Summary of key points: -

- Weaker US employment data depreciates the US dollar

- Aussie economic data stronger than expected

- New Zealand economic data may well follow Australia’s lead

Weaker US employment data depreciates the US dollar

The state of the US economy and how the Federal Reserve read the inflation and employment trends is critical to interest rate changes and therefore the direction of the US dollar. After the chaotic and substantial downward revisions to the monthly May and June Non-Farm Payrolls employment numbers a month ago, further indicators on the health of the US labour market have been eagerly awaited by the financial and investment markets.

The news is not good!

Last week the following US employment data was released: -

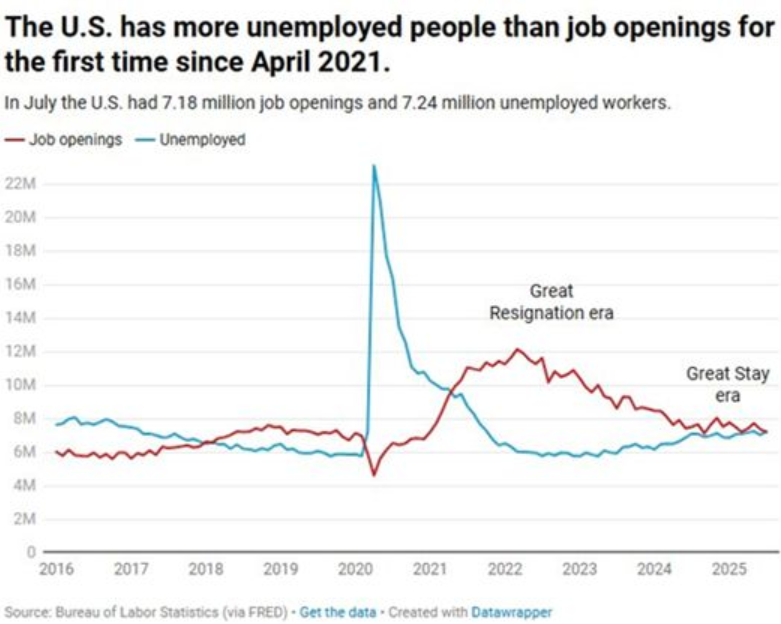

- JOLTS job openings in July fell to 7.18 million, well below prior forecasts of 7.40 million.

- The ADP (private sector) Employment Change for August came in at a weak 54,000 increase, below forecasts of a 65,000 increase.

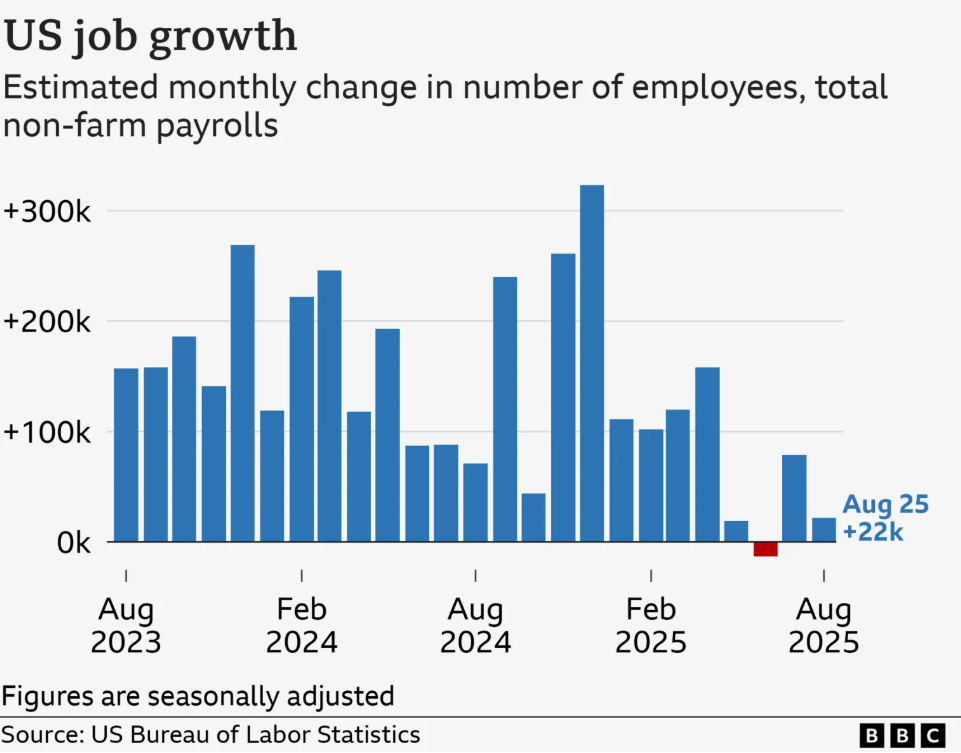

- August Non-Farm Payrolls jobs numbers only increased by 22,000, well below forecasts of +75,000. Manufacturing a Wholesale trade job numbers declined.

