Summary of key points: -

- Economic negatives for the US dollar offset by geo-political risk buying

- Bank of Japan threatens Yen intervention, but fails to deliver

- Big test coming up for new RBNZ Governor

Economic negatives for the US dollar offset by geo-political risk buying

Not only are the voting members of the Fed FOMC interest rate decision-making committee hopelessly divided on whether inflation and jobs are going up or down in the US economy, equally divided are the views in the financial markets as to the direction of the economy, inflation and jobs in 2026.

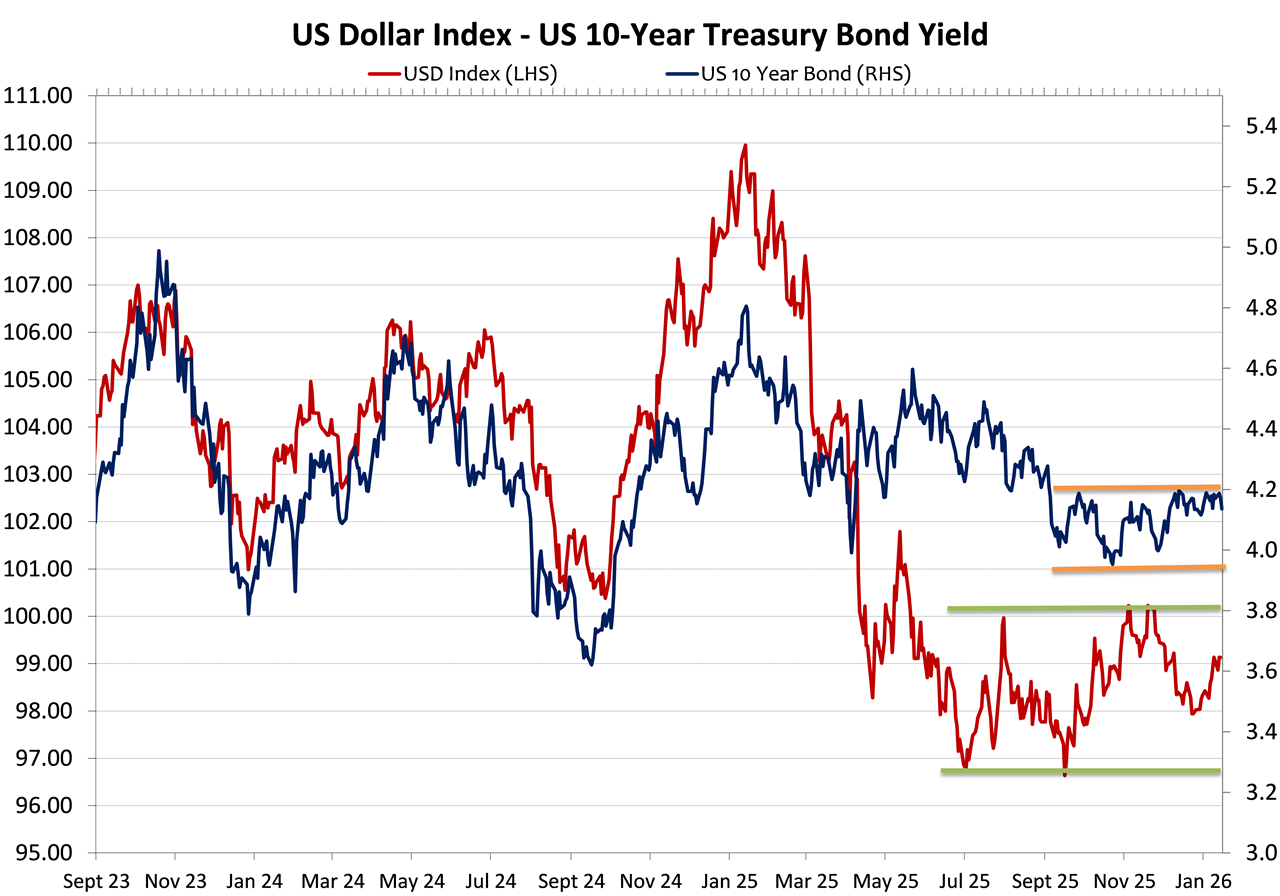

The contrasting opinions are confirmed and represented in FX and bond market pricing over the last six months. US 10-year Treasury Bond yields have shuffled sideways in a trading range between 4.00% and 4.25% since July. Likewise, the US dollar value on the Dixy Index has moved across the page between 97.0 and 100.0 (refer to the chart below). The indecision is largely due to the uncertainty surrounding what President Trump’s chaotic economic policy agenda will deliver for the US economy. No-one really knows what will happen next and the disruption to the economic data due to the Budget-related Federal Government shutdown last year has not helped deciphering underlying trends in the US economy. The equity markets seem firmly convinced that AI will revolutionise efficiencies and productivity in the economy, however the evidence has yet to be proven. Trends in currency and bond markets typically provide direction pointers as to how investors feel about the performance of the economy. We are not receiving any clear signals from the current market impasse. Elevated geo-political risks, such as threats on Iran, have attracted USD buying, offsetting the softer economic numbers. A reduction in geo-political risks will change the picture again.

The failure of the 10-year Treasury Bond yields to sustainably move below 4.00% when US short-term interest rates are 3.50% and moving lower is due to the uncertainties surrounding The US Federal Government’s fiscal position/budget deficit situation. The US Supreme Court is due to bring down its ruling on the legality of Trump’s tariffs by executive order any day soon. An order to repay tariffs collected to date would put another big hole in the budget deficit and borrowing requirements. On top of that, there is the unknown factor of whether the US economy will produce the GDP growth and therefore tax revenue flowing into the Government to contain the deficit that is ballooning under the pressure of massive interest payments on Government debt. Trump’s continuous attacks on Chair Jerome Powell at the Federal Reserve on interest rate settings is a futile attempt to lower his Government’s interest bill on new and rolling over Treasury Bond issues. Different buy/sell forces dictate the direction of 10-year bond yields compared to inflation and jobs trends that dictate the direction of short-term interest rates by the Fed. It is clear that Trump and his henchman advisors do not understand that market reality.

