Summary of key points: -

- US dollar buying on Warsh Fed Chair appointment likely to be short-lived

- Pressure mounts for the Reserve Bank of Australia to hike rates

- Are listed Australian companies hedged against the AUD rise?

US dollar buying on Warsh Fed Chair appointment likely to be short-lived

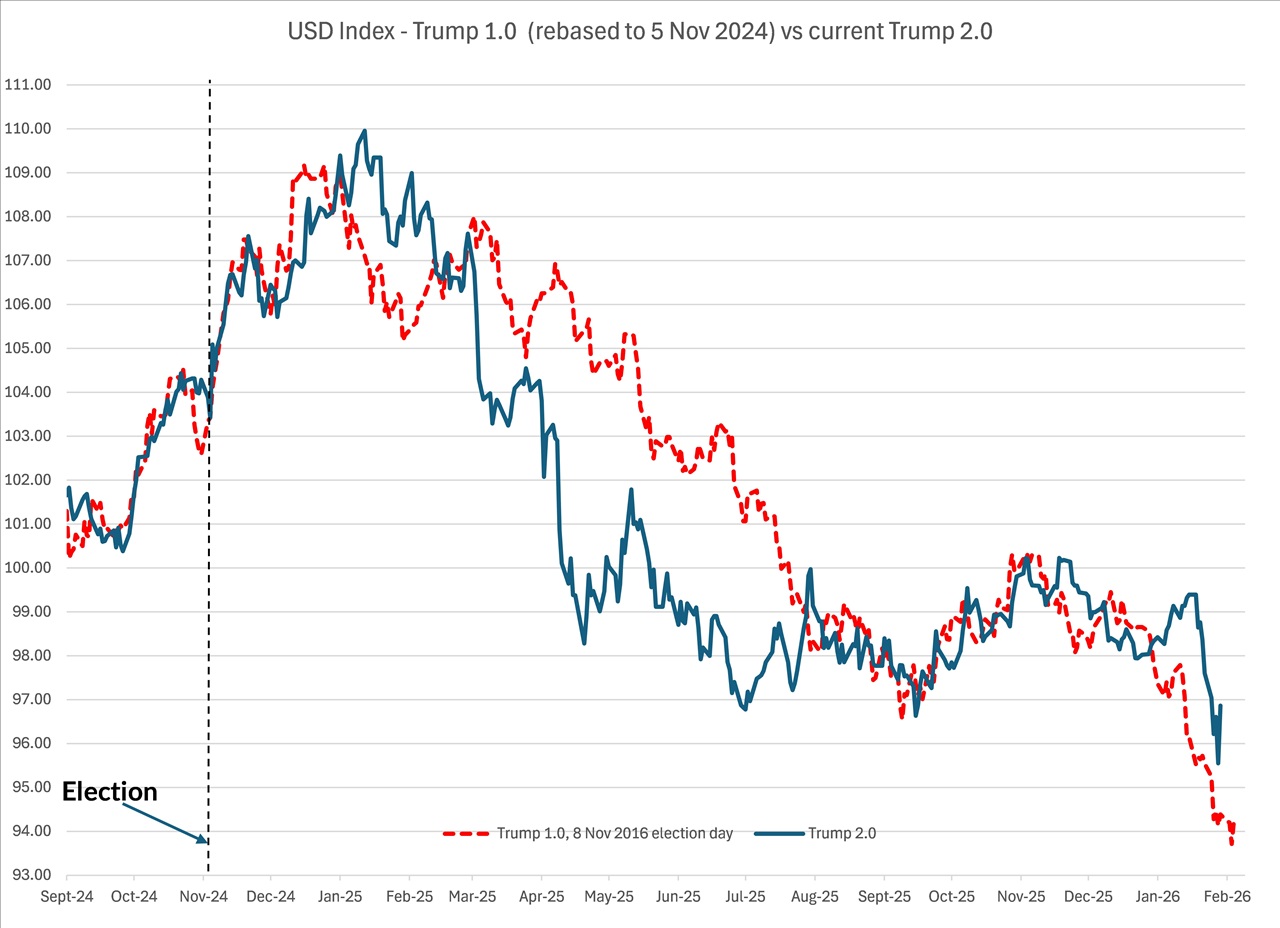

The selling rout of the US dollar in global currency markets continued full on last week until a catalyst was located to stimulate the taking of profits.

