, new orders in June climbed into expansionary territory above 50, at 51.2. The Radio New Zealand news headline last Friday was “New Zealand’s manufacturing slump continues”. There is no doubt that the current weak construction activity is holding the manufacturing PMI index back, against the healthier improvements in local primary industry processing.

It is only a matter of a few short months before the domestic building activity levels start to improve again (lifting local manufacturing optimism) from the substantially lower mortgage interest rates now prevailing.

RBA execute a perfect “Adrian Orr” wrong-footing of the financial markets

Economic commentators in Australia are struggling to explain how they got it so wrong when the Reserve Bank of Australia (”RBA”) called their bluff and left interest rates unchanged at 3.85% last week. It does seem only a question of timing, as the RBA want to see more conclusive economic data on inflation and employment before lowering interest rates again. The Australian dollar received a 50-point boost against the USD on Tuesday 8th July when the shock/unexpected decision hit the newswires, appreciating from 0.6500 to 0.6550. The Aussie has held on to those gains over the remainder of the week to the 0.6580/0.6590 area. It does seem that the RBA want to reduce interest rates further in tandem with the US over the second half of this year, so as to not put undue downward pressure on the AUD.

Australian Prime Minister, Anthony Albanese is in China this week in an attempt to enhance their trade relationship with their largest trading partner. Global currency markets, to date, have been unwilling to buy the AUD as aggressively as the Euro, Yen and Pound against the faltering USD, as there has been a worry that Australia’s close economic reliance on China will be negative for the Australian economy as China is hurt by tariffs. However, it has become very apparent over recent months that the Chinese economy is not sagging under the weight of Trump’s tariffs. Chinese exports to the US may have decreased 30%, however they have increased their exports to Europe and the rest of Asia. Chinese exports increased by 4.80% over the 12 months to the end of May 2025. It has to be anticipated that the Australian dollar will be rerated higher as the China impediment is no longer a factor holding it back relative to the Euro, Yen and Pound.

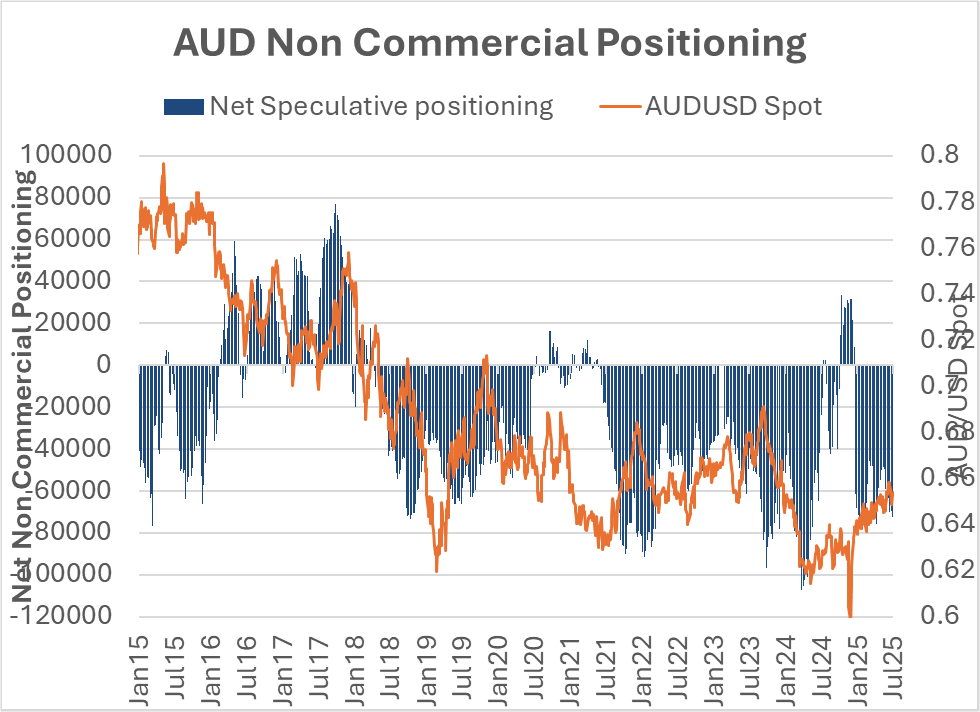

We highlighted in last week’s report that Australian equity market underperformance relative to the rest of the world was one reason why new capital flows will now come Australia’s way. The second reason for likely AUD gains is the current speculative positioning of heavy short-sold AUD positions being held in US futures markets. These punters are betting on AUD depreciation against the USD, however that is not happening, and it seems inevitable that these currency traders will soon by buying the AUD to close down/unwind their short-sold positions. The chart below confirms that when the number of futures contracts (blue bars) moves from short to long the AUD appreciates (and vice-versa). US-based currency traders have already adjusted NZD/USD speculative positioning from short-sold NZD to marginally long the NZD. The conditions are now conducive for the AUD to follow that change.

