Summary of key points: -

- Probability of a “hard landing” for the US economy increases

- PM’s foreign policy stance against China potentially hurting the NZ economy (and dollar)

Probability of a “hard landing” for the US economy increases

Current foreign exchange market pricing, in maintaining the US dollar value at its record highs over recent weeks, reflects total belief by the currency markets that the Federal Reserve can beat the high inflation without sending the US economy into recession i.e. orchestrate a “soft landing” to the economic slowdown.

Our view continues along the consistent theme that the FX markets have too much faith in the Fed to get this right. The markets stand to be massively disappointed. Already, there is a stack of evidence that the US economy slowed abruptly in May, and it appears that the rapid slowdown to activity levels across the US economy has continued in June.

On top of the weaker than expected US retail sales, housing starts and industrial production data for May, the latest ISM manufacturing survey for June was also well below prior forecasts, a 53.0 actual result compared to a 54.9 forecast and 56.1 last month. The Federal Bank of Atlanta GDP growth predictor (GDPNow) projects that the US economy will contract by 2.1% in the June quarter. Added to the 1.6% decrease in GDP in the March quarter, it appears that Jerome Powell at the Fed will again be well wide of the mark in stating that the US economy remains “robust” to handle higher interest rates. The Atlanta GDPNow index has been very accurate against actual GDP growth outcomes over the years, so a “hard landing” is looking increasingly likely.

The weaker economic data has caused the US Treasury bond market to sharply reverse in sentiment and direction over the last two weeks, the 10-year yields plummeting to 2.88% from 3.50%. The bond market is now pricing-in a peaking in US inflation and reflecting a higher probability of economic recession. It is only a matter of a very short time before the FX markets reverse their bullish USD positions and sell it down. The USD currency index closely follows the 10-year Treasury bond yield in direction. The sharply lower bond yields suggest the USD Index is about to reverse from the current 104.80 to somewhere closer to 100.00. A 5% depreciation in the USD over coming weeks, would see the Kiwi dollar clawing its way off the bottom at 0.6200 to a value closer to 0.6500.

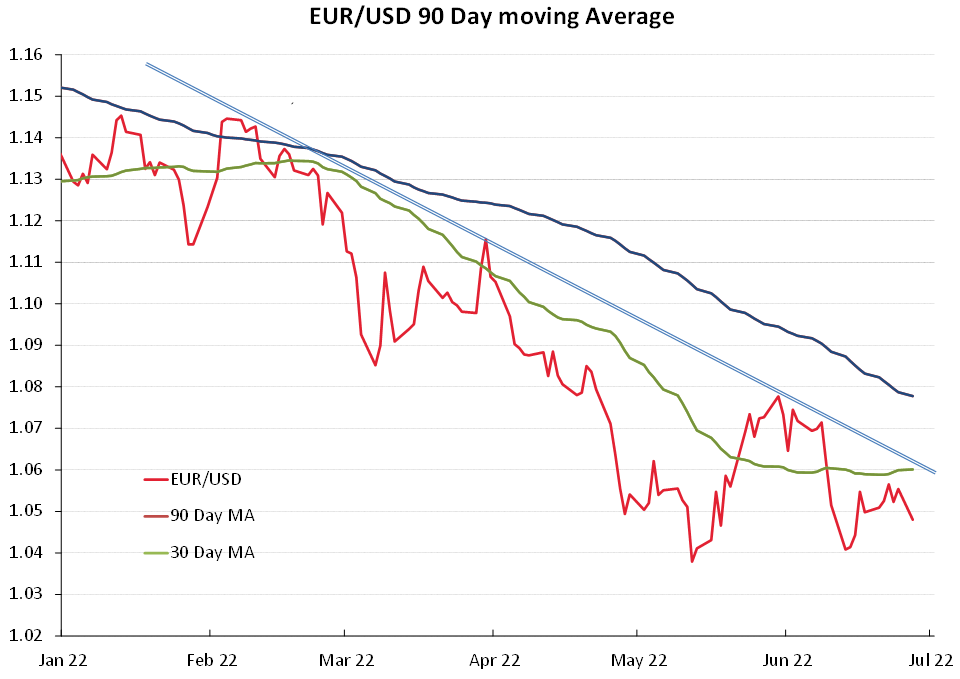

Should the lower bond yields feed into a lower USD, the EUR/USD exchange rate, which has remained under pressure around the $1.0400/$1.0500 mark, may start to challenge the downtrend resistance line and 30-day moving average line at $1.0600 (refer chart below). A recovery in the Euro towards $1.0800 would pull the Kiwi dollar up to 0.6500 and would signal a turning point towards a weaker USD going forward.

