Economists at the country's largest bank, ANZ, have now changed their call and expect the Reserve Bank (RBNZ) to produce double hikes in the Official Cash Rate at each of the next two reviews.

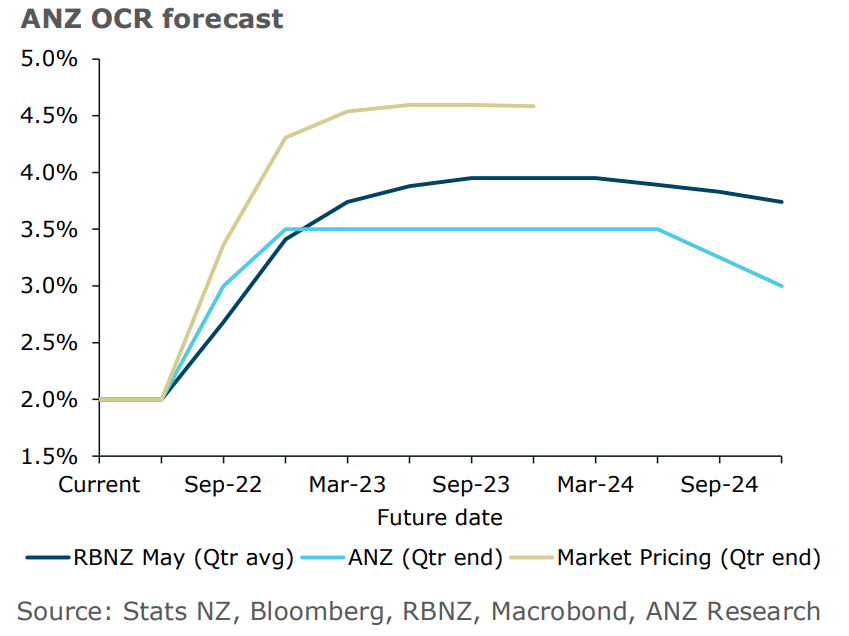

If they are right - and it's what an increasing number of economists believe - the OCR, which is 2.0% at the moment - will be at 3.0% by the end of August.

And that would mean the OCR, which stood at 1.0% into April, will have basically tripled inside five months due to four consecutive rises of 50 basis points. But the ANZ economists - while not expecting it - are also not ruling out the possibility the RBNZ may hike the OCR by 75 basis points at the next review.

At the last OCR review on May 25 the RBNZ raised the rate to 2.0% from 1.5% - which was expected. But less expected was a stepped-up forecast of future rate hikes that projected the OCR would hit close to 4.0% by the middle of next year.

In his comments following the OCR announcement, RBNZ Governor Adrian Orr made clear the central bank's grim determination to battle rising inflation expectations and therefore to get actual inflation back inside the targeted range of 1%-3% again. As of the March quarter annual inflation hit 6.9%.

The ANZ economists had previously picked a double rate rise in the forthcoming July 13 review from the RBNZ but then just a 25 basis point rise in the August 17 review.

However, in their weekly Data Wrap publication they've made the change. And now see 'doubles' in both reviews.

"We continue to expect that signs of softening domestic demand will see the RBNZ return to 25bp moves, just a little later than previously anticipated," they say.

"We’re forecasting further 25bp hikes in October and November will bring the OCR to a peak of 3.5%. From there, we think the RBNZ will hold off on further hikes as inflation pressures wane – as long as there are no further upside inflation surprises."

The economists say they have not had "a big change of view" and still think the RBNZ will be surprised "by how rapidly it gets traction on domestic demand".

"But we’re just running out of time for the data to soften enough for the RBNZ to revert to 25bp hikes by August, due to a combination of strong monthly data prints for inflation and employment, as well as global events."

The ANZ economists say the RBNZ is placing a lot of weight on the strength of the labour market in its assessment that the economy can withstand a rapid rise to 4% for the OCR.

"That means the bar for returning to 25bp hikes will be very high until we start to see a meaningful easing in labour demand. And so far, that’s yet to emerge. Indeed, the small fall in GDP in Q1 was much more about labour shortages than it was weak demand. If the RBNZ assess these data as we do, they’re likely to look though the headline read."

The economists say that most recent inflation data have also offered no respite – particularly with regards food and petrol.

"While there’s not a lot the RBNZ can do about either, the fact is, petrol and food prices are both highly visible, and are driving inflation expectations higher, particularly for consumers.

"The usual policy prescription would be to look through an oil price spike, but that flexibility doesn’t exist when inflation is around 7%, and inflation expectations remain dangerously elevated.

"And food prices surged 0.7% m/m (6.8% y/y) in May. Particularly worrying is the jump in the restaurant meals and ready-to-eat food sub-group (classified as non-tradable). Inflation in this sub-group surged to 6.0% in May (5.3% previously).

