Summary of key points: -

- Improvement in the US dollar unlikely to last

- Trusting New Zealand’s economic numbers!

- Political turmoil in Japan hurts the Yen

Improvement in the US dollar unlikely to last

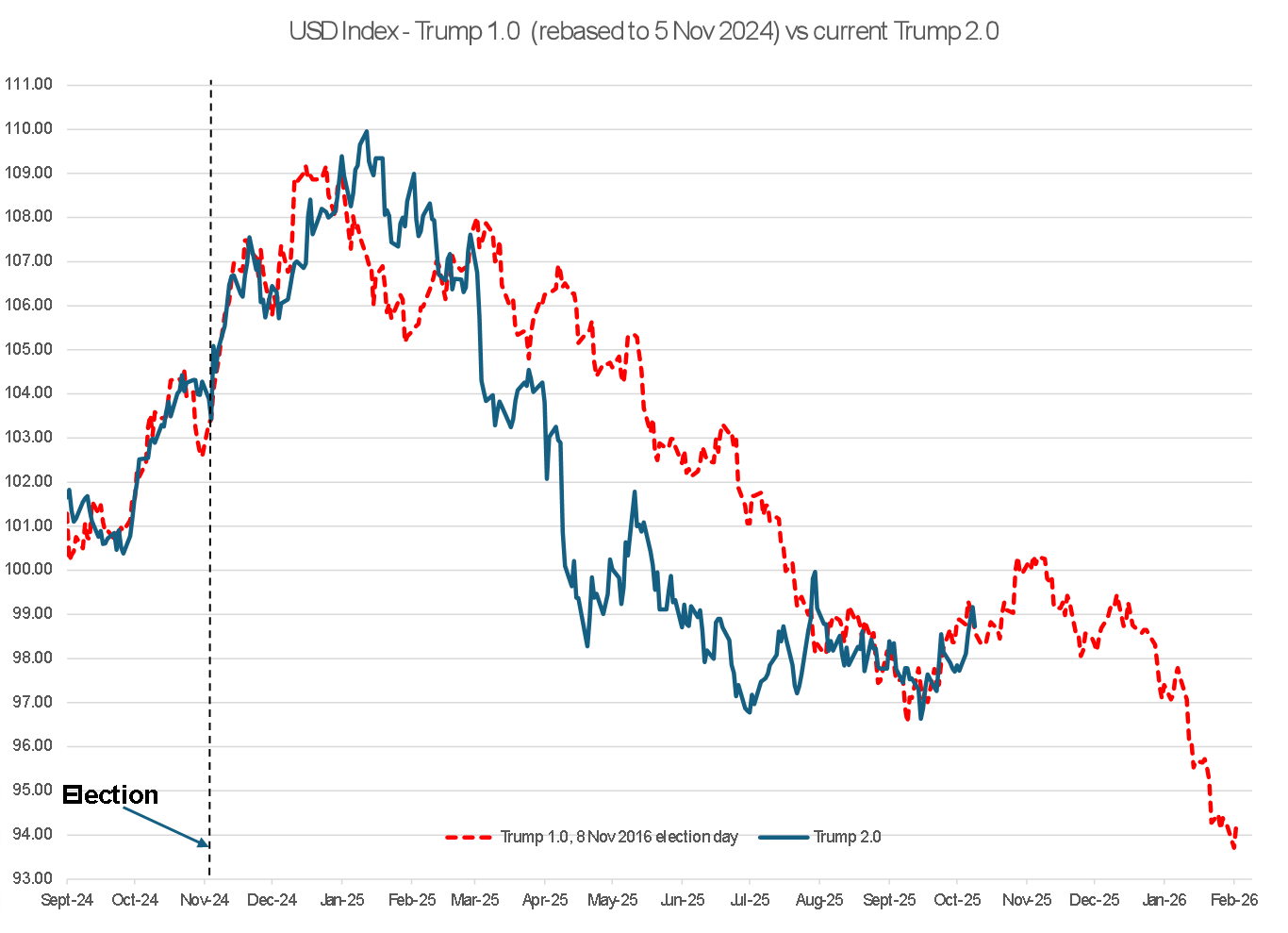

The chart below has become a mainstay of describing what is happening to the US economy and the US dollar currency value under Donald Trump’s second term as President.

