Summary of key points: -

- Is US inflation peaking? – the bond market may be providing the answer

- Upcoming NZ budget and monetary statements poised to be “totally underwhelming”

- US consumer confidence has collapsed – will the US dollar value follow?

Is US inflation peaking? – the bond market may be providing the answer

Concentrated US dollar buying against all the major currencies last Friday 13th May, following the marginally higher than expected US inflation number for April, pushed the Kiwi dollar down to a two-year low of 0.6215.

US inflation trends remain the dominant influence over all global financial and investment market direction at this time as the Fed’s responses with monetary tightening drive decision-making everywhere.

Whilst the US headline inflation figure for the month of April at +0.30% was only fractionally above the consensus forecast of +0.20% with energy prices reducing, the “core” inflation measure (excluding energy and food prices) increased 0.60%, sufficiently above the +0.40% expected to excite the markets that the Fed still has a lot more to do.

However, the wholesale Producer’s Price Index (”PPI”) in the US the following day indicated that some of the supply chain pressures may be peaking as the core PPI increase was less than prior forecasts.

The reaction of the US Treasury Bond market to these latest inflation gauges was instructive. Long term interest rates (10-year bond yields) actually reduced from a high of 3.20% on the 9th of May to a low of 2.82% on Friday 13th May. The dramatic increase in 10-year bond yields from 1.50% in late January to 3.20% last week reflected a lack of confidence by the markets that the Fed was going to combat the rising inflation and also the reality that the Fed themselves has now become a big seller of bonds as they reduce the size of their balance sheet (part of reversing monetary policy from loose to tight). The about-turn in sentiment and direction in the bond market may only be profit-taking by the speculative players, or it may represent a more fundamental belief by the large fixed-interest fund managers that the sharp increases in US inflation over recent months will now abate.

There is clear evidence in both the historical and current inflation numbers that the annual increase in US inflation over coming months will start to trend down from the peak of 8.50% recorded for the year to March. The two largest contributors to the April 2022 inflation increases were housing and airfares. Repeated increases of these two prices over coming months seems unlikely as lumber/oil prices pull back and airline supply capacity ramps up. Assisting the annual inflation rate to trend downwards from here will be the large increases in both used and new car prices 12 months ago (in May and June 2021) dropping out of the annual measure. The US annual core inflation rate could reduce back to 6.00% rather quickly over coming months. Still well above the Fed’s tolerance limit for inflation, but at least heading in the right direction. If other US economic data prints on the weaker side over coming weeks, the bond market will conclude that US inflation has peaked and bond yields will move lower, not higher.

The lead from the bond market will also have implications for the equites and currency markets:-

- US equity markets rallied up 1.50% on Friday 13th May following the PPI numbers, the first sign of buying interest after eight straight days of selling. Lower bond yields are positive for the valuations of the tech stocks.

- The US dollar currency index reversed from highs of 105.00 to 104.50. The AUD/USD exchange rate reversing back upwards to 0.6940 from a low of 0.6830. Further AUD gains seems likely once the political risk/uncertainty comes to an end after the election next Saturday.

The US dollar’s hot bull-run since February, when the Russian/Ukraine war caused oil prices and US inflation to increase further than the FX markets had previously priced-in, may be finally burning itself out.

As the global bond, equity and currency markets re-calibrate over coming weeks to the fact that US inflation has already peaked, the NZD/USD and AUD/USD exchange rates will finally have an opportunity regain a good part of their seven-cent sell-off over the last six weeks. It should be remembered that the recent NZD and AUD selling is not permanent capital exiting our markets, but merely short-term speculative FX market positioning based on selling all currencies against the rampant US dollar. Given the greater probability of the offshore US dollar sentiment and direction reversing over the months ahead, local USD exporters must be forward hedged to the maximum of policy limits (and then some!), whilst USD importers can hold-off and wait for a return to above 0.6800.

Upcoming NZ budget and monetary statements poised to be 'totally underwhelming'

Both Grant Robertson’s budget statement on Thursday 19 May and Adrian Orr’s monetary statement on Wednesday 25th May have the opportunity to deliver policy that will address the largest problem facing New Zealand at this time, the rising cost of living.

Do not hold your breath that they will be bold and innovative to provide solutions for squeezed household finances. Instead, be prepared to receive a Government budget statement all about re-distributing a diminishing pie, not growing the pie. On top of adding fuel to the inflation fire with increased fiscal spending, the budget will be all about re-arranging the deck chairs in health sector and (as always) dominated by climate change narrative.

The RBNZ are also set to disappoint with delivering a more stringent monetary policy setting after the last statement in February achieved the opposite of what they wanted with the subsequent NZ dollar depreciation loosening monetary conditions, not tightening them. The RBNZ need to drop comments like they are lifting the OCR by 0.50% so that they have room to cut interest rates later when the economy turns to custard.

Both statements should be addressing the “elephant in the room” of our bloated bureaucracy to administer regulatory over-kill causing continual cost increases on households and businesses. Both statements will disappointingly fail to do that.

Neither statements will have any impact on the NZD/USD exchange rate. Over the next week, the Australian wages data on Wednesday 18th May is more likely to influence the NZD/USD rate (through following the AUD/USD rate) if the annual increase is well above the 2.50% expected.

