Summary of key points: -

- The risk of the RBNZ “overcooking” monetary policy stimulus – again?

- The US shutdown is over, the markets await key sets of economic data

- Japanese political changes stymie the expected Yen appreciation

- The “lucky country” powers on

The risk of the RBNZ “overcooking” monetary policy stimulus – again?

The decisions taken at the next RBNZ monetary policy meeting on Wednesday 26th November will be critical to laying the platform for both interest rate and foreign exchange rate movements over the next six to 12 months. The interest rate markets are currently pricing-in another 0.25% cut in the OCR interest rate to 2.25%, in doing so concluding that there is not sufficient evidence yet that the economy has turned the corner.

There are several risks with the view that the economy requires yet more stimulus at this point in time: -

- Whilst the RBNZ may well justify another OCR cut on the current negative output gap and excess capacity in the economy, that analysis looks backwards at historical labour market trends. In any case, the RBNZ mandate is to focus solely on inflation, not jobs, investment and economic growth.

- We are not in an infamous “no regrets” economic situation with monetary policy stimulus. Interest rates have been slashed 3.00% from 5.50% to 2.50% in just over 12 months, it would be prudent for the RBNZ to sit and wait to observe the always lagged economic responses to that high level of stimulus.

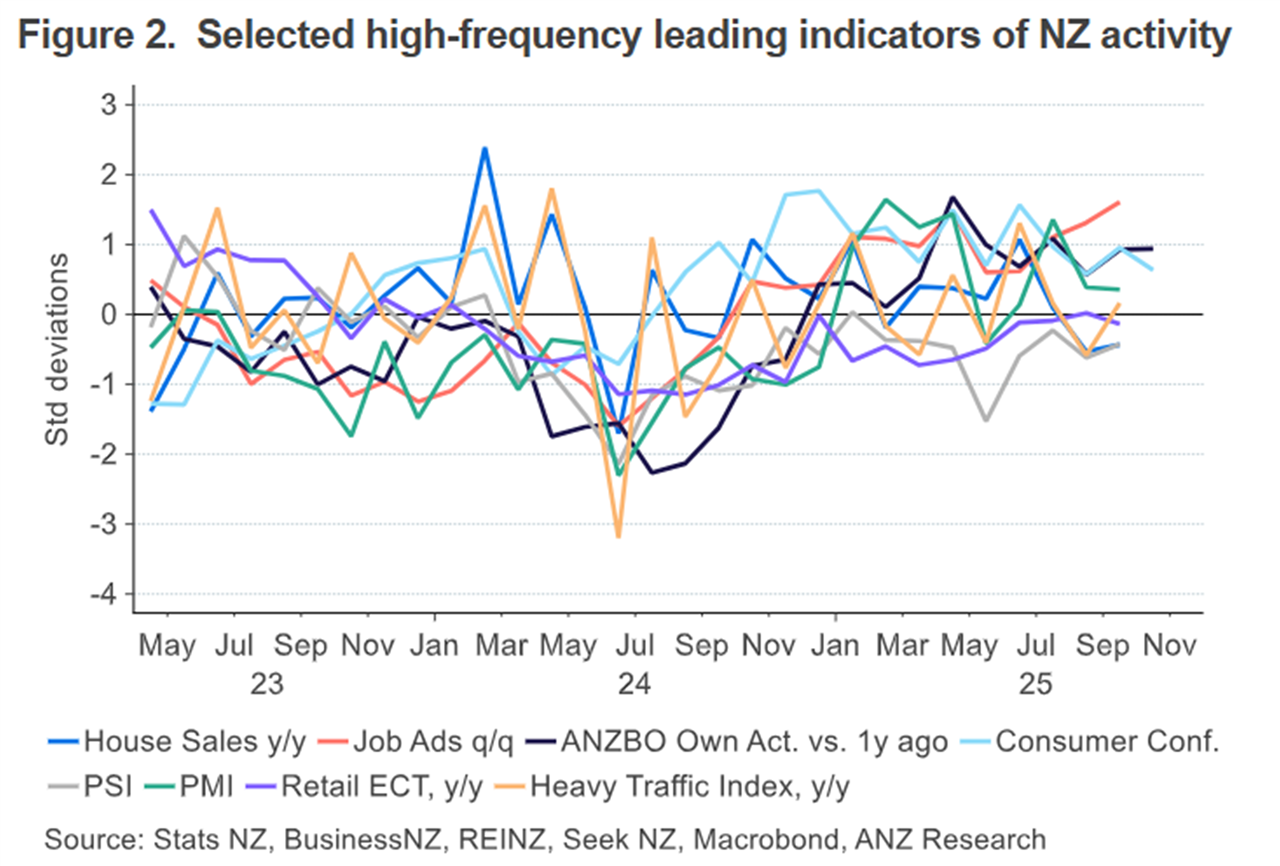

- Back in August the RBNZ highlighted the abrupt softness in the short-term, “high frequency” survey type economic indicators that informed them that the economy was not as robust as what they were forecasting earlier in the year. The chart below confirms a steady recovery and now uptrend in the majority of those indicators since mid-year, particularly job adverts and building consents (not in chart).

- If the RBNZ were forecasting annual inflation to fall below the lower limit of 1.00% in 12 months’ time, there would be a good reason to continue to cut the OCR interest rate further. However, that is not the case. In fact, the opposite situation of annual inflation being currently above the 3.00% upper limit and it may well stay there on higher food price, lower currency and historically sticky non-tradable (domestic) inflation. It is a brave (and perhaps dangerous) call to state that the current uplift in inflation is “temporary” or “transitory” – ask US Fed Chair Jerome Powell about this risk.

