Summary of key points: -

- The challenge of uncertainty for three central banks

- China’s economic fortunes and the NZ dollar

The challenge of uncertainty for three central banks

US Federal Reserve

US President Donald’s Trump’s senseless and pointless tariffs on the rest of the world has upended investment markets and the US economy. The wild market volatility from the announcements of the extraordinary tariffs on 2 April, and the subsequent US backtracking, has left central banks in a total quandary in respect to how to manage monetary policy from this point. The highly unusual situation of rising inflation from the tariffs and weaker economic growth at the same time, due to all the uncertainty caused by Trump, (i.e. stagflation) makes it almost impossible for the US Federal Reserve and other central banks as to what decisions to make and what messages to provide to the markets.

To date, the Fed’s stance has been to do nothing and wait for the evolving economic data to guide them to cut interest rates again, or not. Fed Chair Jerome Powell states that he has the luxury of time and is therefore able to be patient. The problem with their current plan to “wait, watch and worry” (a catch cry hatched by our former RBNZ Governor) is that the US economy is already stumbling towards recession and they are holding interest rates too high for too long. The forward looking or soft economic data all points to a sharp slowdown, as households and business firms hold back from spending and expansion/investment. The issue is further complicated by the inventory build-up and consumer’s buying in advance before the tariffs push prices higher. Retail sales in the US were stronger than expected in January February and March, however they pegged back in April data released last week.

If it was not for Trump’s tariff uncertainty, the Fed would now be slashing interest rates as the CPI inflation rate is very near their 2.00% target. There is no longer a need to have monetary policy settings at a restrictive level. Last week, the CPI inflation for April was +0.20% below the +0.30% of consensus forecasts. The annual headline inflation rate reducing to +2.30%, again well below prior forecasts of +2.50%. The 18 month lagged decreases in the Shelter CPI component (rents) now coming fully onstream to drive the inflation rate lower (as we always thought would happen). Not unexpectedly, US manufacturing and industrial production in April were totally flat.

Whilst the Fed continues to look backwards and wait for the “hard” economic data to tell them what to do, the ongoing tariff uncertainty is still present as everyone waits to see the individual countries’ trade deals being negotiated before the end of the 90-day postponement period in July/August. The markets will now have to wait for the next Fed meeting on 18th June to ascertain how the Fed is dealing with the dilemma. A strong argument is that the Fed should “look through” the inflation increase later this year from tariffs as a temporary/one-off consumer tax that does not come from demand and supply levels in the economy. Therefore, they should re-commence the interest rate cutting cycle. One argument against this treatment is that the tariff-induced price increases lead to other prices being increased i.e. second-round effects. That would happen if there was strong consumer demand in the economy and retailers could get away with higher profit margins by increasing general prices. Surely, Jerome Powell knows that this not the case in the US today, all the consumer confidence surveys are plummeting to record lows.

Chair Powell, in his latest speech, pontificated about another “supply shock” to the US economy caused by Trump’s tariffs (similar to Covid). The considerable walking back by the US with China last week and the lowering of the new tariffs on goods into the US to 30% would suggest the risk of such a supply shock has dissipated.

If the Fed are waiting to see conclusive evidence of employment weakening before recommencing interest rate cuts, they run the risk of waiting too long and doing more damage to the economy than what is necessary. Employment data is always extremely lagged behind economic changes. The 18th June meeting of the Fed includes their full updated economic projections and the “dot-plot” of individual member’s interest rate forecasts. The US interest rate markets have moved pricing to only two x 0.25% cuts this year. However, that forward pricing can change quickly (as we have seen in the past) if the economic data being released prints on the softer side. We expect that it will.

