Summary of key points: -

- New Zealand’s financial markets signalling a monetary policy error

- Return of the “Sell America” trade sends the US dollar lower

- FX market intervention fears turn the Japanese Yen around

- Strong Australian jobs data exerts more pressure on the RBA

In Australia, the media is labelling it an “embarrassing backflip” by the Reserve Bank of Australia (“RBA’), as they are forced to pivot from easing monetary last year to now hurriedly tightening policy with interest rate hikes as they do not have inflation under control as much as they first thought. The same description could be applied to the Reserve Bank of New Zealand (“RBNZ”) at this time, as a much stronger economy and sticky/high inflation is making their 0.25% OCR cut to 2.25% in November appear like a monetary policy error.

Our column on 16th November 2025, before that RBNZ cut to 2.25%, was entitled: ”The risk of the RBNZ “overcooking” monetary policy stimulus – again”. We were a lonely voice at that time highlighting the risks of loosening monetary policy too far and therefore causing unnecessary volatility in the economy, interest rates and the exchange rate. Through the August to November period last year the majority of bank economists were confidently predicting that the RBNZ needed to cut the OCR to 2.00% to get the economy going again. One bank was very vocal in calling for the RBNZ to cut to below 2.00%. Less than three months later, they are now all calling for the RBNZ to hike interest rates twice in 2026, starting in June or September. It makes President Donald Trump’s regular “TACO” U-Turns appear mild in comparison!

So, what has changed over recent weeks to cause a complete reversal in expectations? Well, nothing really, it is just that the economic conditions over the second half of 2025 were completely misread by both the RBNZ and the local economic forecasters alike.

The strong export-led economic recovery producing 1.20% GDP growth in the September 2025 quarter and all indications are that we will see repeated 1.00%+ expansions in both the December 2025 and March 2026 quarters as well. As it has transpired, the RBNZ were busy cutting interest rates over the second half of 2025 when the economy was already growing at a fast clip to reduce any excess capacity and inflation was outside the top limit of 3.00%. The RBNZ may well be regretting that they allowed themselves to be bullied into aggressive interest rate cuts by the banks in late 2025, as the banks sought lower rates to kickstart the housing market so that they could lend more and enhance their profits. We have previously warned the new RBNZ Governor, Anna Breman to be very circumspect in respect to the motivations of our banks with their interest rate views and forecasts.

Further evidence of a likely monetary policy mistake is comparing the length of time interest rates stay stable following a monetary policy easing cycle. If the RBNZ is forced to increase the OCR interest rate as early as June this year, the time from the last cut in November 2025 will only be seven months. History tells us that the average time period of stable OCR interest rates following an easing cycle is 12 to 15 months. The very short time period on this occasion tells you that the RBNZ got it wrong in easing policy too far.

The evidence and belated realisation of the RBNZ being forced to rapidly tighten policy not long after cutting interest rates is also seen in interest rate market and FX market price action of late. The very positive economic news for New Zealand over recent weeks has seen some rapid price adjustments: -

- Two-year swap interest rates have jumped up 0.50% from 2.60% on 1 December 2025 to 3.10% today.

- The NZD/USD exchange rate also jumped up more than two cents over the last 10 days from 0.5730 on 14 January to 0.5950 today.

To be fair, not all the NZ dollar gains have been due to a re-rating of the NZ economy and interest rates higher, the US dollar itself has depreciated in global forex markets as safe haven flows on geo-political risks (Venezuela, Iran and the Greenland non-event) into the USD have rapidly unwound.

