Summary of key points: -

- Time for the RBNZ to be decisive to end the monetary easing cycle

- Escalating US economic risks remain negative for the US dollar

- Oil prices return to 2025 lows - negative for the USD dollar

Time for the RBNZ to be decisive to end the monetary easing cycle

Timing and risk management are two crucial elements of central bank decision making. One might say that financial risk management is all about timing.

As the RBNZ contemplate further easing in our monetary policy settings this week, it is useful to consider both timing and risk management on their part. The US Federal Reserve will be considering additional interest rate cuts before the end of the year as a risk management incision against the possibility that the Federal Government shut down (due to their budget impasse) will go on for a longer period than expected and cause disruption to not only the timely receipt of economic data, but also the economy itself.

At their last Monetary Policy Statement in August, the RBNZ indicated the likelihood of two further 0.25% cuts being necessary (from 3.00% to 2.50%). The RBNZ decided to deliver this message as they believe that there is considerable excess capacity in the economy, therefore the economy can expand without pressurising resources, so inflation will not increase. The money market are pricing-in a bit more than two cuts at this time, therefore there would be a strong argument for the RBNZ to go the whole hog and deliver a 0.50% cut to 2.50%. Given where we have got to, there would appear to be little downside risk in doing this. However, with that decision may well come an accompanying message from the RBNZ that they are at the end of their monetary easing cycle. The risk of overcooking the monetary stimulus and pushing interest rates too low, is that they stimulate another debt-fuelled housing boom. As we observe the last five years, New Zealander’s do go crazy on property when they consider money to be cheap. The reason for the delayed economic recovery on this cycle is the fact that highly indebted residential property owners are using the extra cash from lower mortgage interest rate payments to reduce debt levels before they spend it in the retail stores.

If it is a 0.50% OCR cut by the RBNZ next Wednesday, we would expect the accompanying short statement to be less dovish than what the markets currently expect i.e. one big cut and done! For this reason, the jumbo 0.50% cut will not be as negative for the NZ dollar value as would normally be the case. If the future outlook is no further reductions in NZ interest rates, the current short-sold NZD speculative position holders will be more likely to be buyers of the Kiwi, rather than adding to their shorts. The RBNZ will be very conscious of the current situation where they are aggressively cutting interest rates when the annual inflation rate is not exactly pushing below the 1.00% lower limit. It is in fact peeping above the 3.00% upper limit. Off course, they make their decisions on their inflation forecast, not historical inflation. They are forecasting the annual inflation rate to decrease from the 3.00% level in the September quarter to average 2.20% through 2026. Their confidence on inflation reducing to this extent is based on the excess capacity in the economy. We will get a read on that measure on Tuesday when NZIER publish their quarterly business confidence survey and capacity utilisation report. Our observation over the years is that a capacity utilisation at 90% in New Zealand does not automatically drive inflation downwards as much as the theory would suggest. The exchange rate, commodity prices, oil prices and other supply-side factors having the dominant impact on inflation.

The last thing the RBNZ want to be doing is reducing interest rates too much now, only to find inflation tracking closer to 3.00% for an extended period next year and then having to increase interest rates again within 12 months. That causes too much volatility to interest rates, the exchange rate and the economy, which their remit states they should not do. Herein lies the risk management aspect the RBNZ need to consider in making the decision to cut the OCR to 2.50%. Their mandate is to keep inflation between 1.00% and 3.00%, not to support the housing market, jobs or economic growth.

It is time for the RBNZ to be decisive and provide clarity to the markets. For their 2026 inflation forecast of 2.20% to be accurate they need a recovery upwards in the Kiwi dollar to keep tradable inflation in check. The NZ dollar has lost considerable ground against the NZD/AUD and NZD/EUR cross-rates of late. Further depreciation and an even lower TWI index would require the RBNZ to increase their 2026 inflation forecast.

The Reserve Bank of Australia is now expressing caution because their inflation has become sticky. The New Zealand economy is nowhere near as robust as Australia’s, however our inflation never comes from the demand side. Hopefully, the RBNZ will be aware of the risks of over-stimulating our economy and everyone being forced to pay for that later on. The last five years has been a roller-coaster due to the RBNZ being too loose and then being forced to be too tight. It would be a monetary policy mistake to go too loose again.

