Summary of key points: -

- The current fractured US Federal Reserve is unlikely to last

- New Zealand GDP figures to confirm the reported economic downturn in 2025 did not happen!

- The Chinese Yuan continues to strengthen against the US dollar

The current fractured US Federal Reserve is unlikely to last

The major “take-out” from last week’s Fed meeting, wherein as expected they cut the Fed Funds rate by 0.25%, was how divided the 12 voting members of the FOMC committee are on the current state and outlook for the US economy. The extraordinary division and disagreement on the economy comes from the lack of quality up-to-date economic data and the normal tension that exists between the dual mandate of full employment and inflation at the 2.00% target.

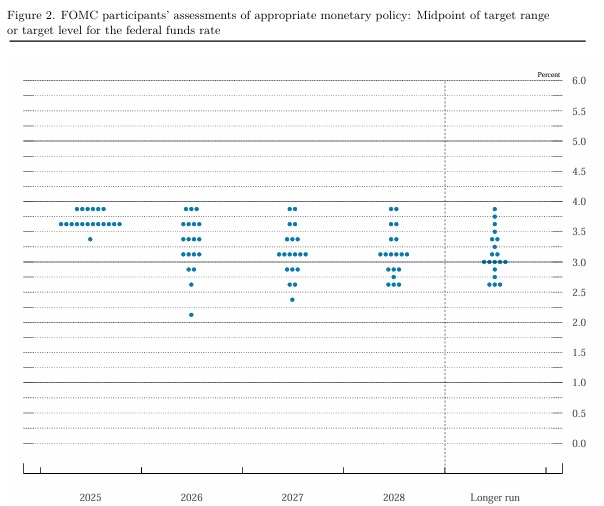

The wildly differing views is best summed up in the “dot-plot” picture below, where all 19 members of the full Fed Board anonymously place their own individual forecasts of the Fed Funds interest rate over coming years. The forecasts for 2026 range from 2.00% (one member, being Stephen Miran) to three members at 3.75% (above the current 3.50% to 3.75% setting). Twelve members of the Board see at least one 0.25% cut in 2026 and seven members either see no change or a small increase. However, it is the 12 voting members that count when making the interest rate decisions.

We foresee three reasons why the current fractured Fed will not last into 2026: -

- The employment data for October, November and December (when it is released) will confirm the sharp downturn in new hiring across the economy. Fed Chairman, Jerome Powell was rightly bemoaning the poor quality and unreliability of the monthly Non-Farm Payrolls jobs data last week. However, the weekly private sector ADP Employment Change measure of jobs has certainly weakened over recent months, with three weeks out of the last four weeks reporting decreases in jobs. As the weaker employment situation is revealed, those Fed voting members currently sitting on the fence, will be persuaded that further interest rate cuts will be required next year to ensure the employment side of their remit is fulfilled.

- Just as the US equity markets are currently rotating out of the over-hyped tech stocks into wider industrial sectors, the Fed also rotate their voting members on the 12-member FOMC. Four of the current state voting members rotate off in 2026, namely Austan Goolsbee (Chicago), Susan Collins (Boston), Alberto Musalem (St Louis) and Jeffrey Scmid (Kansas City). All four of these members could be classified as at the “hawkish” end of the spectrum when it comes to the economy and interest rates. They are replaced by Anna Paulson (Philadelphia) who is much more at the “dovish” end, plus three hawks – Neel Kashkari (Minneapolis), Lorie Logan (Dallas) and Beth Hammack (Cleveland). The balance is expected to swing to more than one 0.25% cut next year as the voter composition rotates and the economic data comes in softer.

- President Trump is very close to announcing Jerome Powell’s replacement as Chairman of the Fed, well ahead of Powell’s formal end of term date of May 2026. It seems to be a choice between the “two Kevins”, Kevin Hassett his economic advisor and former Fed member Kevin Warsh. It probably depends on which Kevin tells Trump that he will cut interest rates the most next year! The Fed will become inappropriately politicised and lose its independence under these Trump instilled changes. The markets will focus on the views of the Chairman-elect over coming months, not Jerome Powell.

