Summary of key points: -

- Weaker than expected NZ GDP numbers pulls the Kiwi dollar back a cent

- Ongoing division in the US Fed, however interest rates and the US Dollar are still going down

- Is the NZD depreciation against the Aussie dollar overdone?

Weaker than expected NZ GDP numbers pull the Kiwi dollar back a cent

The contraction in the New Zealand economy over the June quarter at -0.90% was far greater than any of the most pessimistic economists and commentators expected.

However, to put the state of the economy into some balanced perspective, the March quarter turned out to be much stronger than anyone forecast at +0.90%.

Back in February, the RBNZ forecast the NZ economy to expand by 0.60% in the March quarter and by another 0.60% in the June quarter. Therefore, the economy has certainly been softer than forecast over the last six months, however it also has not fallen off a cliff into a deep/dark recession (as some are taking delight in espousing!!). In February, the RBNZ forecast the annual inflation rate to be down to 2.50% by this time, it is just above that at 2.70% at the end of June and may well be closer to the 3.00% upper limit when the September quarter’s figures are released on 20th October. If the RBNZ still held their “dual mandate” of low unemployment and stable inflation between 1.00% and 3.00%, they would be fully justified in slashing interest rates from here as the flat economy may suggest that the unemployment rate has further to increase. However, the single focus current RBNZ mandate on inflation only does not allow them to cut interest rates to very low levels if inflation is pushing out the top end of their 3.00% limit. In the US and Australia, the weak economic growth would have them cutting interest rates on the employment side of their dual objectives. That is not the case in New Zealand at this time, our rules are significantly different.

The RBNZ would only be justified in cutting interest rates more aggressively right now if the rapidly weakening economy was causing consumer spending to collapse so that retailers reduce their prices, and that in turn causes the annual inflation rate to head below the 1.00% lower limit. To the contrary, consumer spending is not collapsing in our economy, the electronic card retail sales in July and August were up quite strongly. Yet again, we repeat our message that price changes in the NZ economy all tend to come from the supply side, not driven by the demand side. Food and electricity prices are currently increasing by over 5.00% per annum due to supply factors. Rents are falling due to supply issues, as well as softer demand due to leavers and low immigration.

Construction activity was down another 1.80% in the June quarter, which was of no great surprise to anyone. However, manufacturing and professional services reversed their strong gains in the March quarter. Financial services and healthcare industry sectors also declined, which seems at odds with normal trends and anecdotal evidence of activity levels. Seasonal components made up two thirds of the June quarter 0.90% contraction. Therefore, our conclusion is that the “shock” of the headline number of -0.90% being some kind of confirmation of a dramatic fall-off in economic activity, is actually a fair distance from reality. The September quarter’s GDP growth outcome is on track (from the economic evidence so far) to be stellar bounce back, a long way above the RBNZ’s current forecast of a +0.30% lift. Therefore, again it would seem incongruous that the RBNZ would be cutting interest rate more aggressively due the economy and employment being weaker than forecast. Their single objective mandate on inflation only, would not allow that. Let’s hope that the new member just appointed to the Monetary Policy Committee, Ms Hayley Gourley (thankfully not another academic!) has some laser-focused clarity on the aforementioned issues.

Based on the above analysis and reasoning, we do not think the Kiwi dollar will be sold down any further than the one cent from 0.5970 to 0.5860 against the USD on the GDP growth news. Monetary policy settings need to be driven by forward forecasts, not historical economic data in any case. In an environment of a continuation of US dollar depreciation, the Kiwi dollar should be expected to bounce back relatively quickly to the negative GDP news headlines of last week. Over the first six months of this year, we often referred to the dodgy US jobs data as not reflecting the true state of their labour market. As it has transpired, the employment was substantially weaker than the Fed or the financial markets believed though that period. They are again cutting their interest rates and will cut three more times this year based on the employment side of their remit. New Zealand GDP growth data accuracy and revisions over recent years have been just as screwy and unreliable as US employment numbers. Our GDP numbers are untrustworthy and are subject to massive subsequent revisions (more likely to be upwards).