In addition, pending announcements from the Chinese authorities on massive fiscal and monetary stimulus packages for their economy stand to be much more important for the NZD and AUD currency values in the medium term.

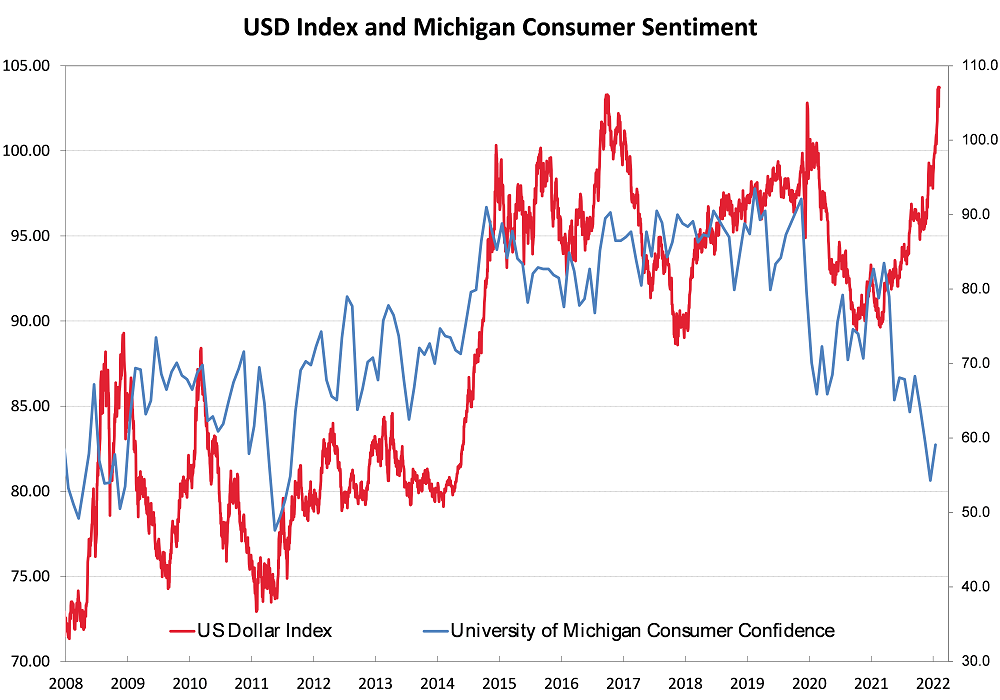

US consumer confidence has collapsed – will the US dollar value follow?

The chart below tells the historical story that when US consumers are not happy and reduce their spending, the US economy does not do so well, and a lower US dollar value reflects that economic under-performance (e.g. 2011). On the other side, when consumers are happy and spending, the US economy out-performs, and the USD appreciates (e.g. 2015/2016). The US dollar appreciation over the last 12 months has been extended in magnitude and timing due the Russian/Ukraine war increasing US inflation a lot further than the Fed and FX markets expected.

The divergence of the two series has been extreme over recent times, the conclusion has to be that the US dollar is living on borrowed time!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

6 Comments

Well this tells me that we are reliant on Chinas economy doing well. Some things are not going to change any time soon.

"If other US economic data prints on the weaker side over coming weeks, the bond market will conclude that US inflation has peaked and bond yields will move lower, not higher."

Say inflation is at 8.3%, and it moves down to 6.3%, will the Fed hike interest rates by 50 bps.

"More than 1 million barrels a day of the country’s oil refining capacity — or about 5% overall — has shut since the beginning of the pandemic. Elsewhere in the world, capacity has shrunk by 2.13 million additional barrels a day, energy consultancy Turner, Mason & Co. estimates. And with no plans to bring new US plants online, even though refiners are reaping record profits, the supply squeeze is only going to get worse.

“We are on the razor’s edge,” said John Auers, executive vice president at Turner, Mason & Co. in Dallas. “We’re ripe for a potential supply crisis.”

"Biden administration cancels oil and gas lease sales in Alaska, Gulf of Mexico"

https://www.bloomberg.com/news/articles/2022-05-13/gasoline-diesel-jet-…

https://thehill.com/policy/energy-environment/3485545-biden-administrat…

Get ready for very high fuel prices. Followed by fertilizer, things could get tough. But maybe interest rates won't get to the highs that have been anticipated.

At current exchange rates, there is considerable NZ inflation in the pipeline. Hence, NZ inflation movements may not necessarily align with US inflation movements over coming months.

KeithW

china still has to shift to a living with covid -- so much supply chain disruption and supply /demand issues

India - huge challenge to rebuild its middle class consumer consumption ( prefer it not to really )

Grain harvests in Ukraine likely to be slashed - and of course hard to be planting the following years crops - not to mention other supplies from Russia /Ukraine - fertalizer cookign oils

$$$ redirect to defence spending -- not infrastructure and climate change across all of the EU

continued higher interest rates - could help inflation with reduced spending ....

Oil / Gas and energy prices in high flux -- Even a minor additional disruption could spend oil into the $130+ bracket

oh -- and dont forget what will be the most massive societal shift in employment relations, employee behaviours and employment practices and reduction of works importance in peoples life and life goals since Woman stayed in the workforce that the working from home/covid pandemic will cause -

Not sure we have even fully entered the Forest -- let alone seeing any endgames

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.