Summary of key points: -

- The Fed comes under increasing and extreme pressure to U-Turn

- Plummeting oil prices and lower US interest rates point to continuing USD depreciation

- Why there is a lag between interest rate cuts in New Zealand and a pick-up in the economy

The Fed comes under increasing and extreme pressure to U-turn

A week after the shock revisions to US jobs data, it seems the global foreign exchange markets are still trying to work out what it all means.

The US dollar has only depreciated marginally from 98.80 to 98.0 on the USD Dixy Indes over the last seven days. The Kiwi dollar has recovered from lows of 0.5890 to close the week at 0.5960. The US interest rate markets are pricing in between two and three 0.25% cuts to the Fed Funds rate by the end of the year. Given the sudden and very significant deterioration in the US labour market through May, June and July, it could have been expected that the markets would price greater interest rate cuts. Fed Chair, Jerome Powell has stated several times over recent months that if the labour market unexpectedly weakened sharply, the Fed would not hesitate to aggressively cut rates. There is no justification for maintaining a “moderately restrictive” monetary policy when jobs are tumbling in a weaker economy. The greater risk to the economy is on the employment side of the Fed’s dual mandate, therefore they now need to act decisively with successive interest rate decreases.

The hesitancy displayed by the markets is somewhat hard to understand against the rapidly changed environment, perhaps they are waiting for further confirmation and corroboration from other economic indicators that the US economy has abruptly slowed up. CPI inflation figures this Tuesday 12th August for July are not likely to answer that question, with a moderate 0.20% increase forecast for the month. Retail Sales numbers later in the week on Friday 15th August may provide a better steer on consumer demand in the economy. The consensus forecast for the retail sales number is a 0.40% increase. Anything below that should see interest rates priced lower and the US dollar sold lower as well.

Arguably overpowering the economic evidence to justify more aggressive interest rate reductions is the revolving door of members coming and going at the Federal Reserve itself. The unexplained and sudden departure of Fed Board member Adriana Kugler last week is very suspicious in terms of political interference by the Trump regime. The temporary replacement for Ms Kugler has already been announced, with Trump economic advisor, Stephen Miran moving into the seat. Current Fed member, Chris Waller is now seen as the leading candidate to replace Jerome Powell as the Fed Chair next May. An early announcement from Trump as to who the next Chair will be will see the markets focusing on that individual as the Chair-Elect, not the outgoing Powell. Mr Waller has already cast a dissenting vote against leaving interest rates unchanged at the last Fed meeting, he wants cuts on the softer labour market. The expectation would be lower market interest rates and a lower US dollar value in response to any utterances from Chris Waller over coming weeks/months.

The next Fed meeting is on 17th September, wherein they produce their full updated economic forecasts and dot-plot interest rate forecasts. The likely main message from that meeting will be the dramatic slowdown in employment, prompting the Fed to “look through” the one-off increases in goods inflation as a result of the import tariffs. The Fed will be concluding, along with most other economic commentators, that Trump’s tariffs have damaged the US economy and produced the worst possible outcome of all – stagflation. The probability of a jumbo 0.50% interest rate cut in September will increase if upcoming economic data prints on the softer side (which we expect it to do).

Plummeting oil prices and lower US interest rates point to continuing USD depreciation

Global fund managers have compounding reasons to continue their disinvestment process from US markets. On top of not trusting Trump’s economic policymakers, they now must have less trust in the Federal Reserve, as it loses its independence with Trump’s politicisation of the institution. They must have also lost trust in the reliability of announced US economic data to accurately reflect what is going on in the economy following the Non-Farm Payrolls revisions fiasco. Yet another Trump appointee to head the Bureau of Labour Statistics will further erode trust that the data is not doctored to suit the boss’s agenda! Trump has managed to undermine credibility in just about everything he touches. At some point in the next 12 months the US public will wake up to the mess he has created.

