Economists at the country's largest bank are predicting that inflation will be back to the targeted 2% level by mid-2024, but they see "a long and difficult battle" for the Reserve Bank (RBNZ) against domestic inflation pressures.

In an NZ Insight publication ANZ economist Finn Robinson and chief economist Sharon Zollner say "surging wage growth" and ongoing local cost pressures will see NZ-generated inflation "hold up around current highs" till early next year before gradually easing. This publication is the second part of a detailed crunch of the inflation picture by the ANZ economists, with the first published earlier in the week.

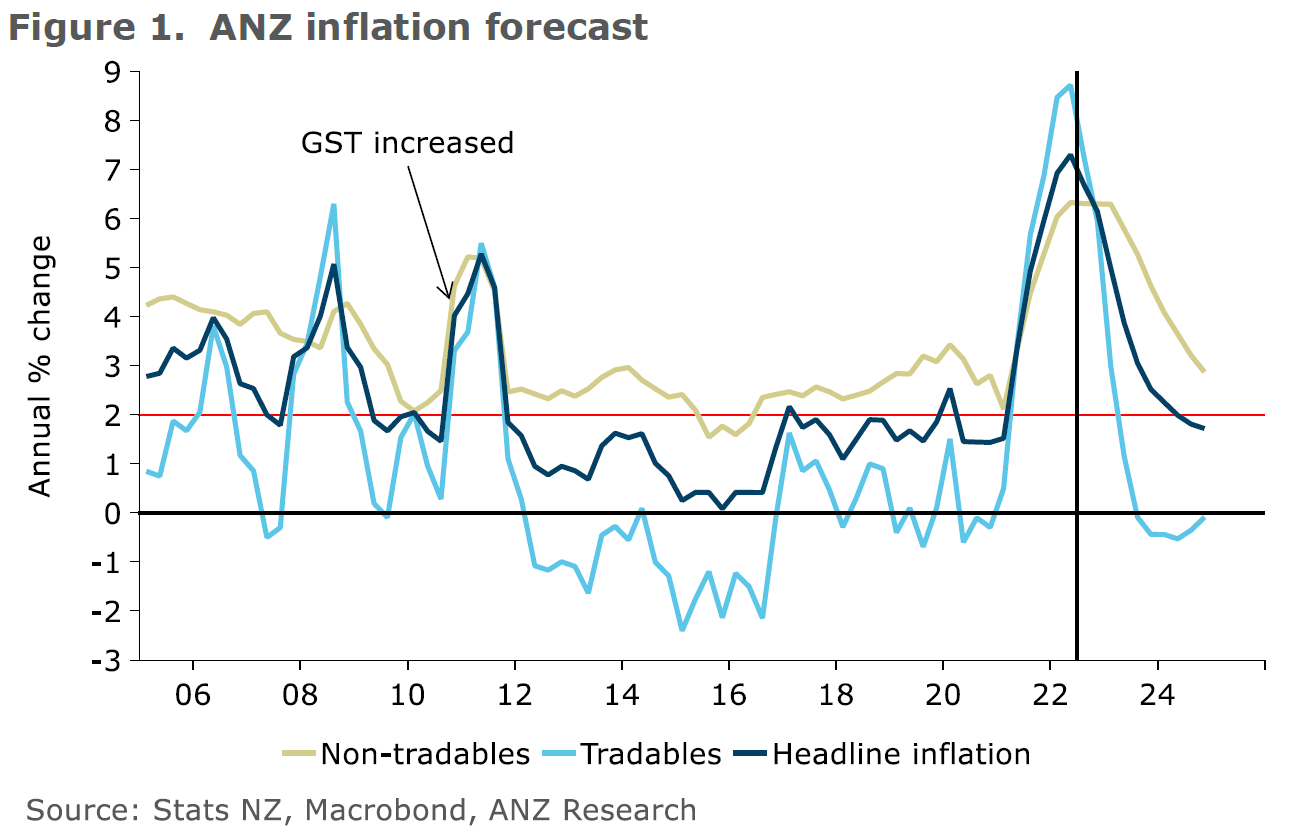

The RBNZ has been aggressively hiking interest rates since October last year to counter inflation that has been running very hot, reaching 7.3% by the June quarter of this year. The ANZ economists believe that was the peak. The Official Cash Rate has been hiked by the RBNZ to 3.0% so far and the ANZ economists see this peaking at 4.0% by the end of this year - although they do see risks it will have to go higher.