The almost identical tracking of the US dollar value since September 2024 to what occurred eight years ago in his first term, is both remarkable and telling. Amidst the chaotic economic policy disruption, the inconsistency and the unpredictability that is everything Donald Trump, the foreign exchange markets have merely followed the cue of his first term. The identical movements of the US dollar over the first nine months of both his terms reflects foreign investors into the US losing confidence and trust in what the Trump regime is doing. The US dollar has depreciated due to the exit of the foreign investors, with the regular bouts of USD strength seen as opportunities for those foreign investors to sell out of their USD assets at a better exchange rate. As we have highlighted on several previous occasions, the periods of short-term USD strength do not last too long.

Over the last month the USD Index has moved upwards from a low of 96.20 in mid-September to 98.73 today, mirroring the bout of USD strength at this time eight years ago (red dotted line on the chart). History would suggest that the USD could move higher to 100.00 in the short-term, before falling away again to our long-held target of below 95.00 by January/February.

There are several simultaneously occurring reasons over the last few weeks that have pushed the US dollar value back up (for the meantime): -

- The Federal Government shutdown in the US resulted in the monthly Non-Farm Payrolls employment data for September not being released last week. Had a soft number been published, the USD would have been sold based on more Fed interest rate cuts. The data vacuum has stopped that USD selling and encouraged some profit-taking on short-sold USD positions i.e. short-term USD buying. There is no information on when the jobs data will be released. The USD is currently effectively trading blind without this data. Preliminary annual revisions of the Non-Farm Payrolls were due in September but have not been seen.

- Trump has re-ignited the prospect of a nastier trade war with China with his latest tweet threatening tariff retaliation to China’s control of their rear-earth mineral resources. Whilst the US was taking much longer with its trade negotiations with China, than with other countries, it was thought that the trade relationship was improving, and the risk had reduced. Unfortunately, Trump gazumped that expectation in one foul swoop, sending US share markets tumbling last Friday. The equity markets seeing this latest Trump tariff stance as negative for the US economy and introducing another level of uncertainty to business and global trade.

- The minutes of the last Fed meeting wherein they cut their interest rates by 0.25% were released last week. The minutes confirmed the massive divide in opinion within the Fed of the weaker labour market requiring interest rate cuts, whereas inflation is rising to 3.00%, well away from the Fed target of 2.00%. However, it has now been realised that the impact on inflation from Trump’s tariffs has been less than originally expected and taken longer to come through. The Fed is not united and therefore uncertainty and risk are higher.

- The current political mess in France is undermining some confidence in the Euroland economy and therefore the Euro. From $1.1860 in mid-September, the EUR/USD exchange rate is down to $1.1620 (however bouncing off a low of $1.1560 last Friday).

The Australian dollar was hit hard late last week following the flaring up again of the China/US trade stoush. Anything negative for the Chinese economy is always bad news for the Aussie dollar value. The AUD/USD rate dropping 1 ½ cents from 0.6620 to 0.6470. The Kiwi dollar was immediately sold off from 0.5800 to a low of 0.5740 following the 0.50% cut to the OCR by the RBNZ on Wednesday 8th October. However, there was no follow-through selling of the Kiwi dollar in overnight offshore trading and it did recover back to 0.5800 on Thursday 9th October. The subsequent Trump ignited trade risk sending the Kiwi dollar lower again to 0.5722, as it followed the AUD downwards.

Numerous media reports after the RBNZ OCR decision highlighted the fact that it was a forgone conclusion (in the reporter’s view) that there would be two more 0.25% cuts to 2.00% as the RBNZ stated that they were “open to further reductions in the OCR”. The media reports failed to comprehend the rest of the RBNZ sentence which was “as required for inflation to settle sustainably near the 2 percent target mid-point in the medium term”. If inflation tracks higher than RBNZ forecasts over coming months there will be no further OCR cuts. There is a better than even chance of that happening in our view.

Trusting New Zealand’s economic numbers!