The US dollar did not depreciate as much as anticipated with the Fed confirmation of a 0.25% interest rate reduction, arguably because the FOMC members seems so divided on what the direction is for next year. The decision by the Fed to buy US$20 billion of short-term Treasury Bills per month is supposedly nothing more than ordinary management of money market conditions. However, long-time Fed watchers are not so sure, viewing the change as an attempt to bring down longer term bond yields and therefore lower the US Governments borrowing costs on the ballooning budget deficit.

The US Dollar Dixy Index dropped from 99.15 before the Fed meeting last week to currently trade at 98.02, allowing the NZ dollar to make some marginal gains to above 0.5800.

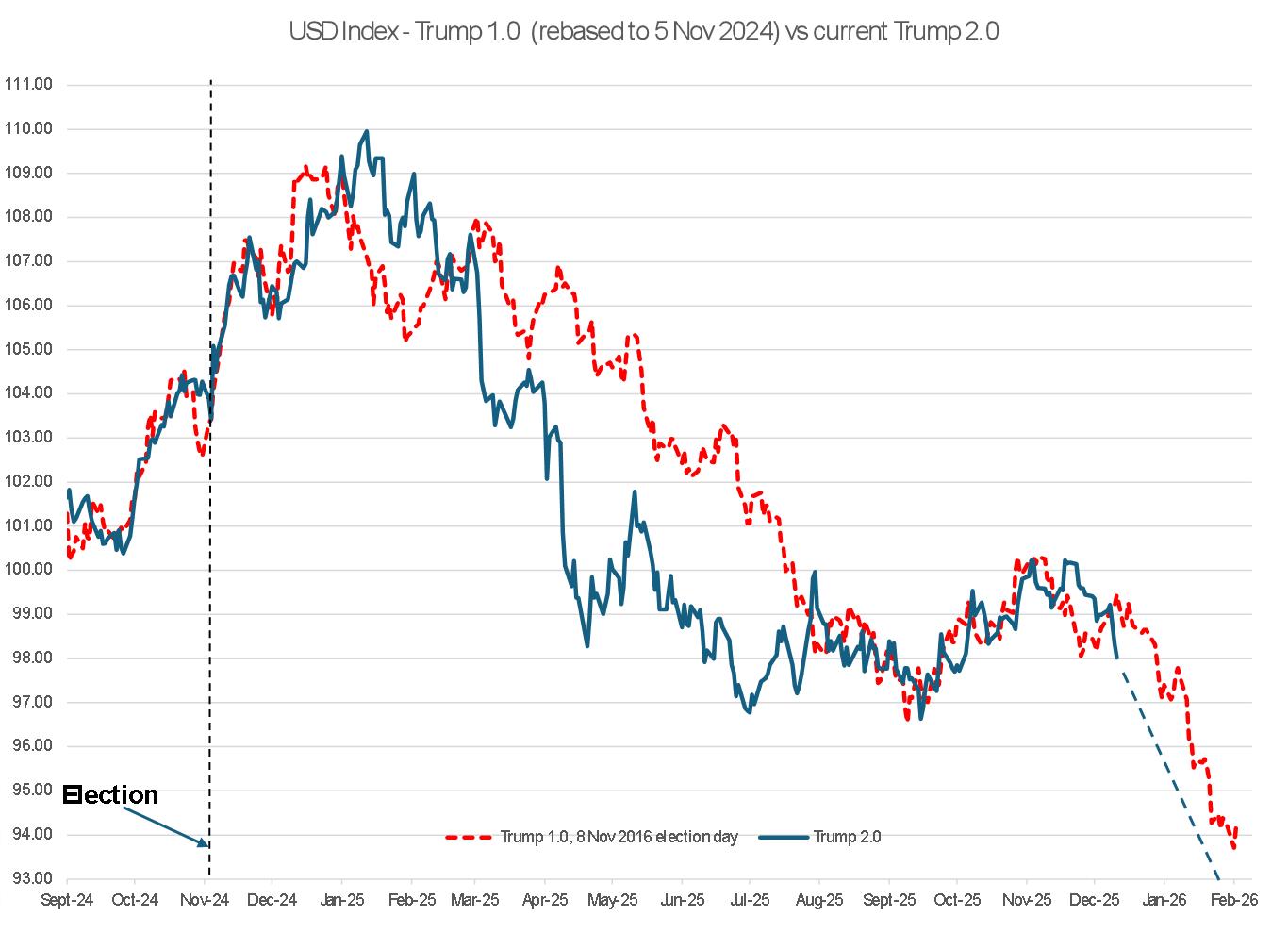

The outlook for the US dollar remains firmly negative with the US now lowering their interest rates, with more to come in early 2026, whereas other economies have reached the end of their monetary easing cycle (Euroland, Australia, Canada and New Zealand). Updated currency forecasts last week from Goldman Sachs and Deutsche Bank included continuing US dollar depreciation. The global interest rate divergence is fueling the pessimism on the US dollar. Fund managers will continue to decrease USD exposures and seek out higher yielding currencies.

Over recent years, the US dollar has benefited from the remarkably strong US economic performance compared to other countries. That outperformance is no longer the case; therefore, the ending of the US dollar’s extended “bull” cycle that has run since 2011 does seem to be very near an end. A USD move below 97.00 over coming weeks will break below the uptrend line that has held since 2011 (refer to the chart below).

New Zealand GDP figures to confirm the reported economic downturn in 2025 did not happen!

The GDP growth numbers this week for the September quarter should confirm once and for all that the performance of our economy in 2025 has been misunderstood, misread and misreported by the majority of economic forecasters. The realisation that the economy did not fall into a hole in 2025, as many bank economists were predicting just two months ago with calls for the RBNZ to cut interest rates to 2.00% because they concluded the economy needed extra stimulus, is best portrayed