Recently released US economic data has been as inconclusive as the sideways market trading ranges. What we do know is that recent interventionist economic policy announcements by President Trump are all designed to reduce the household “affordability” crisis ahead of the mid-term elections in November this year. Trump must realise that the Republicans are in trouble unless he eases the financial pressures on middle to lower income groups in the US.

Consider the following Trump announcements over recent weeks: -

- Subsidising soya bean farmers for lost export sales after he put tariffs on China and China decided to buy their soya beans from elsewhere.

- Attempting to put a 10% interest rate cap on credit cards. The banks and Congress will probably prevent that happening.

- Instructing Fannie May and Freddie Mac to buy US$100 billion of mortgage securities in an attempt to drive down Treasury Bond yields and mortgage interest rates. It has not worked so far.

- Attempting to ban large institutional investors from buying residential property.

- Pushing for further relaxation of the rules to allow individual’s 401(k) pension funds to be drawdown to pay for the purchase of a home.

- Intervening in Venezuela to provide US access to their oil and drive the oil price lower. That has also not worked very well so far! The Exxon CEO states that Venezuela remains “un-investable”.

- Imposing additional trade tariffs on countries that are against his annexation of Greenland.

From our point of view, the impasse at the Fed and in the markets on the direction of the US economy will only be resolved one way or the other by upcoming economic data releases confirming the dramatic slowdown in new jobs (or not) and housing cost/rents deflation outweighing goods inflation from tariffs (or not). When the markets observe that the employment situation is weaker and inflation is going no higher, bond yields and the US Dollar Index will break out on the bottom-side of their recent trading ranges.

It is somewhat surprising that the US dollar has not depreciated on Trump’s latest attack on Fed Chair Jerome Powell with the legal indictment over the Fed’s historic building renovation cost overruns. Maybe the markets are viewing Trump’s attempt to oust Powell over interest rates as nothing new and unlikely to succeed. Trump is hoping Powell will resign to free up another seat on the FOMC voting committee to appoint one of his plants as a replacement. Even though Jerome Powell’s term as Chair ends in May, his term as a Fed member runs for another two years. The best description of Trump’s latest antics came from ex Fed Chair and Treasury Secretary, Janet Yellen who saw the US heading to banana republic status with extreme methods used to get rid of your central banker who does not do what you want to stay in power. Jerome Powell’s unprecedented retaliation and rebuke of Trump’s attack was great to see. The US needs a few more Jerome Powells’ to stand up against the megalomaniac in the White House.

