The draft report from the Commerce Commission's market study into retail banking competition has thrown up plenty of food for thought for the Reserve Bank and the Government. A key question now is to what extent they're prepared to move the prudential regulation of New Zealand banks away from international orthodoxy in an attempt to make banking more competitive for consumers?

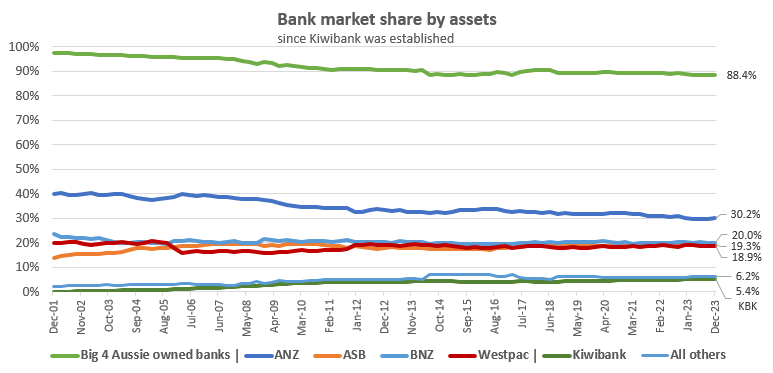

"Our preliminary view is that New Zealand’s four largest banks – ANZ, ASB, BNZ and Westpac – do not face strong competition when providing personal banking services. There are limited constraints from outside the four major banks, and competition between the majors is sporadic," the Commission says.

To see a conclusion like this should be a surprise to no one who has closely followed the NZ retail banking scene over the past couple of decades. It's important to remember the market study focuses on deposit accounts and home loans, where NZ banks have 70% of their lending exposure. (The Commission's full list of recommendations can be found here, and its full, 333 page draft report, here).

It's also no surprise that regulation is a significant factor highlighted by the Commission as hindering retail banking competition, as I foreshadowed last year here and here.

In terms of trying to improve the lot of NZ bank customers, the Commission's recommendations would see significant changes made to the Reserve Bank's prudential settings, which are a legal framework focused on the financial safety and stability of institutions and the broader financial system. Thus there is potential for tension between boosting competition and retaining financial stability.

The market study, launched under the previous Labour government, is now proposing government intervention from a coalition where two of the three parties' instincts are to let the market do its thing. However, it's also proposing reining in some regulation. Thus it'll be fascinating to see to what extent the Government acts on the Commission's final recommendations once they're released in August.

Interestingly NZ First, the coalition party with more interventionalist instincts than its governing partners National and ACT, went into last year's election with a policy of creating a Crown guarantee for capital to expand NZ owned registered banks. The Commission does want the Government to help Kiwibank, which it owns, access more capital. ACT, in contrast, proposed listing 49% of the shares in Kiwibank's parent company on the share market.

Stepping on the Reserve Bank's turf

Notably the Commission cuts right to the heart of prudential regulation, banks' regulatory capital requirements. Back in 2018, with a review of bank capital requirements under way, Reserve Bank (RBNZ) Governor Adrian Orr described bank capital as; "The number one safety valve for citizens of a country because that allows us to absorb losses before it becomes taxpayers' losses and/or future generations' losses."

Or as then-RBNZ Deputy Governor and Head of Financial Stability Grant Spencer put it in 2017 bank capital; "Is the form of funding that stands first in line to absorb any losses that banks may incur. Having sufficient capital promotes financial stability by reducing the likelihood of bank insolvency and moderating the effect of credit cycles."

These quotes highlight how sacrosanct central banks view bank capital, held as insurance against bad loans, as. The RBNZ's bank capital rules are based on standards imported from international bank rule setters based in Basel, Switzerland. The RBNZ takes these rules and gives them some tweaks it believes are appropriate for the NZ market. Typically the capital requirements for NZ banks are conservative by international standards.

