Summary of key points: -

- Lower housing costs cancelling out tariff costs in US inflation measure

- Will the Kiwi dollar close the gap on USD movements?

- Will the NZ economy trade its way out of the doldrums?

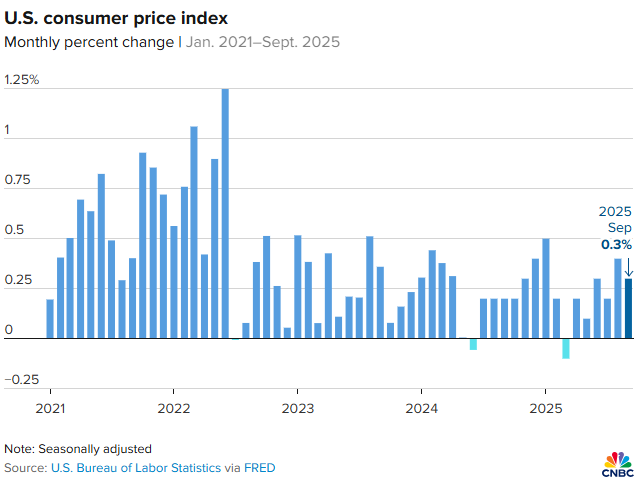

As expected, there were no surprises with the delayed release of the US September CPI inflation figures last Friday. Headline inflation increased 0.3% for the month, which was below the prior consensus forecast of +0.4%. Excluding the volatile food and energy prices, the core inflation increase for September was +0.2%, again less than the forecast of +0.3%. A 4.1% jump in gasoline prices was the largest contributor to a report that otherwise showed inflationary pressures being fairly muted.

What is now becoming evident, six months after Trump introduced import tariffs, is that the flow through impact from the tariff costs onto the inflation rate has taken longer, has been more spread out and overall has been less pronounced than first feared. Over recent months about half of the Federal Reserve voting members have expressed concern about rising inflation from tariffs, and therefore they were not convinced that further cuts to interest rates were prudent. There is now a strong argument that the annual inflation rate will not go any higher than the current 3.00% level as soft demand across the economy makes it more difficult for retailers and wholesalers to increase their prices.

Therefore, a previously divided Fed will shift to the majority now favouring successive interest rate cuts based on the sudden employment slowdown and the higher inflation fears receding.

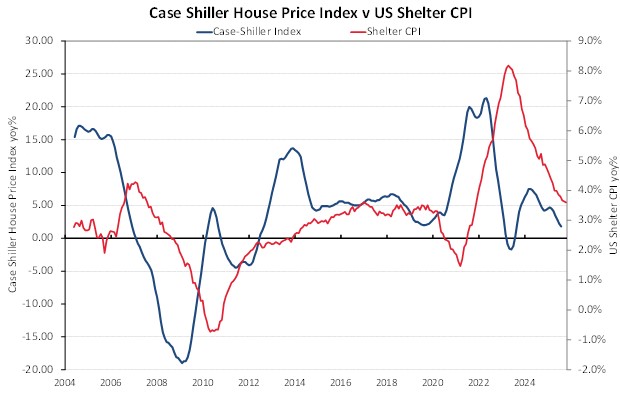

Services sector inflation in the month of September was also less than expected. Shelter costs (housing/rents), which comprise more than 35% of the CPI Index, increased by just 0.20% in September, leaving the annual shelter increase at 3.60%. The shelter CPI increase of 0.20% was the lowest monthly increase since January 2021. Over the last two years we have consistently highlighted that fact that US inflation would reach the Fed’s 2.00% target due to the very lagged rents and imputed rents (shelter CPI) data continuing to decrease and pull the overall inflation rate lower. Off course, the tariffs have caused the annual inflation rate to move up to 3.00% this year from nearly reaching the 2.00% target in late 2024.

Lower US house prices are one factor that has caused the reduction in the annual Shelter CPI (rents) from a peak of +8.00% in 2023 to +3.60% today. The chart below plots the Case Shiller house price index against the Shelter CPI annual increase. The financial markets and the Fed both know that the Shelter CPI index has further to fall over the next six months, due the 18-month to 24-month lagged nature of the data now being reported.

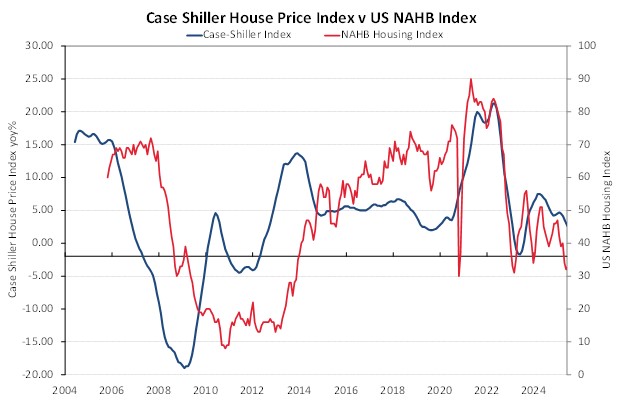

There is also a strong historical relationship between house prices in the US and the level of new house construction activity. Lower house prices and higher 30-year mortgage interest rates means that fewer houseowners sell their properties to undertake new builds (new loans at the higher 30-year fixed mortgage interest rate) as the economics do not stack up. New house building activity slows up as a result.

The first chart below depicts the correlation between house prices (Case Shiller Index) and new bouse building activity (NAHB Housing Index). New housing construction activity levels are back at 10-year lows.