- The widespread fears expressed by the RBNZ, local economists and even the Prime Minister a few months back that Trump’s tariffs would cause much uncertainty and therefore be negative for the NZ economy, have proven to be unfounded. The RBNZ need to seriously review this global trade risk in the econometric modelling. The uncertainty was actually caused by the local fearmongering!

- The RBNZ should also be super conscious of the risk of “overcooking” the monetary stimulus, causing another housing boom (money too cheap!) and having to subsequently deal with the resultant inflation increases. It is time we learnt our lessons from the RBNZ orchestrating boom/bust economic conditions.

The RBNZ’s own NZ GDP Nowcast predictor model is currently signalling a 0.60% expansion in the economy over the September quarter and +0.20% for the December quarter. The surveyed components of both Nowcast predictions are the most negative. However, surveys such as business and consumer confidence have picked up over recent months. The October manufacturing PMI survey for October improved to 51.40 from 50.10 in September. The related services PSI survey results are released on Monday 17th November and they may also record a similar lift (currently 48.3).

The net result of the data analysis is that the overall economy is no longer contracting, global risks have decreased and exporting regions have a strong upward momentum. Unless the RBNZ are seeing something that we are not, the risks of over-stimulating seem to exceed just sitting pat.

It would be a major surprise to the markets if the RBNZ did not cut the OCR on 26th November. However, if that surprise is delivered, the Kiwi dollar will recover a lot of its lost ground.

The US shutdown is over, the markets await key sets of economic data

The US Bureau of Labour Statistics have notified that the Non-Farm Payrolls jobs data for the month of September will be released this Thursday 20th November at 8.30 am New York time (= 2.30am Thursday morning NZT). The normally accompanying household survey of employment and the unemployment rate will not be released. The October PCE inflation release is now scheduled for release on 26th November. Other US economic data releases are not as yet scheduled.

Should the economic data be uniformly weaker, then more voting members of the Federal Reserve will be swayed to cut their Fed Funds interest rate again on 10th December. In the meantime, the markets will reflect the likelihood of softer numbers with US bond yields lower and the US dollar depreciating. The latest bout of short-term USD strength now appears to have run its course with the USD Dixy Index returning to 99.20 from levels above 100.00 last week. Another Fed interest rate cut on 10th December would certainly send the US dollar value lower.