by the two-year swap interest rate skyrocketing from 2.60% on 26 November to 3.10% today. The financial markets have belatedly realised that the RBNZ is not going to cut interest rates any further and the last two cuts of 0.50% on 8 October and 0.25% on 26 November may have not been needed. We highlighted the risk of the RBNZ “overcooking” the monetary stimulus (cutting the OCR interest rates) in our 16 November report. Incoming RBNZ Governor, Anna Breman has just observed, in the first two weeks of being in the job, how inaccurate the description of the state and performance of our economy has been from the majority of forecasting houses.

What has become very apparent with the release of recent economic data is that the NZ economy was already recovering quite robustly as early as July. The doomsayers on what Trump’s tariffs would do to our economy and the dodgy -0.90% contraction (about to be seriously revised to only -0.30%) in the June quarter did a lot of damage in influencing the widespread negativity.

Even today, the consensus forecasts on the released economic data are consistently below (weaker) than the actual numbers being reported. Consider the following examples: -

- Retail Sales for the September quarter increased 1.90% - prior consensus forecasts were +0.60%

- ANZ Roy Morgan Consumer Confidence in November lifted to 98.5 – prior forecasts were 92.0.

- Visitor Arrival in October increased by 9.40% - prior forecasts +3.0%

- Manufacturing Sales for the year to 30 September 2025 increased by 0.90% - prior consensus forecasts were -0.30%.

- Electronic Retail Card Spending for November increased 1.20% - prior forecasts were +0.30%

- Business NZ Manufacturing PMI for November was 51.4 – prior forecasts were 50.5.

The only negative for our economy over recent months has been a significant pullback in dairy export commodity prices as increased milk production in the US and Europe increases global supply.

The strength of our economic activity since July is now plain to see and this Thursday’s GDP growth figures for the September quarter are now forecast to be between a +0.80% and +1.00% expansion on the June quarter. The official RBNZ forecast for the September quarter is 0.40%. Like everyone else, they have miscalculated the strength of the export-led economic recovery in 2025.

