In last week’s column we pontificated that the December jobs data in the US economy would set the tone for the speed of Federal Reserve interest rate cuts and the direction of the US dollar in the early part of 2026.

As it is often the case with economic data releases, there was a little bit of something for everyone with the December Non-Farm jobs figures and the official unemployment rate released on Friday 9th January.

As the increase in the number jobs for the month at 50,000 was in line with prior consensus forecasts there were no surprises for the financial markets – on the surface at least. The US Dollar Dixy Index continued to post gains pre and post the employment numbers to 98.90 as the FX markets adopted the view that there was insufficient evidence of a sharp slowdown in employment, therefore the Fed needed to be cautious about further interest rate cuts. The FX markets tend to react to the media headlines immediately in front of them on their screens, rather than taking the time to thoroughly analyse the bigger picture of US employment trends in the detail of the data.

In marking the US dollar stronger, the FX market’s response suggests that the weakness in US employment is not as bad many feared.

Looking behind the numbers, to the breakdown by industry and historical revisions to earlier released October and November monthly figures, the conclusion can only be that over the last eight months most US business firms have been reluctant to increase their workforces, as there is too much uncertainty on the economic outlook and what the Trump regime will do next.

The 50,000 increase in jobs in December was yet again dominated by the healthcare and hospitality sectors. Under the “K-shaped” economic environment in the US (the rich get richer and the poor get poorer) it is clear that higher income groups buoyed by strong equity investment returns are spending more on hospitality and healthcare, however the underlying/fundamental industrial and retail base of the US economy struggles for any traction. In the month of December there was no change in jobs for the mining, energy, construction, manufacturing, wholesale trade, transportation, warehousing, information, finance, and professional/business services industry sectors. The retail trade sector lost 25,000 jobs.

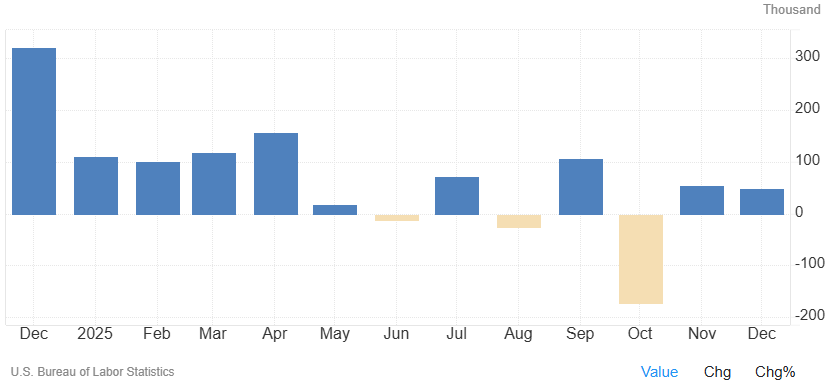

The October Non-Fram Payroll jobs numbers were revised downwards by 68,000 to a total loss of 173,000 jobs over the month. The November figures were revised down by 8,000 to +56,000 jobs. Overall, the total number of jobs added in the US economy of the full 2025 year was 584,000 (monthly average of +48,600) compared to 2,000,000 jobs added in 2024 (monthly average of +167,000). It is a massive slowdown as the bar chart below confirms. The 584,000 jobs increase over 2025 marked the fewest jobs gained for workers since 2020 and the second-worst year since the Great Recession in the early 1930’s. It is a serious situation that the Trump regime appears oblivious to, however the Fed will be all over it.

It is a massive slowdown since May 2025, as the bar chart below confirms. Over the last eight months of 2025 the US economy only added 93,000 jobs at an average monthly increase of a paltry 7,750. Earlier last week the JOLTS job openings data (job vacancies) for November 2025 confirmed that 7,146,000 jobs were available, sharply down on 7,449,000 openings in October and well below prior consensus forecasts of 7,700,000 openings for November. Ai induced data centre and electricity production investment may be keeping US GDP growth at a positive clip, however the Federal Reserve’s dual mandate on inflation and employment has to see them cutting interest rates aggressively in 2026, as the labour market is not only fragile, but actually plummeting at an alarming rate.

