Summary of key points: -

- Soft underbelly of the US economy being exposed

- Weak Aussie jobs data presents a dilemma to the RBA next month

- It’s time to stop “talking down” the New Zealand economy

Soft underbelly of the US economy being exposed

Global currency markets continue to “fly blind” due to the absence of up-to-date US economic data as the Federal Government shutdown enters its fourth week.

The trend and direction of key US economic measures are a major influence on the performance of the US dollar against the major currencies; however, the data is not being released. Market participants are currently guessing as to how important metrics such as employment and inflation have been moving through September and October. The US dollar appreciated on the Trump 100% tariff increase threat to China 10 days ago; however, it soon retreated as Trump dialled back his rhetoric and Fed Chair Jerome Powell delivered a clear message in a recent speech, that in his view, employment has continued to sharply weaken in the US economy. The USD Dixy Index has returned to 98.20 after peaking at 99.15 on 14th October.

Although there is no recent data to substantiate the conclusion that the US economy has slowed up rather abruptly over recent months, there is a stack of anecdotal evidence that the soft underbelly in the US economy is starting to be exposed: -

- Regional banks’ share prices were slammed down last week as defaulting loans started to raise eyebrows of a credit contagion. Commercial property leases and values are crumbling through many US states, and the risk/pressure shows up in the regional banks who have security over such properties. The Japanese Yan and Swiss Franc appreciated against the USD last week on safe haven FX flows following this credit scare.

- The auto industry in the US is in disarray as tariffs disrupt manufacturing and supply pipelines. Last week, auto parts firm, First Brands went bust and bottom-end motor vehicle lender, Tricolor Holdings also plunged into bankruptcy.

- Delinquencies and arrears rates in vehicle loans and leases have hit a four-year high as lower income Americans struggle to make the payments. According to Fitch (credit rating agency), more than 6% of subprime auto loans are now at least 60 days overdue. The arrears are the highest ever recorded, reflecting tighter household budgets, slowing wages growth and unemployment edging higher. Higher car prices are also making affordability a challenge.

