Summary of key points: -

- NZ economy performing well above expectations ahead of RBNZ statement this week

- Aussie dollar on fire

- Inconsistent US economic data - however the Fed is still cutting rates

NZ economy performing well above expectations ahead of RBNZ statement this week

There are mixed expectations as to how the RBNZ will play this Wednesday’s Monetary Policy Statement.

Several economic forecasters are saying that it is too early for the RBNZ to adjust their GDP growth and inflation forecasts upwards, as the strength of economic recovery is still uncertain and risks abound everywhere. Those forecasters appear to be ignoring the strong numbers now undeniably coming through on the level of economic activity across the board, except perhaps for retail sales. Building consents, tourism, export and manufacturing numbers continue to display increased demand and activity. There is no question that the cuts to the OCR interest rate over the second half of 2025 has added to the confidence, along with the positive spending and investment intentions. Employment growth and hours worked increased significantly above expectations in the December quarter, however the unemployment rate increased a tad as more folk have classed themselves as in the workforce again, actively looking for a job. Employment statistics are not a forward-looking economic indicator; they always lag an economic pickup and are a consequence of hiring/firing decisions made by employers six to nine months ago.

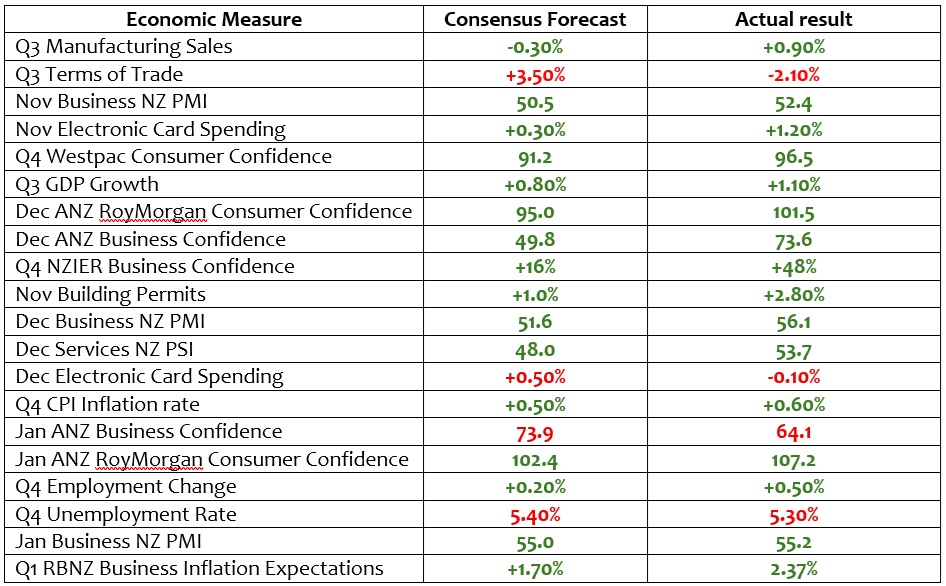

The data released on the NZ economy since the RBNZ’s last monetary policy statement on 26 November 2025 has been well above prior consensus forecasts on most fronts: -

The conclusion from the analysis above is that local economic forecasters have been consistently underestimating the level of confidence and actual economic activity over the last two months, even though the RBNZ provided a massive monetary stimulus to the economy by slashing the OCR interest rate to 2.25%. The RBNZ should be worried about the inflationary expectations increasing. The weight of the positive economic data demands an alteration in the RBNZ’s monetary policy stance.

The RBNZ’s own Nowcast Predictor Model for the December 2025 quarter GDP growth, which incorporates all the economic releases to date, is showing a +0.55% expansion in the economy. The RBNZ’s own GDP growth forecast published in their 26 November monetary statement was for a lift of 0.70% in the December quarter. They will probably not change that forecast. However, the economic recovery is more robust than they earlier estimated, as they had a +0.40% forecast for the September 2025 quarter and actual GDP growth came in at +1.10%!