Wholesale interest rate markets are currently pricing in a 4.25% OCR by the middle of next year, with some leaning now even toward a 4.50% peak.

While forecasting a peak OCR of 4.0%, Robinson and Zollner say "risks are firmly tilted" towards more hikes taking the OCR above 4% needing to be delivered to bring inflation down swiftly enough.

"There’s certainly not much wriggle room on that front. Even in our central forecast, inflation would have been above the 2% midpoint of the RBNZ’s target band for three years. We see risks around the outlook for both domestic (non-tradable) and global (tradable) components of inflation."

The economists say the key is to distinguish between the short and medium term.

"In the very near term, we fully expect inflation to ease, and quickly, particularly thanks to factors like rapidly falling oil prices. But over the medium-term, we see significant risks that inflation will remain too high for too long, which would necessitate further OCR hikes in order to bring inflation back to target within an acceptable timeframe."

They say that "front and centre" on the domestic inflation front is the possibility that rapidly accelerating labour costs (absent a commensurate increase in productivity) could see domestic inflation pressures come in stronger and more persistent than forecast.

"We currently anticipate that annual growth in private sector productivity-adjusted labour costs will peak at 4.4% in the first quarter of 2023 (versus 3.4% in Q2 2022). But wage pressures have surprised recently with their strength. Domestic labour demand remains insatiable, and with the Australian labour market likely to add further heat over the next year, upside surprises feel likelier than downside ones."

This highlights, the economists say, the "double-edged sword" that is sharply rising wages.

"It sounds like great news for households, and it’s no doubt a relief for workers, particularly those on lower incomes, who have been watching inflation eat away at their real purchasing power. But for the RBNZ, strong wage growth means that household demand is more resilient to the aggressive interest rate hikes that they have delivered – ie that more OCR action could be required to slow spending sufficiently to bring inflation down."

Robinson and Zollner say that as surging inflation gets factored into wage and price-setting behaviour, it raises the risk that a 4% OCR is no longer as much of a brake on the economy as previously thought.

"In other words, high inflation expectations and wage growth mean the neutral OCR could currently be creeping higher (the neutral OCR is the level of the OCR that is neither contractionary nor expansionary for the economy). In coalface terms, people’s idea of what a 'reasonable' mortgage rate is might be gradually lifting again, just as it gradually fell as inflation and nominal interest rates trended lower over years and decades.

"The RBNZ’s latest estimate of the neutral OCR is 2%, but they have already said that they are revisiting their models, and some members of the Monetary Policy Committee have given a range of 2-3% as their sense for where neutral is.

"It’s a big deal, as changes in the neutral OCR go 1:1 into the required OCR. If the neutral OCR is 3% rather than 2%, then an OCR closer to 5% rather than 4%would be needed to deliver the monetary tightening required to bring inflation back to 2% within an acceptable timeframe, all else equal. Sounds high, but so is inflation. And it’s still well-below the 8.25% OCR peak seen before the GFC (although the housing market was still in full bubble mode at that point, whereas currently house prices are falling)."

On a global perspective, the economists believe that "one-off spikes" in inflation look likely to become more common.

"While Covid appears to be in retreat as a global disruptor (touch wood), geopolitical tensions continue to raise the risk of ongoing commodity price surges, or a retrenchment of global trade. And the ongoing costs of adverse weather conditions continue to mount as climate change rolls inexorably forward. All of these factors mean the era of New Zealand importing global deflation through our import prices is probably behind us.

"All in all, it’s an inflation soup out there, both domestically and internationally. We’ve seen a perfect storm of supply-side impacts through COVID-19 and the supply chain chaos it has unleashed, combined with what turned out to be overly powerful fiscal and monetary stimulus (given how unexpectedly resilient economies turned out to be over the past few years). While we are forecasting that a 4% OCR will be enough to achieve a return to 2% inflation over the next two years, there are clearly significant risks that interest rates will need to go higher to engineer a timely return to target."

In summing up the situation, Robinson and Zollner say it’s not all one-way traffic for interest rates, but the balance of risks remains firmly tilted towards more hikes being needed than less.