Looking into next year, the additional stimulus the RBNZ have provided to the economy through cutting the OCR interest rate to 2.25%, should propel us forward to a positive GDP growth rate in 2026 of close to 3.00%. We will not have confirmation of our 2025 annual GDP growth rate until late March 2026; however, it is likely to be around +2.30%. The much-improved NZ economic performance will eventually be understood by both local and offshore economic forecasters/commentators, resulting in a material re-rating upwards on their combined outlooks. The impressive economic recovery should also result in a re-rating of the NZ dollar higher, particularly now that the negative interest rate gap to the US is finally closing up.

The FX markets traditionally see the NZD/USD exchange rate appreciate in the December/January period as local meat exporters buy the Kiwi every week to hedge their books in a period when other liquidity flows are reduced. A +1.00% GDP result later this week should add to that positive NZD sentiment.

The Chinese Yuan continues to strengthen against the US dollar

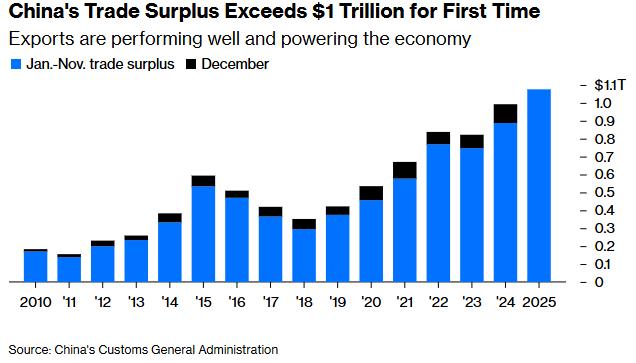

Goldman Sachs reported three days ago that the Chinese Yuan is 25% undervalued in their estimate and will appreciate further against the US dollar in 2026. According to their currency models, the Yuan is undervalued on the basis of the optimal exchange rate needed to sustain China’s economic fundamentals, including a steady Overseas Current Account balance, growth and stable prices. The International Monetary Fund (“IMF”) has linked China’s booming exports and international trade surplus to the real depreciation of the Yuan and has called on China to move toward a freer exchange rate. The IMF view the Yuan as 18% undervalued. The Chinese central bank, the People’s Bank of China is continuing to set its daily reference exchange rate for the Yuan at a stronger level, a sign that it will allow a slow and orderly appreciation of the Yuan.

Whilst China’s domestic economic performance has been across the page of late, their export economy performance has powered on, undeterred by Trump’s trade war and tariffs. Industrial Production and Retail Sales figures for November are released on Monday 15th December and both should post stronger increases than previous months.