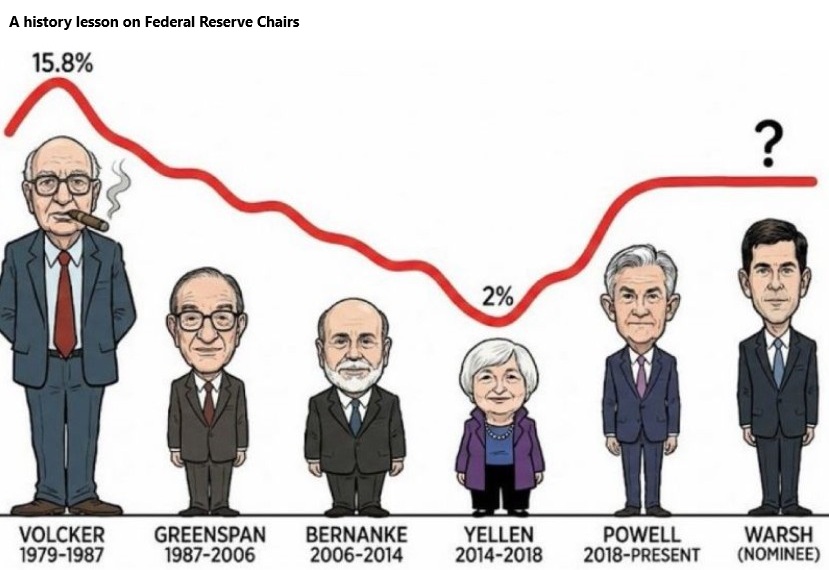

The USD Dixy Index plunged to a low of 95.50 on 28th January, however the announcement from President Donald Trump that Kevin Warsh will be the next Federal Reserve Chairman was that catalyst to halt the USD selling. Serious profit-taking on short-sold USD positions followed, pushing the USD Index back up to 96.86 at the New York market close on 30th January. For some unfathomable reason the FX markets adopted the stance that Kevin Warsh was more on the hawkish side of the monetary policy spectrum and would slow Fed interest rate cuts this year, therefore US dollar positive. Or maybe that announcement was just an excuse for the currency punters to take profits on a Friday afternoon after a 3.50% slide in the USD value over the last two weeks. The FX markets may well have to reassess their reaction that the Warsh appointment as USD positive, as he has been widely quoted over recent months as wanting lower interest rates in 2026, as well as wanting to reform the Fed and reduce the size of its balance sheet (holdings of US Treasury Bonds). To some degree, the Warsh appointment does alleviate worries that the Fed’s independence from political interference would be compromised through Trump’s choice of the new Chair.

Such was the market scare when Trump announced Kevin Warsh’s appointment that the two biggest speculative trades going currently, gold and silver, were completely blown up as the markets panicked that his previous hawkish stance would prevail over his more recent view that US interest rates should be lower. The gold price plummeted 10% on the day and the over-hyped silver price capitulated 30% on the day. Investing in precious metals is not for the feint hearted!

Kevin Warsh, a renowned economist, was the youngest person ever to become a Fed board member from 2006 to 2011. However, it has not gone unnoticed that Kevin Warsh’s father-in-law is billionaire Ronald Lauder (of Estée Lauder) who has been a major donor to the Trump regime. To many pundits the choice of Kevin Warsh seems an odd decision for Trump, as Warsh’s previous reputation was on the hawkish side with higher interest rates to bring inflation under control. However, it is inconceivable to conclude that Trump would select someone who was not going to push for what Trump wants – lower interest rates.

We would agree with the conclusion of one US commentator on the FX market’s reaction to the Warsh appointment when he opined “So that idea that this is good for the dollar is going to be short-lived.”

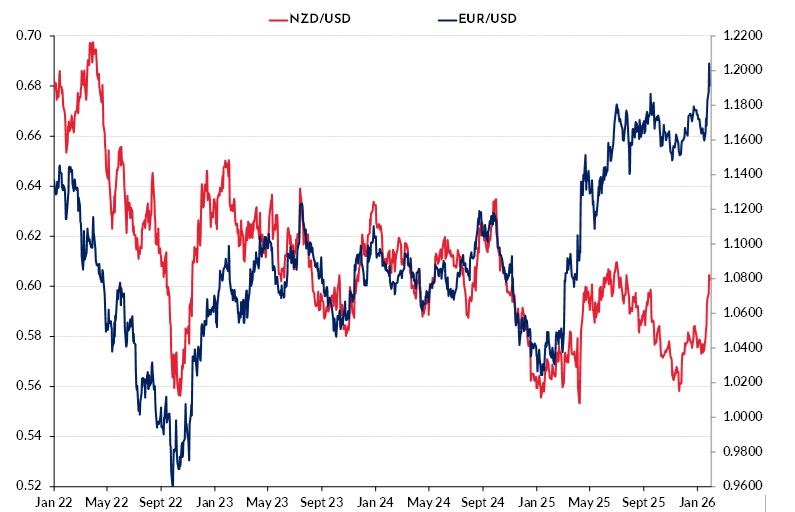

The material pullback in most currencies against the USD late on Friday was not really followed by the Kiwi dollar, it held up better than most. The EUR/USD rate recoiled nearly two cents from a high of $1.2040 to $1.1850 at the close. The Aussie dollar had a blowback of 1.30 cents from a high of 0.7090 to 0.6960. The Kiwi dollar only retraced 0.60 cents from a high of 0.6085 to 0.6025 at the close. As a consequence of the relatively superior NZD performance over the last week, the NZD/EUR cross rate has rebounded up to 0.5080 from lows of 0.4850 in late December.

