By David Hargreaves

The Reserve Bank is going to relax its high LVR lending limits from January 1.

The easing of the LVR restrictions will involve loosening the deposit requirements for investors to 35% from the current 40%.

As far as owner-occupiers are concerned, the RBNZ says it will roll back the current 'speed limit' applied to banks of just 10% of their new lending for loans of over 80% of the value of the property. This 'speed limit' will be relaxed to 15%.

(Clarification: The 'speed limit' applies to the banks. It does not make any direct difference to what an individual depositor requires. The relaxation of the rules means that the banks will be able to lend now to more people who have less than a 20% deposit than they could before. The relaxed rule means that from January 1 banks will be able to advance 15% of their new lending for mortgages where the buyer has a less than 20% deposit. Up till now the banks have only been able to advance 10% of their new lending for mortgages where a deposit of under 20% is put in place.)

In announcing the beginning of rolling back the LVRs, RBNZ Acting Governor Grant Spencer signalled that developments in the market in the wake of these changes would be watched closely.

“The Bank will monitor the impact of these changes and will only make further LVR adjustments if financial stability risks remain contained," he said.

"A cautious approach will reduce the risk of resurgence in the housing market or deterioration in lending standards."

The changes announced on Wednesday by the RBNZ, when releasing its latest Financial Stability Report (FSR), were signalled to some extent by the central bank earlier this month.

But it is fair to say that the announcement does go further than certainly a lot of bank economists were expecting, with many thinking that the RBNZ would merely outline the process for how a gradual relaxation of the LVRs might occur.

ASB chief economist Nick Tuffley said the relaxation of the LVR restrictions "happened a little sooner than we had expected".

"The financial stability risks in housing have receded. However, given a degree of uncertainty around how temporary the election has impacted market activity and uncertainty over when government tax/housing policies will take effect, we had expected the RBNZ would wait a little longer. But the shifts are modest."

He said the ASB economists expect that any future moves would follow the pattern of the first move, with incremental easing of the restrictions.

"The next obvious moment for a future RBNZ decision is the next FSR, in May next year. By that stage the RBNZ will have been able to assess how the housing market has behaved in the initial months after the January easing, as well as have a clearer idea of the Government’s housing-related actions."

This is the statement released by the RBNZ:

New Zealand’s financial system remains sound and risks to the system have reduced over the past six months, Reserve Bank Governor Grant Spencer said today when releasing the Bank’s November Financial Stability Report.

“Momentum in the global economy has continued to build over the past six months, reducing near-term risks to financial stability. However, the New Zealand financial system remains exposed to international risks related to elevated asset prices and high levels of debt in a number of countries.

“Domestically, LVR policies have been in place since 2013 to address financial stability risks arising from rapid house price inflation and increasing household debt. These policies have helped improve banking system resilience by substantially reducing the share of high-LVR loans. Over the past six months, pressures in the housing market have continued to moderate due to the tightening of LVR restrictions in October 2016, a more general firming of bank lending standards and an increase in mortgage interest rates in early 2017.

“Housing market policies announced by the Government are also expected to have a dampening effect on the housing market.

“In light of these developments, the Reserve Bank is undertaking a modest easing of the LVR restrictions. From 1 January 2018, the LVR restrictions will require that:

- No more than 15 percent (currently 10 percent) of each bank’s new mortgage lending to owner occupiers can be at LVRs of more than 80 percent.

- No more than 5 percent of each bank’s new mortgage lending to residential property investors can be at LVRs of more than 65 percent (currently 60 percent).

“The Bank will monitor the impact of these changes and will only make further LVR adjustments if financial stability risks remain contained. A cautious approach will reduce the risk of resurgence in the housing market or deterioration in lending standards.

Deputy Governor Geoff Bascand said “Looking at the financial system more broadly, the banking system maintains adequate buffers over minimum capital requirements and appears to be performing its financial intermediation role efficiently. The recovery in dairy commodity prices since mid-2016 has supported farm profitability and has helped to reduce bank non-performing loans in the sector. Recent stress tests suggest that banks are well positioned to withstand a severe economic downturn and operational risk events.

“The Bank has released two consultation papers on the review of bank capital requirements and a third paper on the measurement and aggregation of bank risk will be released shortly. The aim of the capital review is to ensure a very high level of confidence in the solvency of the banking system while minimising complexity and compliance costs.

“The Bank has also completed a review of the bank directors’ attestation regime and is making good progress in implementing a new dashboard approach to quarterly bank disclosures. This is expected to go live next May,” Mr Bascand said.

