Summary of key points: -

- Kiwi dollar sold down one cent on continuing accommodative RBNZ

- Numerous risk events for global FX markets to traverse

Kiwi dollar sold down one cent on continuing accommodative RBNZ

The NZD/USD exchange rate recoiled one cent from the 0.6040 level before the RBNZ Monetary Policy Statement last Wednesday, depreciating to a low of 0.5938 before a minor recovery to 0.5980 at the New York FX market close on Friday. Overall, the RBNZ outlook on the economy and the setting of monetary policy was marginally more dovish than what the financial markets were expecting beforehand.

As has been the pattern in the past, the FX market reaction to such RBNZ statement is typically an immediate one cent movement up or down and then within a week the NZD/USD exchange rate returns to the level prior to the statement as the FX market day traders unwind their positions (short-sold NZD in this case) taken at the time of the statement release. What the US dollar is doing on the international stage at the time always comes into that expected movement as well.

Under the first monetary policy statement from new Governor Dr Anna Breman, the RBNZ seem supremely confident that inflation will not remain above 3.00% for very long and excess capacity in the economy will ensure that it comes down rapidly in 2026. Back in November, they were forecasting the annual CPI inflation rate to return to 2.20% by 30 June 2026, that forecast has been adjusted to a higher 2.70% in the February statement as actual inflation to 31 December 2025 was significantly higher than what the RBNZ were expecting i.e. their starting point for the 2026 inflation forecast was 0.40% higher. Consistent with the November statement, the RBNZ are hanging their hat on the fact that material spare capacity in the economy will allow robust GDP growth this year without prices increasing. They also see the economic recovery as only being in its early/formative stages, whereas it has been quite clear to us that the economy has been undergoing a robust export-led recovery since July last year. We are eight months into the recovery, and it received an added boost last November when the RBNZ cut the OCR interest rate to 2.25%. As households have been slow to transfer from deleveraging to stronger consumer spending, the RBNZ only see the economic recovery as being in its early stages. Whilst retail sales are a large part of the economy, the economy can be growing in other areas, and that is exactly what has been happening over the last eight months.

Governor Breman handled her first statement and following media conference with firm European-style aplomb. We are certainly not going to see attempts to wrong-foot the markets that the previous Governor, Adrian Orr loved to indulge himself in. Reading the room in the media conference last Wednesday, Dr Breman regularly deferred to her chief economist, Paul Conway to deliver detailed answers on the economy. Herein lies the risk for future movement of interest rates and the NZ dollar exchange rate. The RBNZ are convinced by their econometric models that inflation will decline rapidly in 2026 to 2.30% by the end of the year. Whilst the large +0.90% inflation increase in March 2025 quarter will drop out of the annual figures to allow the annual rate to move below 3.00% to 2.80% as at 31 March 2026, there is a reasonable risk in a growing economy with more job security and lower mortgage interest rates, that the quarterly inflation increases over the rest of the year will be above the RBNZ forecasts of 0.50% and 0.60%. In any case, New Zealand’s inflation always comes from the supply side, not the demand side of the economy. If commodity prices remain high, oil prices remain elevated due to geo-political tensions and the NZD/USD exchange rate does not appreciate much, it is hard to see price-setting behaviour in the NZ economy being to the lower side as the RBNZ currently expect.

The RBNZ monetary policy stance of continuing the very accommodative settings seems totally based on the economy having plenty of spare capacity, therefore we can have strong growth without inflation. If we were deep in an economic recession like the GFC in 2009 and the Covid hit in 2020, that would be a fair assumption. However, the economy is now growing strongly from sources that most commentators do not understand, as it is not based on rising house prices or strong immigration inflows. Scarily, the majority of the media questions to the new RBNZ Governor last week were about house prices and mortgage interest rates, as if only they matter in determining our economic wellbeing.