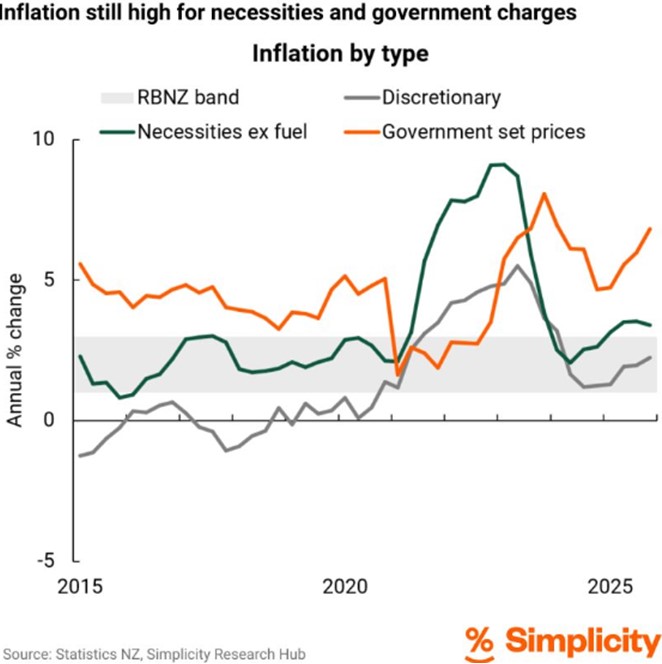

It is a familiar story, with the RBNZ misreading the strength of the economy and confidently expecting that the inflation increases in later 2025 would only be of a temporary nature. The chart below from Simplicity succinctly sums up New Zealand’s problem with inflation control. As stated on numerous occasions in this column, our inflation comes from the supply-side of the economy, disproportionately from the Government and non-competitive industry (“necessities, such as electricity, transport and insurance) sectors.

Return of the “Sell America” trade sends the US dollar lower

Global investors and fund managers have returned to the strategy they adopted last April with Trump’s tariffs “Liberation Day”, reducing exposure to US financial and investment markets. The related US dollar selling has sent the USD Dixy Index sharply lower to 97.40 from highs of 99.20 just six days ago on 19th January. Investors and market participants just do not know what Trump will do next, so good risk management has them reducing exposure to the US dollar. The Europeans were particularly upset at his attacks on them over Greenland, however in the end it was just another TACO moment in a long series of Trump leveraging other parties with his extreme positions to get what he wants in a “deal”. In the case of Greenland, however, no-one actually knows what the “concept of a deal” is.

Amidst all the drama and chaos surrounding Trump interfering in other countries affairs, the value of the US dollar is ultimately determined by America’s relative economic performance compared to others. The geo-political risk sideshows do impact the currency markets, however generally only for a short period and then the participants return to the economic fundamentals.

Outside of upcoming data on the US economy, the markets are still awaiting three announcements that will influence currency positioning and strategies: -

- The US Supreme Court’s ruling on the legality of Trump’s tariffs implemented by Executive Order. Will the US Government have to pay back the tariffs? Unlikely, as further legal avenues will be open to the Trump regime.

- Who will be the next US Federal Reserve Chairman be, replacing Jerome Powell? Four candidates are in the running: Kevin Hassett, Kevin Warsh, Christophen Waller and Rick Rieder. All candidates appear to support lower interest rates in 2026.

- The Court ruling on Federal Reserve Member, Lisa Cook as to whether she can continue in the role. Trump wants her out so that he can appoint one of his cronies as the replacement.

US inflation is slowly moving back lower, and US employment numbers were certainly weaker over the second half of 2025. Confirmation of that weaker employment trend in the Non-Farm Payrolls figures for January on Friday 6th February will bring forward the market pricing of when the Fed will next cut interest rates. The FX markets have not yet priced-in the possibility that the next 0.25% cut will be in mid-March instead of the earlier expected June timing. The 28th January meeting of the Fed this week is too soon, however the Fed’s comments on inflation and employment trends will be closely scrutinised.

There are always hidden risks that can suddenly emerge and upset financial and investment markets in terms of confidence and surety. One of those unrecognised risks that could become centre stage is the private credit market. Direct lending by investment funds to borrowers has ballooned over recent years as regulations have discouraged banks from serving riskier borrowers. The recent collapse of US companies backed by private credit loans has elevated the risk surrounding this murkier end of investment. The fund managers who extend private credit loans state that they are filling a void left by the banks and they are helping growth in the US economy. Whether this is another powder keg of financial risk that is about to blow up remains to be seen.

FX market intervention fears turn the Japanese Yen around

The Japanese Yen exchange rate to the US dollar has been under considerable pressure over recent months as the political upheavals (and related economic policy signals) caused foreign investors to sell Japanese bonds and sell the Yen. The Yen has depreciated 10% from the 145.00 area against the USD last September to above 159.00 a week ago. The Japanese authorities have been verbally warning the FX markets that they are prepared to step in with intervention to stop the Yen depreciating any further. Last Friday those warnings progressed another step forward with reports that both the Bank of Japan and the Federal Bank of New York were requesting Yen prices from banks. The news of possible intervention prompting a sudden reversal in the Yen’s fortunes. The USD/JPY rate plunging from 159.00 to 155.70 at the Friday market close. It is the largest one-day movement in the Yen for six months.