The appointment of Kevin Warsh as the new Fed Chair still has to be confirmed by the US Senate, and that may have some challenges as many Republicans are not happy with Trump slapping an indictment on current Chair, Jerome Powell over the Fed building renovation cost overruns. The incoming Chair takes over in May, and he will face some tricky decisions for the Fed on the management of monetary policy: -

- How does Mr Warsh reconcile a push for lower short-term interest rates when at the same time he wants to reduce the size of the Fed’s balance sheet by selling Treasury bonds i.e. the selling sends long-term yields higher?

- Does the AI investment revolution and the operational efficiencies gained improve US productivity so much that stronger GDP growth ensures, however employment declines as AI replaces jobs. The Fed’s dual mandate is for strong employment and stable 2.00% inflation, not GDP growth. A lift in the unemployment rate requires them to lower interest rates.

- In serving the best interests of the US people how does the Fed square the current “K-shaped” economic growth position, where stronger GDP growth my continue as the richest 20% spend, however the remaining 80% are worse off with household affordability problems.

From the Federal Reserve’s meeting last week, it seems the bar has been lifted a fraction for the next interest rate cut to be as early as March. However, weaker employment and inflation is still expected through January and February, therefore we still see the USD depreciating again as the soft data confirms further interest rate reductions.

Pressure mounts for the Reserve Bank of Australia to hike rates

Last week’s Australian inflation data for the December 2025 quarter increased the pressure on the Reserve Bank of Australia (“RBA”) to complete a U-Turn and hike interest rates at their meeting this Tuesday. The spectacular appreciation of the Aussie dollar against the USD over the last two weeks confirms that high expectation. Inflation, once again, came in above prior market consensus forecasts and above RBA forecasts. What the RBA thought was a temporary increase in inflation in the second half of 2025 has turned out to be much more permanent. Price increases were recorded right across the basket of goods and services in the December quarter, the CPI inflation increasing 1.00% (forecasts were +0.70% to +0.90%) to shove up the annual rate of inflation from 3.40% to 3.80%. The Aussies are certainly paying the price today for not increasing interest rates high enough in 2023/2024 to slow the economy and reduce inflation. Their strategy of only increasing interest rates to 4.50% (the US and New Zealand went to 5.50%) was a big gamble that has now seemingly backfired on them.

It will be interesting to see how the AUD/USD forex market reacts to the likely interest rate hike on Tuesday? How much of the recent AUD gains have already priced-in such a hike by the RBA, or are there still may investors and traders who will be surprised by a hike and buy the AUD as a consequence?

We have been calling for a much stronger Aussie dollar for quite some time on the back of the interest rate differential moving from Australian interest rates being 0.75% below the US last year to now being 0.40% above US interest rates. Further gains in the AUD/USD rate to 0.7200 and above should not be ruled out as global investment funds exiting the US dollar seek out a high yielding and liquid currency as an alternative investment destination. The Australian dollar fits that criteria perfectly!

On top of the interest rate differential reason for expecting further AUD appreciation, the continuing increases in metal and mining commodity prices stands out as a further compelling reason to buy the Aussie dollar.

Are listed Australian companies hedged against the AUD rise?

The question of the level of FX hedging in place by New Zealand and Australian exporters only seems to come up when there is a sudden appreciation of both currencies against the US dollar. Off course, the art of hedging forward within policy limits is all about entering hedging on the way down and accepting the hedged rates being above market spot rates for a period. It is a much more difficult decision for FX risk managers to enter substantial levels of hedging when the NZD or AUD are zooming upwards and no-one knowing how far they will go.

Many New Zealand exporters selling in US dollar are currently very well hedged out to three and four years forward to protect returns and profits from the NZD/USD exchange rate appreciating back up to the 0.6500/0.7000 area. Dairy and meat exporters do not hedge that far forward as the FX risk is passed through to the farmer suppliers in the milk price and farm-gate meat prices.

However, across the Tasman Sea in Australia there are many listed companies exposed to the AUD appreciation hurting not only USD export sales in AUD terms, but also the conversion back of monthly/annual profits of US subsidiary companies into AUD Income Statements. Equity analysts in Australia have identified listed companies such a Treasury Wine Estates, ResMed, Cochlear, CSL, Brambles, James Hardie and Aristocrat as being at risk of lower profits as US subsidiary profits (denominated in USD) are consolidated into group profits in AUD at a less favourable exchange rate. Even the high-flying bank, Macquarie with its global operations may be negatively impacted with the rising AUD value. Macquarie’s FX strategists have been forecasting a stronger AUD; therefore, one would think that the bank themselves would be well hedged on their USD exposures.

Equity analysts and fund managers in New Zealand should also be looking at the FX hedged positions of listed companies here that export in USD’s or are converting/translating USD profits back home. Listed export companies such as F & P Healthcare and Scales Corporation have always been very transparent with their FX hedged positions and risk exposures, perhaps others less so.

At the end of the day, the onus is on the Directors/Shareholders of these Australian and New Zealand exporting companies to understand the materiality and sensitivity of exchange rate movements to their profits and the volatility of profits. A company with predictable and low volatility in their profits will always value up higher than those with the opposite.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.