Financial market reaction to the continuing soft numbers was swift and severe. The US 10-year Treasury Bond yield plummeting from 4.20% to 4.08%, the two-year yield also sharply lower at 3.50%. The USD Dixy Currency Index also falling in response from above 98.00 to 97.70 at the Friday market close.

As we have previously highlighted, the Fed are compelled to cut interest rates aggressively if the labour market suddenly and unexpectedly deteriorates. That is exactly what has occurred in recent weeks. Further USD depreciation to 95.00 on the basis of lower US interest rates has to be expected.

US inflation may well push above 3.00% over coming months; however, it will be very temporary if increased job insecurity pushes down consumer demand. The Fed need to balance of the two mandated objectives, stable inflation and low unemployment. Right now, the plummet in employment takes precedence and that is why there could be three or four interest rates cuts before the end of the year. The probability of a 0.50% cut at their September meeting is increasing as well.

The NZD/USD exchange rate has recovered to 0.5900 and looks set to move back to above 0.6000 this week as the USD depreciates further.

Aussie economic data stronger than expected

One of the key factors in determining interest rate and exchange rate direction is whether economic data come out hotter or weaker than generally expected. One piece of data by itself will not shift the dial, however a succession of data prints stronger than consensus forecasts add up to a central bank having to re-think it monetary policy stance. Such has been the case in Australia over the last two weeks with stronger data almost forcing RBA Governor Michele Bullock to concede that interest rate cuts from here may be slower than what they have been anticipating.

Consider the following recent economic data results: -

- The monthly CPI Inflation indicator for July released on 27 August coming in at 2.80% (annual rate), well above the consensus forecasts in the 2.00% to 2.30% range.

- House prices increasing 0.80% in August in the Cotality Home Value Index, the largest monthly increase since May 2024.

- GDP growth in the June quarter up 0.60%, above the +0.40% forecast.

- Consumer spending measured in the GDP data up a whopping 0.90% over the quarter, with an upwardly revised +0.40% in the March quarter.

- Household spending up 0.50% in the month of July, again well above prior forecasts of +0.20%.

The economic forecasters, as well as the RBA, have been consistently underestimating the strength of the Australian economy over recent months. There is no question that the lower variable rate mortgage interest rates have lifted confidence and activity levels in housing and retail sales. A strong employment figure for August (released on 18th September) that maintains the unemployment rate at a reasonably low 4.20% level will leave the RBA in a position where they may well have to postpone any further interest rate cuts. Current pricing from the forward interest rate curve in Australia is suggesting that the OCR will not be cut below 3.20% (current the OCR is 3.60%).

With the Federal Reserve in the US about to embark on a series of interest rate cuts, the Australian to US short-term interest rate differential is set to significantly close up. The change is a real positive for the Aussie dollar currency value that has been held down by Australian interest rate being below of the US over the last four years.

The undervaluation of the Aussie dollar is being recognised by more and more financial market commentators and economists in Australia. An article in the Australian Financial Review business newspaper last week on the subject was headlined “Tailwinds tipped to push the dollar to near 0.72 cents”. We have been forecasting a strong recovery in the Aussie dollar for some time with a return to above 0.7000 against the USD.

The AUD has certainly been outperforming the NZD against the USD recently, pushing the NZD/AUD cross-rate sharply lower from 0.9100 to 0.8970. Local AUD exporters have had successive orders triggered to increase hedging percentages. A prudent decision, as Australian fund managers and corporates will be attracted to buy up cheap NZ assets at such low exchange rate levels, forcing the cross-rate back up. The four Australian owned banks in New Zealand would have now completed their usual and predictable AUD buying/NZD selling for the transfer of their annual dividends to their parent banks across the ditch. The greater probability from here is that the NZD/AUD cross-rate returns to its five-year average around 0.9200 over the next 12 months.