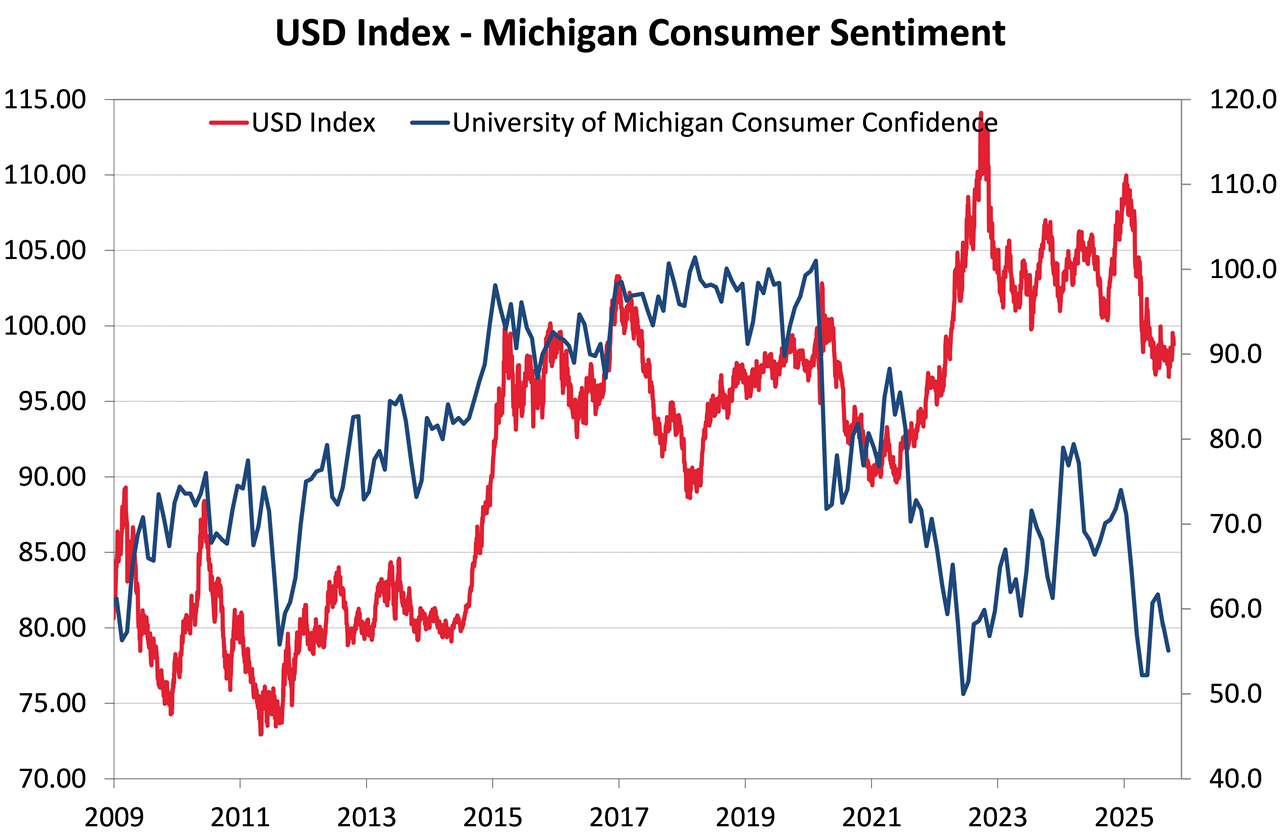

- Consumer confidence levels have fallen away again. The University of Michigan consumer sentiment index has dropped to 55 in October. It is still above the record low of 50 in July 2022, however not by much. The Conference Board consumer confidence index decreased to a five-month low in September of 94.2.

What these negative anecdotes represent is accumulating creaks in the US economic performance, largely caused by the uncertainty surrounding the Trump regime’s erratic policies. Discretionary consumer spending is taking a hit, and this detracts from economic growth. Despite annual inflation pushing up to 3.00%, above the Fed target of 2.00%, the Fed is poised to cut their Fed Funds interest rate two or three more times this year on the sharply deteriorating employment situation.

US 10-year Treasury Bond yields have moved sharply lower over recent weeks, dropping from 4.30% at the end of August to 4.00% today. Bond investors are displaying more confidence that the Fed will cut short-term interest rates, despite the push up in inflation from tariffs. The bond market clearly sees the weak consumer demand as not allowing the full cost of tariffs to be passed through to the end consumer. At the end of the day, Trump’s tariffs are a tax on US importers and consumers, an effective tightening of fiscal policy (increasing taxes), requiring an easing of monetary policy (lower interest rates) to offset it.

US consumer confidence is back near its lows of 50, last seen in 2022, when rapidly increasing interest rates at the time dented consumer sentiment and retail spending. The USD Index (red line in the chart below) has depreciated 15% since the highs of 115 in 2022. However, based on the long-term relationship between the two indices, the USD Index still has a lot further to depreciate over coming months and years. Rising consumer confidence from 2012 to 2020 was reflected in the appreciation of the USD Index on superior economic performance to other countries. We are now observing the reversal of that multi-year trend.

Weak Aussie jobs data presents a dilemma to the RBA next month

The recovering Australian dollar value against the US dollar ran into a setback last week when the unemployment rate jumped up from 4.30% to 4.50%. The increase in new jobs in the month of September of 15,000 was not out of line with prior forecasts of +19,000, however more people seeking a job lifted the unemployment rate. The weaker jobs numbers present a new challenge to the Reserve Bank of Australia (“RBA”), who were set to keep interest rates on hold at the next meeting on Melbourne Cup Day, Tuesday 4th November. The strong upwards trend in public sector jobs in Australia is coming to an end, and it appears that private sector jobs are not picking up to replace them, as they were expected to. It should be remembered that the monthly jobs data in Australia is highly volatile, so the RBA would be right to be cautious and not over-react to one month’s numbers.

Australia’s inflation rate is proving to be sticky around 3.00%, therefore the outcome of their September quarter’s CPI inflation data released on Wednesday 29th October will be crucial information for the RBA interest rate decision a few days later. Consensus forecasts are for a 1.00% increase in inflation in the September quarter, lifting the annual rate of inflation from 2.10% to 2.90%.