It does not instill a lot of confidence in Statistics New Zealand’s measuring of our economy when 0.60% of the 0.90% contraction in GDP in the June quarter was “balancing items”, unrelated to any specific industry sector. The RBNZ stated that the -0.60% is likely to reverse out of the figures in the September quarter, however that made no difference to their decision to implement a 0.50% OCR cut to 2.50%. No wonder that economists and market analysts are reverting to high-frequency alternative measures of economic activity, such as the ANZ’s truckometer and electronic card transactions for retail sales trends.

Readers should not be surprised to see subsequent large revisions to GDP growth numbers for 2025 sometime next year. The economy has not fallen into a hole over recent months; it is just that the stimulus from earlier interest rate reductions has taken much longer to come though on this occasion (due to high home mortgage debt levels). The current preference by households to repay debt rather than spend goes back to the super-loose monetary policy of 2020/2021 that prompted unsustainable high debt levels as the borrowers could afford the interest cost. The RBNZ now need to be careful that they do not repeat that same monetary policy mistake!

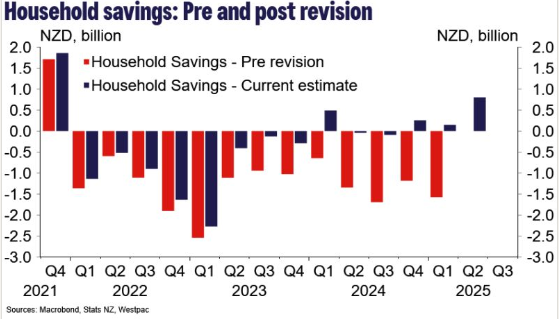

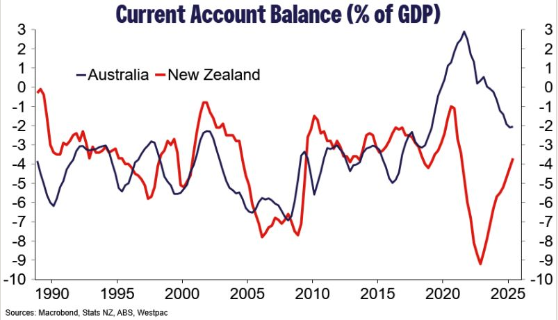

The subsequent revisions to the figures of several of our key economic measures is concerning and potentially leading to incorrect conclusions for the managers of our monetary and fiscal policies. It is also confusing for overseas investors and denting our credibility in their eyes.

Two very instructive charts displaying pre and post revised data from Westpac’s Chief Economist, Kelly Eckhold confirm the frustrating miss-information this is released to the markets: -

Our Current Account deficit for the year to June 2025 was much smaller than earlier reported, the revisions due to higher values of offshore equities and lower Temu/Shein purchases.

