The New Zealand dollar has staged something of a recovery against the previous all-powerful US dollar over the last two weeks, crawling off the bottom of 0.6215 on 13th May to 0.6400 at the time of publication.

A stronger US dollar, tumbling global equity markets and a sudden/orchestrated depreciation of the Chinese Yuan were the forces behind the Kiwi dollar’s sell-off from 0.6800 to 0.6200 through April and early May.

The Yuan value was “let go” by the Chinese authorities from the previous stable 6.35 region to the US dollar in March to 6.80 at one point last week.

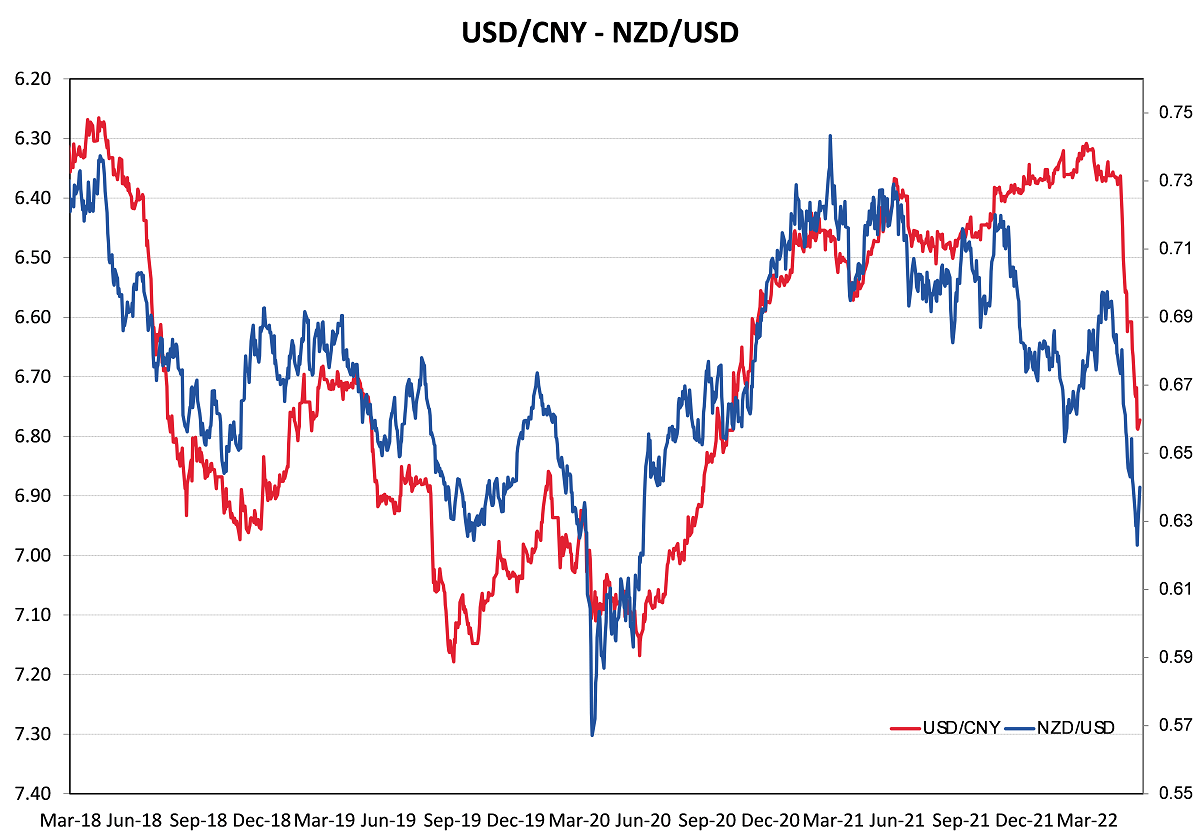

The 7% Yuan depreciation was mirrored by falls in the NZD/USD and AUD/USD exchange rates over the same period.

Whilst equity markets remain under selling pressure, the NZD and AUD have both recovered upwards as the Yuan exchange rate pulls back from 6.80 to the current 6.69 level against the USD. It appears the Chinese central Bank, the PBOC, have completed their first phase of monetary stimulus by deliberately devaluing the Yuan to assist export industries and they are now focused on reducing mortgage interest rates to help their property markets.

Further monetary and fiscal policy stimulus packages can be expected from the Chinese over coming weeks/months as they seek to return economic growth to a path of achieving the target 5.50% GDP expansion this year from the Covid lockdown setbacks.

It is typically good news for the NZ and Australian economies (and thus the respective exchange rates) when the Chinese announce measures to push stronger economic growth. The NZD and AUD are back tracking the Yuan exchange rate closely again after the correlation broke down from October 2021 through to March 2022 (refer chart below).

To form a considered and balanced view of the future direction of the NZ dollar from current levels it is necessary to weight the factors/forces that determine both the NZD side and the USD side of the currency equation. As the NZD/USD rate largely follows the AUD/USD rate in the forex markets, we must also add in the third dimension, the Australian economy and the AUD’s fortunes.

