Summary of key points: -

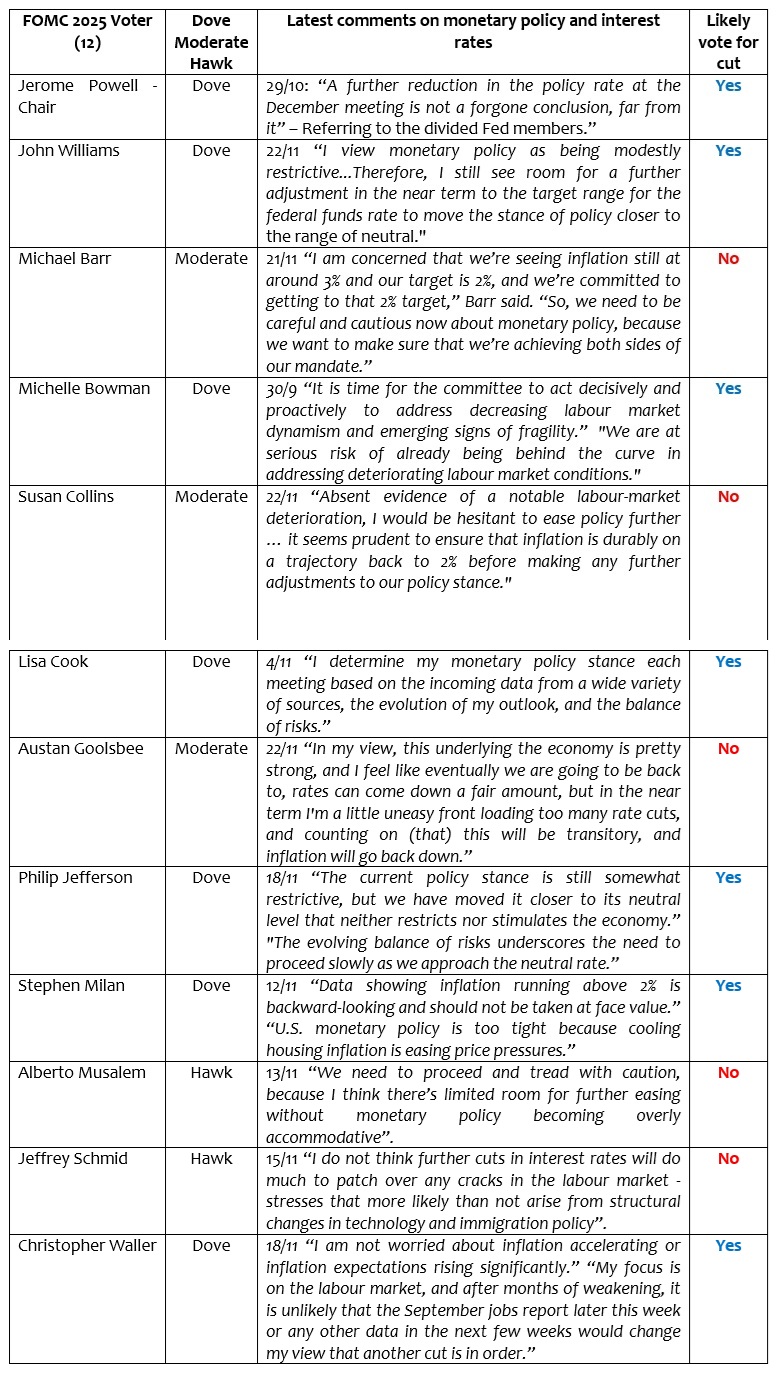

- Scoring how the Fed members may vote on US interest rates

- Verbal intervention halts the Japanese Yen sell-off

- RBNZ monetary easing coming to an end. Will it be the end of the Kiwi dollar downtrend?

Scoring how the Fed members may vote on US interest rates

The dominant determinant of the next movements in US interest rates and the US dollar currency value will be how the 12 voting members of the Federal Reserve FOMC committee submit their votes to cut the Fed Funds interest rate by another 0.25% on 10th December. Media reports point to the committee being deeply divided on the issue. However, the very latest comments from New York Board Member John Williams on Friday 21st November, wherein he sees the need to cut, swung the interest rate market pricing from a 35% probability of a cut to above a 70% chance of a cut.

Our scorecard of how the 12 voting members measure up on the prudency of another 0.25% cut is as follows: -

The moderates who may waiver on which way they vote over coming weeks include Barr, Collins and Goolsbee. The scoresheet above assigns them a “no” vote for a 0.25% interest rate cut. It does seem that the vote will come down to which way Chairman Powell and Vice-Chairman Jefferson vote.

On the face of the analysis, seven members (a slim majority) are likely to vote for another 0.25% interest rate cut.