"While headline inflation numbers look like they may have peaked in several countries, including New Zealand, that’s not sufficient. Central banks need to ensure inflation gets all the way back to their targets, and in a reasonable timeframe (ie within a couple of years).

"If the process is too slow, neutral interest rates will rise significantly, and central banks could find themselves on a treadmill of ever-higher rates just to stay still in terms of the real level of tightening they are delivering."

42 Comments

Dear Government - monetary policy needs fiscal policy friends more so than ever. And by fiscal policy - I don't mean further cost-of-living subsidies. That's entirely unsustainable.

The RBNZ cannot bring cost-of-living down via interest rate rises. That too is entirely unsustainable.

Can you put some numbers in your formula to give us a couple of examples for different value houses within a district.

The value of 'x' depends on what cycle in the 3 year RV review period a particular district is in and its median household income. I did the numbers last year for the Hutt Valley where RVs are due to be updated this year - so RV's were roughly 3 years old. I used the value of 'x' set at zero - and I found the average rent by properties on the rental market at the time were 14% over my the median weekly maximum target. Indicating that when RVs are re-set the value of 'x' might be upwards of 20, depending on how rental prices vs income are trending when the RVs are re-set. The good news is that incomes are rising, albeit slowly - and house prices are dropping - albeit slowly (very little turnaround yet at what are the new market prices).

If you have a particular district you want me to apply the formula to in order to calculate 'x' - I'd be happy to do so!

So a typical median RV of $1m, in a district of median gross household income of $100k pa would give 'x' of 42%.

A house in the same district with an RV of $600k could charge a maximum rent of just under $350 per week.

I think there would be unintended and unforseen consequences. Also hard to see it getting over the line politically.

I think it would be good to run the numbers for two rentals both with an RV of $600K, say one in Kaitaia, one in Taupo.

Never said it was easy to get over the line politically. But then transformative policy never is - unless it's a greater 'handout' (subsidy) from society-at-large (i.e., the accommodation supplement).

Will do those two markets later today.

PS - would really appreciate your ideas of what the unintended consequences might be. Bear in mind, the formula is applied universally.

.

One consequence may be that landlords prefer to invest in areas of higher median income to median house price ratio, as this will give them a greater return on investment. Is that intended?

Also how would you handle where the dwelling being rented does not equal the total value on the RV ? eg a second house on the owners title.

Kate, no doubt you've studied this closely, so can you give us some examples of where your formula would give adverse outcomes, without studying it I'm thinking:

-a run down house on expensive land

- a new house on cheaper land

- comparing the first quarter of a district with the fourth quarter

The problem with controls of this nature is they're highly likely to lead to perverse outcomes, and enterprising people will find a way to exploit it for their personal gain. I guess a black market for rentals could emerge too...

Sorry I'm late, Beanie - hope you come back for the exercise you asked me to do.

Taupo

Median (individual) income = 30,300, so double for median household income = 60,600 - therefore 30% of 60.600 = 18,180, or weekly maximum rent target = $350.00/week (rounded)

Median property value (Waikato District) = 788,550

(788,550/1000) - x% = 350

x = 58

For a property with RV = (600,000/1000) - 58% = $252 weekly rent maximum

Kaitaia

Median (individual) income = 19,700, so double for median household income = 39,400 - therefore 30% of 39,400 = 11,820, or weekly maximum rent target = $230/week (rounded)

Median property value (Northland) = 725,000

(725,000/1000) - x% = 230/week

x = 68

For a property with an RV of $600,000 = (600,000/1000) - 68% = $192/week

Gives you a good idea why the accommodation supplement (private rental market subsidy) is roughly $2 billion/annum (last time I looked) - and add in emergency accommodation costs to that - and the formula demonstrates why we went from a "housing crisis" (5,000 on the state house wait list) under Key to a "housing catastrophe" (30,000 on the state house wait list) under Ardern.

Thanks for that Kate. You should cut and paste that into another relevant thread to get a wider range of opinions.

If you deduct 10% PM fee, and another $50 pw (minimum) allowance for rates insurance etc, you will see the return on investment is 44% higher on the Taupo rental (that it is too low is another topic) so that we would see landlords exiting the Kaitaia market. FHB would buy them when the price has fallen a looong way down, remembering rents are cheap now. Is this an intended consequence?