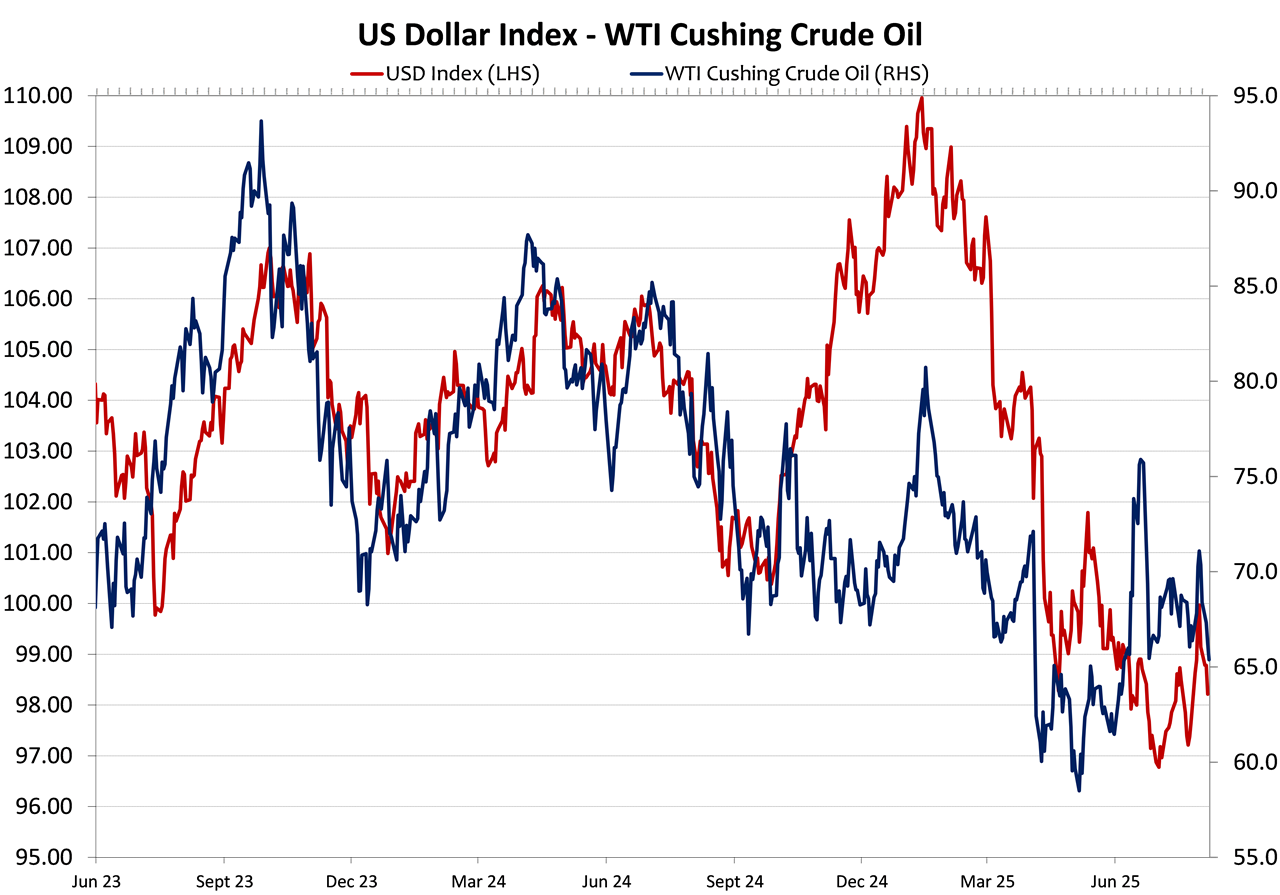

Two lead indicators for the US dollar value that the fund managers will be closely monitoring is the oil price and US tw0-year Treasury Bond interest rate market yields. Trump desires a lower oil price to put economic pressure on Russia, and it will also help offset the tariff impact on US inflation. The recent plunge in the oil price following OPEC+ production increases has seen the WTI crude price drop from above US$70/barrel to US$ 64/barrel.

The USD Dixy Index has been closely following the oil price over the last two years and that correlation is expected to continue (refer to the first chart below). Weaker global demand is also contributing to the oil price decline. Oil prices continuing to fall to below US$60/barrel over coming weeks will pull the USD lower and the NZD/USD exchange rate higher.