Last week’s September Non-Farm Payrolls employment data painted an uneven picture of the labour market with jobs increasing by a stronger than expected 119,000, however the unemployment rate increased from 4.30% to 4.40% as more folks are actively looking for a job. Over the last 12 months, the strong pattern of the monthly Non-Farm Payroll employment data is repetitive revisions downwards in the job increases subsequent to the initial release. In particular, September is a month that has been constantly revised lower subsequent to the initial release over recent years. The fence-sitters at the Fed will be looking for indicators from other private sector measures of the employment situation in the lead up to the 10th December meeting.

Unfortunately for the Fed, the Bureau of Labour Statistics is not releasing the October Non-Farm Payrolls numbers until they publish the November results on 17th December, a few days after the Fed meeting. Likewise, the official CPI Inflation figures for October will not be published, the November inflation result being released on 19th December.

In many respects, the US interest rate markets are already placing their bets on which way the Fed decision will go. The 10-year Treasury Bond yield has decreased from 4.15% on 20th November to 4.06% at the market close on Friday 21st November. The two-year Treasury Bond yield also falling away from 3.57% on 20th November to 3.50% at the close on Friday. The two-year bond yield is now at is lowest level since mid-2022.

We have not seen the same reaction to sell the US dollar in the foreign exchange markets in response to John Williams’ dovish comments on US interest rates. The USD Dixy Index has remained elevated above 100.00 over this last week. Lower US equities markets have caused a “risk-off” sentiment with investors, not allowing the NZD and AUD to recover from their recent sell offs. The Japanese Yen has been independently depreciating for its own reasons, keeping the USD Index above 100.00 for the meantime.

Verbal intervention halts the Japanese Yen sell-off

The Japanese Yen currency finally located some support against the USD last Friday after several weeks of depreciation caused by the political changes in Japan. The Japanese authorities have ramped up the level of verbal intervention to stem the currency’s decline. The Yen popped higher after Japanese Finance Minister, Satsuki Katayama said intervention was a possibility to deal with excessively volatile and speculative moves, leaving traders on alert for signs of Yen buying from Tokyo. The USD/JPY rate topped out at 157.80 on Friday 21 November, before the intervention threat, the rate pulling back to 156.40 at the close.

The change in direction in the Yen/USD rate allowed the NZD/USD rate to recover from 0.5590 to close at 0.5620.

The Japanese Yen has depreciated 8.50% against the USD since new Prime Minister Ms Sanae Takaichi came into office on 4th October (145.50 to 157.80). Her announced policies of more Government spending and opposition to interest rate hikes causing a loss of confidence in Japan by global currency markets. On top of that, she initiated a diplomatic spat with China that has prompted the Chinese to threaten an end to exports of rare earth minerals to Japan and halting tourists going to Japan. It seems that economic realities will force a backtrack by the Prime Minister on her unpopular stances.

Inflation in Japan increased by 0.40% in the month of October, considerably higher than prior consensus forecasts of a 0.10% decrease. The Bank of Japan Governor, Kazuo Ueda has expressed concern at the weaker Yen increasing import costs and therefore inflation.

A reversal in the Yen’s fortunes before the end of the year seems likely, particularly if the Bank of Japan catches market positioning of short-sold Yen with interventionist Yen buying.