It may need the Fed to change their rhetoric around the strength of the US economy, before the FX markets are convinced the US dollar is overvalued vis-à-vis the economic outlook. A piece of economic data coming up that may force a Fed moderation in tone is the June monthly jobs figures on Friday 8th July. New jobs for the month could be well below the +270,000 consensus forecasts, and also well down on recently monthly increases. Following the jobs data, the next key data-point is US CPI inflation figures for the month of June on Thursday 14th July. An annual increase in inflation below the 8.60% recorded for the 12 months to the end of May will be negative for the US dollar. Locally, the focus will be on the RBNZ’s interest rate review on 13th July. No surprises there, with another 0.50% OCR increase (which is already well priced-in to the market).

PM’s foreign policy stance against China potentially hurting the NZ economy (and dollar)

The post-Covid era in the NZ economy in 2022 was supposedly going to see a bounce back in activity and confidence about the future. For a combination of reasons, the direct opposite is occurring with business and consumer confidence plunging to new lows and everyone pretty grumpy. Household finances are under pressure from high inflation and rising mortgage interest rates and businesses are frustrated with the shortages of workers. Our view has been that the NZ domestic economy may well go into recession this year, however the export economy continues to do well and once again will pull the overall economy through. How the economy has been able to make up for the loss of international tourism and international education foreign currency receipts over recent years remains something of a mystery. Higher export commodity prices have compensated to some extent.

The loss of those foreign currency receipts for tourism and education may partially explain why the Kiwi dollar has under-performed the Aussie dollar over recent months against the USD. As a result the NZD/AUD cross-rate nose-dived from 0.9700 last October to 0.9100 today. The lower volumes of selling foreign currency receipts, buying NZ dollars resulting in the weaker NZD exchange rate performance.

There may also be a second reason for the lack of interest to buy the NZ dollar at this time. A quick scan of the headlines across the Bloomberg and CNBC financial/investment news websites over this last week reveals numerous news stories featuring New Zealand and its veiled messages towards China. The Prime Minister’s recent visits to the US and Europe has seen an unheralded and abrupt change to our previous “independent, non-aligned” foreign policy position. Without a mandate from anyone, Jacinda Ardern has signed up to some partnership arrangement with the US for the Pacific and invited NATO and the UK to take more of an interest in the Pacific against China’s ambitions in the region.

Just why New Zealand would be taking up such an aggressive foreign policy stance against our largest export/import trading partner (China) beggars’ belief. It could just be that the PM likes to say all the right things at these international jollies to get the photo-ops with Biden, Boris, von der Leyen, Macron and Trudeau. Even the trumpeted Free Trade Agreement with the EU only results in chicken-feed benefits to the NZ economy. Looks like they gave us some crumbs for kiwifruit, seafood and wine to keep their protectionist policies on meat and dairy.

The implications for the Kiwi dollar are negative as offshore investors observe New Zealand going down an unexplained path of potentially upsetting the Chinese to the point that they ban some of our exported product, as they have done with Australia. The PM always states that it is the export sector that has got the NZ economy through the rough Covid period, however her recent foreign policy actions are jeopardising that very sector. It makes no sense at all!

For the sake of social and economic wellbeing within New Zealand, the Prime Minister would be better off spending her time leading a trade mission to China (to repair relationships), promoting New Zealand to the world as a place to immigrate to as we have a chronic labour shortage and spending a couple of weeks in South Auckland with community/charitable agencies to understand the causes of the child poverty she so publicly vowed to reduce.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

35 Comments

Aderns on a power trip, doing what's benefiting her & not the country...

No, you are on a hate trip

- The red beef quota increases from 454 tonnes to 10,000 tonnes.

- Current red beef tariffs are up to 70%.