The US tariff situation continues to be a moving feast with tariff rates now being reduced for bananas, beef and coffee as Trump realises that cost of living pressures for the middle- and lower-income groups will be damaging the Republican’s chances in the mid-term elections next year. We still await the US Supreme Court’s ruling on the legality of the tariffs, however in economic terms not a lot will change with the Trump regime finding other legislation to confirm the tariffs.

Expect to see profit-talking in US equity markets as we near the end of a very big year of value gains, however additional interest rate cuts are a countering positive for equity markets.

Japanese political changes stymie the expected Yen appreciation

The Japanese bond and currency markets have not reacted well at all to the rapid political changes occurring in the land of the rising sun over recent months. The Japanese Yen was poised to make substantial gains against a generally weaker US dollar, however that expectation has been stymied by the new Prime Minister Ms Sanae Takaichi signalling a looser fiscal policy stance and also not wanting the Bank of Japan to raise interest rates to get inflation back under control. Since early October the Yen has depreciated from 146.50 to 154.50. It seems that the Yen can only turn around and strengthen if the Bank of Japan return to their previous stance of lifting interest rates. The markets may have to wait until the new year to see that happen.

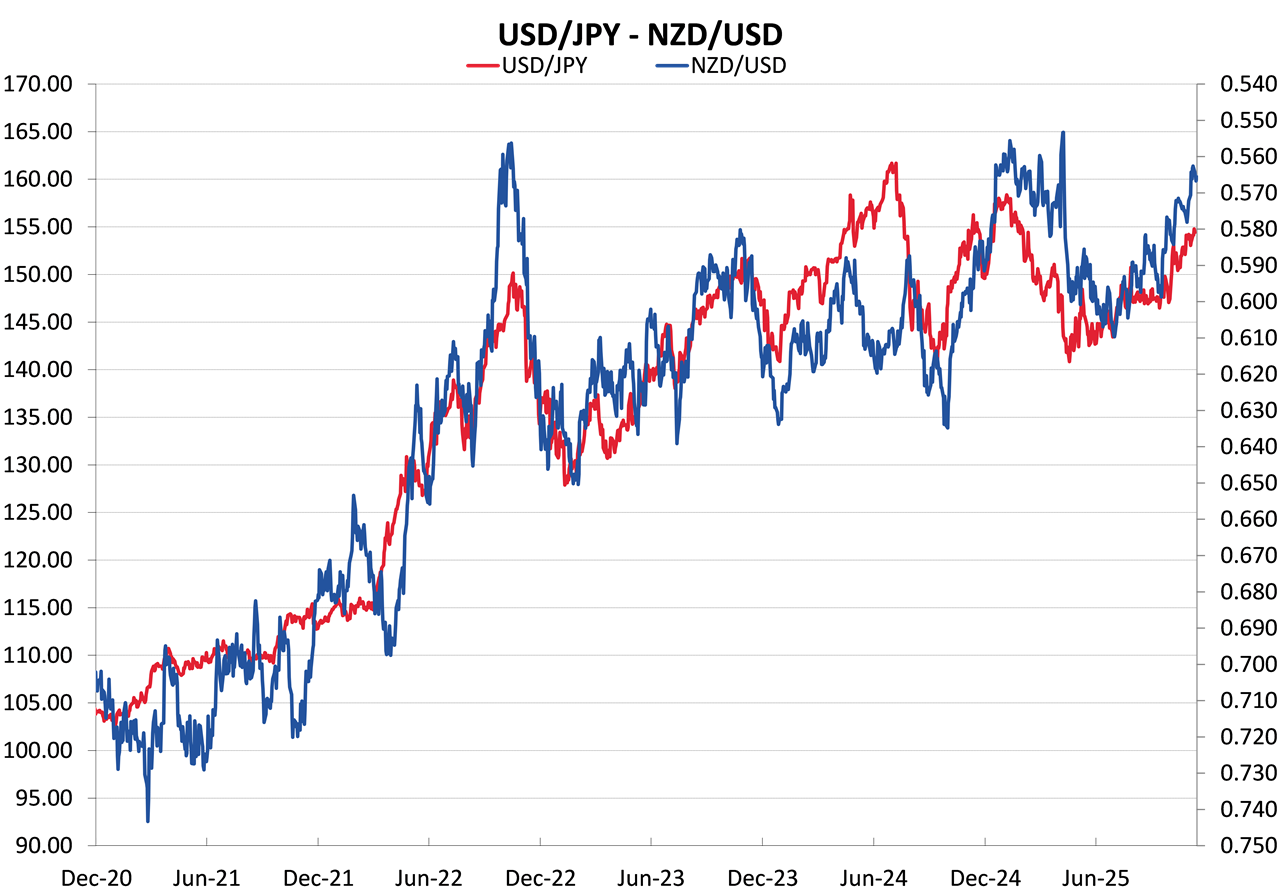

The NZD/USD exchange rate, as an Asian currency, is closely correlated to the Yen movements (red line on the chart below). The Yen weakness over the last six weeks has certainly contributed to the Kiwi dollar falling away into the 0.5600’s. A return of the USD/JPY rate to nearer 140.00 again would allow the Kiwi dollar to return to around 0.6000.