In summary, the RBNZ OCR decision this week is a “sell the rumour, buy the fact” situation if they do a 50-point cut i.e. the Kiwi dollar moves up on its own account, because the next movement in interest rates in New Zealand after that will be up, not down. If it is only a 0.25% cut and they are wishy-washy about waiting to see more economic data, the markets will be disappointed at that, and the Kiwi dollar may have further short-term downside risk.

Escalating US economic risks remain negative for the US dollar

The are two objectives that drive every decision US President Donald Trump makes. Firstly, a burning desire to be personally popular and admired (Nobel Peace Prize etc). Secondly, to burn the “radical-left” Democrats in every US state they have political power (California and New York mainly). For the second objective, the President is currently using the Federal Government shutdown as an opportunity to downsize Government institutions in the cities and states where the Democrats hold power. Retribution and vengeance is his modus operandi. The big question going forward is whether Trump will moderate his attacks ahead of the mid-term house elections next year when his supporters in the rural and industrialised heartland of the US are losing their jobs and suffering lower farm incomes?

The US dollar was sold lower last week as there was further Trump-instigated disruption to the US economy on top of the tariff chaos. The Federal Government shutdown meant that there was no-one at the Bureau of Labour Statistics to compile the Non-Farm Payroll employment data on the first Friday of the month. Another cunning Trump plan to obfuscate bad economic news? Other published employment data such as the private sector ADP Employment Change reported a contraction in employment in September. Whenever the Non-Farm Payrolls numbers are released, it is hard to see the result being positive i.e. less than a 50,000 increase for the month. The ISM Services PMI for September released Friday 3rd October was weaker than forecast, particularly the business activity sub-index which plunged from 55.00 in August to 49.9 in September.

The Federal Government shutdown with no indication as to how long it will last, is just another reason for foreign investors to exit the US markets. There are uncountable differing views on whether the US share market is over-hyped, over leveraged and over-cooked on AI stocks, or not. However, we would go with the opinion of Goldman Sachs boss, David Solomon this last week, who sees a “drawdown” of stocks over the next two years. His view is that there will be a lot of capital that is deployed that will turn out to not deliver returns. Over previous cycles for the Kiwi dollar, when Wall Street is falling and there is a general risk-off sentiment, the NZ dollar struggles to appreciate. What could be different this time around, if David Solomon is correct, is that the GBP, JPY, CNY and AUD currencies appreciate on inwards capital flows into their equity markets as funds rotate out of US stocks. The gains of the Euro against the USD this year from $1.0400 to the current $1.1750 point has largely been due to European investors/fund managers selling out of the US and transferring funds home. The Kiwi dollar has been unable to keep pace with the Euro gains, as our interest rates remain well below those in the US, and that puts us off the investment radar screen.

Once the RBNZ do their thing this week and it becomes more certain that NZ interest rates are going no lower, the interest rate differential position against the US starts to change. The Fed are now on track to deliver three more 0.25% cuts over coming months, taking the Fed Funds rate from 4.00% to 3.25%. Whether that change is sufficient to entice investment funds and hedge funds back to the Kiwi dollar remain to be seen.

The next important piece of US economic data is their CPI inflation rate for September on 16th October.

Oil prices return to 2025 lows - negative for the USD dollar

Crude oil prices are on the march lower again. Decreasing geo-political risks, increased supply and lower global demand seem to be behind the latest push towards US$60/barrel (WTI). The oil price was last below US$60/barrel in May when Saudi Arabia shifted their stance from production cuts to maintain higher oil prices, to accepting lower prices. The price reversed sharply upwards in June/July when Israel and Iran were attacking each other. That Middle East tension point has settled right down, and we may be now on the brink of Israel and Hamas accepting a peace deal in Palestine. Further declines seem likely over coming weeks as the Saudis are expected to increase production in November so that they retain their market share. Two factors may limit further downside for oil prices: Russian supply being disrupted and the Chinese buying to build stocks.