However, as the Commission highlights, the capital rules haven't allowed a level playing field. This has been much bemoaned by the smaller NZ-owned banks including Kiwibank, TSB, SBS Bank and the Co-operative Bank, striving to compete with the big four Australian owned banks over the years being ANZ, ASB, BNZ and Westpac. It has also been highlighted several times in detail by interest.co.nz.

'A material and entrenched competitive advantage'

For its part, the Commission proposes a sea-change.

"The Reserve Bank should review its prudential capital settings to ensure they are competitively neutral and smaller players are better able to compete."

"From a competition perspective, unless a different approach is clearly justified, we think all banks should be required hold the same level of prudential capital for loans that have equivalent risks (which we consider includes major categories of home loans)," the Commission says.

The big four banks are accredited to use what's known as the internal models-based (IRB) approach to calculate their capital requirements. All other banks must use the standardised approach. The effect of being able to use the IRB approach is to enable the accredited bank to apply lower risk-weightings to determine the value of assets to which capital ratios apply. That means the big banks can stretch their capital further, boosting their profitability.

The Commission notes the RBNZ acknowledges the effect of its IRB regime since 2008 has been that the IRB accredited big four banks have held less prudential capital than other banks, for assets with similar risk. This gives "a material and entrenched competitive advantage" to the major banks, and restricts other banks’ ability to compete and grow.

Although the RBNZ introduced a ‘floor’ in 2022 to require IRB banks hold at least 85% of the amount of capital that banks using the standardised approach must hold for assets with an equivalent risk profile, the Commission is "concerned the ongoing 15% differential may not be justified in terms of financial stability and will continue to limit smaller banks’ ability to compete."

"We have not seen a compelling reason to suggest there are material differences in risks between banks for some well-defined categories of home loans, such as first mortgage-backed loans in specific loan-to-value ratio bands, or that the IRB approach results in improved risk management for these assets," the Commission says.

Thus the Commission wants the RBNZ to; "Review the role and operation of the IRB regime for home loans as part of its upcoming consultation on a new capital standard later this year to ensure that the same level of capital is held where risk is likely to be equivalent."

The RBNZ ought to consider whether "some home loan types should have no difference in capital holdings between the standard and IRB approaches, because such loans are similarly risky irrespective of the lender." It also should consider making it easier for banks to acquire IRB accreditation, typically only available to banks with significant scale.

Capital boost sought for Kiwibank

The Commission also promotes a leg-up for government-owned Kiwibank, helping it obtain more capital so it can lend more money. It recommends the Government; "Should consider what is necessary to make it a disruptive competitor, including how to provide it with access to more capital."

The Commission argues that Kiwibank is stuck in the middle of a two tier banking system with the big four banks in the first tier and smaller registered banks and non-banks in the second tier. Kiwibank is bigger than the smaller providers but has less capital and assets than the Australian-owned banks.

"Given the limited prospect of new entrants from offshore into personal banking at scale, the best prospect for more competition in the near term is one or more of the smaller banks or non-banks acting as a disrupter by seeking to grow rapidly," the Commission says.

"Most of the smaller providers we’ve heard from are capital constrained due to their ownership structure. Many stakeholders have told us that regulatory capital requirements are the single biggest factor affecting expansion by smaller banks and non-bank deposit takers in personal banking. For those providers to grow rapidly they may need to review their legal and ownership structures or consider other ways to reduce scale disadvantage, such as shared services or consolidation."

"Kiwibank, which we know is being watched by the four major banks as their next closest rival, appears to have the greatest potential to constrain the major banks in the near term and disrupt a market that is otherwise stable due to lack of competition. However, Kiwibank does not yet have the necessary access to capital backing, or the systems, required to continuously challenge the major banks aggressively. Access to equity is a constraint on how fast Kiwibank can continue to grow," the Commission points out.

"To change this, Kiwibank’s owner should consider increasing its access to capital and support a strategic refocus of Kiwibank’s efforts to compete more strongly with the major banks (which could involve significant systems development)."

The Government should; "Explore what changes are necessary to maximise its [Kiwibank's] potential as a disruptive competitor."

