Summary of key points: -

- US dollar “short-sold” speculative positions cleaned out

- Reasons why New Zealand’s inflation increase may not be “temporary”

US dollar “short-sold” speculative positions cleaned out

The New Zealand dollar was again singled out in the global currency markets last week for special treatment, concentrated selling pressure sending the Kiwi down to a seven-month low 0.5605. What currency traders and investors are seeing as particularly negative for the Kiwi dollar at this time is the fact the RBNZ is signalling further interest rate cuts to come on top of their already jumbo 0.50% OCR cut last month, whereas in stark contrast both the RBA and the US Fed have signalled clear hesitancy about the need for further interest rate reductions. The wider interest rate differentials are hurting the Kiwi dollar, resulting in independent NZ dollar depreciation which has again dropped the cross-rates to the Aussie dollar and the Euro.

Two further forces have played against the Kiwi dollar over recent weeks as well: -

- Equity markets in the US are starting to wobble as investors become uncertain around the massive levels of additional capital the AI stocks will require to expand over coming years. The equity market volatility has escalated the general “risk-off sentiment”, which is never a positive for the NZD and AUD.

- The US dollar itself continued to strengthen in the earlier part of the week as more currency traders unwound their “short-sold” USD speculative positions (buying the USD to do so). The USD Dixy Index climbed to a high of 100.15 on 6th November on that buying pressure, however it recoiled to 99.50 by the Friday close.

Everyman and his dog being short-sold the US dollar over recent months in expectation of further depreciation on Fed rate cuts and weak US economic data resulted in a very “crowded trade”. In many respects, the closing down of these speculative positions is a healthy sign for the market, as the existing positioning is cleared out, paving the way for new positions to be established. The punters sitting on short-sold USD positions over recent months have made good profits as the USD declined from 110.00 to below 100.00 on the Index. The Fed pivot two weeks ago when Chair Powell stated that further interest rate cuts in December “were not a forgone conclusion, far from it!” was the catalyst that triggered the profit-taking by the speculators and caused the USD Index to lift from 98.00 to 100.00.

The way now appears clear for new short-sold USD positions to be re-established as and when the delayed US economic data is belatedly released. The timing if that event depends on the Democrat and Republican politicians reaching a compromise deal to pass the budget to end the Government shutdown. The markets are speculating as to whether employment data has been weaker of stable through September and October. The absence of official statistics makes it tricky to draw firm conclusions on the performance of the US economy. Our view is that the US economic data will turn out on the softer side when it is eventually released, and that will pave the way for another push down in the US dollar value as more Fed voting members are swayed to further interest rate cuts on the employment side of their monetary remit.

Adding to the USD gains to 100.00 on the Index over recent weeks has been individual negatives on the respective major economies and currencies, consider: -

- The Euro weakened to a low of $1.1480 (now $1.1570) as the mess that is French politics and Government finances weighed on investor’s minds.

- The UK Pound has been sold on its own account as capital flows out of the economy due to tax hikes on the wealthy from the Labour Government. The holding steady of UK interest rates last week may be something that halts the Pound selling.

- The Canadian dollar has been under downward pressure due to weak economic data (Trump’s tariffs hurting their economy), lower interest rates and lower oil prices (a major export for Canada).

- The Japanese Yen weakened on the new Prime Minister coming into office as she was not in favour of interest rate increases to control inflation. That FX market reaction has now run its course and inflation/wages data in Japan still points to the need for further interest rate increases.

- Chinese economic data has been pretty ordinary of late, perhaps forcing the authorities to implement another fiscal/monetary stimulus package before the end of the year.

Looking ahead, two upcoming events are likely to prove negative for the US economy and therefore the US dollar value: -

- Weaker retail sales and employment numbers when the figures are eventually released. The University of Michigan Consumer Sentiment survey dropped to new lows of 50.3 in November from 53.6 in October. Both current conditions and future expectations were well below prior forecasts.