At the RBNZ's release of the latest Monetary Policy Statement earlier this month the central bank was more confident than previously about the possibility of the housing market taking off again, with Spencer then saying: "Low house price inflation is expected to continue, reinforced by new government policies on housing."

The previous warning contained in past releases that "there remains a risk of resurgence in prices" was gone.

The LVRs were originally brought in towards the end of 2013 as part of the new 'macro-prudential toolkit' that had been signed off between then Finance Minister Bill English and then RBNZ Governor Graeme Wheeler earlier that year.

The latest iteration of the LVRs saw housing investors slapped with a 40% deposit requirement. While this was officially applied from October 1 last year, it effectively began being implemented by the banks straight after it was announced by the RBNZ on July 19, 2016.

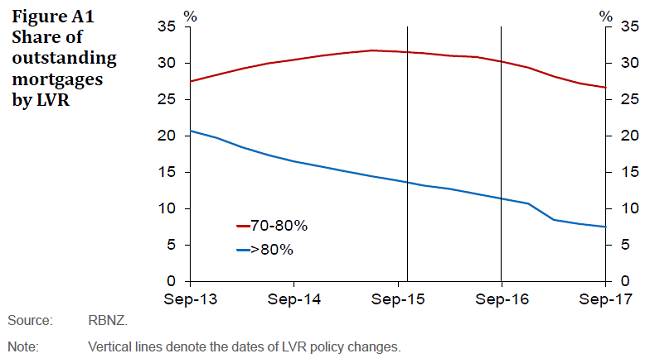

The RBNZ said in its latest FSR that prior to LVRs originally being introduced in 2013, the share of banks’ mortgage portfolios with LVRs above 80% had steadily increased to 21%, "posing a risk" to financial stability.

"This reflected that around a third of new loans being originated had LVRs above 80%.

"As a result of the LVR policy, the share of outstanding mortgages with LVRs above 80% steadily declined to under 8% in September 2017 (figure A1).

"Tighter LVR rules applied to property investor lending have seen the share of outstanding mortgages at LVRs between 70% and 80% decline since late 2015."

97 Comments

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

- Ludwig von Mises

A hitchhiker's guide to the galaxy

"“Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich. […]

“But we have also,” continued the management consultant, “run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut.” […]

“So in order to obviate this problem,” he continued, “and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and…er, burn down all the forests. I think you’ll all agree that’s a sensible move under the circumstances.”

Exactly - they need to 'pump' more money into the market as otherwise no-one will buy and the prices will crash. 2500+ houses on Trademe in Auckland City. that is DOUBLE than was a year ago! You can really pick and choose between a nice house for 4m at remuera or crappy do-up on cross lease in mt roskill for 800k. .... Hold on ... but those prices are still not for the normal people , are they?

they must have data that tells them they need to do this to stop house prices crashing rather than a gentle decline.

I think it goes much deeper than that. The real issue is related to the "what if" scenarios related to asset values and the overall economy. When your economy is inextricably linked to an asset class, there are all kinds of issues that need to be dealt with. For ex, 1. continued and / or stable asset prices (consumer spending is sucked from other sectors of the economy) 2. Falling asset prices or a "crash" (removal of the wealth effect which weakens consumer spending).

gingerninja, it's the self gratification thing - makes materialistic people happy.

A relative of mine bought a big home out West Auckland. Queen of a Castle she was. Bought all sorts of shiny things to put in it, including a flash car. The house turned out to be leaky. All dreams shattered, now suffering depression, had a breakdown and lost all up about $200K. Just a working class girl too.

Life's too short - keep it simple and live within financial means.

You could ask the same question about many behaviours. The one top of mind right now for me is how many marriages/defacto partners will make it to retirement with the same partner? I'm in my 50s and it's gone crazy in my social circle in the last three years. Divvying up the net worth has more impact on a couple's financial health than any penchant for putting the shiny new car on the mortgage, which I agree in itself is crazy behaviour.

The banks should remain stable provided they do not start lending to Speculative Investors based on their property portfolio. Property investors need to provide a substantial deposit or the NZ property market will run out of control again.

Even with relaxing the LVR restrictions for First Time Buyers, It's not going to help those paper millionaires in central Auckland, they'll still continue to drop to more affordable levels, below a million mark or if you think of it another way. Down to 2010 values.