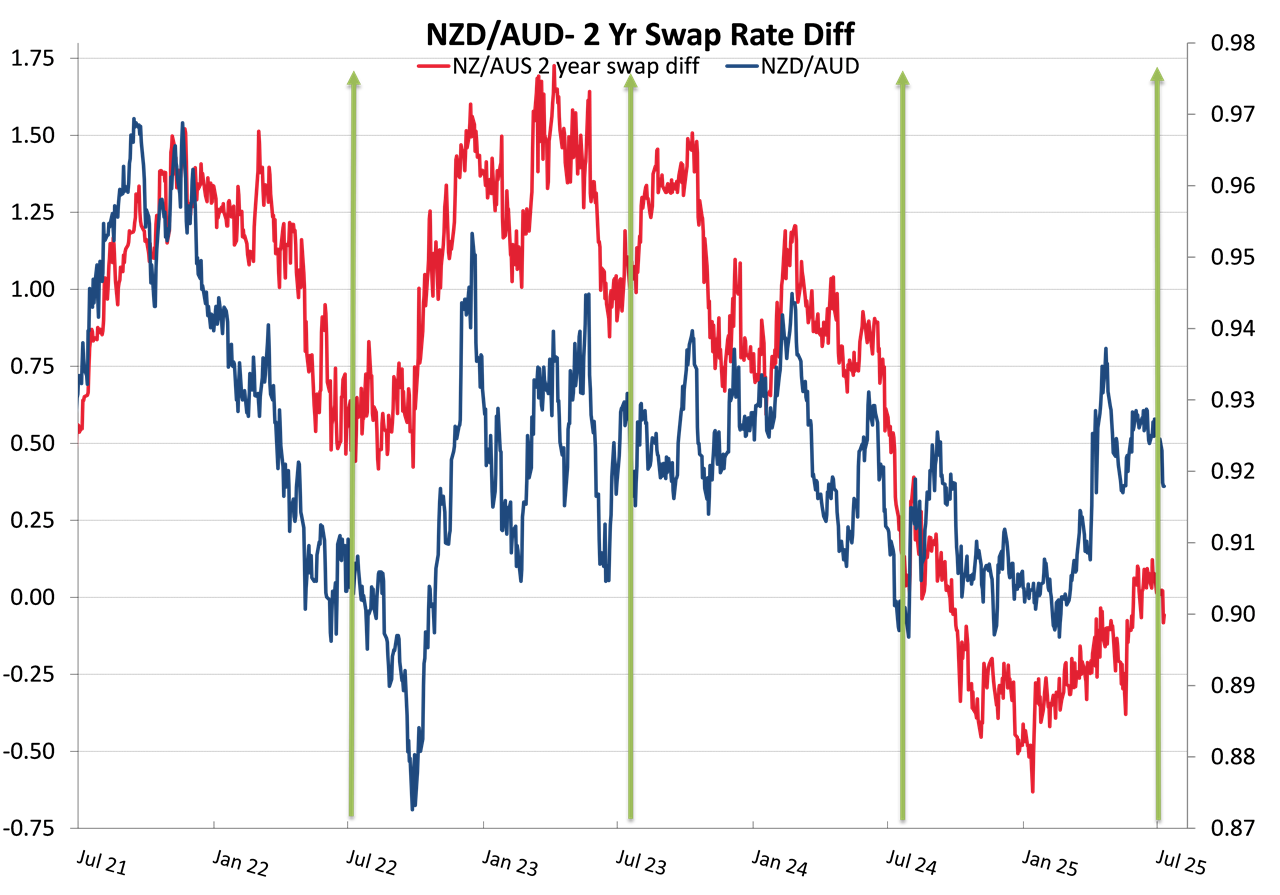

For the above reasons the Australian dollar is expected to outperform the NZD against the USD over coming months, pushing the NZD/AUD cross-rate lower. Another strong reason why the NZD/AUD exchange rate has reversed downwards from 0.9350 to 0.9140 since March is the FX markets anticipating that Australian interest rates may not go as low as our interest rates in New Zealand. The NZD/AUD cross-rate declined from 0.9500 to below 0.9000 through the course of 2024 as the interest rate differential moved from NZ interest rates being 1.00% above those of Australia to being 0.50% below (refer to the chart below). The gap in the two-year interest rates closed back up to zero over the first five months of this year, however Australian two-year swap rates are now back up to 3.43%, above NZ swaps at 3.20%. The interest rate differential is back in favour of the AUD outperforming the NZD again and therefore lowering the NZD/AUD cross-rate.