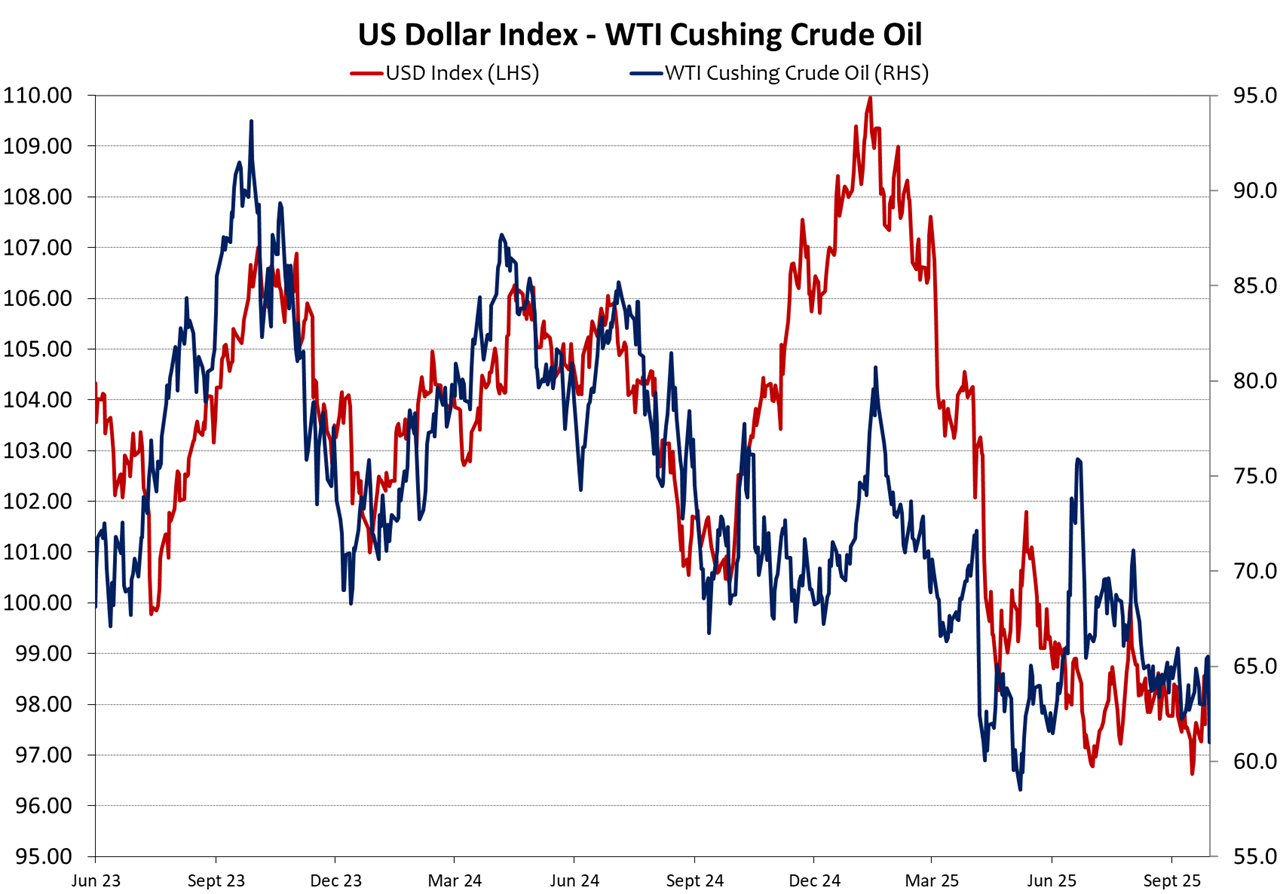

The positive correlation between crude oil prices and the USD Index has been consistent over recent years. Oil prices dropping further over coming weeks towards US$55/barrel would point to further USD depreciation to 95.00 on the Dixy Index. (refer to the chart below).

As the local NZ negative factors for the Kiwi dollar run their course and come to an end, we should see NZD/USD exchange rate movements tracking the USD Index again. A 95.0 USD Index equates to the NZD/USD being back up well above 0.6000 again.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

Why do I get the feeling Roger has USD short position.

It's kind of a trap. Lower interest rates typically lower the value of the NZ dollar. A weaker dollar leads to a higher costs for imports which is inflationary.

The current government removed the RBNZ mandate to consider employment so there single mandate is to keep inflation within the 1 to 3% band. Nothing else.

I must be one of the few who do not want the OCR to go down, at least for the forthcoming review. My prediction done on 10mar25 was 3.5% until Oct25 then a 0.25% drop. Isn't inflation creeping up?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.