government debt

Delta sees Government empowered to spend billions more than what was budgeted for this year; Too early to say how much of the new contingency will be used and whether more debt will be required

9th Sep 21, 1:41pm

97

Delta sees Government empowered to spend billions more than what was budgeted for this year; Too early to say how much of the new contingency will be used and whether more debt will be required

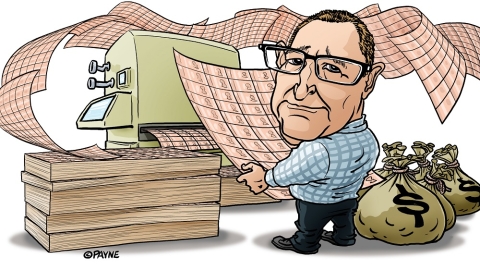

Grant Robertson confident the Government won't need to borrow more to pay for this lockdown - for now; We take a closer look at the numbers

25th Aug 21, 12:30pm

49

Grant Robertson confident the Government won't need to borrow more to pay for this lockdown - for now; We take a closer look at the numbers

An NZ Everyday Investor podcast episode ft. Jenée Tibshraeny on the Treasury's evolving approach towards debt, the drivers of inflation, whether people will be spooked by an interest rate hike, and more

12th Jul 21, 1:29pm

6

An NZ Everyday Investor podcast episode ft. Jenée Tibshraeny on the Treasury's evolving approach towards debt, the drivers of inflation, whether people will be spooked by an interest rate hike, and more

The Treasury warns the Government needs to start looking at the tax, health and superannuation systems, as an ageing population is set to send the country's debt too far north

5th Jul 21, 7:08pm

89

The Treasury warns the Government needs to start looking at the tax, health and superannuation systems, as an ageing population is set to send the country's debt too far north

ANZ strategist argues QE has done its job, so the Reserve Bank should wind back its bond-buying ahead of hiking the OCR

4th Jul 21, 6:59am

47

ANZ strategist argues QE has done its job, so the Reserve Bank should wind back its bond-buying ahead of hiking the OCR

Secretary to The Treasury Caralee McLiesh sees room for government spending to do more to support the economy in this structurally low interest rate environment

23rd Jun 21, 6:37pm

50

Secretary to The Treasury Caralee McLiesh sees room for government spending to do more to support the economy in this structurally low interest rate environment

Westpac economists say the Government's current fiscal stance may be far less stimulatory than was portrayed in the Budget

8th Jun 21, 2:49pm

13

Westpac economists say the Government's current fiscal stance may be far less stimulatory than was portrayed in the Budget

New Zealand Debt Management outlines plans for a 30-year government bond as Budget updates government funding plans

20th May 21, 3:01pm

6

New Zealand Debt Management outlines plans for a 30-year government bond as Budget updates government funding plans

Grant Robertson delivers a 'peak Labour Party' Budget, committing to spending more than expected, including on benefit increases

20th May 21, 2:00pm

231

Grant Robertson delivers a 'peak Labour Party' Budget, committing to spending more than expected, including on benefit increases

Grant Robertson goes into Budget 2021 with options. The questions are: Will he boost benefits and how much more infrastructure investment can the economy deliver on?

19th May 21, 7:20pm

52

Grant Robertson goes into Budget 2021 with options. The questions are: Will he boost benefits and how much more infrastructure investment can the economy deliver on?

Institute of International Finance's Global Debt Monitor shows global debt down slightly in the March quarter

15th May 21, 9:23am

2

Institute of International Finance's Global Debt Monitor shows global debt down slightly in the March quarter

Secretary to The Treasury Caralee McLiesh says current debt levels are manageable and the Government has options when it comes to deciding who should bear the burden of repaying the debt

22nd Mar 21, 12:34pm

18

Secretary to The Treasury Caralee McLiesh says current debt levels are manageable and the Government has options when it comes to deciding who should bear the burden of repaying the debt

Gareth Vaughan looks at a rare occurrence of the National Party and the E tū union being on the same side against the Labour government, and why we should reframe the discussion on government spending

14th Mar 21, 6:01am

41

Gareth Vaughan looks at a rare occurrence of the National Party and the E tū union being on the same side against the Labour government, and why we should reframe the discussion on government spending