Every year in the June to October period the NZD/AUD cross-rate is pushed down by NZ subsidiary banks of Aussie parents hedging forward their dividend payments to Australia i.e. they buy AUD/sell NZD. The decreasing NZD/AUD cross-rate over recent weeks indicates that the banks are at it again. The vertical green lines in the chart below highlights the pattern of NZD depreciation against the AUD in the June to October period each year when the banks are hedging their 30 September financial year- end dividend amounts.

The NZD/AUD cross-rate appears enroute to 0.9000 again, however history tells us that it does not remain there for long. Local exporters in AUD should have their NZD buy orders to hedge forward placed from 0.9075 downwards.

Global fund managers continue to hedge against further USD depreciation

Global fund managers in the UK and Europe are not only reducing their investment asset allocations/weightings to the US markets (i.e. selling the USD as they exit), but they are also increasing the FX hedge ratios on their investments that remain in the US. Fund managers in Asia will be doing the same. They are hedging against expected continuing USD depreciation as Trump’s tariff policies damages the US economy, and the period of US economic exceptionalism comes to an end. Foreign investors hold more than US$30 trillion in US securities, approximately US$17 trillion in equities and US$13 trillion in fixed interest/bonds. Therefore, it is easy to see that just a small percentage adjustment in weightings to US investments can have profound impact on the FX markets and the USD value.

The pattern of movements in the USD Dixy Index over recent months is that every small recovery back upwards is hit with a barrage of USD sellers as the fund managers maintain their strategy to hedge higher amounts of USD exposure. The USD Index has recovered marginally from below 97.00 to 97.50 over this last week as Trump blasts out further threats and ultimatums on tariffs.

A further reason as to why foreign fund managers are reducing USD exposure is the real threat to the independence and credibility of the US Federal Reserve. Trump has continued his attacks on Chair Jerome Powell to lower interest rates, and his next step could be to appoint Powell’s replacement will ahead of the May 2026 date. Deutsche Bank currency strategists do not think the FX markets are pricing enough of this risk into the USD value. They foresee the USD index depreciating another 3.00% to 4.00% from the current 97.50 level if and when Trump loses his patience and makes an early appointment that would throw the Fed into some disarray. The Fed’s creditability is lost when the new Chair-elect is likely to be a Trump stooge that will talk about the need for lower interest rates immediately. Watch this space.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

16 Comments

If you want to understand the Trump administrations economic goal you can look to Argentina. A weaker local currency helps exports and reduces imports. This goes hand in hand with a weaker domestic economy which we are going to see in the US over the next 12 months primarily due to ongoing cuts to US government spending.

The US will import less and attempt to grow its exports with high levels of unemployment providing cheaper labor costs and a weak dollar boosting exports.

No. NZ will not have an interest rate led recovery - low interest rates are a lagging indicator and tell us the economy is continuing to struggle. There is not a chance in hell that NZ hits 3% GDP this year - absolute fantasy land.

Treasury and the RBNZ are now forecasting GDP going into negative territory in the next quarter. The NZ economy is lacking demand and won't recover until this is restored - either through a massive increase in private sector debt or public sector spending.

You said - "The NZ economy is lacking demand and won't recover until this is restored - either through a massive increase in private sector debt or public sector spending."

NZ's total debt, including unfunded liabilities, is already over 600% of GDP - we are technically insolvent - and yet you expect more massive borrowing to somehow fix the problem which was caused by a history of massive borrowing?

The only way that increases in public sector spending could help is if our banking is run as a public utility - it's not - and so billions are paid out in unearned rent to overseas-based banking corporations.

It does seem that if house prices are not rising, the majority of the local economic commentators do not think the economy is performing. These are jaundiced and ill-informed attitudes that do not serve the public well.