- The US Supreme Court ruling that Trump’s tariffs were illegal and must be repaid. Counter legal claims will be made by the Trump regime under other legislation, however it will be another reason for foreign investors to “sell America”, selling the US dollar as they depart.

The USD Index is precisely following the track of eight years ago under Trump’s first term. History repeating points to the USD depreciating from the current 99.50 level to 95.0 and below over coming months.

Reasons why New Zealand’s inflation increase may not be “temporary”

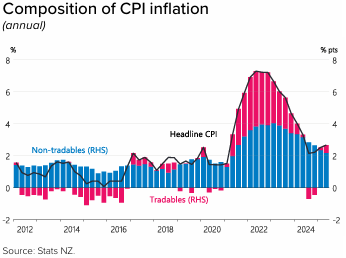

The RBNZ and market economists appear supremely confident that the latest uptick in our inflation rate to above the 3.00% upper limit is “temporary”, caused by short-term price lifts that will not repeat. The high expectation of the RBNZ cutting the OCR again to 2.25% is based on the inflation rate rapidly reversing to 2.50% and lower by mid next year. Confidence in that eventuating however may be starting to wane. The two-year swap interest rate has jagged sharply upwards from 2.60% to 2.90% over the last week, reflecting reducing market expectations around further cuts.

The forecasts of the current increase in inflation being temporary in nature is based on non-tradable (domestic inflation) rapidly reducing from the current 3.50% level to below 2.50% and tradeable inflation (imported goods) not increasing any further. Current financial market and economic conditions would suggest that there is considerable doubt that this inflation forecast/assumption will be accurate.

Firstly, over the last 20 years non-tradable inflation has remained consistently above 2.00% as public sector and non-competitive parts of the economy always implement price increases, no matter what is happening to demand and supply pressures in the economy. We do not see that phenomena changing anytime soon. Secondly, non-tradable inflation looks set to further increase over coming months with still elevated commodity prices and a much lower New Zealand dollar exchange rate i.e. import costs increasing. Whilst US dollar denominated crude oil prices have reduced to below US$60.00/barrel (WTI) over recent weeks, we will not necessarily see that represented in lower petrol pump prices as the NZ dollar has depreciated by 6.00% against the USD since mid-September.

Components of tradeable inflation that will be increasing over coming months due to the latest bout of NZ dollar depreciation include: -

- Imported fuel and chemicals.

- Imported steel and other imported construction materials/hardware.

- Imported food, particularly fruit and grocery items imported from Australia (the NZD/AUD cross-rate depreciating 7.30% from 0.9350 in April to the current 0.8665 level).

Importers of the above-listed goods do not generally hedge the NZD/USD and NZD/AUD FX risks further forward than three months, unlike the clothing/electronic/appliance retailers who are usually highly hedged nine to 12 months forward. Almost immediate price increase have to be expected from these higher import costs. Construction costs have been reducing in recent years with the weak demand, contributing to the lower inflation rate. However, with the demand now increasing (refer to large increases in building consents), the likelihood is that construction costs will start to increase again through higher cost imports and shortages of skilled labour (many have moved across the ditch to Australia).