Bank of Japan threatens Yen intervention, but fails to deliver

New Japanese Prime Minister, Sanae Takaichi is taking a massive political gamble to call a snap election to gain a mandate for her expansionary fiscal policies for the Japanese economy. The Japanese Yen has been sold off from 150.00 to 158.00 against the US dollar over recent months due to the political turmoil and PM Takaichi’s opposition to interest rate increases. Throw in the deteriorating Japanese relationship with China, there is plenty for the Japanese voters to consider.

A clear-cut win for Ms Takaichi will likely see the Yen weaken further as she will have the power to implement her policies and dictate over the Bank of Japan. A loss for her would lead to further political turmoil and the Yen would not be able to recover until a new strong leader emerged with opposite fiscal policies Ms Takaichi.

The Bank of Japan does need to increase interest rates further to get inflation under control and the depreciating Yen makes that job harder as Japan imports key commodities such as oil. The Bank of Japan continues to “jawbone” threats that they will intervene directly in the FX markets if the Yen weakens further. Hollow threats that are not followed up with overt action quickly lose their effectiveness on the markets. This is the situation with the Yen today. Unless the Bank of Japan acts with buying of Yen in the markets, the Yen will continue to depreciate.

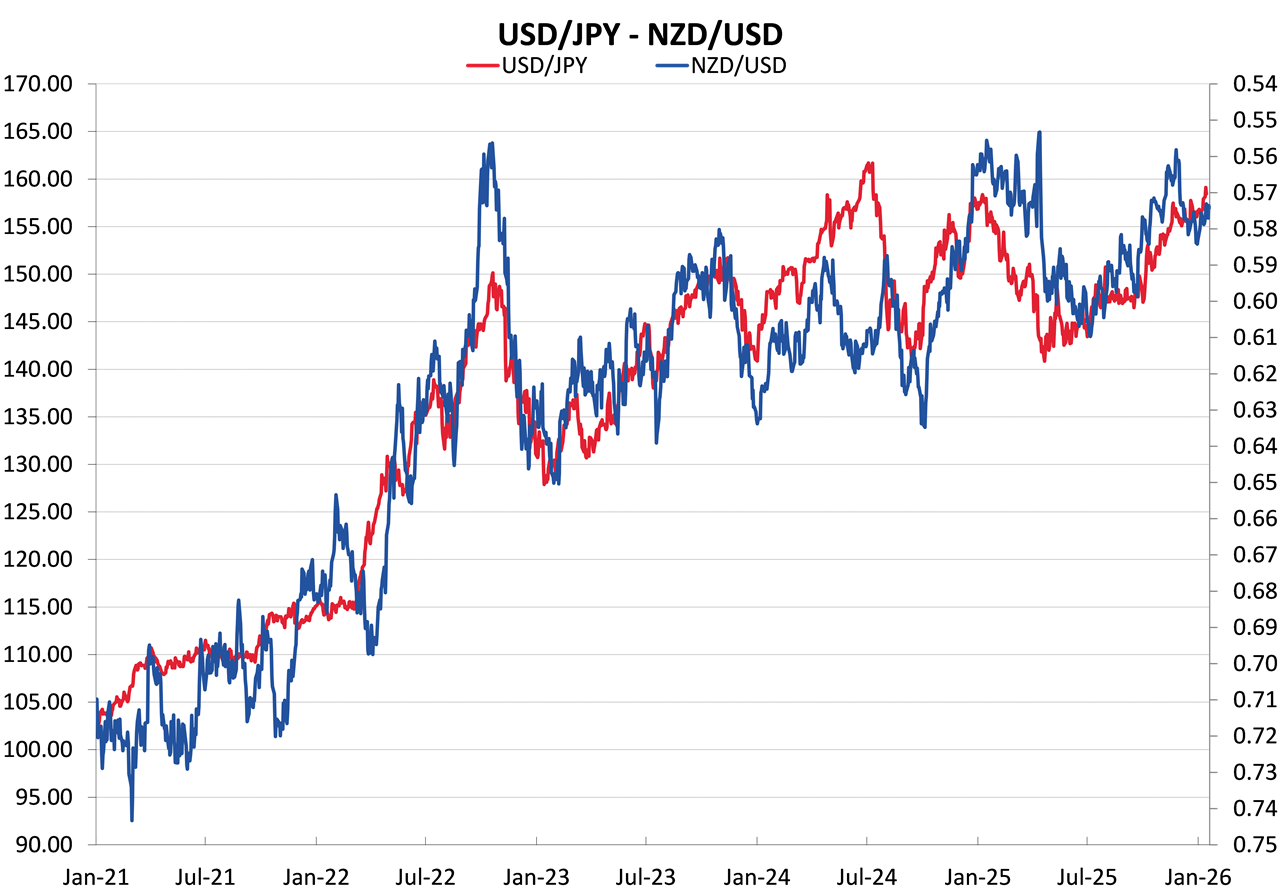

Developments in Japan are important for the NZD/USD exchange rate direction as we are closely correlated to the USD/JPY movements. The Kiwi dollar would record an unexpected gain against the USD if the Bank of Japan did intervene successfully and the Yen strengthened as a result.