That's because it's true. Show me the economic performance in NZ over the last 30 years that isn't in some way linked to residential property booms. The idea that the dairy industry feeds through to households in Grey Lynn or Eastbourne has been overstated many times.

The fact is, this country does not have a credible economic substitute for property booms, barring a few niche pockets who are trying their best. And good on them for doing so. Keith Woodford's excellent research on NZs falling productivity confirms this.

Correct - the majority of lending by NZ banks is for property and very little is invested in productive assets or business. This I believe is a common feature of all advanced economies where the government has stepped back from engagement in economic outcomes. The free market makes the most optimal decisions - apparently.

"Why do Kiwi's continually talk the economy down?" No-one's talking the economy down - it's staying down all on its own. From the RBNZ here is average rate at which real GDP has increased over the past year:

2024Q1: 1.4%

2024Q2: 0.6%

2024Q3: 0.0%

2024Q4: -0.6%

2025Q1: -1.1%

2025Q2 - is expected to be negative as well. So how you get 3% GDP for 2025 I have no idea.

That's happening for real not because we are talking about it.

It would be useful if the author could reply on where their 3% came from

Blind ideological faith in the author's preferred government. Political bias is a predictable feature of his "analysis".

New Zealand's current mix of a shrinking workforce, reduced investment, and cautious policy does carry real risk of a self-reinforcing stagnation — a textbook low-growth trap. Avoiding it will require reversing some of the recent policy direction and actively stimulating demand and capacity, not just relying on the private sector to lead.

Increasingly older population needing extra care $. Extra 100bl in debt with nothing to show for it. Divisive politics promoting racial separatism. Last govt letting youth run wild and stopping police doing their job. Price to income ratio in housing out wack, protecting older and foreign owners, driving enslavement of younger workers renting and entering home ownership. Youth exiting west as a result. Extra million in immigration the last 20 years with no electoral mandate.

Summary, Less workers paying tax. More people needing benefits(tax). Those paying tax getting less. Growing financial divide and racial tension.

Whats not to like?

:"In BNZ's latest weekly Markets Outlook publication, issued separately, BNZ's head of research Stephen Toplis noted that the last few days "have seen a number of high frequency activity indicators support our view that not only did the economy stall in the June quarter but it is also struggling to gain momentum going into Q3".

Where Roger Kerr sees lots of blue sky ahead, I see dark clouds with just some rays(the primary sector) of sunshine piercing them. There seems to be no end to Trump's tariff madness and that has a chilling effect on companies' investment and hiring intentions.

I have bookmarked the article so that I can remind him of his, I think, misplaced optimism later on.

So China is exporting more to Europe and the rest of Asia which makes up for a decline in the USA. What I can't fathom is how long will that back stop last if Europe in particular has trouble exporting to USA.

I think in a nutshell that sums up the damage Trump is doing to World trade. I think that ultimately NZ will be hit also, think beef, and many other Ag products. US farmers are sitting on stock piles of grain and where will that go?, feedlots of course. This is all due to China sourcing grain from other countries rather than USA.

It was all a happy merry go round until someone hit the kill switch.

Edit, according to Bloomberg the EU are one of the biggest buyer of goods from the USA. Sounds like an own goal by Trump.

In reply to Keyne's comment at 9:33

"If you want to understand the Trump administration's economic goal you can look to Argentina."

IMO, Milei, Argentina's president, was manoeuvred into power by Wall Street interests not simply to hamper the BRICS/BRI momentum in LatAm, but also to facilitate the firesale of vital public utilities - a strategy straight from the Economic Hitman's playbook

This was also a package where Melei could sell out Argentina's public utilities to private corporations and the fifth column elements, as part of a modern-day reinvigoration of the 200-year-old Monroe Doctrine, which was all about the US pillaging South American resources and keeping their vast working class in the poor house.

The privatisation efforts combined with austerity measures, such as subsidy cuts for energy and transportation, have contributed to a recession, and significantly increased poverty to well over 50% of the population. Selling out these vital public to private rent monopolies, as Trump's buddy Brazilian ex-president Bolsonaro tried to do, is selling out those countries' sovereignty as well.

I am not supporting previous Argentinian regimes either - the West installed their comprador regimes there long ago, just as they did in Brazil - these are multigenerational astro-turf elements that hold their countries to ransom - there is nothing organic about them.

Both Milei and Bolsonaro are examples of the tragic pillaging of the vast natural resources of what could have been two of the wealthiest nations on planet Earth - but for the greed of the West.