Bill English takes aim at central banks for overcooking their responses to COVID-19 in fear of repeating mistakes made during the Global Financial Crisis

10th Mar 21, 10:00am

75

Bill English takes aim at central banks for overcooking their responses to COVID-19 in fear of repeating mistakes made during the Global Financial Crisis

Ending exceptional fiscal support measures designed to combat COVID-19 will be painful in a world awash with debt, the Institute of International Finance says

18th Feb 21, 4:38pm

11

Ending exceptional fiscal support measures designed to combat COVID-19 will be painful in a world awash with debt, the Institute of International Finance says

Gareth Vaughan gets lost in a fictional world full of fairies, rainbows and unicorns where banks use cheap public money in ways that make New Zealand a better place

14th Feb 21, 6:02am

83

Gareth Vaughan gets lost in a fictional world full of fairies, rainbows and unicorns where banks use cheap public money in ways that make New Zealand a better place

Jude Murdoch and Steven Hail argue modern monetary theory offers desperately needed clear thinking and fresh ideas for our society and our democracy

27th Nov 20, 10:04am

84

Jude Murdoch and Steven Hail argue modern monetary theory offers desperately needed clear thinking and fresh ideas for our society and our democracy

Institute of International Finance says unprecedented increase in global debt means it's not clear how the global economy can deleverage without significant adverse implications for economic activity

19th Nov 20, 9:00am

42

Institute of International Finance says unprecedented increase in global debt means it's not clear how the global economy can deleverage without significant adverse implications for economic activity

Social Credit leader Chris Leitch says the Government should borrow from itself to fund state house building, infrastructure development, health investment, and a substantial lift in low incomes

14th Nov 20, 9:52am

21

Social Credit leader Chris Leitch says the Government should borrow from itself to fund state house building, infrastructure development, health investment, and a substantial lift in low incomes

Government books only $3.2 billion in the red, as New Zealanders spend more and require less support via the wage subsidy than expected

10th Nov 20, 11:22am

52

Government books only $3.2 billion in the red, as New Zealanders spend more and require less support via the wage subsidy than expected

The election result, house price inflation, monetary policy, LVRs, NZ's economic recovery - Jenée Tibshraeny shares her two cents with Sharesies users

22nd Oct 20, 6:21pm

6

The election result, house price inflation, monetary policy, LVRs, NZ's economic recovery - Jenée Tibshraeny shares her two cents with Sharesies users

Gareth Vaughan on the IMF advocating borrowing over austerity & a new Bretton Woods moment, the good times roll for US banks, the case for a Scottish currency, less extreme wind in NZ, the problem with our SUVs, utes & vans, and an orange Lamborghini

16th Oct 20, 9:56am

22

Gareth Vaughan on the IMF advocating borrowing over austerity & a new Bretton Woods moment, the good times roll for US banks, the case for a Scottish currency, less extreme wind in NZ, the problem with our SUVs, utes & vans, and an orange Lamborghini

Gareth Vaughan on a green future v an authoritarian future, ancient hunter-gathers & modern day anxiety, debt relief for poor countries, Billy Te Kahika in the South China Morning Post, the teeny tiny EU unifier

8th Oct 20, 9:34am

13

Gareth Vaughan on a green future v an authoritarian future, ancient hunter-gathers & modern day anxiety, debt relief for poor countries, Billy Te Kahika in the South China Morning Post, the teeny tiny EU unifier

Gareth Vaughan strives to spark a 21st century conversation on government debt, urging our politicians to leave the ghost of Rob Muldoon behind and focus on the real challenges New Zealand faces today

6th Oct 20, 11:56am

102

Gareth Vaughan strives to spark a 21st century conversation on government debt, urging our politicians to leave the ghost of Rob Muldoon behind and focus on the real challenges New Zealand faces today

National's 16-month income tax cut could do more to boost high income earners' bank balances than get people out spending, Jenée Tibshraeny suggests

18th Sep 20, 3:59pm

138

National's 16-month income tax cut could do more to boost high income earners' bank balances than get people out spending, Jenée Tibshraeny suggests