The Nowcast indicator for the current March 2026 quarter is a robust +0.80%, which is what the RBNZ had as their forecast last November. What we can conclude from recent economic data is that the excess spare capacity in the economy is not as high as the RBNZ have been factoring into their inflation forecasts. The RBNZ forecast for the CPI inflation increase in the December quarter was +0.20% with the annual rate of inflation reducing to 2.70%. The actual result was +0.60% for the quarter and the annual inflation rate increasing from 3.00% to 3.10%. The starting point for inflation this year is much higher than the RBNZ expected. A serious revision upwards to their June 2026 annual inflation forecast of 2.20% is warranted and has to be expected.

We do not expect the RBNZ to increase the OCR interest rate until later in the year, however the strong economic data justifies a major rethink by the RBNZ to the statement from Governor Breman in December that the interest rate markets “had got ahead of themselves” in pricing in higher interest rates in 2026. The RBNZ Monetary Policy Statement on Wednesday 18th February therefore has to be much more circumspect around inflation decreasing significantly this year, and for that reason it will be a shift in their monetary policy stance/outlook compared to November 2025. It is too early for the RBNZ to do a backflip/U-Turn as the Reserve Bank of Australia has recently executed. However, the signs are growing that a major recalibration by the RBNZ of the demand and supply levels in the economy is warranted.

The implications for the NZ dollar currency value from the RBNZ being far less confident about New Zealand’s inflation falling abruptly in 2026, is certainly not negative and should prove to be mildly positive for the Kiwi dollar on the day of the statement.

Aussie dollar on fire

The appreciation of the Australian dollar against the US dollar has gathered significant momentum over recent weeks. The AUD/USD exchange rate has lifted 10% over the last three months, from 0.6440 in mid-November to 0.7075 today. The expected burst higher in the Aussie dollar has been well signposted in this column for more than six months. It was the undervalued and unloved currency for so long as Australian interest rates were below those of the US. That has now dramatically changed as Aussie interest rates increased to well above those of the US. The majority of bank and investment bank currency forecasters in Australia still see further upside for the Aussie dollar towards 0.7500. Last week, the AUD strengthened further following a speech by RBA Deputy Governor, Andrew Hauser who stated “Inflation at this level is too high. We will continue to do whatever is necessary to ensure that inflation does return to the target band”. Red rag to a bull for the currency markets!

What has come to light over recent months is that the Reserve Bank of Australia (“RBA”) has not been on top of controlling inflation. Inflation has increased mostly due to domestic factors, in particular, Federal Government and State Government irresponsible fiscal spending/wage setting and immigration policies set for significant inflows. Demand in the economy is running well ahead of supply.

As expected, the Australian dollar is now finally benefiting from global fund managers and currency traders diversifying out of the weakening US dollar and the AUD with its higher yields fits the bill nicely as the alternative destination. Local Australian fund managers with USD denominated equity portfolios are all busy lifting their hedge ratios, buying AUD’s to do so.

Higher than expected inflation and interest rates is not the only force causing the strong demand to buy Aussie dollars. As we have repeatedly stated, the Australian economy is hitched to the Chinese economic wagon. As a consequence, the AUD/USD exchange rate is closely correlated to the USD/CNY exchange rate movements (see chart below).