CJ099, your statement is wrong. There has never been an LVR restriction on first home buyers. The LVR restrictions capped new lending with a deposit of less than 20%, at 10% of total new funds lent this has been increased to 15%. Banks could lend a 100% to an owner occupier if they wanted to. Effectively banks would use this 10% allocation for high LVR loans for owner occupiers, principally first home buyers. The changes give the bank more scope to make low deposit loans, I would expect this to still be targeted at owner occupiers.

Ha, ha, Not for Auckland. Have you forgotten that China has we and truly slammed on the breaks for their main land Chinese Investors who have not been able to invest in property full since early this year.

That's why central Auckland has dropped $200k (Almost -20%) since March and will continue to decline for quite some time.

Nation of Debt: Half a trillion dollars and still rising

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=118…

Unbelievably stupid.

Have they not been watching the RBA painting themselves neatly into a corner, wedged between asset prices and world leading debt.

The analogy that comes into my mind is:

Seatbelts (LVRs) were put in place to make driving safer because the car (house prices) was accelerating heavily. The car is now travelling at about 270kph but has stopped accelerating, so it's safe to remove your seatbelts now....madness.

This will not end well.

Not Really, you are all using the same old yardstick to measure current and future market conditions ( or as some economists call it the new normal) ... Sure most of us don't like it and cannot get our heads around the logic of carrying too much debt ...However, my limited exposure to people in business and property on the ground while in AUS recently concluded that it was no different than NZ and elsewhere in the world - the numbers are much bigger there !! BTW same Bloomberg Article is making the rounds !!

I read an analogy which said: Don't worry about debt? no one will ask for it back until the US stops borrowing and pays its 20 Trillion back ( if ever) ... look how that chunk of debt ( bubble) is treated !! Debt proved to be the only medicine to salvage the world after GFC and put us all in the intensive care unit ( weather we liked it or not !)

Tension and risks will ease when they get overboard and when it is time to release the pressure, albeit very slowly - it is foolish to think that RBs and Finance Authorities around the world let this happen haphazardly !! the world's economy is a big interlaced sophisticated machine and there is always collateral damage on the sides to get it running and more than one person ( or Nation ) needs to carry the can

Here is what Mr. Spencer summed it up in this regard:

"The central bank didn't plan to introduce the debt servicing instrument when it first proposed adding it to the tool-kit, but rather saw it as a useful addition to a future cycle. The financial stability report notes "the level of house prices remains particularly stretched relative to incomes and rents in Auckland and some surrounding cities" and if there was a "disorderly" correction it coiuld amplify an economic downturn.

"The housing market is cyclical and down the track, there will be another housing cycle and debt service instruments may well be appropriate at that time," Spencer said. "

Do you honestly believe that all the RB's globally are in control!!!! Do you believe that the GFC was a "controlled event planned and foretasted by the RB's????? Do you understand that the last event was caused by unserviceable debt? Can you even comprehend the fact that the current level of debt makes 2008 look like a pimple on a baby's arse?

For the first time since perhaps the Great Inflation, there is an unnerving official, mainstream sense that monetary policy and effective monetary conditions may not be at all the same thing.

http://www.alhambrapartners.com/2017/11/28/inflation-expectations-corro…

Yes I do Groen_mamba, but you surely missed my point, invented a statement I did not say, and jumped to conspiracy theory conclusions which seems to be your prefered way of thinking !!

I did NOT mention the causes of GFC as we all know what they are, I was talking about the current situation and about the RB coordinating QEs and monetary policies and interest rates around the world to control its effects - these are two different things .... read my post carefully again.

the current debts ( including CDs and other complex debt instruments) is a drop in an ocean, everyone knows that, hence after 10 years of money printing they are now signalling that they "would" consider tuneing that down a notch next year or the year after, no one is yet talking about paying the debt or any method of writing some of that off -

I hope you can comprehend the difference .!!

So if I try to continue the example a little further in regards to your response, are you saying that 270kph is the "new normal" and therefore we shouldn't worry about it? And that because some other drivers are travelling at 300kph we shouldn't be worried about going 270kph? And also that because the end of the road isn't in sight we're all good?

Central bankers are absolutely NOT coordinated enough to plan and manage the global economy together. I actually think they're all desperately trying to stave off the inevitable and frantically trying to NOT be the nation that tips the whole thing over.

The debt response to the GFC was necessary but there was no day 2 plan for the withdrawal of the medicine and now we're hooked on the opiate of cheap debt to the point where we think our addiction is normal and that there's something wrong with the non-addicts.

The main point to note in the announcement today is that the RBNZ started feeling the pain in the market and its effect on the overall business in the country ( including the construction industry), hence signaling that it might ease LVR further depending on how this reduction worked in relieving some pain caused by having restrictions for too long - the LVR is a two edged sword, so it was about time to ease.