"That’s wages. It suggests there’s plenty of domestically generated pressure still coming through."

The ANZ economists said the US Fed's decision last week, after release of "alarmingly strong" 8.6% inflation figures, to hike the fed funds rate (FFR) by 75bps and significantly upgrade their future projections, with the median pick for FFR to peak at 3.8% in 2023, had triggered "a rapid recalibration of market expectations for the OCR in New Zealand".

Markets were now pricing in an OCR of 4.57% in October next year, versus an already-high 4.17% a week earlier.

And the markets are pricing 66bps of OCR hikes in the July RBNZ meeting.

"While the RBNZ may not be inclined to raise rates in jumbo steps just because markets are pricing it, it does make it easier, all else equal.

"And the parallels between the US and NZ have been hard to miss – so could we get a similar CPI shock here? [June quarter inflation figures will be released on July 18.]

"It’s certainly true that higher inflation in the US suggests we’ll see some of that pressure in import prices. In addition, the gap between the OCR and the fed funds rate is rapidly shrinking, which could put downward pressure on the NZD [New Zealand dollar], further exacerbating imported inflation.

"Combining these global developments with lingering strength in domestic data puts us over the line to call a fourth 50bp hike in August.

"But as to a 75bp hike in July, which markets are currently flirting with, we’re not convinced. The urgency for the Fed to raise rates is much greater. Interest rates rose much earlier here, and the impacts on housing are already very clear.

"That said, one can’t rule out a 75-pointer from the RBNZ along the lines of 'while the going’s good'. The market is pricing a good chance of it, and as yet there’s no real push-back to the idea that rapid rate hikes are needed. The RBNZ will be well aware that hiking is going to get harder as the economy slows.

"Any upside surprises to inflation and it’s game on, but for now, no need to panic."

60 Comments

As well as the pertrol/diesel subsidy coming off, there is going to be more upper cuts than a Mike Tyson fight...hope some people have strong chins. "soft landing" though .

I bet they will extend it, it would be 3.5/L in my area

Of course they will. They are already in the political poop on cost of living

ANZ economists change their mind more often than I change my underwear.

... twice a year , then ?

The wonders of merino...

Surely a revision downwards in their house price forecast is coming? If they are right on the OCR, it will be a 20-25% fall MINIMUM.

ANZ (and any of the other banks) won't forecast a serious decline in house prices until it has already happened. You have to realise that these guys are out there talking their book, not providing legitimate economic analysis.

True, although they are always talking up the objectivity of their analysis, take with a grain of salt

Its not good for ones promotion or retention within a bank to forecast bad times.

Hence nearly every bank economist failed to forecast the housing crisis in the US before the GFC.

Goes to show that listening to biased commentary on a topic is a waste of time.

Then again, Zollner has been cautioning for quite a while that things could turn bad in the NZ housing market so I guess that is as extreme as one can get while maintaining their job at the bank.

Show me the money and I will show you the outcome you desire...

Yes and their Book is looking decidedly shaky. Help where is the Taxpayer

... kind of wish the government had taken green hydrogen more seriously as a fossil fuel free way to power our nation's vehicle fleet ... and , wholly produced here ... no supply chain issues ...

....have you not worked it out yet gummy. The days of private motor cars for all, no matter what fuel source, is coming to an end.

How are we supposed to get anywhere without a 1-ton air conditioned metal box sitting on our driveway for 90% of its life?

Hydrogen is a joke for small private transport. It might have a use case for large industrial uses like mining, rail or aviation. Unless you are getting it as the byproduct of a process that you already need to undertake its just not energy efficient.

Well its not perfect but it has the most potential and can be sustainable, we should be throwing R & D $$$ into hydrogen IMO.

Way more efficient to just use the electricity to charge an EV battery than to generate hydrogen you then have to compress and move the country, isn't it?

Even better if the battery is in an e-bike or scooter.

ATM that is true, but to create that battery takes a lot of rare earth minerals and they only have a certain life. Hydrogen is sustainable even if it is a loss of energy as a battery, but that is acceptable due to its scalability.

Yup, a positive EROI is great but there comes a point where you need to sacrifice efficiency to get the work done. I suspect Battery electric and Hydrogen will exist in future like Petrol and Diesel does today..

Linus Tech Tips crunched the numbers, a trucking Hydrogen nozzle has an "effective charging rate" with a 50% loss of 3.5MW. To achieve that with 800 volt battery you'd need 4400 amps.

I'm under the expectation that even an OCR at 3.5% is going to cause a significant slowdown in the economy and also very fast. I suspect come September/October you'll see a marked change in everything (obviously needs to happen) but its still quite incredible to watch how quickly we've gone from one extreme to the other.