US 10-year Treasury Bond yields have increased again to 4.44% over the last few weeks as investors price-in increased supply of new bonds from the massive budget deficits and the US not having the savings to fund their own debt. The US has always relied on foreign investors into their bonds to fund the shortfall. Currently, those foreign investors are reducing US investment asset allocations, and they will not return to buying US bonds until the US dollar entry point is at a much lower level. Another justification was added last week for foreign investors to exit, with Moody’s finally joining the other major credit rating agencies and downgrading the US sovereign rating from Aaa to Aa1. Moody’s cited concerns about the US Government’s US$36 trillion debt pile and their ability to service it (i.e. increasing budget deficits as the interest bill piles higher).

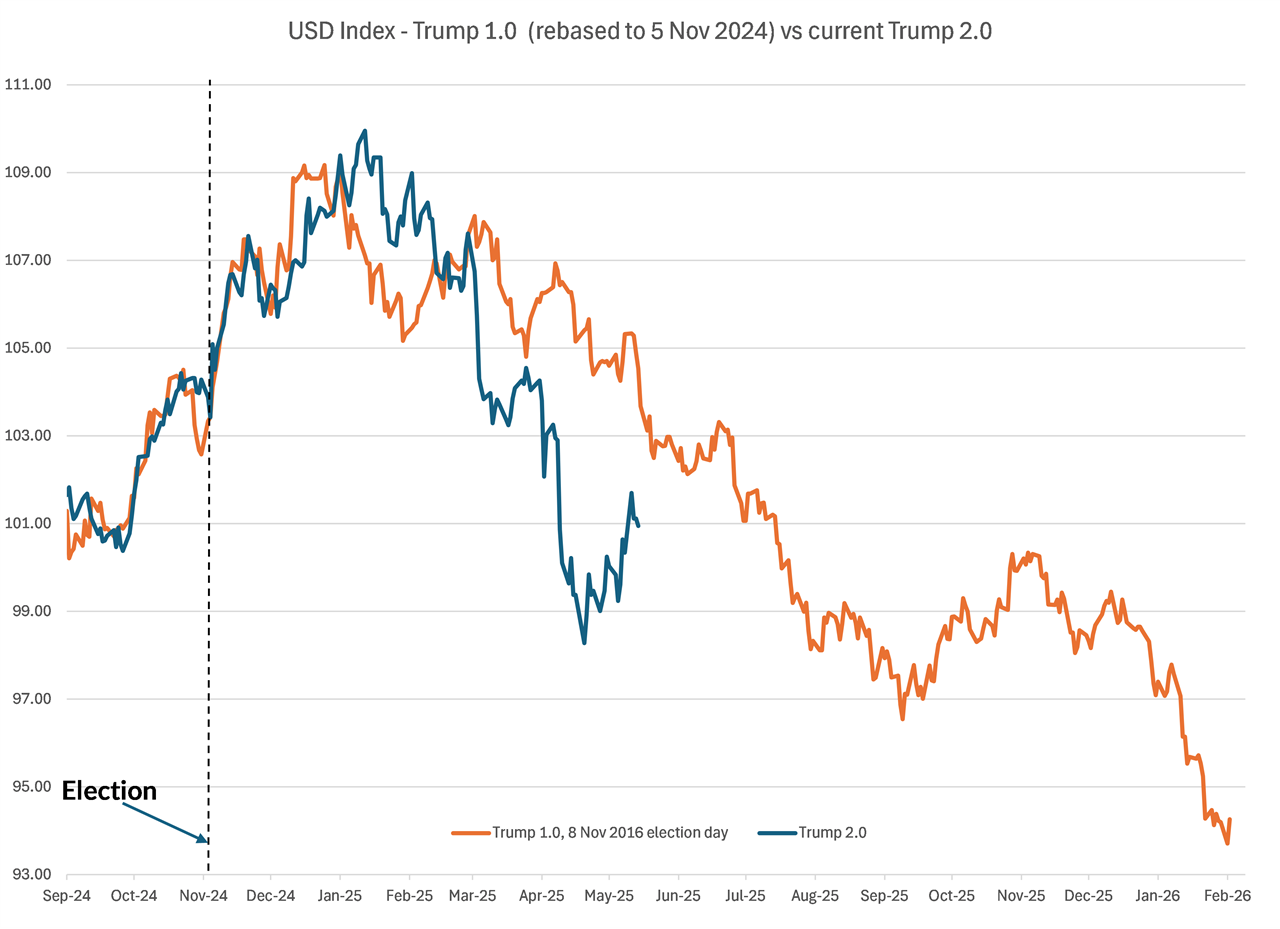

Implications for the US dollar? Weaker US economic data over the next month will add a more dovish tone to the Fed’s 18th June statement than what the markets are currently expecting. The original outlandish tariff rates have been reduced substantially, so the Fed can relax a little. The current uptick in the US dollar Dixy Index to above 101.00 appears to have run its course. The balance of probability remains that the USD Index will have another leg down (following Trump 1.0 in 2017) to at least 95.00.

Reserve Bank of Australia

The Reserve Bank of Australia (“RBA”) are also facing a massive dichotomy ahead of their next meeting this Tuesday 20th May. The Aussie interest rate markets are currently pricing-in five x 0.25% cuts to their OCR over the balance of this year – from 4.10% to 2.85%. The chances of the RBA delivering to that high expectation seem remote to us. The RBA has for a very long time warned the financial markets, business firms, trade unions and the Government that continuing high wage increases coupled with no gains in productivity leads to higher inflation. The RBA warnings have gone unheeded. Last week, Australia’s wage price index increased 0.90% in the March quarter, the annual wage rate increasing by 3.40%, well above the 3.20% forecast. The next day, on Thursday 15th May, new jobs added in Australia over the month of April increased by a stunning 89,000 against a prior forecast of +20,000. The unemployment rate remains very stable at 4.10%. The RBA does not need to cut interest rates to aid an ailing economy, the employment and wages data suggests that the economy is in fairly good shape already.