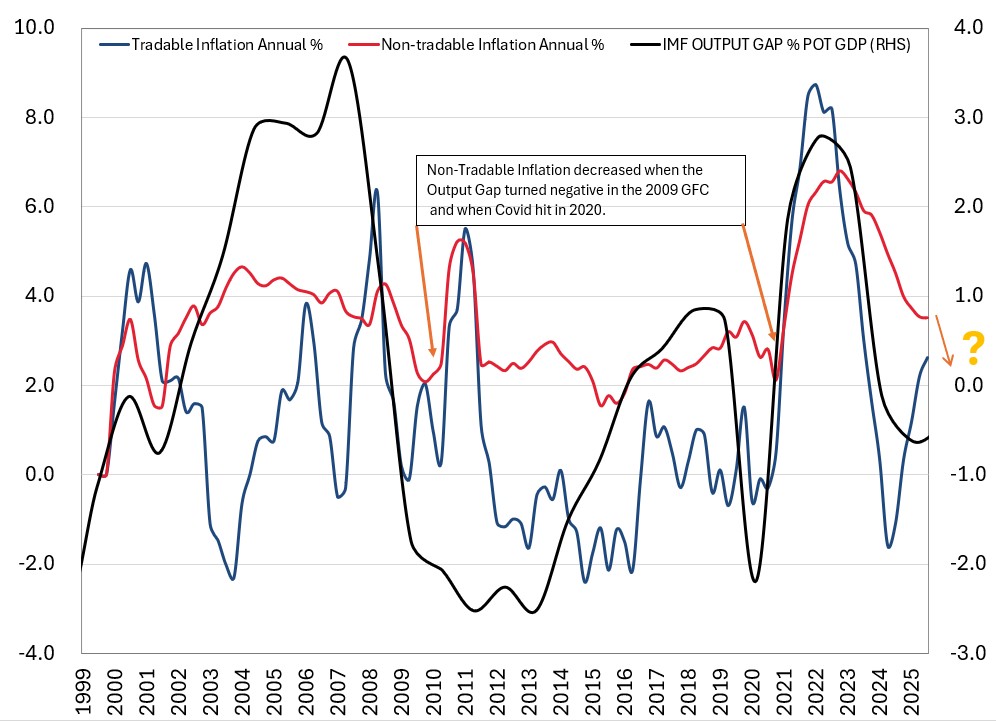

The RBNZ’s forecast that domestic prices (non-tradable inflation) will reduce this year from a 3.50% annual rate to below 3.00% and that tradable inflation will also decrease from 3.00% to nearer 1.00%, seem rather heroic in any economy that is expanding at a +3.00% GDP growth clip. In calculating the amount of spare capacity in the economy to produce their Output Gap measure, the RBNZ apply the NZIER Quarterly Survey of Business Opinion data. The problem with that data set is that is excludes the economy’s largest industry, agriculture. Therefore, it is not representative and may be misleading. In the chart below we have used the IMF’s Output Gap measure (black line in the chart, right-hand axis) for the NZ economy as a more accurate picture of the level of spare capacity in the economy (when the Output Gap is negative). Non-Tradable inflation (red line in the chart, left-hand axis) decreased from 4.00% to 2.00% when the Output Gap went negative in the economic recessions of 2009 and 2020. The NZ economy is not in the same recessionary conditions today; in fact, it is the opposite with strong economic growth. The IMF Output Gap measure has not currently plummeted into negative territory and seems to be already turning back upwards. Any previous spare capacity in the economy is currently being rapidly used up in our considered opinion.

There has to be major question marks over expected further decreases in both non-tradable inflation and tradable inflation this year. If the RBNZ have misread the track of inflation this year, then they have monetary conditions far too loose. As the economic data evolves over coming months, the interest rate and FX markets will quickly reflect a potential U-turn by the RBNZ, just as the RBA have currently been forced into by persistent high and sticky inflation.

Numerous risk events for global FX markets to traverse

Global foreign exchange markets appear both perplexed and confused by recent US economic policy risk events, geo-political risk events, fledgling investment risks and contradictory US economic data releases. As a result, currency levels have not changed very much as no-one is too sure how to read the evolving risks and what they all mean for relative economic performance.

US Supreme Court’s landmark decision against Trump’s tariffs – It was generally expected that the Supreme Court would throughout Trump’s tariffs, implemented under the International Emergency Economic Powers Act (“IEEPA”) as illegal. The 6-3 court ruling against Trump released over the weekend, however, came as a shock and the markets were not too sure how to react. The tariffs under the IEEPA statute cover about 60% of the tariffs Trump has introduced. It is no great surprise that Trump has immediately retaliated with a global tariff of 10%, rapidly increased to 15%, under an alternative statute, Section 122 of the Trade Act of 1974. This statute allows the President to impose temporary tariffs for 150 days only and then any extension requires Congressional approval. In reaching their decision, the Supreme Court failed to provide a mechanism of how the tariffs will be repaid. That is for a lower court to work out they said. Dissenting Justice Brett Kavanaugh aptly described the whole debacle as a “mess”. If the US Government have to repay say 60% of the US$175 billion of tariffs they have collected to date to the importers that paid them, how does the importer refund the overseas supplier and end consumer to whom the costs were passed through to? It is off course impossible to implement and for that fact it will never happen. Trump’s tariff and trade policy has been a total cluster from the get-go, and this is just the latest episode of the soap opera that is his Presidency. The economic and financial/investment market repercussions are difficult to work out. In theory, US inflation should move lower as the tariff refunds are applied through lower goods prices. However, in reality that will not happen.