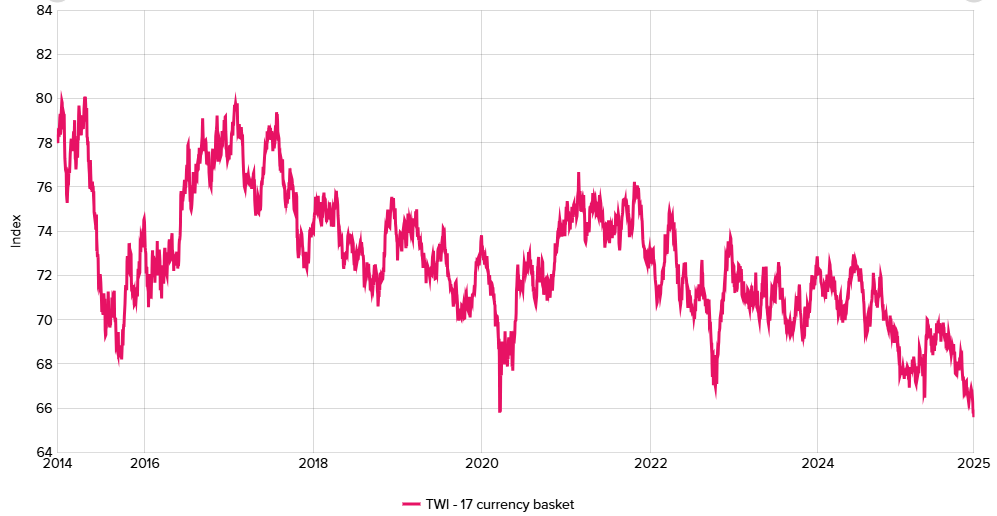

The overall value of the NZ dollar, the Trade Weighted Index (“TWI”) of 17 cross-rate currency pairs has dropped away sharply over recent weeks as the RBNZ have aggressively cut interest rates to stimulate economic activity. The TWI Index is down to new five-year lows of 65.60 (refer to the chart below), depreciating 6.30% since July. The TWI has returned to the lows below 66.00 reached when the NZ dollar was sold off in the early days of the Covid pandemic crisis in early 2020. The TWI rapidly rebounded back upwards in 2020, as it also did in 2022 when the Kiwi dollar was sold off during the UK Gilt Government bond crisis in October 2022.

Why the TWI value of the NZ dollar is important is the fact that the RBNZ always assume a stable TWI Index going forward when they compile their inflation forecasts. In their last full Monetary Policy Statement on 20th August the RBNZ assumed a 68.00 TWI for their 2026 inflation forecasts. When they produce their next set of economic forecasts on 26thNovember they will be adjusting their tradable inflation forecast higher as the TWI Index is now considerably lower than 68.00.

There have been reasonable expectations that Trump’s tariffs would force Chinese manufacturing exporters to dump product into markets like New Zealand at lower prices as they divert export goods way from the US market. There has not been any real evidence of this occurring, however our local tradies are enjoying the cheaper utes like BYD now available out of China.

In continuing a policy to cut the OCR interest rate further that depreciates the Kiwi dollar, the RBNZ walk that fine line between stimulating the economy through stronger exports and importing inflation. If the annual inflation rate was around 2.00%, they could tolerate some increase in tradable inflation through a lower currency value. However, they are currently breaching their 3.00% upper limit, therefore really have no room to tolerate a lower exchange rate.

The RBNZ also have a responsibility under their Policy Targets Agreement with the Government not to conduct monetary policy changes that cause undue volatility in the economy, interest rates and the exchange rate. They are currently at risk of doing that with the now material depreciation of the NZ dollar against the USD, AUD and Euro.

Wholesale price data (Producers Price Indices) for the September quarter due for release on 19th November will provide the markets with some hard evidence of the higher import costs now being experienced. A quarterly increase close to 1.00% will not be comforting news on the inflation front for the RBNZ and the markets.

chart:daily exchange rates]

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

Without reading through the detail of the article, I am sure R Kerr's key point will be exactly the same as it ever was, the NZD will strengthen against the USD imminently...

While the erratic buffoon is in the Whitehouse (well, what's still left of it), anything is possible. The uncertainty he creates is what has seen the USD remain elevated for so long.

At least the article is acknowledging the risk that the lower valued Kiwi dollar to inflation. Something that most have been conspicuously silent on. Not least the RBNZ. But they are being asked to do the work of monetary and fiscal policy with only monetary policy and it isn't going to work.

Further interest rate cuts are going to lead to imported inflation and the RBNZ will be in a trap of their own making by early next year - negative GDP, rising unemployment and rising inflation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.