Given the recent stronger economic data and the “China risk” reducing with Trump’s backdown on tariffs, the RBA are very likely to deliver a statement on Tuesday that is not as dovish as the markets are currently expecting. All the uncertainty in the world does make it difficult for the RBA to provide forward guidance on future interest rate direction. However, they are very aware that it would not take much to push their inflation rate back out the top end of their 2.00% to 3.00% target band. Adding to the mix in Australia is the re-election of the Albanese Labour Government with a larger majority, which does not suggest that their loose fiscal policy is going to be reined-in anytime soon. The RBA will not want to be loosening monetary policy too fast when fiscal policy is also loose.

The RBA will still cut their OCR by 0.25% to 3.85% on Tuesday (already baked into market pricing), however the extent and pace of future cuts is not so clear-cut.

Implications for the Aussie dollar: Against a global backdrop a weaker USD, the Australian dollar again seems poised for gains on its own account if the RBA deliver a monetary policy statement less dovish than market expectations. The AUD is a proxy-trade for all things China and the risks to the Chinese economy from the US tariffs/trade war have much reduced in recent weeks. Australian interest rates still below those of the US remains an impediment to AUD buying. However, that interest rate gap is slowly closing. The AUD is now out-performing the NZD against the USD, sending the NZD/AUD cross-rate to below 0.9200. That momentum is expected to continue over coming weeks, the NZD/AUD cross-rate dropping back to the hedging zone for local AUD exporters in the 0.9000 to 0.9100 range.

Reserve Bank of New Zealand

Current economic and business conditions in New Zealand with record high export prices and high business confidence levels does not add up to an economy that needs extra stimulus assistance with 2.50% interest rates from the RBNZ. Forward interest rate pricing has adjusted a little already from a terminal OCR interest rate of 2.50% a few weeks back to nearer 2.80% today.

The RBNZ will deliver their interpretation and analysis on the outlook for the NZ economy at their next meeting on 28th May. Global economic risks have decreased since the last RBNZ statement on 19th February. It will be interesting to see if the RBNZ understand the two-speed economy now developing in New Zealand. The regions outside Auckland and Wellington cities are gaining rapid upward momentum from the record high export prices and the additional dollars that come into the economy. Wellington is depressed with much needed rightsizing and the Auckland economy is always dependent on retail spending and residential property activity that is yet to be fully activated with lower interest rates.

