Summary of key points: -

- Political ructions have no impact on the major currencies against the US dollar

- US inflation and jobs data still point to a weaker USD

- Global investors continue to downsize USD currency exposures

Political ructions have no impact on the major currencies against the US dollar

The importance and potential impact of “political risk” on the future direction of exchange rates is always a difficult one to quantify.

Changes and potential changes (particularly around election times) to political power always has implications for economic policy settings, therefore economic performance, which ultimately feeds through into how currencies are viewed and valued. Global investors do not like the risk and uncertainty surrounding economic policy changes, therefore political risk is always there in the background as one of the determinants of exchange rate direction.

The political events and developments in several countries over recent weeks has again raised the spectre of how the political upheaval and turmoil may depreciate a currency as investors lose confidence.

However, the conventional wisdom that elevated political risk is negative for a particular currency has been challenged as not holding true under the following recent issues: -

- President Macron in France has appointed his third Prime Minister in the space of the last 12 months, as political pressure from their city streets causes pandemonium in French politics. The political disruption does not suggest that France will have a solution to its ballooning budget deficit problem anytime soon. The credit rating agencies state that the new Prime Minister will make no difference to the economy or their deficit.

- UK Prime Minister Keir Starmer has lost his deputy Angela Rayner (for not paying the correct property tax) and appears to have a revolving door of economic advisors around him. The UK gilts market (Government Bonds) has already voted with their feet, sending long-term bond yields to record highs.

- Japanese Prime Minister Shigeru Ishiba has predictably and honourably fallen on his sword following the disastrous recent election results for the ruling LDP party. Early next month, the LDP will choose its fifth Prime Minister in four years.

All these political ructions increase risk and normally would suggest a weakening of the Euro, Pound and Yen against the US dollar. However, that has not happened on this occasion as currently investors and currency traders obviously see the United States as having greater political risk and change to policy that is detrimental to the economy and USD currency value. The FX markets unusual response to these political risk events is a telling indictment on the damage that the Trump regime is doing to the US economy, far outweighing any negativity for the Euro, Pound and Yen.

The other major political development in the world is the buddy/buddy meetings in Beijing recently between China, Russia and India. It is impossible to gauge whether the emergence of this Anti-West Alliance is positive or negative for the USD currency value, however the more these major economies trade between themselves and exclude the Americans, the US dollar becomes less dominant as the world’s trade, reserve and investment currency.