I expect an improvement in market activity next month ( sales volumes will increase ) with stabilized prices this summer. Looks like we will be gradually heading back to the 2-5% pa price appreciation in the main centres again.

Those who hoped for a Crash can now relax and have a cold one , read the writing on the Wall - it's time for FHBs to hunt for an opportunity and close a deal when they find one that suits.

OK, here's some questions that will sink your opinion to the bottom of the toilet bowl.

I expect an improvement in market activity next month ( sales volumes will increase ) with stabilized prices this summer. Looks like we will be gradually heading back to the 2-5% pa price appreciation in the main centres again.

Why do "I expect" and :looks like" mean anything without any robust explanation? And without any rationale, what makes your opinion any more than BBQ banter?

Those who hoped for a Crash can now relax and have a cold one , read the writing on the Wall - it's time for FHBs to hunt for an opportunity and close a deal when they find one that suits.

Why? Because you read it in the gift pack materials from the seminar? Without any reasoning, what makes you any different from the guy exhaling Jesus and selling pencils from a cup?

I am certain that many here will like your colorful language and expressions as they reflect your maturity in conducting a meaningful conversation.

No need to question or evaluate my opinion or anyone else's posted here - I did not ask you to do that !! and we are not in a contest or competition... But you seem to think it is a BBQ party or a free seminar ....!!

My posts are my own views and predictions, Not some Uni Lecture where some slow students need to be spoon fed until they grow some brains.

I am certain that many here will like your colorful language and expressions as they reflect your maturity in conducting a meaningful conversation

I think you're just trolling, but relatively unsophisticated at that dark art of the internet.

Naturally, if your views and opinions have any gravitas, the "why" question shouldn't be too much of a problem to deal with.

I hear if you go outside and put your finger in the air and feel which way the wind is blowing is a great way to predict which way house prices will move. You should try it JC.

Then you to can predict with utter certainty and people will believe you as well.

Then if your want you can sell sand to the Saharans.

Great analogy, and following on from that, what I think the RB are doing is giving the banks a chance to grow up (as it would be only a mindless teenager driving at that speed anyway), slow down and stop so they don't need to mandatory be told to wear a seat-belt anyway.

And once they prove to their parent that they are more responsible and can move forward again at a more comfortable inflation only speed, that they will naturally want to wear a seat-belt (higher LVR) anyway.

And their car of choice will be a new Toyota once they have traded in the smashed up Lambo. at a greatly reduced price.

The LVR restrictions should not become another tool which is fiddled with monthly. It works much better as a fixed standard that people can learn to work with. Adding a further variable to borrowing (interest rates and LVR) that is regularly changing will make planning more hazardous and only works on the assumption that the RBNZ has access to good data and sound predictions (it doesn't).

In other words, if they can meet their targets by fiddling with 1 variable, they have no chance of doing it with 2 tools.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=119…

Ashley Church performed his best chicken little role this morning in the Royal NZ Herald.

"'Perfect storm' of rent rises to hit market, Property Institute says"

Rents may rise up to 26 per cent as property shortages hit the market.

"Property Institute chief executive Ashley Church said research pointed to rent rises of up to 26.8 per cent in Christchurch in the past year and other big jumps elsewhere."

Using a few cherrypicked examples I haven't seen such nonsense in print for a while, well, not since the last time he was quoted by Anne Gibson who doesn't seem to know the distinction between paid publicity and journalism.

Ashley Church performed his best chicken little role this morning in the Royal NZ Herald.

Yes, Ashley Church has created his own myth about his own importance. Anyway, assume that he is right (even though there is no reference to the research in the media release) and rents rise by 26%. What happens when that money is removed from the consumer spending sectors of the economy both upstream and downstream?

That is more important than Ashley Church.

Well it's very unsurprising, there have been several rules making investing in houses less attractive, less houses to rent = higher rents.

(yes I know, in a idealistic world, landlords sell their houses to tenants who become home owners and everything is ... well perfect. Except that in the real world only a few tenants will buy off the landlords and become home owners)

So if only a few houses get bought what happens to the rest?.. oh, they stay rented and sit on the market till the owner drops the price until a former renter buys it. Or they sit empty till the bank sells them in a mortgagee sale... then a former renter buys them, or a landlord buys it and rents it. Landlords don't change the overall housing capacity (except the slum lords that divide perfectly good houses up into multiple generally illegal units)

Anyone want a free house plus $1,000.00?: https://www.stuff.co.nz/auckland/local-news/papakura-courier/99289568/r…

OK, maybe it's better to let the Fire Service raise it for training purposes....