In summary, this latest tariff shemozzle is just another reason for foreign investors into the US to exit or hedge more of their USD FX risk, as they can just not trust what the erratic and unpredictable President will do next and how that impacts on the US economy. US business firms must be tearing their hair out at all these changes and uncertainty. Sadly, they do not speak up against Trump as they are afraid of his vindicative retribution actions against their companies. All the hallmarks of a corrosive dictatorship.

D-Day for US intervention into Iran – the probability of direct US military action on Iran is growing and with that the US dollar has made some gains on safe haven flows on the elevated geo-political risk. Oil prices have increased sharply over the last month from US$59/barrel (WTI) to the current US$66.40 level, reflecting the heightened uncertainty in the Middle East. As we have seen in the past, these geo-political risk events only ever have a very temporary impact on the US dollar value. Typically, it is a “buy the USD on the rumour, sell on the fact” situation. Therefore, if there is a US air-strike on Iran and it is quickly over with, any USD appreciation we have seen to date will quickly reverse.

Private Credit market risk increases – We highlighted this potential risk a few weeks back, the risk has increased since that time. The US private credit group, Blue Owl is permanently restricting their investors from withdrawing their cash from their fund due to liquidity problems. Sound familiar? In 2008 Bear Sterns did the same with sub-prime mortgage funds. It is a potential powder keg for financial and investment markets as the underlying borrowers under the covenant-light private credit loans start to falter and the private credit funds suffer liquidity issues just like Blue Owl. Is it a “canary-in-the-coalmine” moment as one well respected market commentator, Mohamed El-Erian pontificated last week?

Inconsistent and contradictory US economic data – The markets are struggling to interpret what the US economic data released last week means for the Fed and its expected interest rate reductions this year. At the end of the day, the forward pricing of interest rate decreases this year remained the same at two 0.25% cuts fully priced from June/July and a 40% probability of a third cut before the end of the year. US inflation measured by the Fed-preferred metric of the PCE deflator for January came in higher than forecast at +0.40%, lifting the annual PCE inflation rate from 2.80% to 2.90%. The larger increase was in stark contrast to the CPI inflation measure a week earlier that saw annual inflation reduce to 2.40%. On the other side, US GDP growth printed much weaker than expected for the December quarter, the annual rate of growth dropping to 1.40%, compared to a 4.40% annual rate in the previous quarter. The markets were expecting a lower growth rate due the Federal Govermment shutdown, however other areas of the economy such as consumer spending were also weaker. Earlier last week, the US trade deficit in the month of December was US$70 billion, greater than prior forecasts. So far, Trump’s tariffs have done nothing to increase US exports and reduce US imports to reduce their trade deficit with the rest of the world, as he claimed they would.