Big test coming up for new RBNZ Governor

New RBNZ Governor Anna Breman rightly supported her international central banking colleagues in support of Fed Chair Jerome Powell against the vindictive Trump fellow. At least Ms Breman now knows who Winnie is in the New Zealand political landscape! However, the RBNZ Governor has a sterner test in front of her with inflation and interest rate settings than being told to stay in her lane by our Foreign Minister.

Governor Breman’s first job in the New Year will be to challenge the RBNZ’s Chief Economist Paul Conway on his team’s current forecast that the New Zealand inflation rate will plummet from the current 3.00% level over the next six months to 2.20% by June 2026. The RBNZ’s forecast of a rapid decline in the annual inflation rate is based on two factors: -

- The large quarterly increases in inflation in March, June and September last year (+0.90%, +0.50% and +1.00% respectively) being replaced by much lower numbers this year – driving the annual inflation rate sharply lower.

- Considerable excess capacity in the economy allowing reasonably strong GDP growth without price increases from local manufacturers and suppliers - Yeah, right!

The RBNZ are forecasting a low 0.20% increase in the December quarter’s CPI inflation figures to be released this week on Friday 23rd January. Latest consensus forecasts are at a 0.60% increase, leaving the annual inflation rate at 3.00%. Higher electricity prices and a lower exchange rate are just two factors causing a higher inflation trajectory in late 2025 and 2026 than what the RBNZ are expecting. Governor Breman may be forced to eat her own words that the interest rate markets have become ahead of themselves in pricing-in interest rate increases later in 2026, well above the RBNZ assumed OCR track.