The interest rate markets are pricing a 60% probability of a 0.25% cut from the RBA on 4th November, however if the inflation rate comes in higher than forecast, there will be no cut. The Aussies believe their “neutral interest rate” for the OCR is around 3.00%, therefore the current OCR at 3.60% is still on the tighter side.

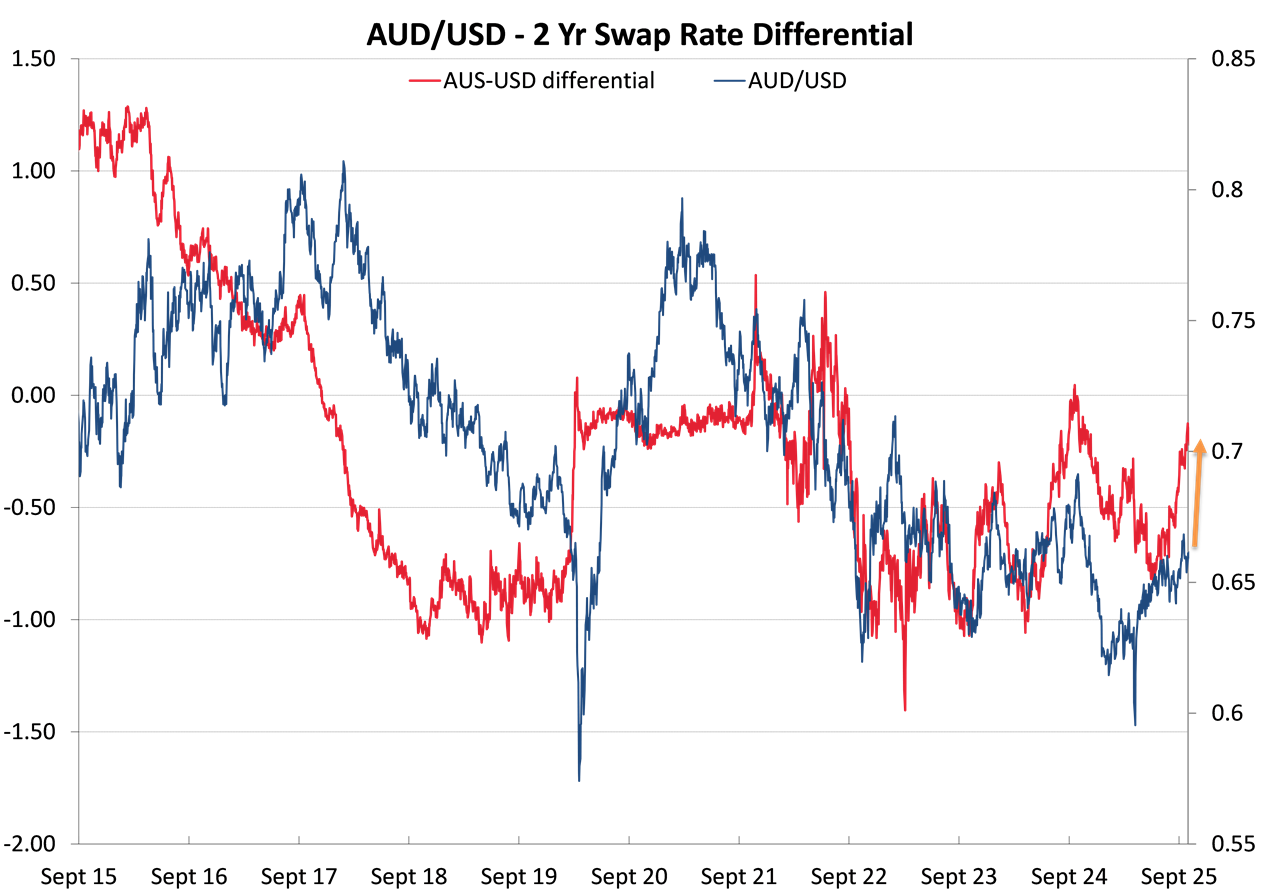

A higher inflation result and a “no cut” decision by the RBA would be positive for the Aussie dollar. The AUD/USD exchange rate still lags the interest rate differential between US and Australian two-year interest rates by a long way (refer to the chart below). The interest rate gap (red line on the chart) has closed up over recent weeks from Aussie interest rates being 0.80% below those of the US, to now being only 0.10% below. The decrease in US two-year swap interest rates to 3.50% and the stabilisation of Australian two-year swap rates at 3.40% has closed the gap. The big disincentive for buying and holding the AUD over recent years has almost disappeared.