That is going a bit further than a mattress and a busted TV. I take it this house did not sell for relocation and the previous owner paid to have it dumped, perhaps even illegally on someone else's property. There is likely a removal business who operates with a good profit or a trademe listing history. Bit of a laugh.

I can't share your view on landlords as I was a renter for many decades and I needed somewhere to live. I do however share your view on home ownership creating communities. in my area, 1071, owner occupation is high and it shows in the liveability of the area. Well kept properties, respect for neighbours, fewer fences, less obnoxious behaviour, less transience.

..yeah you get my drift though. Average kiwi was happy with one house....now the greedy want multiple houses and turn a blind eye to the damage they are doing - depriving the young of the fun we had, buying a cheepey, doing it up, create a family and a healthy community. Thus as a 'group' I despise the b###tds.

The property I highlighted 2 weeks ago that failed at auction ( after rejecting a pre-auction offer and relisting it at a much reduced price) apparently had a "Sold!" sticker slapped on it this morning. Coincidence? I doubt it! Shades of the discriminatory LVRs debacle of a few years back. RBNZ? Get ready for your Price Stability mandate to blow up in your faces.....

Not sure the relaxation of the 10% owner occupier <20% deposit is going to make any difference at all. If the banks can already write 10% of their loan with <20% deposit but are only writing 5%.. why would raising the limit to 15% make any difference?

So it just depends if there are enough delusional people that think buying an investment property with a gross yield of 3-4% is a good idea. (at least in Auckland, might be better returns in other cities)

Its amazing how quickly the Reserve Bank folded and agreed to do the Government's bidding when faced with the threat of being regulated. So much for being independent. Sure, lets get New Zealanders loaded up to the eye balls in debt again - its not like debt levels are not already at world record levels!

Hopefully the Reserve Bank can explain how the extreme levels of house prices and debt in 2017 is not more risky than the (much lower) levels of house prices and debt back in 2013 when they were implemented?

A feeble attempt to stop the rot

Banks are not going to increase their loans of more that 80% in the current environment unless the repaying potential & assurance of the asset holding value is rock solid.

So maybe a $100K home in Greymouth being sold to a newly qualified & employed Doctor would qualify....

Also how many investors are actively looking to buy in a flat to falling market with a negative outlook...

Throwing the banks a bone to take on further risk in a finely unbalanced market seems irresponsible. It may not have much of an impact, however the intent is clear, add a bit more demand to the market by injecting more debit into the market by accommodating those with low equity levels. Clearly not enough debt in the system yet.

"The central bank didn't plan to introduce the debt servicing instrument when it first proposed adding it to the tool-kit, but rather saw it as a useful addition to a future cycle. The financial stability report notes "the level of house prices remains particularly stretched relative to incomes and rents in Auckland and some surrounding cities" and if there was a "disorderly" correction it could amplify an economic downturn.

"The housing market is cyclical and down the track, there will be another housing cycle and debt service instruments may well be appropriate at that time," Spencer said.

http://www.sharechat.co.nz/article/91c88ca5/incremental-lvr-changes-to-…

The RBA is a sheltered workshop and its consistently wrong forecasts give politicians cover for not confronting real economic problems.

http://www.afr.com/opinion/columnists/why-real-wages-are-falling-and-th…

Not a major difference for anyone really!

You would wonder why Robertson even suggested to the Reserve Bank to tinker with the LVRs when I thought it was this coalitions idea to tighten up on the lending and drop prices to so called affordable level?

Won’t make a difference until they make it for 100 per cent of the lending rather than 15 per cent etc!

Opportunities in Christchurch are still around even though prices are at worst staying steady and not dropping whatsoever!!!!

Come on people, The RBNZ's remit is keeping the banking sector safe. Its not surprising they want to avoid a full blown price collapse in the provinces. Another option that could be considered from the government side is injecting a few billion of first home buyers grants into the housing market, as the Australians did in the early 2000's. That is doubly beneficial as it keeps prices up and the economy chugging without pushing up private dbt to gdp levels, it also increases the home ownership rate.

Still 800 new cars coming onto the roads in Auckland every week. Logic would suggest all these people have to live somewhere so rents and property prices will continue to increase. Plenty of people on here going on about a crash in the market, perhaps they should predict a date on that because it could be next week or if could be in 7 years, there is a big difference if your putting your life on hold waiting for it.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.