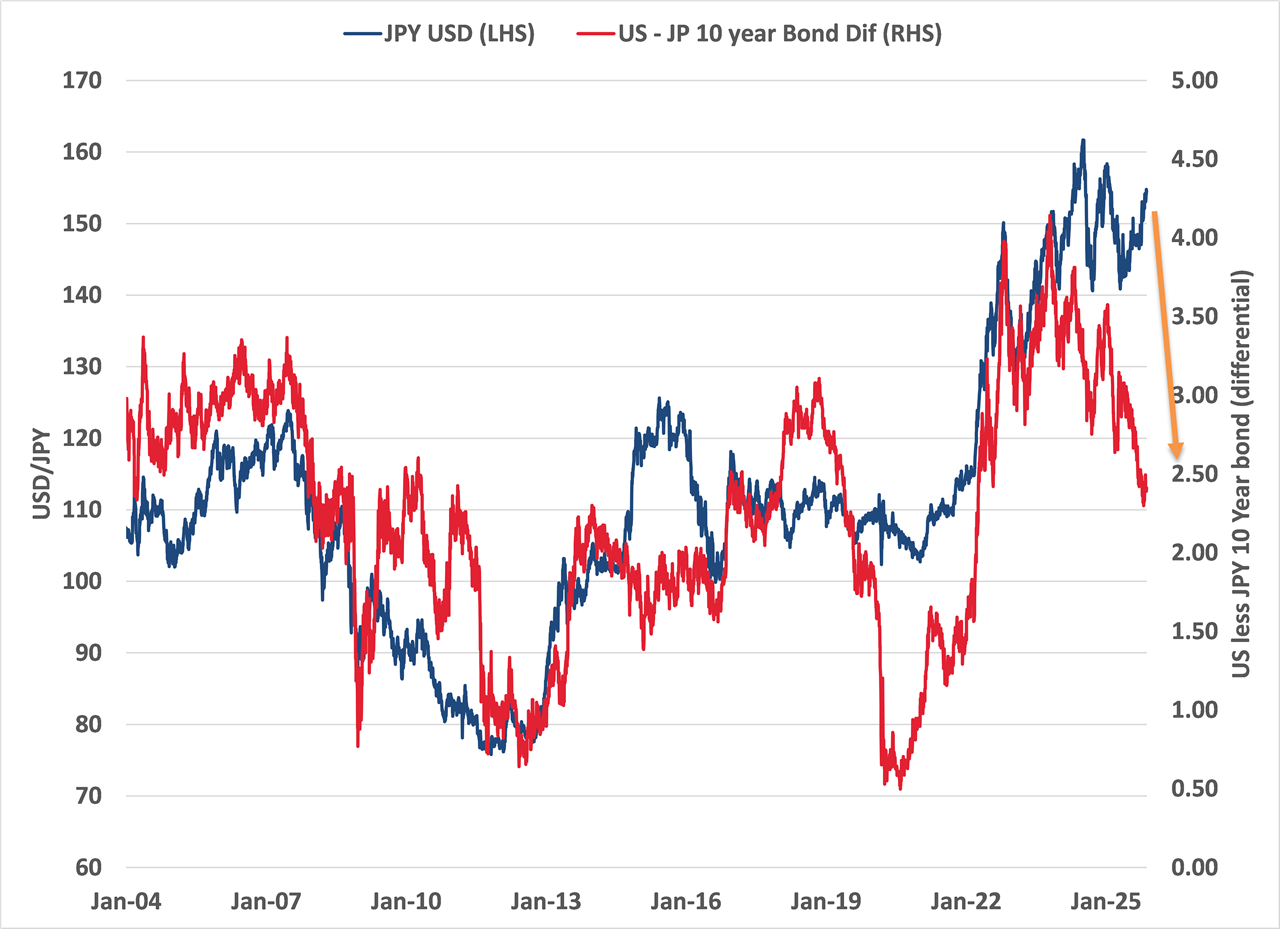

A major determinant of the USD/JPY currency value is the difference between US and Japanese 10-year bond yields. Changes to that interest rate differential drives investment capital flows between the US and Japan. The chart below confirms the dramatic closing up of the bond yield gap from 4.00% (Japanese bond yields 4.00% below those of the US – red line) two years ago to just 2.45% today. US 10-year bond yields have reduced to 4.15% and Japanese yields have increased to 1.70%. The historical correlation points to the Yen being undervalued against the USD at 154.50, the bond yield differential change signalling a stronger Yen towards 130.00 and 120.00.

The “lucky country” powers on

The preconditions for the widely regarded undervaluation in the Australian dollar to appreciate all seems to be in place; however, the currency continues to disappoint. The AUD/USD exchange rate remains in the low 0.6500’s despite a much stronger than forecast employment data released last week. The increase in jobs in October was a robust 42,200, well above prior forecasts of a 20,000 loft. The unemployment rate reduced from 4.50% to 4.30%. As a consequence of the stronger jobs numbers, the local interest rate market shifted their pricing of another 0.25% cut in the OCR by the RBA on Tuesday 9th December from above a 60% probability to less than 40%.

The housing market and consumer confidence measures in the Australian economy continue to improve. The disruption to global trade from Trump’s tariffs has not really hurt the Aussie economy with their export commodity prices remaining at profitable levels.