Taupo FHB would have to fight off investors who have moved their sites to Taupo, which may drive prices higher. Investors would be entering the market despite it still being a lousy return in anticipation of a change of government that would 'tweak' the rent controls.

Thanks for this and other comments above on unintended consequences.

Yes, I can see that, but, as you say the ROI is too low in Taupo - so why would a rational investor go from a bad ROI to a less bad ROI as a means to put their excess capital to work for them?

I assume you might think rents are "cheap" now, based on rental yield being as low as it is?

Yes, typical yields don't make good investment sense these days - but that is because property values are overvalued on a price to income metric - not because rent is cheap.

I don't think you are arguing that generally rents are affordable - if they were successive governments of both colours would not be subsidising them to the tune of 2 billion a year. And even with that level of subsidy, rents are still (in many cases) not affordable.

Will investors run for the exits in our lowest of low income regions - it will depend on when they purchased the property and how much debt they have on it. But will those that have excess capital (equity) they end up with and move to invest it in another poor performing investment class located somewhere else in NZ - I doubt it. Interest in the bank or investment in a profitable business would be the way to go.

PM fee is a choice a landlord makes - they don't have to use one, and it's not considered as part of the rent-setting equation by tenancy law.

350p/w is actually a pretty good ball-park figure for Taupo - I have family who rented a large house there for $340/week up until they moved into their new build [still in Taupo] in 2020. We were looking at similar rentals for roughly the same price then as well (though demand is high there due to the number of holiday homes owned by non-locals).

Property prices falling + cheaper rents + more people owning = sounds like a good idea, especially in Kaitaia which has significant levels of poverty.

Thanks - good to know the ballpark looks right for Taupō. When I tested it for the Hutt - what I found was that from the median RV up, the formula worked out not far off the market. But, it was in the lower value RV properties that the weekly rents were way too high. Looked sadly like the current market fleeces the poor.

I was recently looking at suburbs around Wellington - house values compared to median incomes. A couple stood out, in particular Island Bay where median household incomes were at or below national median based on the 2018 census however house prices generally 1.5 - 2x the national median. There are some very tired, run down 2 - 3br houses renting for $1200+ pw in Island Bay. Cases likely this are what make me think we still have a lot of downward pressure in the market. Entirely unsustainable without major wage inflation, and given the economy is being squeezed this money is disappearing fast.

I believe the real issue is that in Wellington at least, there are supposedly 80k homes. 40k of which are rentals. There have been major restrictions on expanding the city and renters are simply being squeezed out. Quite literally, they're leaving.

Yes, a particular problem for the student population, but many other demographics in the city area are highly affected - pensioners who do not own their own home being one. I'm not sure where there is room for greenfield expansion (aside from further intensification) in the WGN area - that expansion of (what could be considered greenfield) row townhouse complexes seems to be higher in the suburbs (e.g Hutt Valley) where based on lower valuations more generally, it has made sense for developers to bowl the old single dwelling stock on the site and build multi-dwelling new. Rent prices are still $700/week plus on those though. And that is still unaffordable based on median household incomes in the Hutt Valley.

(RV/1000) - x% = weekly rent maximum

Katharine Moody should join the Labour party, she'll fit right in, ideas with no substance!

I'm a member of TOP.

Ah, yes. TOP that brought Bill Mitchell over here for a lecture and then understood nothing of what he had to say.

excellent . the kind of vote that SHOULD be wasted .

I never voted in the Trump v Biden election either - given voting for either was a wasted vote. Granted Nats and Labour aren't that bad, but...

Easy Yvil, I don't agree with it either but it's actually being proposed in both Australia and the UK right now. Kate is as entitled to her view as we are.

In fact, it would not surprise me one iota if it was introduced - we are living in disfunctional times. I read this morning that we are discussing a carbon linked trade agreement with Germany, that is the beginning of the end, you heard it here first. The moment we start taxing Chinese good because of their emission is the end of society and lifestyle as we know it - to the point I would consider emigrating.

Katharine why not petition govt to confiscate all rental property and rent it directly. It has been done before and you are half way there.

Yeah, but I do not want a return to our old colonial ways.