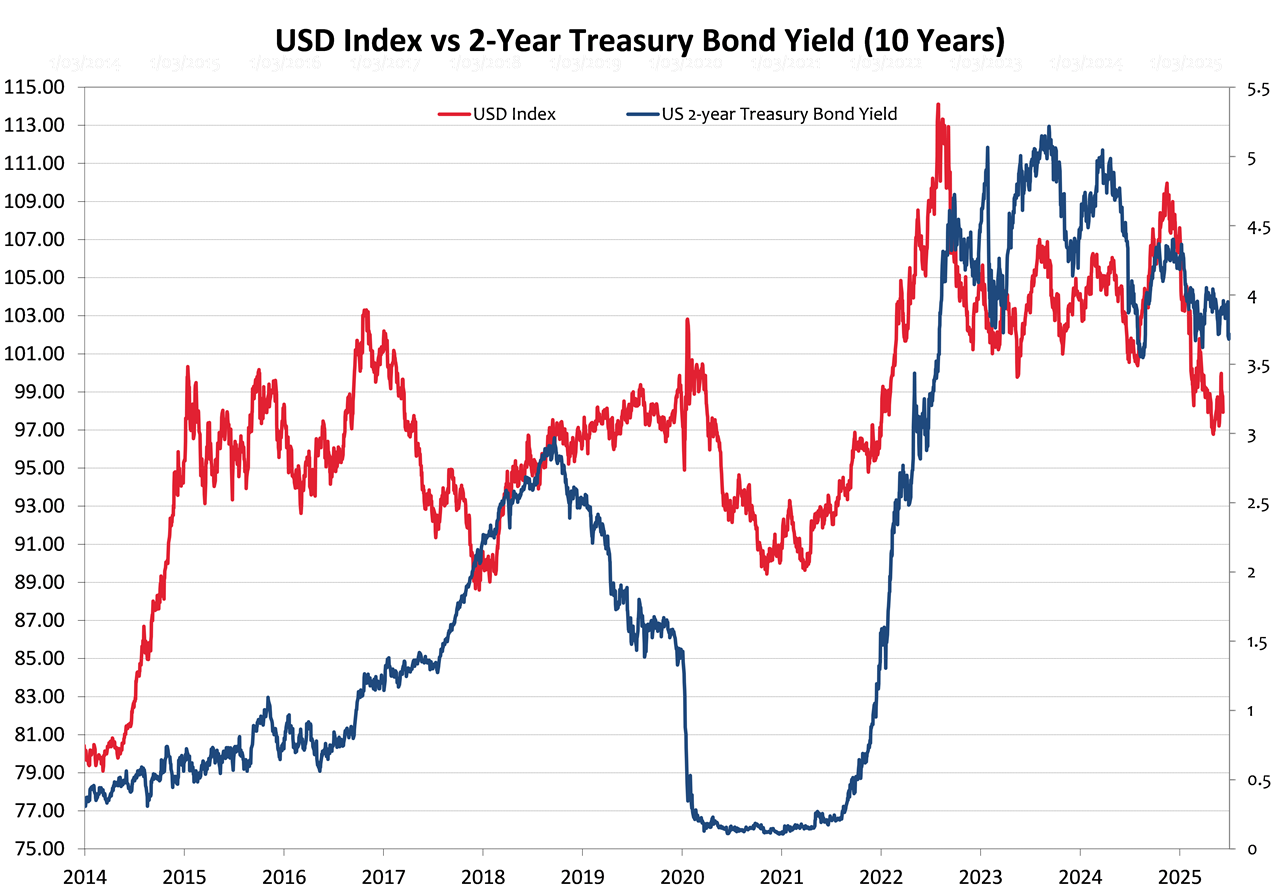

The US two-year bond interest rate has held above the key 3.50% level since 2022 (refer to the second chart below). However, the weaker jobs data seems likely to be the catalyst for additional softer numbers on the economy that will propel market interest rates lower. The two-year rate is currently 3.70%, which prices-in just over two Fed 0.25% cuts. A move downwards to 3.30% is expected over coming weeks as the market shifts to pricing in four 0.25% cuts from the Fed. A 0.40% decrease in US two-year yields, with New Zealand two-year interest rates remaining unchanged, certainly closes up the yield gap between the two currencies and is therefore positive for the Kiwi dollar.

Why there is a lag between interest rate cuts in New Zealand and a pick-up in the economy

The chorus grows louder every day from several bank economists, from John Key and from Mike Hosking for the RBNZ to slash the OCR interest rate to 2.50% to get the NZ economy going again.

It seems they all have very short memories.

Adrian Orr’s slashing of interest rates to low levels in 2020 and 2021 stimulated a housing boom, spending spree and resultant inflation that we are now paying the price for with successive economic recessions in 2023 and 2024. Interest rates were required to be rapidly hiked to control the inflation, sending the economy into contraction. Unfortunately, New Zealanders go a little crazy when they see borrowing costs as low as 3.00%. They load up on debt and spend the proceeds. We are at risk of making the same mistake again and it will again end in tears.

As has been explained on multiple occasions by the RBNZ, there is a 12-month time-lag from when they cut interest rates until economic activity improves as a result of those cuts. The natural transmission mechanisms in the economy are part of the explanation for the delay. However, the principal cause of the time-lag is the fixing of interest rate rates by mortgage borrowers. The majority of home mortgage borrowers do not really understand future interest rate risk when deciding to borrow floating or fixed. They merely take the lowest interest rate on offer from the banks at the time, which invariably is the one- and two-year fixed rates. The banks have decided to compete for new business in the one and two-year fixed rate market and that is where they all have the lowest margin between their cost of funds and the lending rates. As more than 75% of borrowers fix their interest rates it takes a long time before OCR cuts produce lower monthly interest bills and therefore monetary policy stimulation to the economy as the interest savings are spent.

You would think that the banks, of all people, would understand the time-lag as they cause it in the first place!

It is a different story in Australia, where the banks compete aggressively with each other in the variable/floating part of the mortgage lending market, resulting in 75% of borrowers remaining floating as that is always the cheapest rate. In New Zealand, the highest mortgage rate on offer is always the floating/variable rate. RBA cuts to interest rates have a much more immediate positive impact on consumer behaviour and the economy as a result.

It is hard to fathom why the same banks on both sides of the Tasman are prepared to have quite different margins for variable rate and fixed rate lending. It is just how the mortgage market has developed in the more competitive New Zealand space with the banks thinking that they are locking in the borrower for a longer time as a customer if they are enticed to fix the interest rate.

The RBNZ commenced cutting the OCR 12 months ago, the anticipated pick-up in economic activity will be starting about now. Last week’s lift in electronic card spending for July is one of the early signs of improvement.

The workings of monetary policy takes time in New Zealand, requiring patience and understanding. For this reason and the reasons cited above, the RBNZ may do one last cut in the OCR to 3.00%, however calls for further cuts to 2.50% should be ignored.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.