Further volatility in the Yen has to be expected in the near term with the snap election on 8th February. A poor showing for the ruling LDP Party and Prime Minister Sanae Takaichi may lead to yet another change in Japanese political leadership. Sterner fiscal discipline under a new Prime Minister would be positive news for the Yen.

The Kiwi dollar is closely correlated to USD/JPY movements, so development is Japan over coming weeks will certainly influence NZD/USD exchange rate direction. The differential between Japanese and US 10-year Treasury Bond yields has now closed up to less than 2.00%. History tells us that the Japanese Yen strengthens when the bond yield gap reduces as Japanese investment houses sell US bonds (and the USD) to bring funds home to invest locally. “Capital wars” are as important as trade wars – watch this space!

Strong Australian jobs data exerts more pressure on the RBA

Aussie financial markets are now pricing a 60% probability that the RBA will be forced to pivot from cutting interest rates, to hiking their OCR come their next meeting on 3rd February. Last week’s increase in new jobs for December of 62,500 was much stronger than all forecasts and almost cements-in rate hikes as the economy is running much hotter than the RBA previously estimated. The RBA will be keen to see the inflation data for the December quarter on 28th January before reaching their decision.

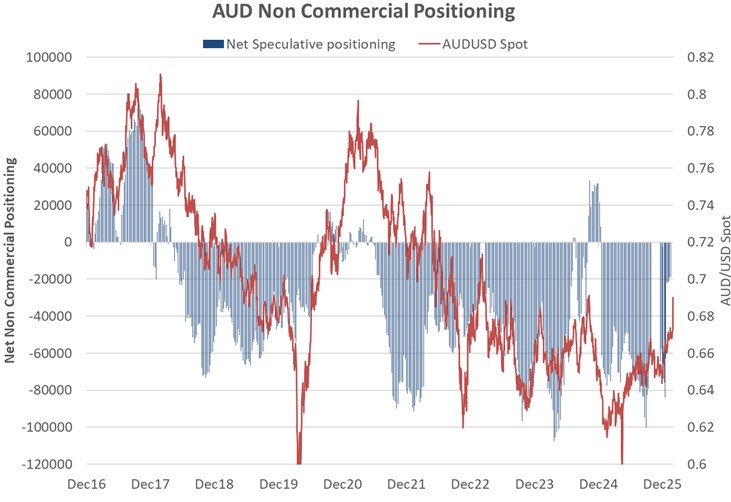

Inevitable interest rate hikes is how the FX markets see it. The Aussie dollar has posted rapid gains against a weaker USD over the last week. The AUD/USD rate lifting from 0.6730 on 21 January to close the week at 0.6900. The decisive appreciation of the AUD to well above to 0.6600/0.6700 area has propelled the AUD/USD exchange rate above the downtrend line is has been under for the last five years (refer to the first chart below). The second chart confirms the massive unwinding of “short-sold AUD” speculative positions over recent weeks as the punters realise the Aussie dollar is appreciating, and no longer likely to depreciate lower. The number of short-sold AUD futures contracts have reduced dramatically from 80,000 in December to 20,000 today.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

It is a familiar story, with the RBNZ misreading the strength of the economy...

One quarter does not make a booming economy, and the current quarter's forecast is based almost entirely on a survey.

If you're going to make such bold claims, back it up with some credible data.

I think the last cut was to much, but it was insurance policy, now its not needed up we go again two 0.25 lifts this year are highly likely.

These will be postponed if the economy rolls over, the housing market is not a major concern of the RBNZ, as long as it does not collapse they do not care if it drifts lower, in fact it probably helps the economy if it does.

Feel sorry for the RBNZ. A lot of our inflation is not driven by domestic demand. Electricity, rates, insurance, and international shortages of some foods.

We could double the OCR and most of those would still not budge.

the climate change and go green brigade must be costing 50-100bps bas inflation

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.