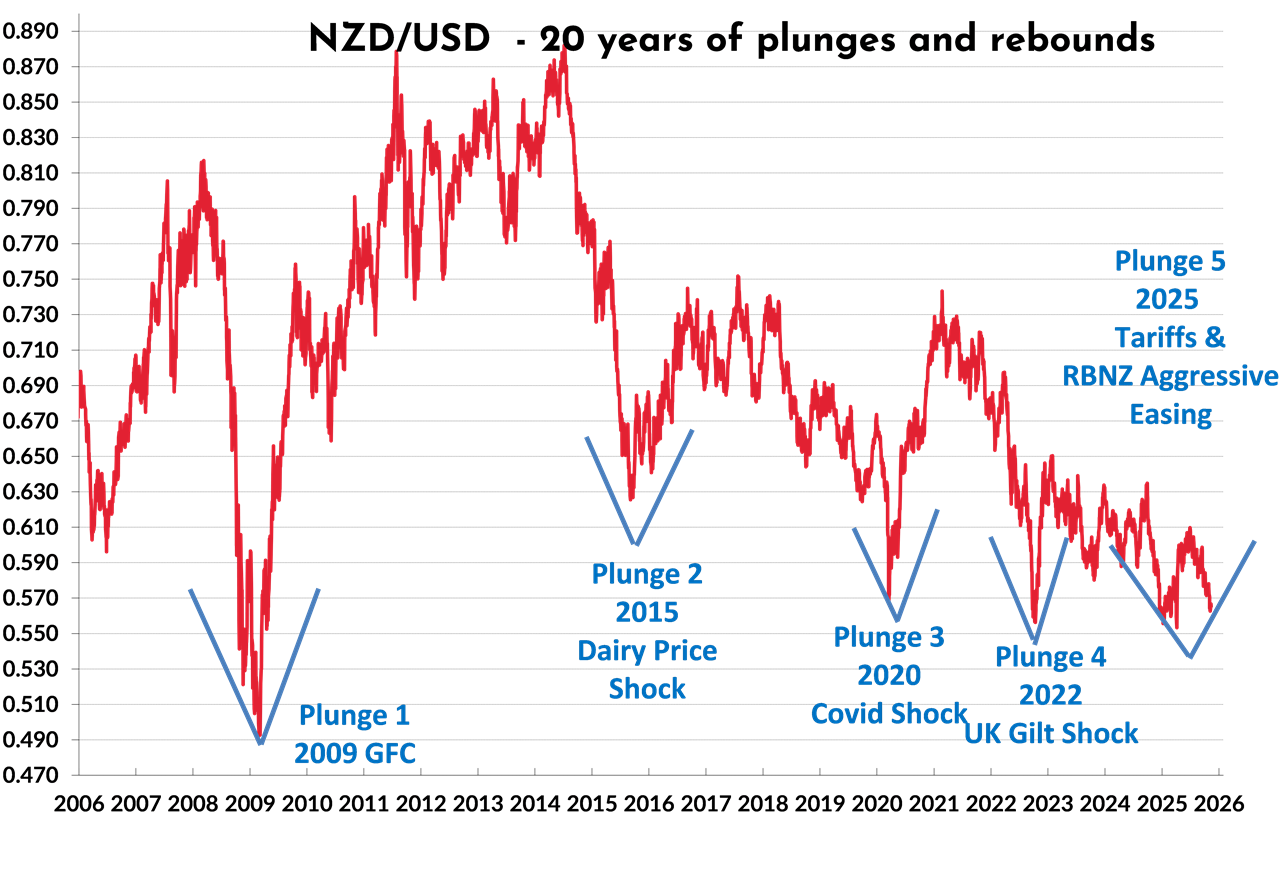

RBNZ monetary easing coming to an end. Will it be the end of the Kiwi dollar downtrend?

The brief plunge in the Kiwi dollar to 0.5500 against the USD earlier this year was caused by Trump’s April “Liberation Day” extreme tariff announcement. As it has transpired over the last eight months, the negative disruption to world trade and economic growth from the US import tariffs has been much less than first feared. The Kiwi recovered back up to 0.6100 through April, May and June on a weaker US dollar against all currencies as foreign investors adopted a “sell America” strategy, due to the high level of economic policy uncertainty from the new Trump regime.

Since July, the USD itself has moved sideways as the financial markets balanced up higher US inflation from tariffs against weaker employment from the business uncertainty caused by tariffs.

Over recent months the NZD/USD exchange rate has fallen away again on its own account, unrelated to general US dollar movements. Three factors have been behind the latest plunge to 0.5600, resulting in a two-pronged plunge in 2025: -

- The 0.90% GDP contraction in the June quarter. History tells us that these negative GDP figures will be subsequently revised by Statistics NZ to something a lot less than -0.90%.

- RBNZ cutting the OCR by 0.50% to 2.50% in early October in response to a sharp deterioration of short-term/high frequency economic indicators. Most of these indicators have rebounded back up in September/October.

- Speculative selling of the NZD against the AUD when the RBA and stronger economic data in Australia pointed to an end of Aussie interest rate cuts at 3.60%. New Zealand interest rates are more than 1.00% below those of Australia, stimulating the sell NZD/buy AUD FX trades.

We await the RBNZ’s prognosis on the fledgling New Zealand economic recovery at this Wednesday’s Monetary Policy Statement (including updated economic forecasts). The unanswered question is whether the RBNZ now consider that they have done enough monetary easing at 2.50%, or do they see little risk in another insurance 0.25% cut to 2.25%. The interest rate market and the FX market have already fully priced-in a cut to 2.25%, so it would be a major surprise if the RBNZ decided not to cut. Outgoing Interim Governor, Christian Hawkesby is probably not into surprises in his last major act for the RBNZ. Even if the RBNZ do cut to 2.25%, their rhetoric and tone is likely to suggest they are nearing the end of the monetary easing cycle.

If that proves to be the case, the two-pronged plunge in the Kiwi dollar to 0.5600 in 2025 may mirror the previous four “plunges and rebounds” from similar levels over the last 20 years (refer to the chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.