Inconsistent US economic data - however the Fed is still cutting rates

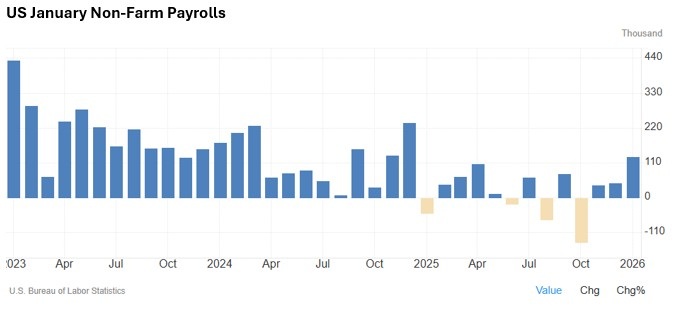

Media reports and market commentators heralded a “strong” +130,000 US Non-Farm Payrolls job report for January as evidence as to why the Federal Reserve should delay interest rate cuts. The bond and FX markets did not really react to the higher than forecast increase in jobs, as like us, they are suspicious as to the accuracy of the employment measure. As we witnessed through the second half of 2025, the initial announcements of monthly jobs increases were consistently revised lower at a subsequent data release. The large revisions downwards meant that over the last six months of 2025 there was zero jobs growth in the US economy. Therefore, the +130,000 January increase appears to be another rogue figure that does not represent what is actually happening in the US labour market in early 2026. The surprising increase was completely at odds to earlier released ADP Employment Change and JOLTS job vacancies figures, which were softer than prior forecasts. It also does not seem credible that the jump up in hiring of new jobs occurred in the middle of winter amongst snowstorms and traffic disruption. Fed members should treat this January jobs result with a large dose of caution.

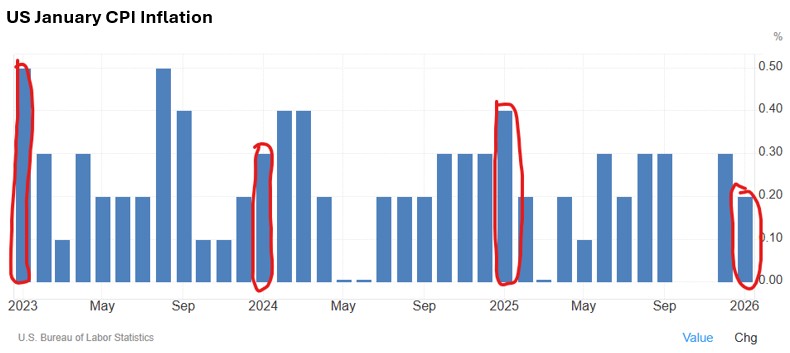

US interest rate market pricing swung to a lower probability of the Fed cutting interest rates in March and April following the Non-Farm Payrolls headline number release. However, that all changed with the CPI Inflation result for January released on Friday 13th February. Inflation increased by 0.20%, which was in the middle of +0.10% to +0.30% consensus forecasts. What caused a significant reaction in the bond market, in particular, was the fact that the annual headline inflation rate reduced from 2.70% to 2.40%. Perhaps Trump is right after all, US inflation is trending down not upwards, as a good number of Fed members fret about.

US 10-year Treasury bond yields decreased from 4.17% on 12th February to close at 4.05% on Friday 13th February, representing a major shift in market pricing in relation to future short term interest rate levels. Expect to see the probability of the Fed cutting interest rates again in March increase over coming weeks as inflation trends lower. PCE inflation numbers for January are released on Friday 20th February with a 0.30% to 0.40% increase forecast.

What is telling about that low 0.20% increase in the January CPI inflation figures is that historically January is the month that US business firms implement their annual price increases. In recent years (refer to the second chart below) the January increase has been +0.30% to +0.50%. Over the last 30 years the average January inflation increase has been 0.50%. The low 0.20% result this year confirms that US retailers and wholesalers currently have limited pricing power in an environment of low consumer confidence and demand. US Retail Sales were 0.00% flat in December, much weaker than prior forecasts of a 0.40% increase. Another month of weak retail sales data will be informing the Fed that the demand side of the US economy is not an inflation risk, in fact, it is the opposite.

A break below 4.00% in US 10-year bond yields will be a significant signal that in the minds of bond investors, US inflation is headed lower this year.

The US dollar Dixy Index remained quite stable in the 96.40 to 97.00 trading range through the volatility in bond and equity markets caused by the jobs and inflation data last week. The forex market sentiment and trend of the US dollar remain firmly downwards, therefore there will be an opportunity for the NZD/USD exchange rate to push up through the previous resistance level at 0.6120 in the near future.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.