- US July jobs increase defies all prior forecasts and financial markets

- Plummeting oil prices suggest inflation may fall as fast as it went up

- Another stunning Australian trade surplus

US July jobs increase defies all prior forecasts and financial markets

The 528,000 increase in new jobs over the month of July in the US, released last Friday night, was considerably above all expectations and does not reconcile with the marked slowdown in other US economic measures such as two quarters of GDP contraction, consumer spending, housing market conditions and manufacturing production. The number of new jobs was surprisingly high, double that of consensus forecasts at around 260,000 and well above the monthly average increase for this year of 380,000.

How everyone got this forecast so wrong belies belief, either all the economic forecasting models are broken, the time lag between a slower economy and employment adjustments is longer than most estimate or the official count is corrupted and will be substantially corrected downwards in subsequent months (i.e. a rouge/outlier result).

Whatever the reasons, the debate will continue between the Federal Reserve Governors, the private sector economic forecasters and the financial/investment markets as to whether the US economy is heading for a soft or hard landing as a result of the aggressive tightening in monetary policy over recent months. The reaction by the equity, bond and currency markets to the shockingly high increase was erringly more muted than what we have seen in the past to such a big miss in the most important economic indicator. The US dollar only appreciated 50 points against the Euro to $1.0180, and posted similar relatively small gains against the NZD and AUD. Perhaps the markets do not believe that such large employment increase are sustainable going forward and it does not materially change the extent or timing of Fed interest rate increases which the markets have already priced-in over coming months.

The appetite for workers in the US economy was most pronounced in the leisure/hospitality and services sectors, perhaps a lagged catch-up form earlier lay-offs and furloughs. A feature of the result was the consistency of jobs increases across all 12 industry sectors. Healthcare, Government, construction and manufacturing followed the aforementioned two highest increases.

Despite the unexpected strong jobs outcome, US 10-year Treasury Bond yields only increased 12 points from 2.70% to 2.82%. Likely counteracting the strong Nonfarm Payrolls data that pushed up bond yields was the continuing slide lower in crude oil prices.

Plummeting oil prices suggest inflation may fall as fast as it went up

Global oil market conditions, outlook and thus oil price direction is changing rapidly, with West Texas crude prices tumbling 28% since the highs of US$123/barrel in early June to US$88/barrel today. The oil price is now back to the level prevailing before the Russian/Ukraine war started in February. Only a small number of oil market commentators/forecasters picked the speed and extent of this price reversal. It has been a pincer movement from both sides of the demand/supply equation. Lower global GDP growth forecasts have reduced demand and some minor production output concessions from OPEC+, coupled with a ramp up in supply from US and Canadian shale producers, has increased the supply scenario. The net result is that financial traders of oil (speculators who have no underlying supply or use for oil) have been forced to hurriedly unwind their long oil price positions taken out when Goldman Sachs produced forecasts of the price going to above US$200/barrel several months ago.

The increase in the oil price from February to the end of May was the major reason global inflation took off from low levels at the start of the year to the 7% to the 9% annual rates today around the world. The jump up in oil prices caused shipping, freight, transport, plastics and a whole range of consumer goods prices to increases on top of the pain experienced at the petrol and diesel pump. The view from here is that the financial and investment markets are potentially under-estimating how quickly inflation could reduce over the second half of the year, and in turn, prompt central banks to ease their foot off the tight monetary policy brake a lot sooner than most would have imagined.

Given what has occurred in FX markets since February with the significant further strengthening of the US dollar against all currencies due to higher US inflation and interest rates (totally due to the oil price increase), a continuation of the oil price slide would logically see a reversal of the USD direction. As previously highlighted in this column, the FX market speculators are at extreme “long-USD” positions, however the reasons for holding on to those positions (higher inflation and US interest rates) are starting to dissipate and reverse.