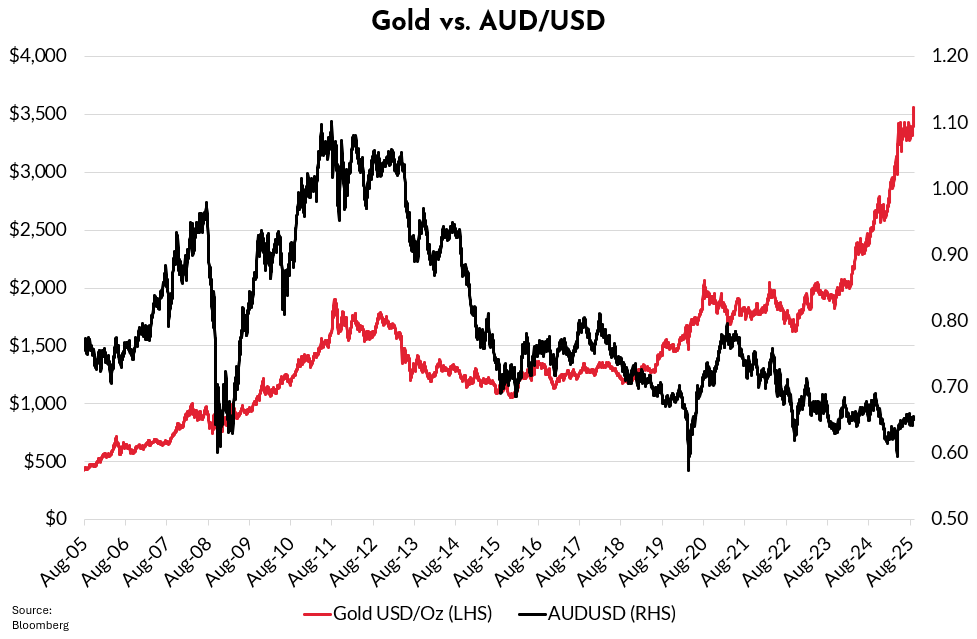

The interest rate differential to the US being against the Aussie dollar for the last four years has dislocated its historical correlation of the gold price (refer to the chart below). Investors and central banks around the globe have been buying gold as an alternative investment asset to US Treasury Bonds as they have lost confidence in the Trump regime’s handling of economic policy and management of their massive budget deficit problem.

The unanswered question is whether the AUD/USD exchange rate will restore its historical link to the gold price once the interest rate gap disappears? Our view is that it will.

New Zealand economic data may well follow Australia’s lead

A reflection back on local NZ economic data releases over the last two weeks leads to the same conclusion as the situation in Australia – all the economists have been consistently underestimating the underlying strength in the economy.

- Retail Sales in the June quarter increased by 0.50%, in stark contrast to prior forecasts of decreases of 0.20% to 0.70%!

- ANZ’s own card spending was up a robust 0.40% in August, with only vehicle sales down, out of 10 categories.

- Building permits issued in July were stronger than forecast.

- The Terms of Trade Index (export prices over import prices) increased 4.10% in the June quarter, well above prior consensus forecasts of a 1.40% increase.

- Our overseas trade balance is poised to move up strongly over coming months from an annual deficit to a surplus as export prices are at record high levels (despite last week’s 4% drop in dairy prices) and import prices are reducing (lower oil prices). On top of that, Statistics NZ has been overestimating the amount of low value imported items (less than $1,000 per item). The growth of buying through Temu has changed things. One estimate is that the overall Current A/c deficit could be revised lower from 5.70% of GDP to 5.20%.

The Kiwi dollar may well receive an unexpected shot in the arm when our GDP growth numbers for the June quarter are belatedly released on Thursday 18th September. Economists forecasting a contraction in the economy after the strong 0.80% expansion in the March quarter may be in for an unpleasant surprise. The RBNZ Real GDP Growth Nowcast prediction model has moved back to a 0.10% contraction, after earlier predicting a 0.30% contraction.

A positive GDP growth number in the June quarter is not what the markets and the RBNZ are expecting, they are both forecasting a 0.30% contraction. Offshore currency market players will be sitting up to take notice of New Zealand’s economic improvement, defying most forecasts of continuing gloom!

The local interest rate yield curve has moved to an even more sharply upsloping shape with NZ two-year Government Bond yields at 3.00% and 10-year yields at 4.43%. Typically, a steep/upward sloping yield curve indicates that monetary policy settings are too loose compared to the inflation and growth outlook. However, we still have the majority of bank economists calling for the RBNZ to cut the OCR interest rate from 3.00% to 2.50% to make conditions even substantially looser! Go figure!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.