A helping hand for non-bank deposit takers

There's also the issue of non-bank deposit takers (NBDTs), such as building societies, credit unions and deposit taking finance companies. Like the smaller banks, NBDTs have also long bemoaned that they don't operate on a level playing field with the big four banks. The Deposit Takers Act (DT Act), which is currently being phased in over several years, establishes a single regulatory regime for banks and NBDTs, which are currently overseen under separate legislation.

The Commission notes the RBNZ; "Has signalled NBDTs will likely have an ‘overall uplift’ in prudential requirements as those entities’ prudential regulation is brought under the DT Act, and that they may need to ‘assess their viability in line with operating in a well regulated competitive marketplace’."

The Commission wants the RBNZ to; "Provide further information about its views on the prudential requirements that NBDTs may have under the DT Act, including the policy reasons for any proposed changes to the status quo. In doing so, we recommend the Reserve Bank explicitly and transparently articulate how it is thinking about its role in setting prudential requirements with reference to the purposes and principles set out in the DT Act."

The DT Act also sees the introduction of a deposit compensation scheme in circumstances where a deposit taker fails. Here the Commission wants more clarity on; "The extent to which the Reserve Bank is considering competition in preparing its advice to the Minister [of Finance] on how the industry levy should be set."

"Different approaches to imposing the levy could impose a disproportionate cost on smaller providers, potentially significantly adversely affecting their ability to compete for personal banking customers," the Commission says.

"This is important, given that the Reserve Bank has itself acknowledged that a risk-based approach is likely to result in, on average, smaller deposit takers having higher levies, as a proportion of their covered deposits, than larger deposit takers. We query the Reserve Bank’s apparent view that under a risk-based approach, the smaller providers who are more heavily levied are likely to see a greater net benefit from the Deposit Compensation Scheme. It is also possible that the major banks, who are systemically important, will impose a greater cost on the Deposit Compensation Scheme because of the higher risk of contagion if they fail."

The Commission says the Government; "Should amend the DT Act to enable the Reserve Bank to take account of the need to ‘promote’ competition within the deposit-taking sector."

The competitive advantage from access to RBNZ settlement accounts

Another area of interest to the Commission is the RBNZ's Exchange Settlement Account System (ESAS) accounts. The ESAS is the RBNZ owned and operated system for processing and settling payments between banks and other financial institutions. Those with ESAS accounts including ANZ, ASB, BNZ, Kiwibank, TSB, Rabobank and Westpac, get paid at the Official Cash Rate, currently 5.50%, for money held in these accounts.

Financial institutions that don't have an ESAS account can access one indirectly, at a price, through a bank that has an ESAS account via what's known as an "agency banking" arrangement. The RBNZ is currently reviewing its ESAS access policy and criteria.

"Access to an ESAS account conveys a competitive advantage to those providers that have it, and significant disadvantages to those who do not. We think there are benefits to both innovation and competition of broadening access to ESAS accounts, including because it will allow smaller, innovative providers to reduce their reliance on larger bank competitors," the Commission says.

In its ESAS review, the Commission suggests the RBNZ; "Place significant weight on the benefits to competition and innovation in the personal banking sector that would result from broadening access to ESAS accounts; and consider whether the risks it has identified are already present in the system, indirectly under agency banking arrangements, but with less Reserve Bank visibility."

What about anti-money laundering laws?

The Commission also wants the Government to reduce the barriers imposed by the Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT regime) on banks working with fintech service providers. Like bank capital requirements, AML/CFT rules are based on international standards overseen by the Financial Action Taskforce (FATF), the Paris-based inter-governmental body that sets international standards and is considered the global money laundering and terrorist financing watchdog.

"Our draft recommendation is that the Government should explore ways to reduce the actual and perceived risks to banks under the AML/CFT regime when providing banks accounts to fintechs. This could include prioritising AML/CFT reforms that seek to address banks’ perception of fintechs as being high-risk," the Commission says.

