bank capital

Analysts suggest ASB's parent CBA, expected to need more capital to meet new RBNZ requirements, will splash out A$3.5b in share buyback

30th Jan 19, 3:53pm

Analysts suggest ASB's parent CBA, expected to need more capital to meet new RBNZ requirements, will splash out A$3.5b in share buyback

Roger J Kerr says low local inflation has reduced the risk of a NZD selloff, the NZD won't fall relative to the major currencies, and the gloomy AUD view is overdone

28th Jan 19, 8:13am

1

Roger J Kerr says low local inflation has reduced the risk of a NZD selloff, the NZD won't fall relative to the major currencies, and the gloomy AUD view is overdone

Deadline extended for feedback on Reserve Bank's proposals for increases to banks' regulatory capital requirements

25th Jan 19, 2:11pm

2

Deadline extended for feedback on Reserve Bank's proposals for increases to banks' regulatory capital requirements

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan details the nitty-gritty of the RBNZ proposals & what they might mean for bank customers

24th Jan 19, 5:00am

28

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan details the nitty-gritty of the RBNZ proposals & what they might mean for bank customers

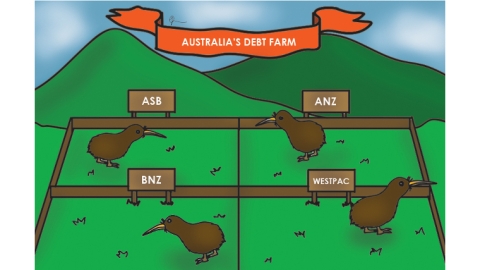

Against the backdrop of the RBNZ's bank capital review, Gareth Vaughan details the advantageous position NZ's Aussie owned banks have over their rivals & how this may change

23rd Jan 19, 5:00am

38

Against the backdrop of the RBNZ's bank capital review, Gareth Vaughan details the advantageous position NZ's Aussie owned banks have over their rivals & how this may change

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan explains how bank capital rules were liberalised for NZ's big 4 banks in 2008

22nd Jan 19, 5:00am

17

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan explains how bank capital rules were liberalised for NZ's big 4 banks in 2008

Roger J Kerr says the NZD isn't rising on improving global risk tolerance, and upcoming inflation figures will be key to the Kiwi's direction

21st Jan 19, 7:50am

2

Roger J Kerr says the NZD isn't rising on improving global risk tolerance, and upcoming inflation figures will be key to the Kiwi's direction

Westpac economists challenge their ANZ counterparts, downplaying the effect higher proposed bank capital requirements will have on interest rates

16th Jan 19, 9:23am

11

Westpac economists challenge their ANZ counterparts, downplaying the effect higher proposed bank capital requirements will have on interest rates

Roger J Kerr sees the neagtives accumulating for the US dollar allowing the Kiwi dollar to rise along with a global sentiment shift

14th Jan 19, 8:12am

2

Roger J Kerr sees the neagtives accumulating for the US dollar allowing the Kiwi dollar to rise along with a global sentiment shift

Roger J Kerr looks at the new year currency puzzle and sees the Kiwi dollar caught in the backwash of global market volatility

7th Jan 19, 7:54am

12

Roger J Kerr looks at the new year currency puzzle and sees the Kiwi dollar caught in the backwash of global market volatility

Gareth Vaughan details the two reports, the consultation process and the chart he'll be keeping a close eye on in 2019

24th Dec 18, 7:02am

80

Gareth Vaughan details the two reports, the consultation process and the chart he'll be keeping a close eye on in 2019

Roger J Kerr ends the year with some specific predictions on how the Kiwi dollar will track in 2019. He sees a game of three halves

21st Dec 18, 10:10am

9

Roger J Kerr ends the year with some specific predictions on how the Kiwi dollar will track in 2019. He sees a game of three halves

Slower than expected GDP growth, major bank capital changes, and a gloomy global outlook prompt ANZ economists to jump off the fence and forecast 3 OCR cuts by 2020