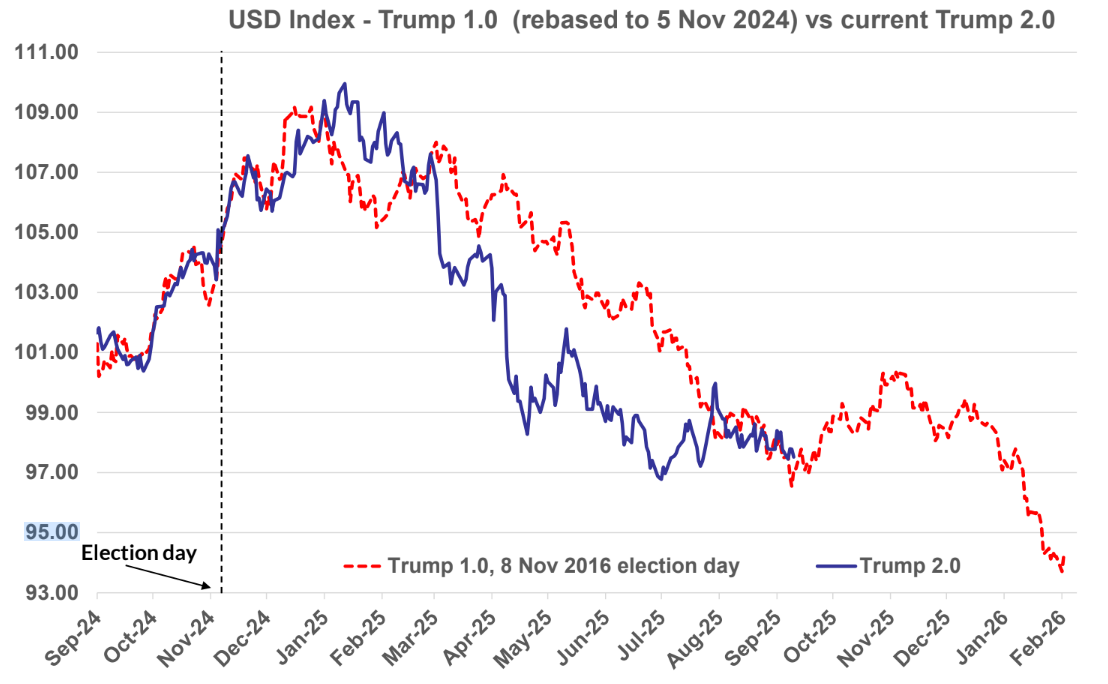

We have published the following chart many times over the last nine months, however the information and confirmation it displays on the demise of the US dollar under the two Trump regimes is very instructive. Whilst having moved sideways over recent weeks/months, the greater likelihood is that the US dollar has further to depreciate, as the Fed cut interest rates due to the sharp deterioration in US employment.

US inflation and jobs data still point to a weaker USD

Whilst the headline US CPI inflation increase for the month of August came in at +0.40%, marginally above forecasts of +0.30%, US interest rates and the USD did not increase. The Core CPI inflation results were in line with forecasts. In some respects, there appears to be relief in the financial markets that US inflation results are not surprising to the upside due to the tariff increases. Wholesale prices in the US economy, as measured by the PPI Index, surprisingly decreased in August. The PPI index fell 0.10% in August, substantially weaker than the +0.30% expected. As wholesale price trends feed through into retail consumer prices over subsequent months, the markets took the PPI result as a reduction in the risk that the annual CPI inflation number moves substantially above 3.00% over coming months.

Last week, US unemployment claims increased sharply to confirm the rapid fall-off in jobs in the economy. Initial jobless claims were 263,000, well above forecasts of 240,000. The jobless claims four-week average is now running at a much higher 240,000 (against prior estimates of 232,000). If retail sales and industrial production numbers print weaker again next week, the evidence will be in front of the Fed to deliver a significantly more dovish monetary policy statement on Thursday 18th September (Friday morning NZT).

We have highlighted the fact several times over recent months that the Fed should “look through” the likely temporary and one-off nature of the inflation increases from import tariffs and conclude to recommence their interest rate reductions. The collapse of their employment market over recent months definitely swings the balance to rapid interest rate decreases on the employment objective side of the Fed’s remit. The Fed’s hesitancy on cutting interest rates since the start of the year has been their worry that inflation will not be temporary (they were badly caught out on this in 2022) if the economy and jobs remain robust. Time has now moved on to the situation where the employment weakness now significantly outweighs the opposing inflation concerns. The economy and jobs are no longe robust.

Expect a big change in the individual member’s “dot plot” interest rate forecasts when they are published in the SEP (Summary of Economic Projections) at the Fed meeting this week. The previous hawks and “sitting on the fence” members will have to concede defeat on their previous views that the economy was still robust. A statement from the Fed more dovish than what the markets are expecting is set to send the USD value below its previous low of 97.00 on the USD Dixy Index (currently 97.50).

Global investors continue to downsize USD currency exposures

The failure of the US dollar to gain from political turmoil in France, the UK and Japan, plus higher inflation in the US, tells us that global investors are continuing to sell the USD as they reweight their investment portfolios and currency exposures to lower USD ratios.

Last week, the new Chief Executive for global investment manager Amova Asset Management (formerly Nikko) was visiting New Zealand. Stefanie Drews provided some reasons as to why investors are moving away from the US dollar and US assets to a preference for Europe and Asian assets. Amova manage US$260 billion of assets globally, so it is worth taking note of their view on the currency exposure changes. Ms Drews observes global investors replacing US bonds with non-US private assets as a major diversification strategy. She saw the reallocation away from the US as a natural consequence of most investors being heavily overweight US assets prior to Trump’s tariff bomb earlier this year. Her view was that the downsizing away from USD assets was a fantastic opportunity for Asian-Pacific region to attract those investment funds.