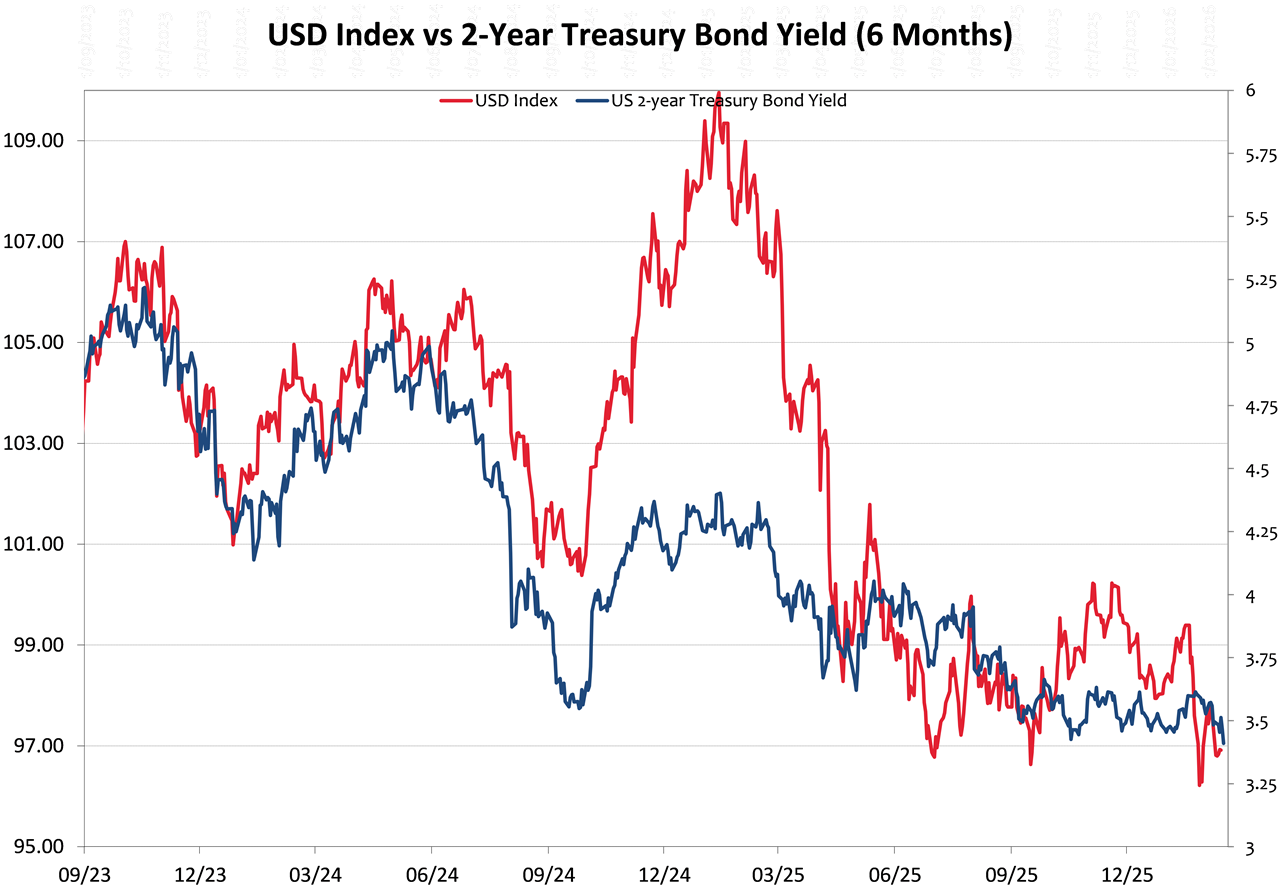

A reliable gauge or indicator as to expected future US dollar currency direction is the correlation of the USD Dixy Index to their two-year Treasury Bond yield (refer to the chart below). The two-year yield builds in expected changes to short-term interest rates by the Federal Reserve. Over recent weeks the two-year bond yield has reduced from well above 3.50% to 3.48%. The two-year interest rate is at its lowest levels since August 2022 and it reflects a growing expectation that the Fed will be forced to cut interest rates sooner, rather than later, this year. Further reductions to 3.25% and ultimately 3.00% in the two-year bond yield, based on weaker US economic data over coming weeks/months, would see the US Dixy Index follow to 95.00 (currently 97.70) and below.

The pullback in the Kiwi dollar to below 0.6000 caused by the RBNZ last week does not look like it will last too long, as a weaker USD is still the dominant theme and trend in global currency markets.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

3 Comments

My view is that the USD has decoupled from it's traditional interest rate differentials and instead draws guidance from Trumps behavior. The USD will not go back to "normal" behavior while he remains in office. I expect it to remain elevated for some time.

This is very bullish on the NZ economy and I think it highlights that the NZ economy is entering stagflation - an inability to grow sufficiently to outpace rising inflation. The article correctly highlights the NZD value as an inflation risk with an OCR that stays too low for too long. The other risk to growth in NZ is the labor market and the fact that over 130,000 working age Kiwi's have left. There is a skills shortage that is being overlooked and it will trigger wage inflation if (big if) the economy starts to grow.

I don't see a sustained recovery in 2026 - there are too many recessionary indicators - rising unemployment which is (now) being forecast to recover by mid 2027 and record numbers business liquidations.

The agriculture sector is about 5% to 6% of NZs GDP - it is not large enough to deliver economic recovery to the broader economy on its own. What's more record high levels of debt in NZ are likely to lead to deleveraging over consumption.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.