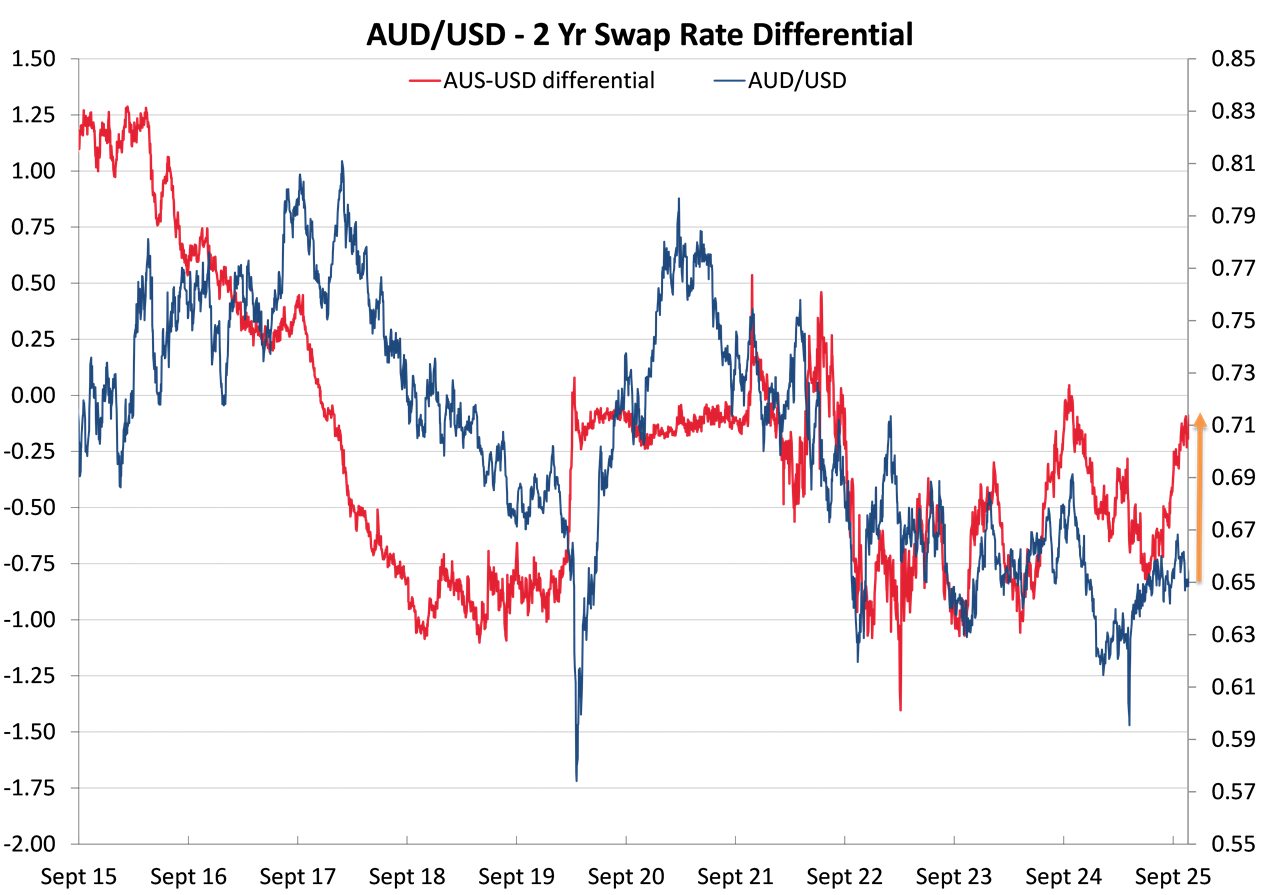

It only seems a matter of time before the AUD/USD rate breaks above previous resistance levels at 0.6700 and moves upwards to 0.7000. The interest rate differential between the USD and the AUD has closed up from Aussie interest rates being 0.75% below those of the US (two-year swap rates) in July to close to 0.00% today (red line on the chart below). Over recent years the Australian dollar has been unable to appreciate due to its interest rates being well below the US. That situation has now fundamentally changed with Australian short-term rates remaining at 3.60% and US interest rates expected to reduce further below 3.60%. The interest rate gap is about to change to Australia’s favour.

Australian CPI inflation data on 26th November and GDP growth figures on 3rd December should add to the case for the RBA to not cut their interest rates on 9th December.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

2 Comments

The same for longer.

Hi Roger,

Thanks for your article and insights. I agree with your observations around the lag in the data, though I wonder if you might be subject to the same dynamic. While the tariff effects currently appear muted, time may tell a different story—especially if a US recession unfolds over the next 6 to 18 months.

Valuations across asset classes seem stretched. There’s no shortage of clever minds and sophisticated instruments chasing gains wherever they can be found. What concerns me is where this ultimately lands for the rest of us—the everyday investors who aren’t wired into the machinery. The disconnect between financial engineering and real-world outcomes feels increasingly stark.

US data appears to be in a holding pattern, gold has recently hit record highs (heaven forbid Bitcoin returns to its 2010 price of

I don’t have any answers, and I agree we don’t want the RBNZ overstimulating and further amplifying the boom-bust cycle, particularly in housing. It’s not an easy job—good luck to our new Governor.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.