credit cards

The Government details the Commerce Commission's proposed powers to regulate merchant service fees in a 'future-proofed' regulatory regime

13th May 21, 7:36am

The Government details the Commerce Commission's proposed powers to regulate merchant service fees in a 'future-proofed' regulatory regime

Government to empower Commerce Commission to regulate fees charged by banks and card companies that are paid by retailers and other small businesses

12th May 21, 9:05am

16

Government to empower Commerce Commission to regulate fees charged by banks and card companies that are paid by retailers and other small businesses

Kiwibank economists say according to the bank's own transaction data, spending slumped 9% in the March quarter

8th Apr 21, 11:46am

36

Kiwibank economists say according to the bank's own transaction data, spending slumped 9% in the March quarter

The FMA says ANZ had admitted making misleading representations in providing credit card repayment insurance to some customers

12th Feb 21, 12:47pm

9

The FMA says ANZ had admitted making misleading representations in providing credit card repayment insurance to some customers

Kiwibank economists have been tracking our spending - and we are still doing our best to make up for the lack of tourist dollars

29th Jan 21, 5:00am

39

Kiwibank economists have been tracking our spending - and we are still doing our best to make up for the lack of tourist dollars

Government outlines wide ranging merchant service fee regulation proposals including 'hard caps' on interchange fees

10th Dec 20, 12:08pm

2

Government outlines wide ranging merchant service fee regulation proposals including 'hard caps' on interchange fees

Kiwibank economists have been scrutinising our Covid spending. It's good news and bad news. We are eating really healthily. But we're drinking more and gambling

6th Oct 20, 3:14pm

2

Kiwibank economists have been scrutinising our Covid spending. It's good news and bad news. We are eating really healthily. But we're drinking more and gambling

Reserve Bank figures show credit card billings dropped a seasonally-adjusted 5.8% in August as Auckland went into level 3 lockdown and the rest of the country level 2

21st Sep 20, 3:35pm

4

Reserve Bank figures show credit card billings dropped a seasonally-adjusted 5.8% in August as Auckland went into level 3 lockdown and the rest of the country level 2

National Australia Bank and Commonwealth Bank of Australia push back at buy now pay later service providers with zero interest rate credit cards

12th Sep 20, 9:31am

25

National Australia Bank and Commonwealth Bank of Australia push back at buy now pay later service providers with zero interest rate credit cards

Labour pledges 'regulation of the price' as it eyes introduction of merchant service fee regulation in New Zealand, should it be returned to government in the October 17 election

9th Sep 20, 4:08pm

1

Labour pledges 'regulation of the price' as it eyes introduction of merchant service fee regulation in New Zealand, should it be returned to government in the October 17 election

Labour Party unveils commitment to reduce fees small businesses pay their banks for accepting debit and credit cards through regulation of merchant service fees

8th Sep 20, 12:00pm

7

Labour Party unveils commitment to reduce fees small businesses pay their banks for accepting debit and credit cards through regulation of merchant service fees

Labour Party reportedly set to unveil policy to regulate retail payment fees on Tuesday in move designed to reduce fees small businesses pay their banks

8th Sep 20, 10:18am

8

Labour Party reportedly set to unveil policy to regulate retail payment fees on Tuesday in move designed to reduce fees small businesses pay their banks

Figures from credit bureau Equifax show consumer loan arrears down significantly this year. But what will happen when COVID-19 related support ends?

7th Sep 20, 4:04pm

2

Figures from credit bureau Equifax show consumer loan arrears down significantly this year. But what will happen when COVID-19 related support ends?

Flexigroup NZ says it will 'shake-up NZ’s buy now pay later sector with some major changes' in September; Harmoney posts loss but says it's in a 'strong financial position'

28th Aug 20, 2:44pm

Flexigroup NZ says it will 'shake-up NZ’s buy now pay later sector with some major changes' in September; Harmoney posts loss but says it's in a 'strong financial position'

Retail NZ and banks trumpet cuts in Visa & Mastercard interchange fees and merchants' contactless debit fees, but Commerce & Consumer Affairs Minister Kris Faafoi wants more competition

6th Aug 20, 9:34am

Retail NZ and banks trumpet cuts in Visa & Mastercard interchange fees and merchants' contactless debit fees, but Commerce & Consumer Affairs Minister Kris Faafoi wants more competition

Latest figures from the Reserve Bank show that credit card spending and amounts outstanding are both rising again - but are still below levels seen a year ago

21st Jul 20, 3:33pm

7

Latest figures from the Reserve Bank show that credit card spending and amounts outstanding are both rising again - but are still below levels seen a year ago

Economists are welcoming the country's faster than expected move to normality after the lockdown but warn that bad news is still ahead regarding unemployment

8th Jun 20, 3:04pm

29

Economists are welcoming the country's faster than expected move to normality after the lockdown but warn that bad news is still ahead regarding unemployment

ANZ NZ 'very sorry' as FMA takes it to court for allegedly charging some customers for credit card repayment insurance policies that offered those customers no cover

5th Jun 20, 9:56am

9

ANZ NZ 'very sorry' as FMA takes it to court for allegedly charging some customers for credit card repayment insurance policies that offered those customers no cover

Westpac economists say some recent data is tentatively suggesting that the economic situation may not be quite as severe as they had been predicting

2nd Jun 20, 11:46am

73

Westpac economists say some recent data is tentatively suggesting that the economic situation may not be quite as severe as they had been predicting

Economists at the country's biggest bank say based on their bank's card data, spending has returned to 'normal' - but there's no sign of any catch-up on spending that was 'lost' during lockdown

28th May 20, 2:40pm

44

Economists at the country's biggest bank say based on their bank's card data, spending has returned to 'normal' - but there's no sign of any catch-up on spending that was 'lost' during lockdown

Reserve Bank figures show credit card billings plunged 41.3% in April, bringing billings back to levels last seen in 2006

21st May 20, 3:16pm

24

Reserve Bank figures show credit card billings plunged 41.3% in April, bringing billings back to levels last seen in 2006

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

26th Apr 20, 7:31am

25

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

The abrupt cutting of travel and the first impacts of the lockdown have seen credit card spending slashed

23rd Apr 20, 3:27pm

21

The abrupt cutting of travel and the first impacts of the lockdown have seen credit card spending slashed

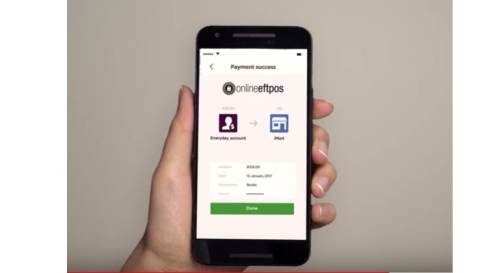

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

8th Apr 20, 10:00am

12

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

Buy now pay later schemes could end in an unseemly crash as credit card capacity jumps to accommodate settlement obligations, and shoppers recoil as jobs are lost and these unregulated scheme plans can't be changed, David Chaston argues

6th Apr 20, 12:24pm

54

Buy now pay later schemes could end in an unseemly crash as credit card capacity jumps to accommodate settlement obligations, and shoppers recoil as jobs are lost and these unregulated scheme plans can't be changed, David Chaston argues