Therefore, Kiwi dollar risk managers would be advised to view the GDP factor with a large grain of salt…………

Even if the RBNZ do cut interest rates further by another 50 to 75 basis points over coming months, as many are suggesting must now happen, they run the real risk of overcooking the monetary stimulus and therefore needing to rectify it later with rate increases. The RBNZ have been caught out in the past with massive historical GDP growth revisions stuffing up prudent monetary policy management decisions. They would be wise to be very circumspect in respect to the -0.90% GDP outcome for the June quarter. The RBNZ’s own GDP Nowcast predictor model pointed to a -0.20% based on all the sector inputs. Something is off, and we do not think it is the RBNZ’s model on this occasion.

Ongoing division in the US Fed, however interest rates and the US Dollar are still going down

It was a case of the FX markets “selling the rumour and buying on the fact” in respect to the US dollar trading ahead of, and after the 0.25% Fed interest rate cut last week. The USD weakened sharply against the Euro from $1.1680 to $1.1860 in the lead up to the Fed meeting in expectation of a 0.25% cut and an accompanying dovish statement. As is often the case, the USD bears (those that sold USD’s) took the opportunity to cash-up their FX profits, therefore becoming USD buyers after the statement. The EUR/USD exchange rate has returned to 1.1750 since the statement. The USD selling prior to the statement lifted the Kiwi dollar to 0.6000 briefly, however subsequent USD buying and the “shocker” GDP numbers sending the Kiwi sharply lower to 0.6860.

The interest rate markets in the US are now pricing-in two further 0.25% cuts before the end of the year. As has been the case all year, US economic data has been a mixed bag of late with retail sales in August stronger than expected, however the University of Michigan Consumer Confidence index falling further away this month to new four-month low at 55.40.

The Fed meeting proceeded as expected, with Chair Powell clearly more concerned about the dramatic softening in the employment area and less concerned with the rising inflation. The inflation lift due to tariffs has taken longer to come through than what the Fed originally thought, and it is not increasing as fast as they forecast.

In our view, the direction of the US economy over coming months is likely to more brittle than what many have been expecting, providing further ammunition for the Fed to cut interest rates more aggressively. The trend of the US dollar remains clearly lower, despite the short-term bout of profit-taking at the end of last week that caused a minor recovery to 97.30 from lows of 96.00 earlier in the week. Our earlier forecast of the USD depreciating to 95.00 and then possibly lower over coming months is very much on-track.

The Donald Trump “plant” at the Fed, replacement FOMC member Stephen Miran, was the only vote for a 0.50% interest rate cut at the meeting last week. He will need to work a lot harder of coming weeks to convince his Fed colleagues that the economy is losing jobs and more rapid cuts are needed. The irony of the situation is that Trump is attempting convince Americans that the economy is doing well under his leadership!

The Fed remains very divided on the outlook for the US economy; therefore, their jobs, inflation and interest rate forecasts such wide ranges you could drive a bus through them. The Fed member’s individual interest rate forecasts for the end of 2025 (the “dot-plot”) range from 3.00% to 4.25%, with the majority at 3.50%. As we stated several months ago, we have a scenario from now until the end of the year where the Fed is cutting interest rates aggressively again, whereas other central bankers have ended, or are near to the end, of their monetary easing cycles. It is this factor that ensures continuing US dollar selling.

Is the NZD depreciation against the Aussie dollar overdone?