- Our exports will save $37 million on tariffs each year.

[¬º-°]¬ Red bad, Blue good. Red bad, Blue good. Red bad, Blue good. [¬º-°]¬

Is that why she visited Blackrock, while in New York?

Well, I have no expertise in diplomatic affairs, but having spent most of my life in business, I have no difficulty in spotting that, in trade terms, we are dangerously over exposed to one market-China.

Any sensible business would be working very hard to reduce that dependency, not increasing it, though certainly we should not unnecessarily annoy China while doing so.

I'm sorry, but she is doing something we should have had the guts to do years ago. I've been calling China's govt for what it is for more than 10 years. I would not trust them as far as I could throw them, look at what they are doing to their OWN people for crying out loud.

Diversification is something we must do, or we will end up so beholden to them, we will lose our sovereignty in all but word.

Animal farming is not the only string in our bow, we do other stuff, you know.

If we want tourism cranked up again, we have to look elsewhere, the Chinese are not coming back, they never were since their govt put the brakes on capital flight and cracked down on Hong Kong. That is all over.

Do... do we want tourism 'cranked back up'? How is that compatible with the flogging we give agri-producers for emissions and waterways - flying people in from the other side of the world to visit places that were happy to price local (i.e. much lower carbon) visitors out of their regions?

I mean by all means we should do less of it all but we need to be ideologically consistent at the very least.

I don't want to see tourism back to what it has been, but I'm pretty sure tourism operators do. We won't ever get the numbers we had in heyday of Chinese tourism, but some will think we are going to see it. Reality will sink in at some point, but people will still want to come here.

I reckon the ‘new norm’ in tourist numbers will be around halfway between now and the pre Covid peak. Which is probably a good sweet spot

People tend not to visit hermit kingdoms. North Korea!

Oh for crying out loud. That is beyond pathetic

I'm not sure that farming exports will directly solve urban poverty. Or is Roger trying to say that lack of immigration from China causes poverty? A most unfocused post.

As far as I can see Roger uses his column on foreign currency predictions to basically slag off Labour. It's a shame because I would be interested in his analysis of the NZ dollar but get turned off by his anti-labour rants.

I agree with Roger that it is risky to "poke the Panda" (as Fran O'Sullivan calls it). But Roger does omit the ethical dimension. China's reluctance to denounce Russia's invasion of Ukraine is simply the latest in a series of steps (think Hong Kong, Taiwan and Xinjiang) that show that the values which NZ expouses differ significantly from the way that China operates.

The trade deal with the EU may not be perfect but it is a good start in working to diversify our export markets as soon as possible.

Being we didn't poke it long ago, then now is the best time to, it'll get riskier and riskier to do it in future. Your morals should not be up for sale, no point in having them in the first place if that's the case

Why would centre-right people like Roger who pretty much only care about ‘business’ (in their own narrowly defined sense) care about ethics???

Roger writes some good stuff but this isn’t one of those good pieces, but fair enough that’s his opinion I guess…

Not only is China reluctant to denounce Russia's invasion of Ukraine, BRICS, Netherlands, Mexico, Serbia and a lot of other countries are reluctant.

It also beggars belief that we have allowed ourselves to become so beholden to a country that is plainly a threat to our way of life and beliefs. If anything this exposure highlights our failure in diversifying our exportable products , relying on a small primary sector group of products largely sold in a low value state rather than value added .

Yep our strong reliance on China is a significant economic risk, and regardless of their ethical naughtiness, we should be trying to pivot away from that over reliance.

yes that might come at some short term pain but our future will be more resilient for it.

"Just why New Zealand would be taking up such an aggressive foreign policy stance against our largest export/import trading partner (China) beggars’ belief."

In the beginning of her PM ship, JA tried to be be good terms with China, something(s) changed and now NZ is aligned with the West vs Russia/China.

If you look at Pakistan or Cambodia now, they are essentially vassal states of China. NZ must never enter into a master-slave relationship with China.

Happy to vote no to Luxon, should he be "pro business". Choose freedom and liberty over the mighty yuan.