It is a brave person who states that the FX markets have got this all wrong in buying the US dollar higher, however the aforementioned evidence of a sharp deterioration in jobs in the US economy will convince more members of the Fed FOMC committee to continue cutting interest rates at their next meeting on 29th January. Such a decision would be a major surprise to the markets (who are not pricing-in a cut at this meeting) and would send the US dollar value lower.

This coming week sees the release of other important US economic data that will further frame expectations about the speed of Federal Reserve interest rates cuts this year: -

- Tuesday 13 January – CPI Inflation for December, +0.20% forecast.

- Wednesday 14 January – Retail Sales for November, +0.30% forecast.

- Friday 16 January – Industrial Production for December, +0.30% forecast.

Weaker than forecast outcomes would force the FX markets to reassess their recent bets/strategies to buy the US dollar against the major currencies.

US Non-Farm Payroll Job Results - 2025

Trump’s Fed man, Steve Miran, argues why US monetary policy is “unnecessarily restrictive”

The lone dissenter on the Fed FOMC voting committee, demanding even lower interest rates, Steve Miran, has restated his strongly held view that the current Fed Funds interest rate at 3.65% is 1.50% higher than where it should be. He sees the underlying annual inflation rates closer to 2.30% than the official 2.70%. The four supporting reasons behind Miran’s view are as follows: -

- Shelter inflation is overstated. It is great to see someone else highlighting this anomaly with how the US measures its housing costs in its inflation rate. Markets rents are now stable and given the massive lag in the data, we are about to see a significant drop in shelter inflation this year.

- Tariffs are not a major driver. Goods inflation has been less than expected from tariffs, some tariffs are now being wheeled back and any increase in goods inflation is being offset by disinflation in housing costs.

- Focus on forward-looking forecasts. Setting of monetary policy should be based on forward-looking forecasts of the economy, not backward-looking historical data. Hear, hear!!

- Risks to the employment mandate. The labour market deterioration is a bigger risk to the US economy than inflation being slightly above target. He warns that labour market deterioration can be rapid (refer to our comments above) and difficult to reverse.

We agree with all four Miran points, which certainly outweigh the arguments on the other side that inflation is high at 2.70% and going higher. Job insecurities are dampening demand in the US economy, so worries about inflation increasing seem misplaced.

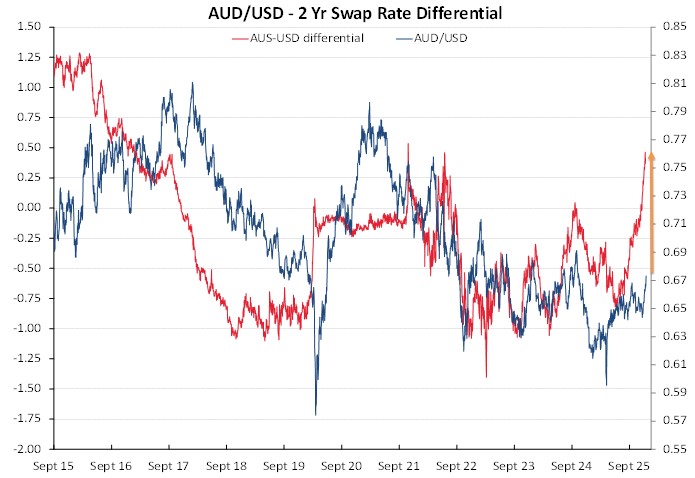

The rapid change in the interest rate differential to the US looks good for the Aussie dollar

The Australian dollar has displayed considerably more resilience to the latest bout of US dollar buying than other major currencies. The AUD/USD exchange rate has remained close to the 0.6700 level over this past week, whereas the NZD/USD rate has dropped from 0.5800 to 0.5735 and the EUR/USD rate has decreased from $1.1720 to $1.1640. It appears the FX markets are no longer prepared to sell the Aussie dollar and hold short sold AUD positions in the face of the risk that the next change in Australian interest rates is up, not down. It has been a dramatic reversal of sentiment and expectation in the Australian interest rate markets over recent months. From confident interest rate market forward pricing for further cuts to their OCR in 2026 not so long ago, the markets are now pricing hikes by the Reserve Bank of Australia (“RBA”) from the current OCR level of 3.60%. Global currency players are no longer selling the AUD against the USD and receiving forward points in doing so, as Aussie interest rates were below the US. They now have to pay away the forward points as Aussie interest rates are above those of the US.