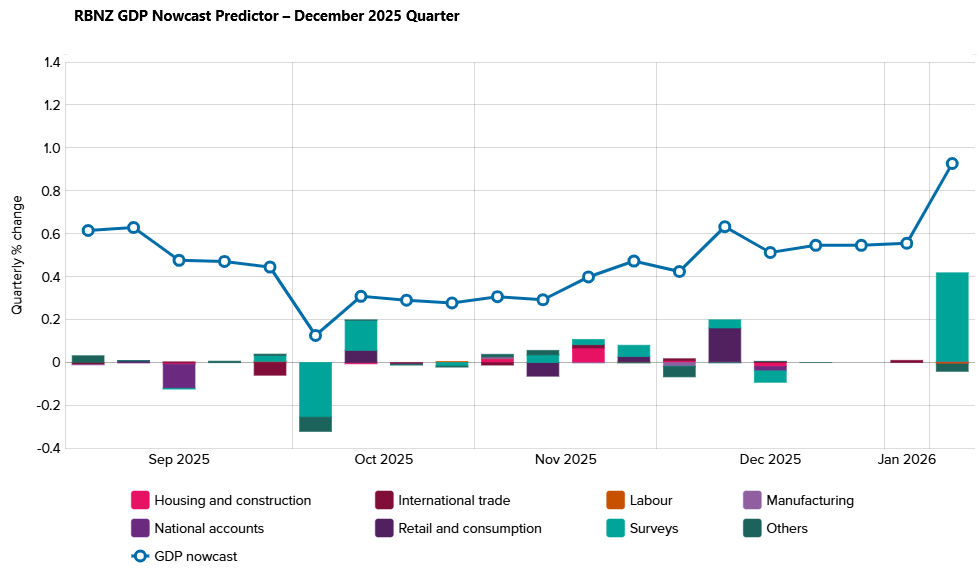

Recent economic data releases would suggest that the economy has rebounded more strongly over the second half of 2025 and into 2026 than what the RBNZ are forecasting. In their 26 November 2025 Monetary Policy Statement, the RBNZ had a forecast of +0.40% GDP growth in the September quarter, the actual result released 18th December was an impressive 1.10% increase. The RBNZ are forecasting +0.70% quarterly GDP growth numbers for the next four quarters in 2026. As we commence the year, the economy is at a much stronger starting point than what the RBNZ have factored into their forecasting models.

Last week, the NZIER Quarterly Survey of Business Confidence for the December 2025 quarter recorded the highest (+39%) expectation of business firms seeing better economic conditions ahead since March 2024. Considering the survey excludes our largest industry, agriculture (which is very strong currently), the result confirms the rapid resurgence in the economy over recent months. The other extraordinary facet of this impressive recovery in the NZ economy is that it is not on the back of strong immigration or rising house prices pushing up domestic demand. We are now seeing a true export-led economic recovery that this column has been banging on about for over 12 months. For other reasons, we have not seen that improvement reflected in a stronger NZ dollar exchange rate (yet!).

The RBNZ’s own “GDP Nowcast” predictor model which builds in all the economic data and survey results released to date is now projecting GDP growth of +0.90% in the December quarter (first chart below) and an even higher +1.40% for the March 2026 quarter. If these projections are accurate to reality, the RBNZ have some major rethinking to do on GDP growth and inflation trends in 2026.

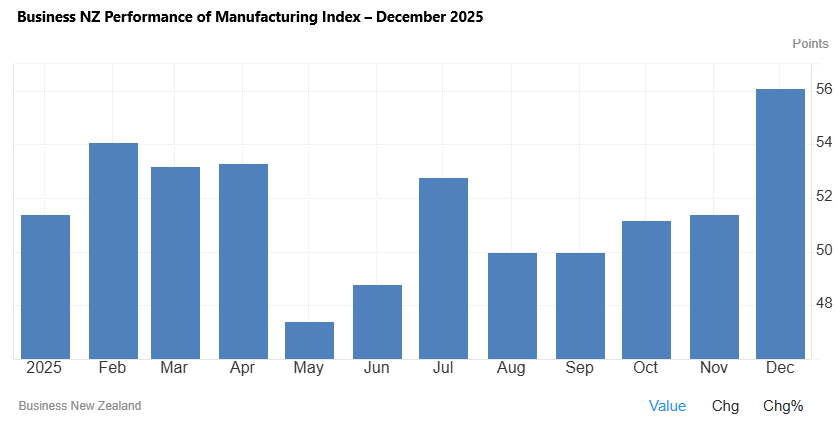

The second chart below on the December Business NZ Performance of Manufacturing Index also confirms the strong rebound in confidence, investment and activity levels in last 2025.

The implications of the stronger economic environment in 2026 than what the RBNZ are anticipating is that the next RBNZ Monetary Policy Statement on Wednesday 18th February will have to be more upbeat on the economy, including upwards revisions to their previous OCR track for 2026. Against US Fed cuts to interest rates over coming months, a much more hawkish then expected RBNZ statement must support a higher NZ dollar trend on its own account.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

1 Comments

I commented a while back that the risk for 2026 would be stagflation - there is no private sector demand driver - such as job growth or rising house prices and the negative demand shock of procyclical fiscal policy is going to continue.

Inflation is staying high - probably in part because of the falling OCR driving down the value of the NZD and making imported input costs rise.

The economy is staying low - unemployment is predicted to keep rising as are record business liquidations. It is difficult to understand the high levels of optimism.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.