Luxon has not got the goods, look at his own gaffes at dreadful shots of him in Singapore he posted himself and obviously someone else had to tap him on the shoulder to point out he looked like an ill educated minion, and how he can barely contain his anger at being called out over Roe v Wade and can only cough and splutter out worn out buzz words.

Compare that to the composure and ability to deal with a very long presser at Chatham House for the PM and there just isn't any, comparison, that is

Three cheers for our PM standing up to China, fancy finding one thing she does that we can cheer

hmmmm

Not a lot of support here for your views Roger

You come across as a Adern hater so any meaning in your message has got lost.

M.

If you look at Roger's posts they're all just Labour bashing without much substance. Yes, he uses statistics a lot to support his views but the causations are entirely made up to fit his narrative.

He's a blue zealot and I have come to the conclusion his ramblings are as useful as reading Putin's propaganda.

Just mention 200000 homes and any credibility disappears out the door and Nats couldn't do any better but from memory they didn't promise much.

Yeah well, we all know you can't fail if you don't try

The comments on this article is one of the reasons I really enjoy this site. Commentators seem way better at calling out bullshit propaganda/spruiking/spin rather than just mindlessly agreeing

Spot on, Roger!

We made it through Covid due to the wage subsidy, the govt small business loans and the housing upswing.

We made enough foreign exchange not to be in Sri Lanka's position because our terms of trade were good, people staying at home overseas were still eating and New Zealanders that normally spend $10 Billion as tourists overseas spent that money on local travel, home renovations and housing investments.

All these sources of demand are fading away but the govt does not understand that replacement demand sources are needed.

We need immigrants to fill the gaps in our skills base and the govt has made it too bureaucratic for immigrants to be able to come here.

Business and consumers still need to be able to borrow money but the CCCFA is putting too many barriers in the way people can access credit.

The hospital system is about to fall over because the govt cannot resist putting another layer of bureaucracy on top of the present system when what the health system needs is more medical staff - which means more govt spending on staff and for immigration settings to be released.

I do not have any confidence that the present govt is willing or able to fix any of our problems. A combination of the unwillingness to spend money on necessities (hospital staff, energy security and the changeover to sustainable energy sources) and the willingness to spend money on the Maori caucus agenda and unproductive projects like $14 Billion airport links gives me no hope of productive change assistance from most levels of govt.

If National get in with Act, at least the immigration settings will change and 3 waters will be abandoned. I have little faith that any real work on sustainable energy self sufficiency will occur.

Our future prosperity in New Zealand does depend on our self sufficiency in energy and our planet needs for that energy to be renewable and sustainable.

All we need are a couple of practical politicians in charge of an energy and works dept and our future prosperity is possible.

The health workers the Nats did not support coming through are the ones we are missing now

All you newly-minted China haters here, and Jacinda herself, should read Chris Trotter's piece below to see how your opinion has been manipulated by a US that suddenly got scared of being overtaken by China 5 years ago:

Bowalley Road: From “Friend”, To “Threat” – In Just Five Years.

Thanks for clearing that up for me, always good to know how my opinions have been manipulated. I assume you are able to remain free from such mind control?

"US suddenly scared of being overtaken by China" I don't think that sums up what happened in the US 5 years ago. What happened was that the populace decimated by 25 years of pro-globalism by US politicians finally overthrew the status quo and elected an American First administration. To accomplish that former labour democrats switched parties and Trump ousted 7 business as usual presidential aspirants to seize the Republican nomination. Putting an end to the Financialization of the US economy was the mandate for Trump voters and in 4 years he moved the country and the world to understand that continuing to do business with China on the same terms as the past was detrimental to not only Americans, but to the West. Without Trump's efforts to expose China the tide would never have turned . New Zealand may have to live with having moved all its manufacturing to Asia, but US voters in the heartland were not willing to be so accommodating. In 2024 they will come back with a vengeance after 4 years of backpedaling.

Oh, so they haven't wiped out any protest from the people of Hong Kong, they are persecuting the Uighers, they haven't just recently clamped down on the freedoms of their own people? Did I just dream that or something? I've been critical of them for years and predicted once they had power they would ramp up the authoritarianism

Well you do know the Dr PM is only an expert in virtue stuff. Oh, and kinda doing stuff that doesn't matter to most of the population in NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.