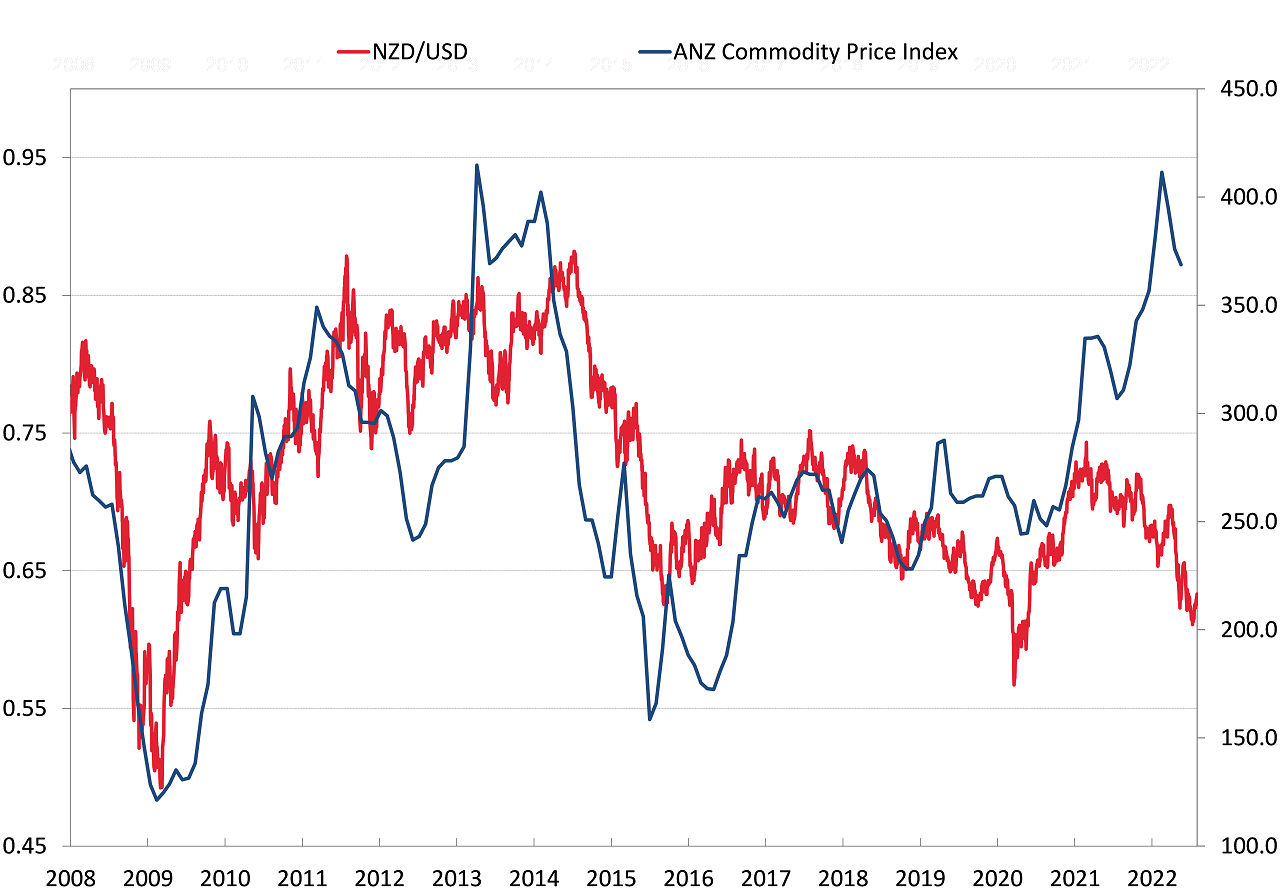

As inflation rates reverse downwards as fast as they went up, the prospect of a global economic recession reduces. There may be shallow recession in the US economy and elsewhere, however nowhere as bad as the forecast picture painted by several Aussie banks who have stated that a global recession will keep the US dollar at strong/elevated levels over the next 12 months. Also counting against the rationale of these Aussie bank FX rate forecasters is that decreasing commodity prices would be negative for the NZD and AUD currency values. Over the last six months the NZD and AUD have weakened against the USD despite the rise in our export commodity prices. Therefore, it is not the situation that a ton of speculative FX flows have come into the two currencies on the back of higher commodity prices, only to flow out again as commodity prices fall. The reverse is the true situation with currency speculators currently sitting on 40,000 futures contracts short-sold the AUD