Would this not just end up with slums where all the poor people gravitate to the cheap to rent suburbs resulting in a downward cycle in rent? I guess at some point they could just put a fence around the area and isolate societies social problems within.

I quite like the idea of this unintended consequence.

That's exactly what they've done (put a perimeter fence patrolled by security guards) around a number of motels (emergency accommodation) in Rotorua.

Watch Sunday 4 September episode

Required watching for Robertson/RBNZ appointment committee:

Tom Hagen: Michael, why am I out?

Michael: You're not a wartime consigliere, Tom. Things may get rough with the move we're trying.

Great article here - in summary, against today's market prices for properties, no one will make a decent yield. But, many investors (far more than not) bought when house prices were affordable - and they are doing just fine based on profitability, but not yield;

https://www.stuff.co.nz/business/property/129793096/property-investors-…

I remain bemused that the IR hasn't taken a test case based on these sort of numbers. i.e that the intent for capital gain can be inferred and thus the gains are taxable.

Brightline has made IRD's life a whole lot simpler no need to take that fight now. Next change will be to extend the brightline to infinity and then it can be called what it really is, a capital gains tax.

“Ultimately there’s no natural income streams to be able to service and repay loans. What you have is capital gains which are contingent on the game continuing. So it’s a Ponzi scheme. says Werner. - https://wire.insiderfinance.io/richard-werner-qe-infinity-707e2c627e03

How's that PaTh oF LeAsT ReGreTs working out Adrian Orr?

Muppet.

WeAlTh EfFeCt 🤪

DuMb aNd dUMbEr

Looking at the graph, this does feel like best case scenario. At any rate it's difficult to see what may happen over the next year or two, especially with all that may happen offshore.

Basically, there's no need to bet on it right now and I certainly wouldn't be putting my money in the ring. I guess in a way that's putting my money in my mouth, and holding on to it as tight as possible.

Why is it that workers and households are always the ones that are deemed to bear the costs of inflation? We have economists saying that unemployment must rise to tame inflation and workers must reduce wage increases to below inflation and yet there are never the same calls to stop businesses from passing on costs or to reduce their profit margins.

Much of our economy suffers from a lack of true competition and where companies are free to charge us as much as they think that they can get away with. The power companies and supermarkets as an example.

Landlords are another example.

There is too much uncertainty to put any weight in these predictions.

We are facing an unprecedented number of unprecedented events. War, pandemics, and weather events to name a few.

Betting on horses is safer than speculating on the time and speed of OCR changes.

But she'll be right, interest rates have peaked, housing market is resilient af, election next year, low wage immigration, CCCFA changes, it's spring!

I can't think of many other straws to grasp.

While Covid appears to be in retreat as a global disruptor (touch wood), geopolitical tensions continue to raise the risk of ongoing commodity price surges, or a retrenchment of global trade. And the ongoing costs of adverse weather conditions continue to mount as climate change rolls inexorably forward. All of these factors mean the era of New Zealand importing global deflation through our import prices is probably behind us.

Agreed. This is why I think the low inflation and low neutral OCR rate era had been passed. Globalisation is in retreat which brings higher demand and lower supply. There will be less money flow to assets and more money flow to goods and products which will give a decent boost to productive industries. The cost to service debt will be high also. But there are still many uncertainties and perhaps some bumpy roads ahead. But this the future trend I can see in general.

I find it fascinating that economists never seem to mention the very real prospect of a deep, deep recession and it's inflation-negating potential. There are signs of a potential financial crisis brewing, or barring that big economic weakness building around the globe which could result in plenty of demand destruction

Look at their prediction of a steep plunge in tradeable inflation.

In contrast, non-tradeable inflation not really starting to drop till late '23 early '24. I think it will start dropping mid '23.

Last year we were told inflation was transitory - incorrect. Now what do they want people to believe, with NZD tanking and most countries in recession we will see this downturn last for more than 18 months, rates will continue to climb until inflation is under control. You can be sure it will hit anyone with debt, in New Zealand this will destroy housing market as it’s so overvalued compared to incomes ( million plus for 3 bedroom box on tiny piece of land in Auckland 10 x average couples income what could go wrong )

If ANZ are say inflation will be back within target by mid 2024 just add another year on could be right or maybe not. Let face it when was last ANZ forecast correct.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.