Outlook for the NZD through the New Zealand lens: -

- The RBNZ has been tightening monetary policy with higher interest rate since last October and will ramp up the OCR another 0.50% at next Wednesday’s Monetary Policy Statement. Higher New Zealand interest rates would normally force the NZ dollar value upwards and help reduce inflation through cheaper imported goods. However, our short-term interest rates at less than 1.00% above US short-term interest rates do not offer an attractive enough yield return advantage to bring in the offshore carry-trades to buy the Kiwi dollar. Historically, the NZD has only appreciated under its own steam from carry-trade demand when the interest rate gap is well above 2.00%.

- High export commodity prices have in the past been positive for the Kiwi dollar, however the strong US dollar over recent months stemming from the Ukraine war, higher oil prices, US inflation and an aggressive Fed have out-weighed this local positive.

- Very weak consumer and business confidence indices point to a slowdown in the NZ economy over the next 12 months that is not positive for the Kiwi dollar. However, our well-performing export economy should pull the overall economy through and prevent a recession.

- The health of our economy and Government’s budget deficits/debt in the post-Covid recovery period is no better or worse than our peers. Sadly, as last week’s uninspiring budget displayed, there are no bold economic policy initiatives to lift productivity (like accelerated depreciation for business firms), attract skilled immigrants and to reboot the two big foreign currency earners (education and tourism) that were decimated by the Covid border closures. Grant Robertson’s last minute decision to spread “helicopter money” to households should be seen for what it is – bribing the public for voter support with their own tax money!

The local New Zealand variables for the Kiwi dollar are evenly balanced and will continue to be overwhelmed by the Australian and US forces over coming months, as has been the case for the last 18 months.

Outlook for the NZD through the Australian lens: -

- Political risk factors in the lead up to Saturday’s general election arguably held the Aussie dollar back from otherwise further gains due to continuing impressive economic numbers. The change to a Labour Government will not be a surprise to the currency markets as the political opinion polls suggested such an outcome. Essentially, the ScoMo Liberal Coalition lost votes to independents and small fringe parties on climate change, woman’s affairs and anti-corruption issues, not on their management of the economy.

- The Reserve Bank of Australia (“RBA”) have finally woken up to their inflation risks and are now aggressively tightening monetary policy through hiking interest rates. The RBA is six months behind the RBNZ in timing, therefore their recent U-turn on monetary policy is much more positive for the AUD value at this time.

- Australia’s mining and metal export commodity prices are already at elevated levels and will be held there by the upcoming Chinese economic stimulus packages.

- On any comparison, Australia’s strong economic position with 4% GDP growth in 2022, record low unemployment rate and large external Balance of Payments Current A/c surpluses stands head and shoulders above other economies and currencies. Now the distraction of the general election is out of the way, global investors must recognise Australia’s impressive economic credentials and substantial capital inflows into the Aussie dollar should result.

Despite the sharemarket “risk-off” sentiment and Yuan depreciation pulling the AUD/USD exchange rate back from 0.7600 to just above 0.7000 over the last six weeks, the forward outlook for the Aussie dollar remain extremely positive (for the above reasons) and the majority of currency forecasters still see the AUD heading to above 0.8000 over the next 12 months.

Outlook for the NZD through the American lens: -

- On many measures, the US dollar is now at an extreme over-valued position, and it is damaging to both the US economy and to the global economy. The US dollar index above 100 is at 20 year highs and the strong dollar is hurting US exporters, local manufacturers who compete against cheaper imported product and the giant technology companies who earn half their revenues/profits from non-USD currencies. The Federal Reserve require a resilient US economy to weather the higher interest rates being imposed to combat inflation, the over-valued USD is not helping that economic resilience.

- Over recent months the USD has benefited from safe-haven inflows from the Russian/Ukraine war and the sell-off in equity markets. Through the month of April the US Treasury Bond market also sold-off as bond investors clearly did not have confidence that the Fed would get inflation under control. The 10-year bond yield climbed to 3.20% on 9th May and the US dollar value followed it up. However, over recent days the bond market has reversed with the yield dropping to 2.78%, the USD currency value should follow it back down. It appears that the bond market is now reflecting a view that US inflation has peaked and will trend lower from here.

- The key US economic lead-indicator to monitor over coming months is their monthly CPI inflation figures. May, June and July 2022 price increases are set to be significantly below the same months in 2021 when crazy prices were paid for used cars and building materials. As a result the annual inflation rate will start to trend down to 6.50% from the current 8.50% as the large monthly increases in 2021 drop out of the annual inflation rate calculation.

- The Europeans were forced to postpone planned interest rate increases at this time due to the Ukraine war. However, the ECB is now signalling that they will be lifting interest rates in July to combat their inflation problem. Forward-looking FX markets have already priced-in the US Fed monetary tightening with the stronger USD, now we will see the Euro recovering back up to $1.1000 and above due to the markets pricing-in the upcoming ECB monetary tightening.

The latest bout of USD strength (which this column did not expect as along with everyone else we did not anticipate the Russian/Ukraine war) has now run its course in our humble opinion. We may now be witnessing a major, multi-year pivot in the value of the USD, and for that reason the forecast of the NZD/USD rate returning to 0.7000 as fast as it slid down remains valid.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.