The Government’s budget this week will be of the austerity variety, however few are brave enough to call it that! Finance Minister, Nicola Willis is correctly cutting the Government’s cloth to the economic reality with a reduced budget for any new increases in spending.

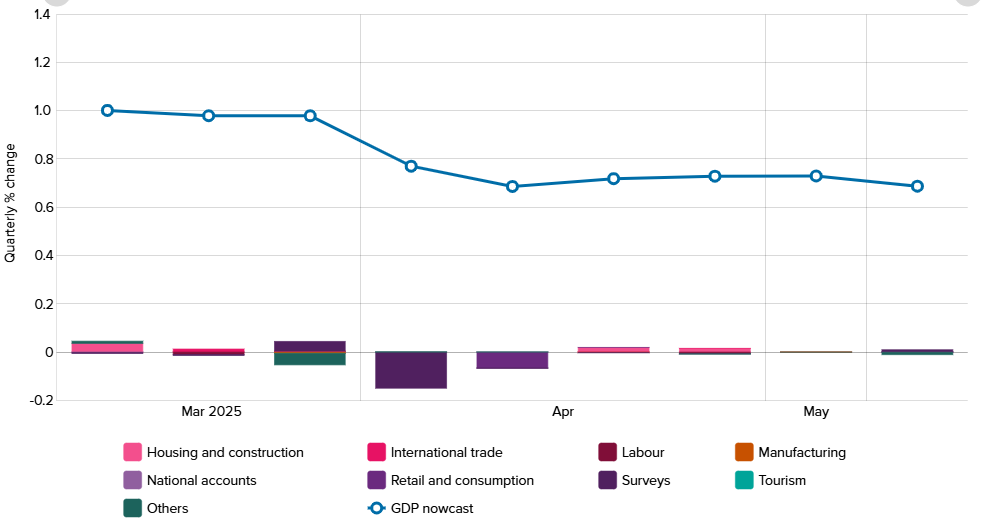

A major local bank increased their 2025 GDP growth forecast to 2.70% this week, coming into line with the +3.00% forecast this column has espoused for many months. The RBNZ should also be increasing their 2025 and 2026 GDP growth forecasts if they are following their own recently introduced “GDP Nowcast” growth predictor model. As the first chart below depicts, their model is indicating +0.70% expansion for the NZ economy in the March quarter, which if continued, adds up to an annual growth rate approaching 3.00% for 2025.