20th Dec 18, 3:45pm

45

Slower than expected GDP growth, major bank capital changes, and a gloomy global outlook prompt ANZ economists to jump off the fence and forecast 3 OCR cuts by 2020

BNZ interest rate strategist Nick Smyth has a crunch of the detail of the RBNZ's new bank capital proposals; says bank funding costs will increase but the RBNZ may offset future increases in lending rates with delays to OCR rises, or even cuts

19th Dec 18, 4:48pm

10

BNZ interest rate strategist Nick Smyth has a crunch of the detail of the RBNZ's new bank capital proposals; says bank funding costs will increase but the RBNZ may offset future increases in lending rates with delays to OCR rises, or even cuts

RBNZ's new capital requirements would need Heartland to lift its 'Tier 1' capital by about $15m a year; company believes the new requirements will stir more takeover activity and says it will consider any 'value-accretive' acquisition

19th Dec 18, 11:06am

4

RBNZ's new capital requirements would need Heartland to lift its 'Tier 1' capital by about $15m a year; company believes the new requirements will stir more takeover activity and says it will consider any 'value-accretive' acquisition

RBNZ bank capital proposals go well beyond the international norm, are highly conservative & positive for banks' credit profiles, Fitch says

19th Dec 18, 9:56am

9

RBNZ bank capital proposals go well beyond the international norm, are highly conservative & positive for banks' credit profiles, Fitch says

Analysts crunch the numbers on how much capital the big 4 banks & Heartland would need to meet proposed new RBNZ capital requirements

18th Dec 18, 12:40pm

Analysts crunch the numbers on how much capital the big 4 banks & Heartland would need to meet proposed new RBNZ capital requirements

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

17th Dec 18, 5:14pm

34

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

RBNZ capital proposals would see bank profits take a significant hit with billions of dollars worth of new Tier 1 capital required

17th Dec 18, 2:40pm

RBNZ capital proposals would see bank profits take a significant hit with billions of dollars worth of new Tier 1 capital required

RBNZ wants big 4 banks to increase assets held to determine capital requirements to 90% of what other banks hold, up from 76%

17th Dec 18, 2:38pm

RBNZ wants big 4 banks to increase assets held to determine capital requirements to 90% of what other banks hold, up from 76%

The ANZ Banking Group says ANZ NZ would need up to NZ$8 bln of new capital to meet RBNZ's new bank capital proposals

17th Dec 18, 9:37am

29

The ANZ Banking Group says ANZ NZ would need up to NZ$8 bln of new capital to meet RBNZ's new bank capital proposals

Roger J Kerr says the mood towards the US dollar value over 2019 should turn more negative, with the sharp increase in the US Government’s budget deficit cited as a reason to adjust USD currency holdings lower

17th Dec 18, 8:25am

6

Roger J Kerr says the mood towards the US dollar value over 2019 should turn more negative, with the sharp increase in the US Government’s budget deficit cited as a reason to adjust USD currency holdings lower

RBNZ proposes significant increase in bank capital requirements that will eat up 70% of the sector's profits over 5 years but only have a 'minor impact' on borrowers

14th Dec 18, 1:26pm

52

RBNZ proposes significant increase in bank capital requirements that will eat up 70% of the sector's profits over 5 years but only have a 'minor impact' on borrowers

Governor Adrian Orr says RBNZ to impose capital standards on banks that match the public’s risk tolerance

30th Nov 18, 2:24pm

23

Governor Adrian Orr says RBNZ to impose capital standards on banks that match the public’s risk tolerance

Higher bank capital requirements are necessary, RBNZ Governor Adrian Orr says, with big four banks' use of internal capital models to be constrained

30th Nov 18, 12:47pm

Higher bank capital requirements are necessary, RBNZ Governor Adrian Orr says, with big four banks' use of internal capital models to be constrained