Based on the strong historical correlation, the AUD/USD exchange rate is set to appreciate to 0.7000 and higher over coming weeks/months.

It’s time to stop “talking down” the New Zealand economy

Over recent months it has almost become a competition amongst local bank economists to see who can be the most negative on the New Zealand economy, all designed to bully the RBNZ into cutting interest rates. Which they have duly delivered on!

It is a sad commentary on a sad country if these economists, representing the “dismal science”, convince the masses that we are a total basket case. The NZ economy was “flat” over the first six months of this year, not exactly the national disaster that the daily media dribble would have you believe. However, it must be accepted that the export-led recovery has taken longer to lift the overall economy in 2025 than we first thought. The monetary stimulus through the RBNZ cutting interest rates for 14 months now has also taken longer than expected, as mortgage borrowers use the extra cash from lower interest rates to reduce debt ahead of spending in the retail stores.

Many economic commentators have been celebrating the RBNZ 0.50% OCR cut as the “circuit breaker” the NZ economy needs to get moving again. They appear to have forgotten that the RBNZ’s sole purpose is to maintain stable inflation between 1.00% and 3.00%. Their mandate does not extend to “saving jobs in the economy” or “increasing house prices” as many would like to think it is.

It has been encouraging that the debate as to whether a stimulatory 2.50% (or lower) OCR is warranted or not, has regained some balance over this last week. Independent economic forecasting house, Infometrics has warned of the dangers of the RBNZ “overcooking” the monetary stimulus with further interest rate cuts that may lead to yet another boom/bust housing market cycle. We would agree that this risk is very real as Kiwi’s like to gear up on debt when interest rates are considered low. It is the last thing the NZ economy needs, as it would result in interest rates going back up again next year.

Monday’s CPI inflation result for the September quarter may well determine whether the RBNZ add a further 0.25% cut next month and take the OCR down to 2.25%. Inflation is forecast to increase by 0.90% over the quarter, lifting the annual inflation rate from 2.70% to 2.90%. A result above that would put pay to further interest rate cuts and would send the NZ dollar higher on its own account. A result below 2.90% would confirm current interest rate market pricing for a 0.25% cut on 26th November and be negative for the Kiwi dollar.

Standing back from the daily market and economic noise, all the bad news for the Kiwi dollar (GDP contraction and the 0.50% OCR cut) that depreciated the currency from 0.6000 to 0.5700 is now behind us. Looking ahead, the economic news is set to be much more positive, forcing the doom and gloom merchants to put away their “Grim Reaper doom scythes” for another cycle.

The NZD/USD exchange rate has remained below its downtrend line since 0.7400 in early 2021. The chart below confirms the following NZD/USD exchange rate patterns: -

- Every NZD recovery upwards since 2021 generally ends lower than the previous one.

- The Kiwi dollar has bounced off 0.5500 three times since 2021.

- There remains significant resistance around the 0.6300 and 0.6400 region.

- A movement up in the NZD/USD rate to above 0.6000 would trigger additional NZD buying, as the downtrend resistance line is broken to the upside.

A recovery to above 0.6000 in the NZD/USD rate, due to the expected further depreciation in the USD, may well be the game changer in terms of local sentiment. The rest of the world also start to see us in a more positive light, which should put an end to the talking down of our own economy.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Wrong article for comment - removed.

'forcing the doom and gloom merchants to put away their “Grim Reaper doom scythes” for another cycle.'

This article was worth reading - but that comment is flat-earth linear.

When you base your 'wealth' and 'growth' on the exponential growth in physical extraction, cyclical does not apply. Oscillations on the way up, yes. And very likely increasing oscillations on the way down.

But the macro picture is a single pulse, no longer than 300 years in total.

Peak Oil, Ponzi Pyramids, and Planetary Boundaries | Frankly 109

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.