"The Ministry of Justice’s 2022 AML/CFT review has already recommended that AML/CFT supervisors [the RBNZ, Financial Markets Authority and Department of Internal Affairs] develop a code of practice for businesses, especially banks, to on-board high-risk businesses and that there should be a licensing framework applied to high risk sectors. These recommendations have not been implemented yet, and we think there is merit in expediting consideration of whether there are appropriate ways to reduce this regulatory entry barrier for fintechs."

CCCFA changes suggested

The Commission also turns its sights on the much maligned Credit Contracts and Consumer Finance Act (CCCFA), whose purpose is to protect the interests of consumers in connection with credit contracts, consumer leases, and buy-back transactions of land. It says aspects of the CCCFA regime appear to create an unnecessary barrier to consumers switching home loans providers, potentially impacting competition.

This includes that borrowers refinancing a home loan with a new lender may trigger an affordability assessment under the CCCFA that wouldn't arise if they stayed with their original loan provider. Any new lender is thus required to make reasonable inquiries to be satisfied it's likely the borrower can afford the home loan repayments without suffering substantial hardship. The need to go through this process may deter some consumers from considering their options, the Commission says.

"Competition would be promoted if lenders refinancing a home loan are not subject to additional obligations (in the form of affordability assessments) in comparison to obligations on existing home loan providers in similar circumstances," the Commission says.

"Our draft recommendation is that the Government consider amending the CCCFA to achieve competitive neutrality between existing home loan providers and potential alternative providers in the context of a consumer refinancing a home loan."

The RBNZ's response

What does the RBNZ have to say about the Commission's draft report? In comments attributed to its Deputy Governor Christian Hawkesby, the RBNZ told interest.co.nz it engaged constructively with the Commission and will now review the draft report’s findings with interest.

"The Reserve Bank supports a healthy and stable financial sector. Our policies are designed to protect and promote the stability of New Zealand’s financial system by addressing prudential risks, while also considering competition, compliance cost, and the diversity of the deposit taking sector. We aim to ensure we apply a proportionate approach to designing rules for deposit takers, and do not adopt a one size fits all approach. This was a key consideration when conducting our review of the capital adequacy rules for locally incorporated, registered banks in New Zealand. It was also an important consideration in the development of the Deposit Takers Act 2023," Hawkesby says.

"In addition, our Proportionality Framework sets out how we balance the costs and benefits of regulation for different types of deposit takers, while protecting and promoting the stability of the financial system for all New Zealanders. This will be the foundation of the development of a new suite of prudential standards over the next two to three years. We will continue to work with the wider banking sector and the public at large to ensure these standards strike the right balance."

Minister awaits final report, eyes select committee probe

Commerce and Consumer Affairs Minister Andrew Bayly also welcomed the release of the Commission's draft report, noting the final report is due by August 20.

"This is an independent process and I look forward to receiving the final report in August," Bayly says.

“The Coalition Government is committed to delivering better banking outcomes and a more productive economy for New Zealanders. I am working with our coalition partners to determine any possible response including the option of the select committee inquiry, but will determine what actions to take following the release of the final report.”

Bayly told interest.co.nz in February the coalition government's promised select committee banking inquiry could look at how to encourage banks to lend more to "productive" sectors of the economy rather than having such a big focus on "unproductive" housing lending.

An obvious area of cross over in what Bayly said and the Commission's draft report highlights is a desire to look closely at making changes to the RBNZ's bank capital requirements. These were, remember, the subject of a major RBNZ review culminating in 2019, with changes being phased in by the banks through until 2028.

It's important to note bank capital rules, allowing them to hold less capital against housing loans than against business and rural loans, are also based on international standards.

Narrow focus included look at international money transfers

It should be noted in its market study the Commission is following the direction given to it by the former Labour Government via Bayly's predecessor as Minister of Commerce and Consumer Affairs, Duncan Webb.

Webb requested a market study on personal banking services being those ordinarily acquired for personal, domestic, or household use. The Commission decided to focus on deposit accounts, being transaction, savings, and term deposit accounts including overdraft facilities, and home loans.

This means corporate, institutional, commercial, small and medium sized business (SME) and agricultural banking are excluded from the market study.