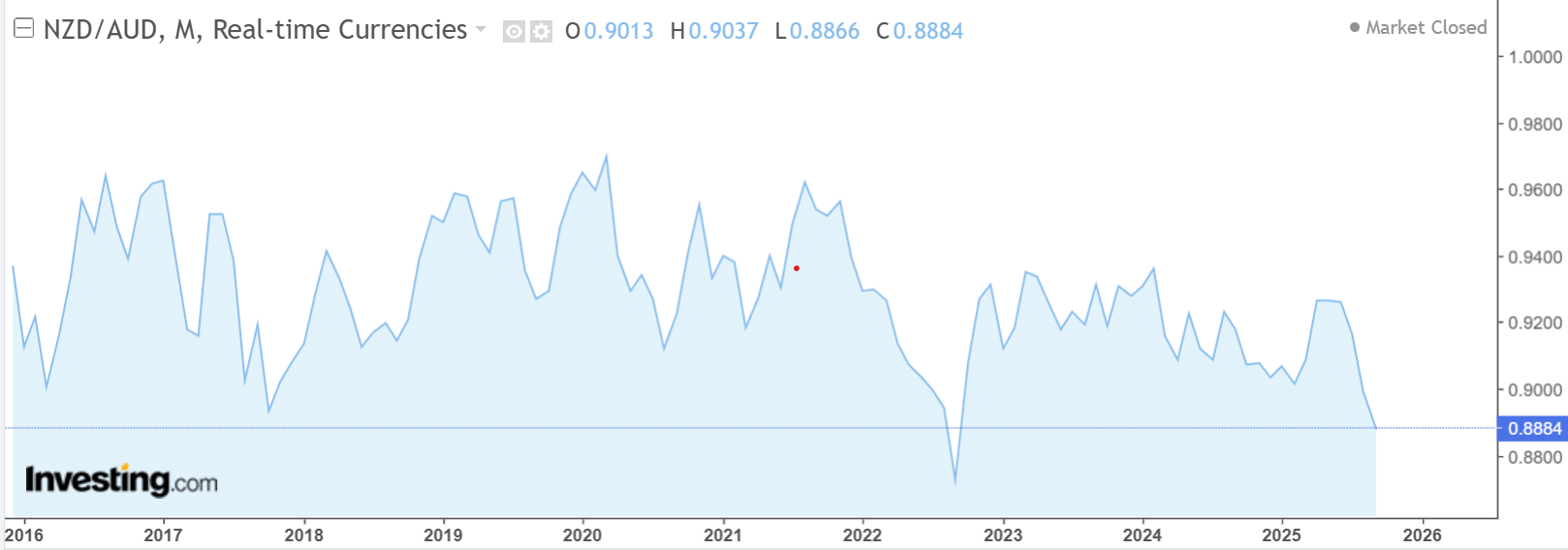

The NZD/AUD cross-rate hit a fresh low 0.8865 last week following the surprisingly weak NZ GDP figures. The FX markets see the RBNZ cutting interest rates a lot further than the RBA in this easing cycle. In addition, the Australian economy has expanded over the last nine months, whereas our economy was flat at best. All good reasons for the NZD/AUD rate to shift lower. The last cross-rate plunge (to 0.8755) was in September 2023, however like all previous dips below 0.9000 over the last 10 years it did not last too long (refer to the chart below). We do not expect this plummet, to well below 0.9000, to last very long either, as currency speculators have made great profits since shorting the NZD against the AUD at 0.9350 in April of this year. We would expect a bounce back up in the NZD/USD rate over coming weeks that will also lift the NZD/AUD cross-rate. The punters will by buying the Kiwi dollar back against the Aussie to cash-up their trading profits.

Local NZ fund managers who have investment portfolios denominated in AUD’s will be busy lifting hedge ratios at these levels i.e. buying the NZD/selling the AUD. On the other side, Australian fund managers with investments in New Zealand will be reducing their existing hedges, therefore doing the same, NZD buying against the AUD. Add on the hedging activities of local NZ exporters to Australia who will now be extending their forward hedges to two and three years forward, the end result is more NZD buying than selling against the AUD at these low levels.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

6 Comments

The RBs true mandate is non-tradable inflation, and last time I looked, that measure was continuing to fall.

"more likely to be upwards"? What country and economy is this guy talking about?

"Our GDP numbers are untrustworthy and are subject to massive subsequent revisions (more likely to be upwards)."

"Something is off, and we do not think it is the RBNZ’s model on this occasion."

NZ economists cannot simply accept that their modelling and religious belief in supply side economics might be a few sandwiches short of a picnic. Surely, their waywardly optimistic predictions for the past 3 years are beginning to raise some doubts.

Here's my prediction for the NZ economy. Unemployment continues to rise. Q3 comes in with lower than predicted GDP. Whatever Treasury predicts subtract 1% and you'll be close.

I'd expect a lift in retail for Q4. Next year - we are likely to see weak or negative growth again and if Budget 2026 is the same as the last 2 then there'll be another drop in confidence mid-year as spending and investment are sucked out of the economy by the coalition.

And the Government will get the boot at the election.

There's no guarantee. Kiwi's do love taking bitter medicine - especially if they think someone else is going to get what's coming to them - the Woke, Maori, low-skilled workers, beneficiaries etc.

National will offer more tax cuts (with the implicit cuts to public services that entails) - that would be my guess. Probably aimed at business.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.