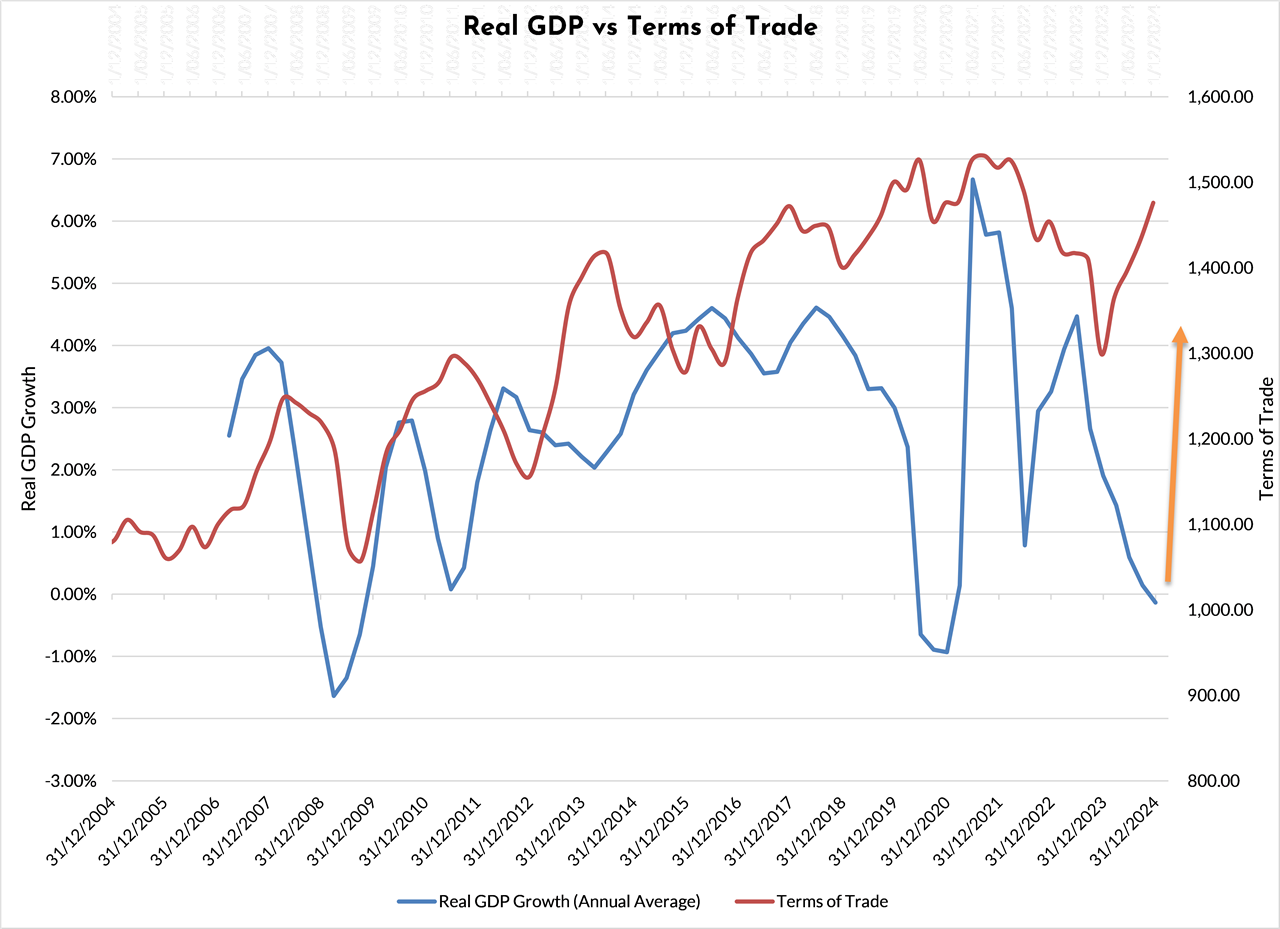

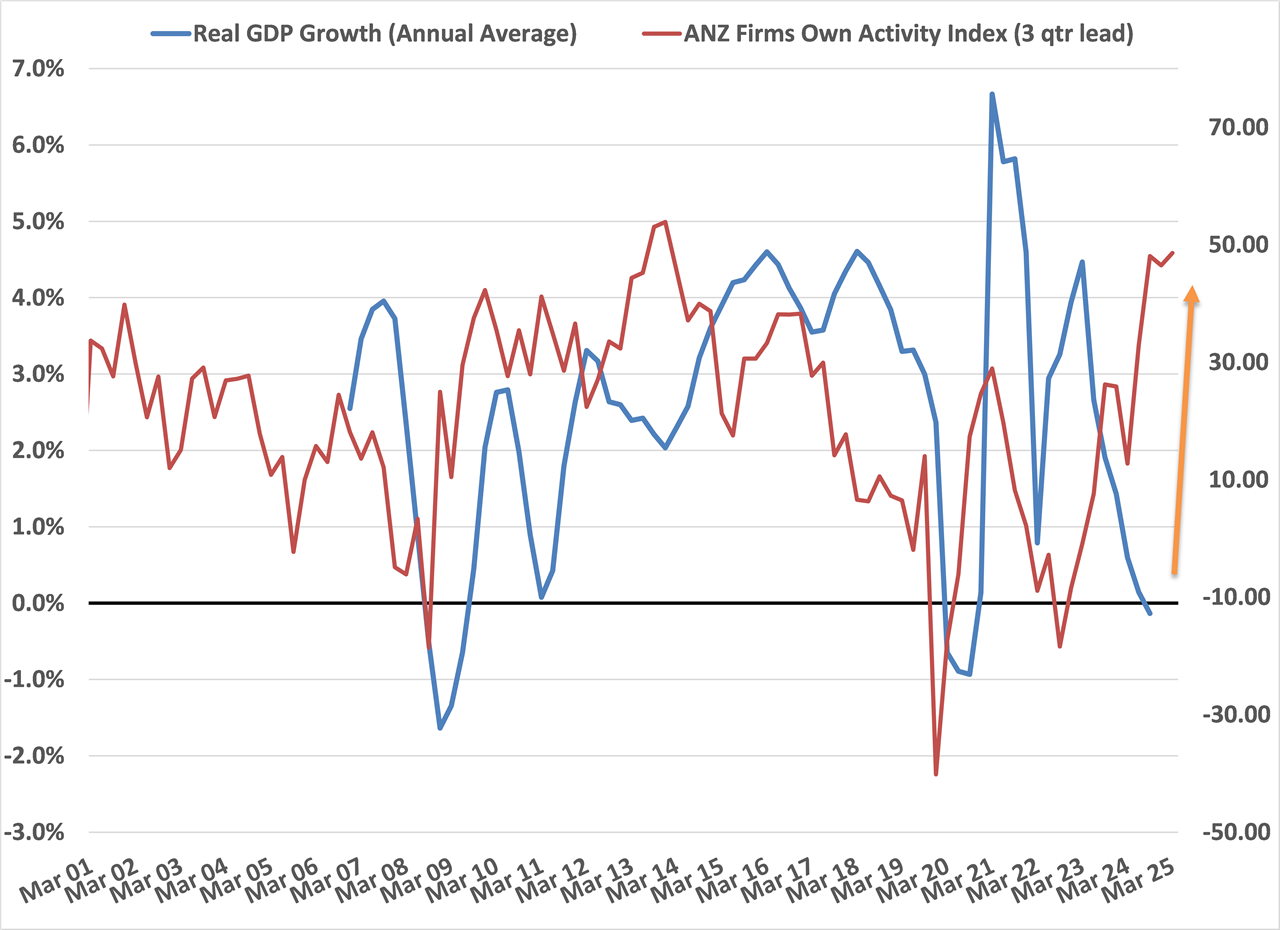

Other forward indicators of Terms of Trade (export prices) and Business Confidence also point to a strong rebound in GDP growth this year.

Implications for the NZ dollar? A weaker USD Index to 95.00 will produce an NZD/USD exchange rate closer to 0.6400. Further gains above that, based on New Zealand specific factors of superior economic performance, will only occur if the restricting NZ:US interest rate differential closes up on US interest rates falling faster and further than NZ interest rates from here.

China’s economic fortunes and the NZ dollar

It is apparent that the Beijing authorities are fully prepared to calibrate their monetary and fiscal stimulus actions to achieve their 5% GDP growth target for 2025. Therefore, the risk that the Chinese economy is damaged by Trump’s tariffs is much reduced by this factor and also by the trade deal reached two weekends ago. Chinese economic data is now on the improve, therefore we are seeing an end to the AUD and NZD being discounted in global FX markets (vis-à-vis other major currencies) due to the close economic links to China.

The strong upward Chinese credit cycle that typically drive growth has been held at low levels over the last five years by the plunge in property values and an over-supplied housing stock. The weak credit conditions are now arguably past the worst position.