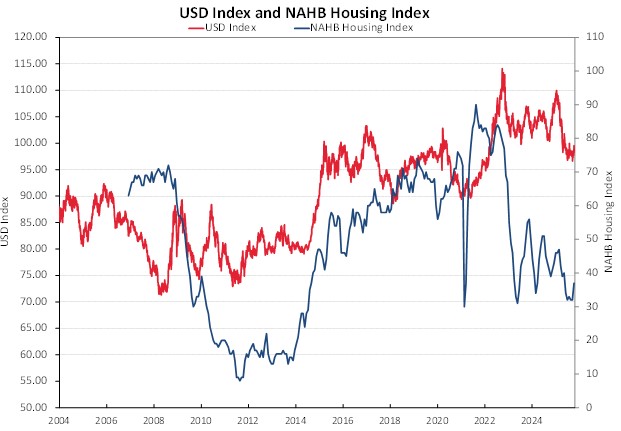

The second chart below plots the NAHB Housing Index as a proxy US economic barometer against the value of the US dollar (USD Dixy Index). The NAHB Index is currently at 37, when it was below 30 in 2010 to 2014 (GFC) the USD Index was trading between 75 and 85. The above analysis is another good reason why we continue to see the US dollar value heading lower, due to lower inflation, lower interest rates and weaker economic activity (as evidenced by the softer new house builds being just one of several weaker economic indicators).

Will the Kiwi dollar close the gap on USD movements?

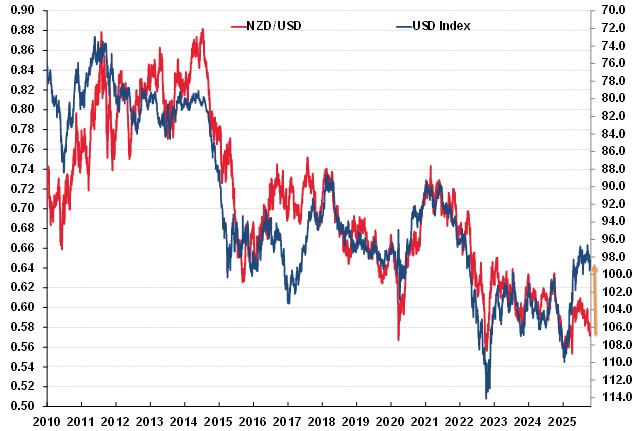

The New Zealand dollar’s underperformance over recent months has seen all the cross-rates (except the Japanese Yen) fall away to new lows. As a result, the NZD/USD exchange rate has widened the gap to the USD Dixy Index even further (refer to the chart below). The current divergence is the widest for many years. The question is whether the Kiwi dollar will continue to underperform or will local and international developments from here allow the Kiwi dollar to catch up its lost ground?

Two changes will be critical to give the NZ dollar a chance to recover and therefore move in tandem with the USD Index once again: -

- A closing of the interest rate gap between NZ and the US coming about due to NZ interest rates going no lower and US interest rates decreasing over coming months with successive Fed cuts.

- New Zealand’s economic performance dramatically improving. The probability of this occurring through our summer months looks better now than anytime over the last two years. Regional economic growth is spreading into the cities, tourism (aided by the lower cross-rate) is set to have strong growth, job adverts are up, and lower mortgage interest rates will finally bring consumers back to the retail stores.

We reiterate the point made in last week’s column, all the bad news for New Zealand and the NZ dollar appear to be behind us, it just requires offshore investors and currency traders to recognise the change that is occurring.

Will the NZ economy trade its way out of the doldrums?

Sometimes it does not pay for our politicians to pontificate a view on how the New Zealand economy is responding to global events. A number of months ago, Prime Minister Christopher Luxon stated that Trump’s tariffs were causing much uncertainty and damaging our economy. It was a factor in our poor economic performance through the winter months since April, according to the PM. Whilst our manufacturing exporters have experienced some uncertainty with pricing as they navigated the shifting sands of the US tariffs, our major exports of beef and lamb to the US have powered on regardless. The impact of the US tariffs on the New Zealand economy has actually been less negative than the local fearmongering. Mr Luxon’s comments about the negative impact arguably did more damage to confidence and business decision making than the 15% tariffs themselves. Readers will recall that PM Luxon was all keen on forming an international group to retaliate against Trump’s tariffs. Thankfully, that went nowhere and the wise words of Deputy PM, Winston Peters to just “wait and see” prevailed and helped our situation.

At the recent European/NZ business summit PM Luxon promoted the concept that the EU should join the 12-member CPTPP trade group to strengthen the rules-based trade order. Trump has thrown out that rulebook with his bilateral tariffs, however that does not mean that the rest of the world moves away from free trade that has improved living standards around the globe. PM Luxon will be attending this week’s East Asia Summit and APEC economic leaders meeting where he will be encouraging the Southeast Asian countries to join the CPTPP and EU discussion. Such an amalgamation would represent 40% of global trade.

The outlook for the NZ and Australian economies may also get a boost this Thursday when President Trump and Premier Xi Jinping of China meet to sort out their trade relationship. A positive resolution will be good news for the Chinese economy, therefore positive for the AUD and NZD. Trump will be using his latest oil sanctions on Russia to leverage Premier Xi to convince Putin to call a ceasefire and come to the peace talks table.

It all might be wishful thinking; however, these developments have a good chance of reducing geo-political risk factors for currency markets. The Euro would certainly strengthen on an end to the Ukraine/Russia war and the USD depreciating further as traders increase “short-sold USD” bets on lower US interest rates, without the fear of trade wars and other wars escalating (typically USD positive).

chart:daily exchange rates]

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.