Milei's campaign was delusional - he ran on a promise to fully dollarise the Argentinian economy, replacing the pesos with the dollar, and to abolish their central bank - effectively handing the entire caboozle over to Wall Street and the US Fed - and to think that he was voted in on this abject idiocy.

The Argentinian peso remains and is not pegged to the US dollar, but operates on a float using regular CB interventions to try to stabilise the market. The use of US dollars in the domestic market is still widespread, reflecting a high level of informal dollarisation.

If full US dollarisation had been implemented, the Argentinian government would have lost its ability to issue currency, effectively ceding all monetary control to the US Fed, which is 100% owned by the global private banking cartel and part of the network that helped him into power.

Argentina was fully accepted as a BRICS member and, as such, was offered a secure path to national sovereignty - this was a real chance of aspiring to significant societal wealth after having been raped by Western interests for centuries.

When Milei pulled out of the deal, he squandered this opportunity. In doing so, he was rewarding the entities that placed him in power. A major part of the package was for him to sell out Argentina's vital public utilities to overseas private corporations. These include...

(i) Most of the energy sector, including the company that operates their nuclear power plants. The state-owned coal mining company. Hydroelectric power plants. YPF - their state-owned oil and gas company.

(ii) Transportation - the national airlines, including Aerolineas Argentinas. The National Rail Company

(iii) Media - the public TV network. The state radio network. Telam - the national news agency.

Milei sings from the same playbook as his buddy Trump - and has tried to use emergency decrees to push through his privatisation agenda.

Initially, in December 2023, his omnibus bill included plans to privatise 41 public companies, including YPF, the national airlines, and their rail company. While the bill faced significant opposition and was watered down, it was passed in June 2024, enabling the privatisation of key utilities.

According to Mr Grok...

"Javier Milei assumed the presidency of Argentina in December 2023, his administration has pursued a policy of privatisation and deregulation aimed at reducing the state's role in the economy. Several public utilities and state-owned enterprises have been privatised or partially sold, as authorised by the Argentine Congress through Law No. 27,742 (the "Ley Bases") and other executive actions. Below is a summary of the key public utilities and state-owned companies that have been privatised or are in the process of privatisation, based on available information:

1 IMPSA (Industrias Metalúrgicas Pescarmona S.A.)

Details: In January 2025, the Argentine state sold 85% of its shares in IMPSA, a company specialising in hydroelectric equipment and renewable energy projects, to the U.S.-based company Arc Energy for approximately $27 million. The sale included the national government's and Mendoza province's stakes, with Arc Energy also assuming part of IMPSA's debt.

2 Energía Argentina S.A. (Enarsa)

Details: In April 2025, President Milei authorised the full privatisation of Enarsa, a state-owned energy company, through Executive Order #286/2025. The process began with the sale of Enarsa’s 50% stake, marking a significant step in reducing state control over energy assets.

3 Hydroelectric Power Plants

Details: In August 2024, Milei issued a decree authorising the privatisation of several hydroelectric power plants, including Alicurá, El Chocón, Cerros Colorados, and Piedra del Águila. These plants are critical components of Argentina’s electricity generation infrastructure.

4 Nucleoeléctrica Argentina

Details: The same August 2024 decree included the privatisation of Nucleoeléctrica Argentina, the state-owned company responsible for operating Argentina’s nuclear power plants. This move has sparked controversy due to the strategic importance of nuclear energy.

5 Yacimientos Carboníferos de Río Turbio

Details: Also included in the August 2024 decree, this state-owned coal mining company, located in Santa Cruz province, was slated for privatisation. The company operates the Río Turbio coal mine and associated power plant.

6 YPF (Yacimientos Petrolíferos Fiscales)

Details: While not yet fully privatised, Milei announced plans to privatise YPF, Argentina’s majority state-owned oil and gas company, shortly after his election in November 2023. YPF oversees the development of Vaca Muerta, one of the world’s largest shale gas and oil reserves.

The announcement led to a more than 40% surge in YPF’s New York-traded shares, reflecting market optimism about potential privatisation. However, as of the latest available information, the privatisation process is still in preliminary stages, with Milei’s team assessing YPF’s business activities to determine the scope of privatisation.