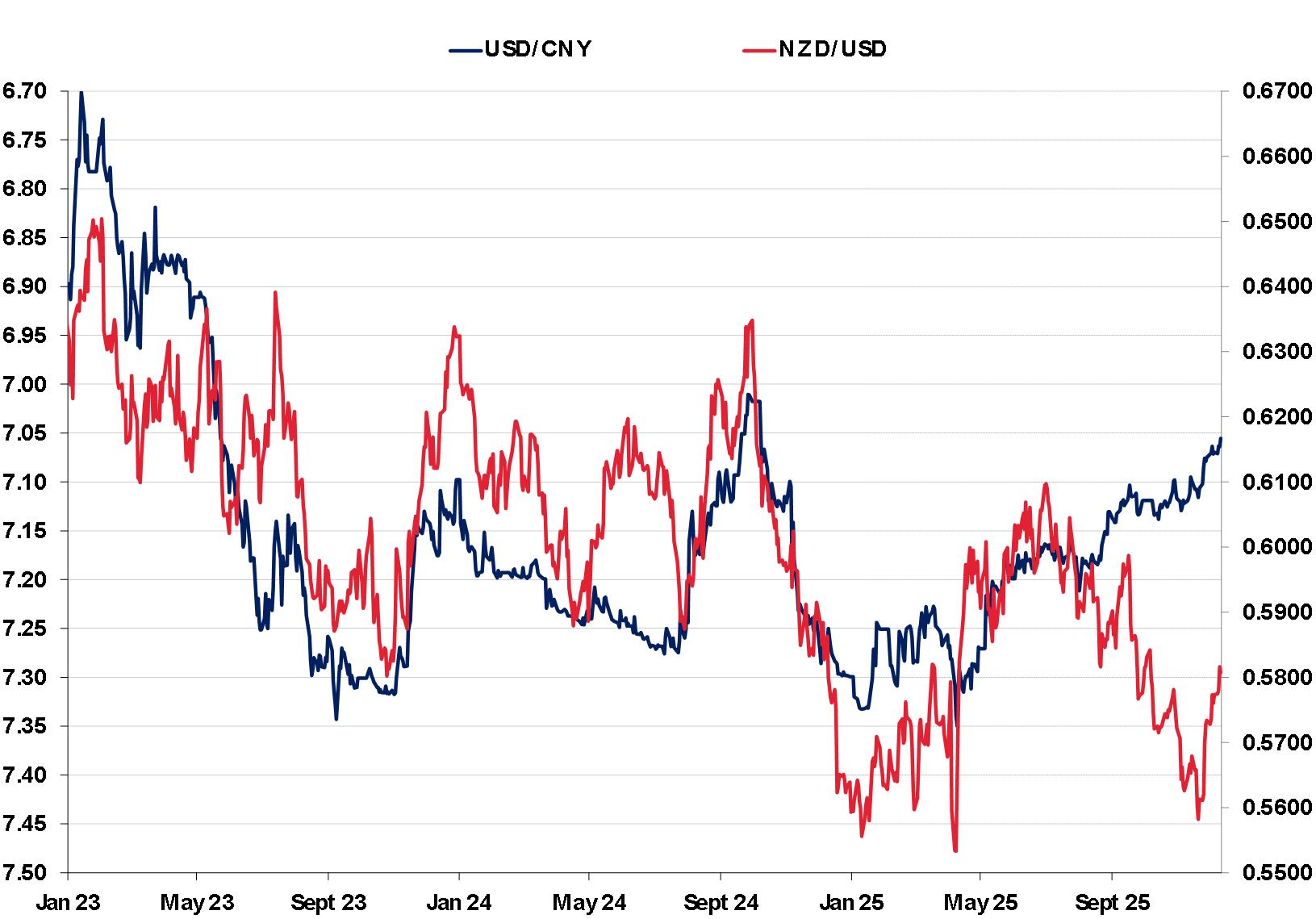

Even if the Yuan only appreciates 10% over the next 12 months, from the current USD/CNY rate of 7.0555 it would move to around the 6.3500 level. The NZD/USD exchange rate has been highly correlated to the USD/CNY movements over recent years (refer to the chart below), however it has dislocated since September on RBNZ interest rate cuts and the “fake news” on our economic performance. We would expect the Kiwi dollar to catch up to recent Yuan gains, lifting it to the 0.6150 area. After that, continued Yuan appreciation to well below 7.000 would drag the NZD/USD exchange rate higher.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

7 Comments

Bold call on NZ economic performance for 2025. Let's see what the numbers say on Thursday.

Informative read thank you Roger. The NZD/USD exchange rate has been highly correlated to the USD/CNY.... is very good....if only NZ could have timely, reliable data for the skittish markets.

I agree - the impact of export income into provincial NZ has been understated

Oh f*ck. The services sector. When the October PSI came out it was notable that on-one mentioned it. Not even Bernard. Part of the hopium I guess - https://www.interest.co.nz/economy/136541/latest-bnz-business-nz-perfor…

Wow - this has to be the record for the fastest aging prediction on this platform. What a cruel editor you have.

😂😂

Another check against a single GDP figure being used to measure anything useful for the experience of the majority

This, and some of the other articles on economic performance, make it look like no-one really understands what's going on and that the data are suspect.

That's not terribly reassuring.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.