The Commission says it undertook desktop research on international money transfers, which "suggests possible useful lines of enquiry for further study or analysis as it does seem to us that there is room to improve competition for these services."

It decided against focusing on other types of credit, such as personal loans and credit cards, arguing supply of these services is less concentrated, and they're not as important to understanding the competitive dynamic of personal banking services as home loans and deposit accounts are.

The Commission notes its draft recommendations are preliminary and subject to consultation through submissions, a consultation conference, and further analysis and deliberation, where bank lobbyists and their hired consultant helpers will doubtless go to work.

"We may also identify areas where we (or others) could undertake further work in the future. Our recommendations may therefore change in the final report," the Commission says.

There's plenty of water to flow under this bridge yet.

*For those interested in knowing more about bank capital, see my 2019 series of articles here, here, and here, plus the RBNZ's website here.

12 Comments

The Commission does want the Government to help Kiwibank, which it owns, access more capital. ACT, in contrast, proposed listing 49% of the shares in Kiwibank's parent company on the share market.

Kiwibank has actually cut the services it provides with the wealth business being hawked to Fisher and insurance to NIB.

We do need more competition within the sector but I suspect that would be more likely to arrive as a result of new entrants into the market.

"The number one safety valve for citizens of a country because that allows us to absorb losses before it becomes taxpayers' losses and/or future generations' losses."

At least he's honest that ultimately the great unwashed pick up the tab if/when it all goes to seed.

Interesting to compare this rhetoric with the action that the CC took in respect of the Wharehouse wheatbix issue.

Long on talk, invisible on action. Nothing will come of this. A total waste of our taxpayers dollars.

But hey, it makes it look like they are doing something meaningful and keeps the plebs a bit happier.

Depending on the ComCom's final recommendations, it'll ultimately be up to the politicians as to what happens.

JA just slammed pollies playing the fear card

https://www.nzherald.co.nz/nz/politics/former-prime-minister-jacinda-ar…

This comment is unrelated to the story. Please post such comments on 'what happened today' or 'breakfast briefing' where there's wider discussion of an array of topics. Thanks.

Will anything material actually happen this time? We've had these conversations and reports in the past with it ending up swept under the carpet. All talk and no do.

I understand the cynicism and scepticism. However, I believe this work is well worthwhile. Once the final report comes out in August, the ball will be in the government's court. This is a good point from the Commerce Commission;

Although we have previously considered competition in the banking sector in the context of specific merger decisions, this market study is the first opportunity to consider and evaluate in-depth whether competition in personal banking is promoting outcomes that benefit New Zealand consumers over the long-term.

THE ONLY WAY

That change will occur is if NZ Gov starts a Fannie Mae or Freddie Mac style secondary mortgage market.... They could easily do it but it may impact the profit of the 70% lending boo re Resi mortgages the big 4 make.....

No small player can access funding to compete.

No a hard problem to solve.

If the US can issue MOST of the mortgages this way, why can we not do it, Asking for a Friend (called ComCom)

Great article, thank you.

From my POV, banks are entirely parasitic (as you know, on the resource/energy streams). So to are many of us (even Gareth, writing this). We all expect to take out proxy, head to a shop and exchange it for something tangible.

The parasitic suck is offshore, in the case of the big4 banks. The proxy still gets presented, just by them, over there. It's rentier-ing, and a monopolization of rentier-ing at that.

The game-changer is that the lid is sinking globally, and if the banks continue their parasitic ways, it iwill mre and more be at the expense of someone else. Ultimately, usury will be outlawed, or the system will crash, unable to carry the load.

Intelligent leadership - not likely in this term - would discuss ways to remove NZ from the vacuum-cleaner, and ways to do trading WITHOUT the charging of interest. Because, from here on in, growth is going to get increasingly negative, per time.

What's the point of this essay writing competition? They should also disclose how much taxpayers money was wasted on this. RBNZ knows it all and is administering the banking system in an appropriate way.

I am still waiting for my groceries to come down

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.