Another stunning Australian trade surplus

Yet again Australia has delivered another fresh record high in their June trade surplus. On top of the extraordinary A$16.7 billion trade surplus in May, the June surplus was a stunning A$17.7 billion, driven by strong prices in key exports from grains to metals to gold. The prior consensus forecasts were for a A$14 billion surplus. The very positive outcome will boost the June quarter’s GDP growth figures. The RBA, who have just revised their GDP growth forecasts lower and inflation forecasts higher may have to think again following these successive record trade surpluses. The AUD/USD exchange rate was trading comfortably above the 0.7000 level ahead of the RBA’s 0.50% interest rate hike last week. However, rather surprisingly, their accompanying commentary and outlook on the economy and inflation was more dovish than what the markets were anticipating. The AUD dropped one cent in response.

As we have stated many times previously, at some point Australia’s superior economic credentials to the rest of the world in the post-pandemic era will eventually be recognised and a strengthening Aussie dollar will be the inevitable result. The Kiwi dollar looks set to continue to track the AUD/USD rate closely, leaving the NZD/AUD cross-rate tracking sideways at 0.9000/0.9100 as we expected it to.

Our export industries will also be enjoying good trading conditions with the higher commodity prices and lower NZD value (refer chart below). There also looks to be some relief in sight for the exporters with lower shipping and energy costs not too far away.

Note to readers: There will be no FX Market Commentary reports published on Monday 15th and Monday 22st August as I am overseas on holiday.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

9 Comments

Inflation cooling, I wish it was true but it is all very hard to believe. It seems we, as a nation and as an economy, have become the playing ball of central bankers as they drive massive wealth shifts and boom/bust cycles. For example, they choose to ignore property prices in setting their interest rates (both down and now up), pretending the property market does not affect inflation, and thus they seem to be swinging the country around as if the people and their assets do not matter.

Rb records rent inflation/deflation and new build inflation in cpi. That takes account of material cost change and labour rates. What you're asking for is to add the cost of secondhand homes and how much they are traded for. Important but not relevant

So how long do you think oil can stay down if the economies pick up?

If inflation eases it will be transitory - energy prices are are only going one way.

I wonder if the Govt will be watching what the oil companies do as the price drops? I think it's likely, as they are convenient and popular villains to punish.

The net result is that financial traders of oil (speculators who have no underlying supply or use for oil) have been forced to hurriedly unwind their long oil price positions

Indeed... demonstrating that the rapid swings in international oil and commodity prices are the result not of actual changes in supply and demand, but because traders are gambling billions of dollars a day trying to guess what changes in supply and demand are going to be.

Also worth noting that NZ CPI correlates almost perfectly with petrol prices. All this talk about profligate Govt spending, wage / price spirals, RBNZ solemnly tweaking the OCR is incidental - probably irrelevant.

My thinking is all of the above is relevant. Oil prices increasing and reducing in price is only part of the inflation equation.

Correlation between oil prices and NZ CPI is 86%. Our CPI model does not recognise how much of the increases in other prices is driven by the oil price (and some people still believe that inflation is a monetary phenomenon).

so waiting for the council to reduce rates because oil has dropped -- Insurance companies to reduce their premiums -- bound to see a reduction in electricity, gas and water costs - all the building materials are about to drop the 30% they have gone up - Fabulous that food is not going to be effected by all these weather events -- and super happy that imported goods, whiteware, fertiliser will all not be effected by teh NZ$ at 63 or 64 cents

Sure -- oil price will help at the pumps - but no way businesses are about to reduce their charges to the consumer - or those core costs are going to stop rising as a result

Dealing with Climate change / the impacts of weather events -- is likely to add 2-4% inflation annually on its own over the next 30 years -- so without significant decreases in other costs -- Inflation is here to stay as the climate can can no longer be totally kicked down teh road !

And PLEASE sort out the bloody spellcheck issue !

"[Non-Farm Payrolls] does not reconcile with the marked slowdown in other US economic measures such as two quarters of GDP contraction, consumer spending, housing market conditions and manufacturing production."

I think it's safe to say if most other indicators as signalling an economic downturn then the employmet numbers are the outlier and will likely end up correcting lower at some point in the future.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.