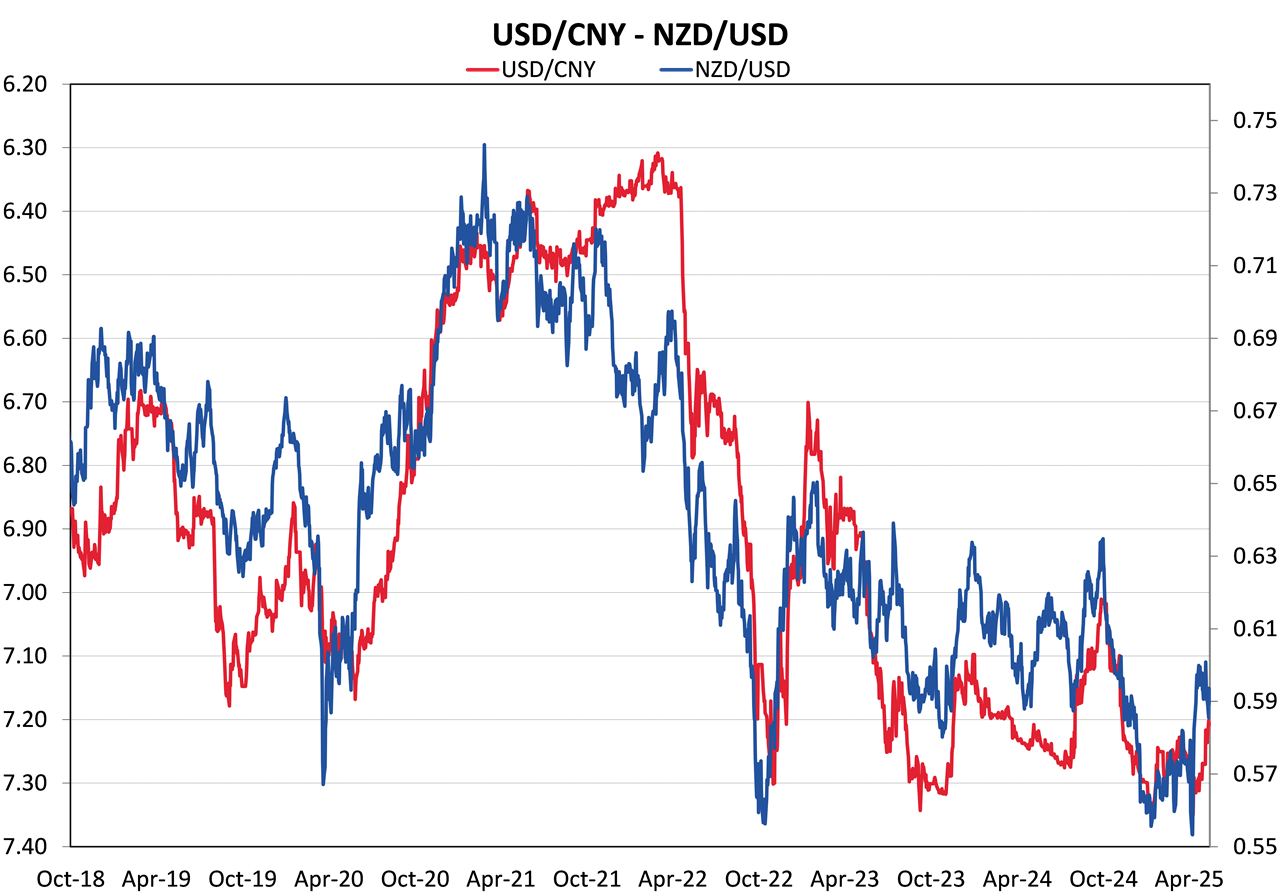

The People’s Bank of China has been successful over recent years in defending the Yuan from weaking above 7.3000 against the US dollar. The Chinese do not want a weaker currency value as that would provide ammunition to the Americans for trade negotiations. Global investment bank currency forecaster such as Goldman Sachs are now revising USD/CNY forecasts from 7.3500 for the end of 2025 to 7.1000. A 7.1000 rate equates to above 0.6000 for the NZD/USD rate (refer to the first chart below).