7 Télam (National News Agency), LRA (National Radio Station), and TVP (Public Television Network)

Details: In November 2023, Milei announced plans to privatise these state-owned media entities, including Télam (the national news agency), LRA (the national radio station), and TVP (the public television network). While these are not traditional public utilities, they are state-controlled entities providing public services in information and communication. The privatisation process for these entities has been outlined, but specific progress updates are limited as of July 2025.

Additional Context

Legislative Framework: The "Ley Bases" (Law No. 27,742), passed on June 27, 2024, authorised the privatisation of several state-owned entities, including those listed above, as part of Milei’s broader agenda to deregulate and reduce government spending. The law also provides tax, foreign exchange, and regulatory incentives to promote private investment in large projects, which may facilitate further privatisations in sectors like energy and infrastructure.mayerbrown.com

Controversy and Public Reaction: The privatisation of critical infrastructure, such as hydroelectric and nuclear power plants, has faced significant opposition. Posts on X and reports indicate public concern over rising utility costs and the potential loss of national control over strategic assets. For example, one user warned that privatising hydroelectric plants could lead to unaffordable electricity prices.

Economic Impact: Milei’s privatisations are part of a broader economic "shock therapy" program, which includes slashing subsidies for utilities like electricity and gas. This has led to significant price increases for consumers, with electricity tariffs rising by 179.7% and 191.1% for certain providers as of February 2024.ri.pampa.com "

I'm not supportive of Mileis policies at all but they are at the extreme end of what Willis in NZ, Reeves in the UK and the new US administration is aiming to do. Weaken the domestic economy with cuts to public spending and increase unemployment - these attributes make the country more attractive to overseas investors - cheap labor and cheap assets.

What's more by reducing imports through contraction of the domestic economy imports become a greater proportional contributor to GDP - what I call 'Milei Math' by crushing the local Argentine economy exports now contribute much more to the numbers.

IMO this article is simply an attempt to praise the status quo, kick the debt-trap can further down the road, and ignore the fact that within the Western casino monetary system, ~97% of the MS is created out of thin air by unearned rent-seeking privately owned commercial banking cartels.

https://globalsouth.co/2024/03/12/economics-part-iv-interest-rates-mani…

Re the above link - all of the empirical evidence proves that interest rates are a lagging indicator and a farcically ineffective monetary tool. The status quo is all about blowing asset bubbles, investing in financial capitalism, ignoring industrial capitalism, and the productive sector of the economy.

Neither are interest rate hikes an effective monetary tool to address inflation – on the contrary, they feed inflation just as hikes in energy prices do – you do not even require the most basic economic nouse to understand this principle.

History proves that interest rate hikes have to be so utterly brutal that they need to be at the very least the level of the TRUE inflation rate (not the contrived bullshite figures we are fed), or higher.

Paul Volcker, the US Fed Chairman from 1979-1987, did this in the 1980s when the rates were pushed above 20%. This was construed as successful, from the point of view that it appeared to halt inflation, when all it had done was eviscerate enough of the economy and liquidity to make sure that ‘inflation’ was halted.

Furthermore, our units of measure are farcically inappropriate too.

The US dollar has lost 98.16% of its purchasing power when measured against the spot price of gold since 1971.

The NZ dollar has done even worse, at a loss of 98.99%.

However, these calculations are based on the manipulated (read massively paper-shorted gold price).

The true organic price is likely to be at least US9000/oz, making even these horrendous percentage losses grossly understated.

This will be highlighted even more graphically as the imminent short squeeze occurs, and more and more entities stand for delivery tonnages on the COMEX and the LBMA bullion derivative and bullion exchange markets when the physical is simply not there.

The LBMA delivery time is supposed to be T+1* - even in January, 2025, it had ballooned out to T+8 weeks, and now might be T+infinity, or kiss your gold goodbye forever and accept a potentially completely worthless fiat paper token instead.

*(T+1 = Transaction day plus 1 day)

COMEX is a similar disaster.

The author is voicing some valid concerns, although this statement in the last paragraph...

"USD exposure is the real threat to the independence and credibility of the US Federal Reserve."

... almost made me spill my coffee.

This is the Frankenstein-like 'Creature From Jekyll Island' - how can anyone" even entertain the idea of using either the word 'independence' or 'credibility' within the same sentence - a monumental oxymoron if ever I saw one.

Regards to all

Col

https://www.rbnz.govt.nz/research-and-publications/research/our-researc… GDP nowcast 11-07-2025 -0.2462% which is <3% by a lot. Given the international situation my economically naive opinion is that -0.25% GDP growth is extra optimistic.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.