Political turmoil in Japan hurts the Yen

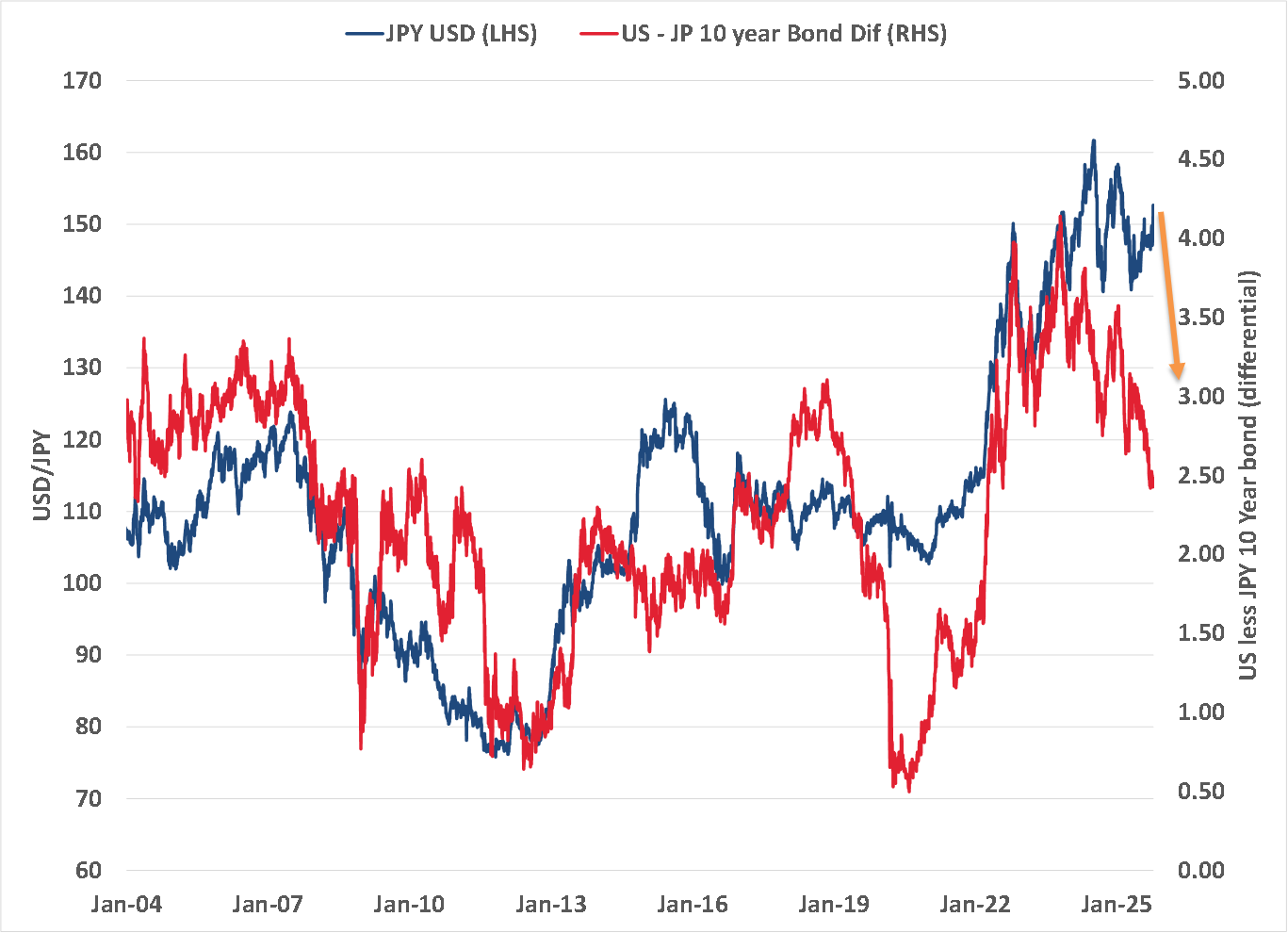

The Japanese Yen has been beaten-up in global currency markets over recent weeks as investors and traders lose confidence in Japan’s management of their monetary and fiscal policy. The Yen has depreciated against the USD from the 145.00 area it maintained through July/August/September to a high of 153.20 on 9th October. The USD/JPY rate has recovered a touch to currently trade at 151.20. Tumultuous political changes within the ruling LDP Coalition and the promotion of Ms Sanae Takaichi as Japan’s first female Prime Minister have caused the negative reaction by bond and FX markets. Firstly, it was viewed by the markets that Ms Takaichi was a fiscal dove i.e. wanting increased Government spending. Secondly, it was reported that she was not in favour of the Bank of Japan continuing to hike their interest rates to control their increasing inflation rate.

The risk of further Yen depreciation from here seems to have moderated by three more recent developments in Japan: -

- PM Takaichi has appointed a deputy and party secretary who are both proponents of tighter fiscal policies.

- Ms Takaichi also stated that she “has no intention of triggering and excessively weak Yen”.

- Last Friday the Yen recovered somewhat to 151.20 when the junior partner in the LDP Coalition Government, the Komeito Party rebelled against the new hardline leader Ms Takaichi and walked out of the coalition.

The markets are trying to make sense of the political split and a potential scenario of Ms Takaichi not being made Prime Minister after all. Another candidate who is more fiscal austere and pro an independent Bank of Japan may well send the Yen right back down to where it came from at 140.00 to 145.00. An unwinding of the “Takaichi trades” where the Yen was sold, would certainly reverse the direction.

Based on the dramatic closing up of the interest rate differential between Japanese 10-year bond yields (1.70%) and US 10-year Treasury Bonds (4.05%), the USD/JPY exchange rate is much more likely to move back to 140 (and lower), than stay above 150.00 (refer chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.