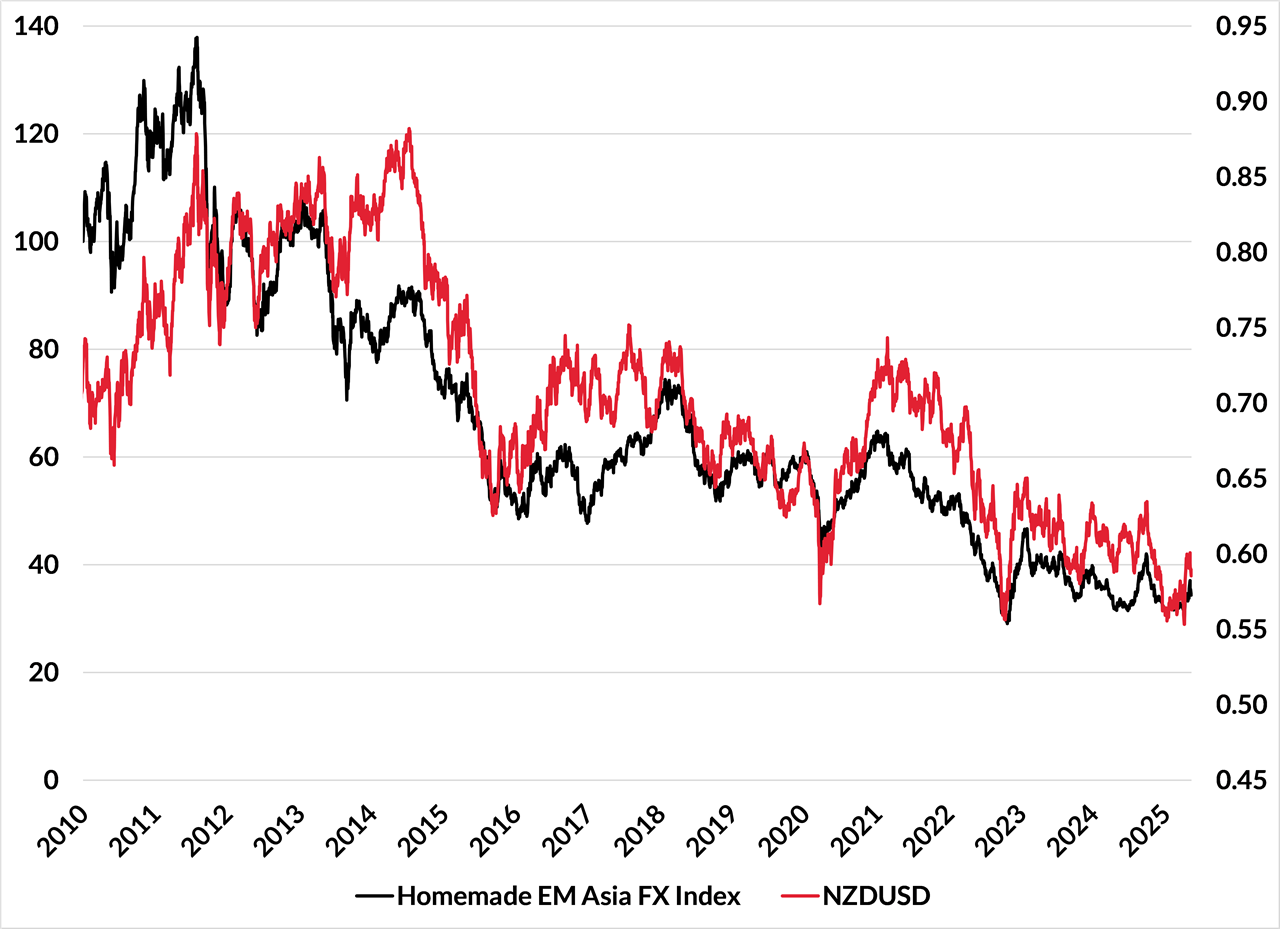

The second chart below plots the NZD/USD exchange rate against a basket of Asian currencies to the USD (China, Taiwan, Singapore, Thailand, Indonesia, Vietnam, Malaysia and Korea).

We go where Asia goes!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.