Even though last week’s CPI inflation data for the month of November was below forecast (3.40% actual against prior forecasts of 3.70%), the expectation remains that the RBA will need to hike interest rates at their next meeting on 3 February. The fact is that Australia’s inflation rate remains well above their target range of 2.00% to 3.00% (i.e. a 2.50% midpoint). Housing cost, being rents and cost of new builds, are a large component of the CPI basket of prices and these prices are rising and showing no signs of abating. Building permit approvals increased in November at the strongest clip in four years.

It could be a close call for the RBA to hike or remain at 3.60% on 3 February. The markets are only pricing in a 35% probability of an interest rate increase at this meeting, the pricing indicates increases later in the year. The full December quarter CPI inflation numbers released on 28th January may sway which way the RBA goes. Monthly employment data for December released on January 22nd will also be important in their assessment.

One of the major issues as to why Australia has sticky high inflation is the high spending by the Government sector, both Federal and State Government. Productivity in Australia is at its lowest levels for many years and wage increases (particularly in the public sector) with no productivity improvement is inflationary. The RBA seems very reluctant to call out the stimulatory fiscal policy of the Albanese Labour Government that is contributing to the inflation problem.

Australian two-year swap interest rates are now trading at 4.00%, which is 0.40% above US two-year swap rates at 3.60%. It has been a colossal change in the interest rate differential over the last six months. In July 2025 Aussie two-year rates were 3.14% and the US two-year rates were 0.75% higher at 3.89%. The dominant determinant of exchange rate movements is interest rate differentials; however, the real driver is the change in interest rate differentials. The change in Australian versus US interest rates over recent months has been swift and severe. The historical correlation of currency values following changes in interest rate differentials is clear to see.

The chart below is compelling evidence for considerable upside to the AUD/USD exchange rate not being that far away.

It just requires the market sentiment towards the US dollar on global FX markets to turn bearish again on Fed cuts to their interest rates, driven by weaker economic data. The probability of the USD Dixy Index turning down again from the current 98.90 level to 97.00 and below, appears higher than continuing USD gains to 100.00 on the Index. Geo-political tensions caused by Trump’s imperialistic forays into other countries’ affairs is behind some of the recent USD gains. However, as we have seen over the last 12 months, relative economic performance outweighs geo-political factors as currency determinants. Off course, the Trump intervention into Venezuela and threats against Mexico, Colombia, Cuba, Greenland and Iran have to be seen for what they are. A politically motivated distraction and diversion away from the real threat to the Republican Party’s mid-term election chances later this year, household affordability issues. Making the American economy great again is not going too well for Trump, so he has pivoted to American power/bullying over the rest of the world to garner votes. Luckily, Australia is not in his sights!

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

When is Roger Kerr going to factor in the reality that blocking cheap illegal immigration means less jobs are being created?

Also, that the US economy grew at +4.3% in Q3? In 2026 it will break 5% growth.

Hardly an argument for lower interest rates or a weaker USD.

kiwi trader,

Irrespective of the growth rate or any inflationary pressures, is it not likely that when Powell is replaced by a Trump appointee, there will be increased pressure to lower rates?

Yes, undoubtably. But markets will be already factoring in those pressures. The White House will look to run the US economy hot ahead of the mid- terms, that much is obvious.

With falling oil prices, they may get away with lower interest rates as inflation will remain relatively benign. This will also mean other countries will have low CPI pressures as well, leading to further cuts in their own interest rates. Switzerland is already flirting with zero, negative rates again.

Either way, capital will be attracted to the US economy, so it's hard to see why the USD would weaken appreciably.

Lower interest rates do not automatically mean a weaker currency, just ask Switzerland or the eurozone. Equally higher interest rates do not automatically mean a stronger currency, just ask South America.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.