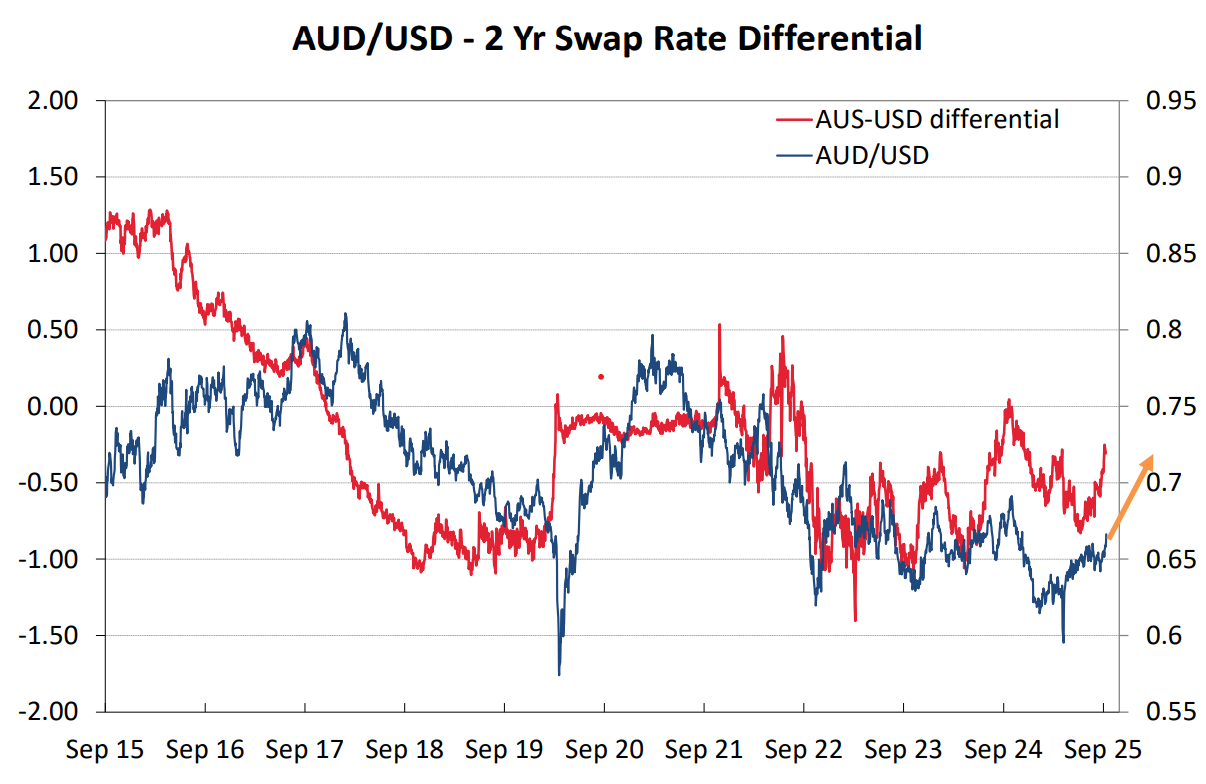

We have long held the view that the Australian equity/bond markets and the Aussie dollar would be a major beneficiary of these global investment flows when the interest rate differential to the US was no longer an impediment for the AUD. Today, the US two-year Treasury Bond yield is 3.55% and the Australian two-year Government Bond yield is 3.40% - just a 0.15% gap. Six months ago, the gap was 0.75%. The closing-up of the interest rate gap is confirmed in the swap differential chart below (red-line). The AUD/USD exchange rate has already lifted on the closing interest differential and at the current level of 0.6650 it has broken up above the downtrend line that it has remained below since 2021.

Stronger Australian employment data this Thursday 18th September and higher CPI inflation figures on Wednesday 24th September should cement in a much more circumspect RBA on interest rate cuts at their 30th September meeting.

The stars are finally aligning for another wave of appreciation for the Aussie dollar, and it generally pulls the Kiwi dollar up with it.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.