Another thing to think about is asset prices coming down much further. Who is going to have spare money to invest when most people are going to struggle to make ends meet in the stagflation environment? Polar opposite of middle 2020- end of 2021.

House prices needs to continue falling until average wage earners can afford to purchase. So in Auckland another 60% could do it.

Where does it have to drop to so that average jo bloggs, who has been putting the minimum into his now-thrashed kiwisaver, can afford the deposit - let alone the mortgage repayments?

I suspect we're going to over-correct in a big way.

Policy response seems to be getting more and more vigorous. It’s a sign of the times when the only speeds they have is 5th gear and reverse. I’ve no doubt it’ll overshoot and sharply correct.

You seriously think a 3 bed townhouse in Auckland selling for $1.5m in 2021 is going to drop to $600K?

Dreaming. That would be the end of NZ economically.

You could pick up a 3 bedroom freestanding property on the shore for that much not all that long ago, and I don't seem to remember it being an economic wasteland then.

I'm with you, ShoreThing! Why do people predict that the economy's bottom will fall out if (when?) house prices crash/correct (whatever label you prefer) down, say, 30%? That is my point too. Things were OK before house prices rose almost 50%, which I think was only 18 to 24 months ago? So a 30% fall taking us back to those times should make relatively little difference, except to those that overextended themselves in the last few months? OK, it will also be tough on real estate agents, ticket clippers, property scalpers, and those in construction who became spoiled by and addicted during the good times?

There has been a huge increase in housing debt over the last 24 months

@tuisbest the issues is the massive increase and debt taken in and increasing interest rates that some will not handle. Add to that the removal of interest deductibility for rentals. Whilst most could probably handle a drop in equity, cashflow is another story entirely

Agree.

The medium-long cost to society of not falling to at least $600k would be greater. We would still be at 10x median wage. I prefer $450k as a target.. in a short while people would be happier, less stressed, more to save and spend, less work, investment would channel to productive businesses etc.

Besides i wonder how many people as a percentage of population (not counting banks, investors and local government) would really be affected for long by a big crash. Someone on here from Ireland when houses dropped 70% said it was very tolerable.. sounds good to me.

That the average 3 bed townhouse in Auckland was ever valued at $1.5m is the end of NZ economically....

Bit like being drunk and thinking one will never have a hangover....but the pain always follows the unprincipled pleasure.

💯

Drop of only 600k some places in north shore already down 250k and crash has just started by early next year you will see the 600k drop level if rates and inflation continue to climb this will drop even more over next few years.

$1.5m to $600k = 60% drop. Ireland had a 70% drop, and they survived just fine?

Great comment Thinker

The herd has turned! A loss of confidence or a threat does that and quickly.

When the hits are coming thick and fast, like they are now, the choices come back to the basics and survival.

https://www.instagram.com/reel/CeTUQXflrRU/?igshid=YmMyMTA2M2Y=

Nothing changes it is the Politicians that come and go

"But as to a 75bp hike in July, which markets are currently flirting with, we’re not convinced ... interest rates rose much earlier here, and the impacts on housing are already very clear."

So what? People don't eat their houses or put them in their car.

The reserve bank was fairly vocal about house prices not being their problem on the way up. Surely they're not hypocritical enough to turn around and start worrying about them on the way down.

Fear not lc, real estate agents will do everything in their power to keep house prices as high as they can for as long as they can... (probably helping to instigate a 'hard landing)

(probably helping to instigate a 'hard landing)

So ironic, isn't it? If it wasn't for all the spruiking and self-serving, misplaced optimism (or could we simply call those lies?) by everyone with vested interests in property, we would probably not have seen so much frantic, FOMO-fuelled buying and we'd have been looking at a much softer landing now. Which would have been more beneficial to everyone in the longer term.\

I wonder how many surplus people have become employed in property speculation adjacent businesses and what that will do to the employment rate when these businesses wind up.

RB cause & effect working out OTT I see. Over caused & now over effecting seems to be their MO recently. Not the greatest piece of central banking I've seen. The good news is that the RB gets it so wrong so often that it could go anywhere from here, including in the other direction. Makes investing fun though, doesn't it?

Fun times for those with mortgages coming off fixed rates in 3-4 months...

These people must of understood rates were at emergency level and would go back up,

That's not what Mr Orr told them.

Media reports in 2019:

"Orr was firmly of the view that low rates were the new norm... It’s easily within the realms of possibility that we might have to use negative interest rates,” Orr said.

https://www.interest.co.nz/bonds/101089/closer-look-regret-analysis-and…

People who locked in a rate 3 years ago were led to believe that rates would be very low, or negative, by now.

What a debacle. Orr's tease of negative interest rates, quickly followed by our prime minister saying she wants shelter to get more expensive every year for NZ humans because that's what most people 'expect'... 🤦♂️ These will be parts of NZ ECON/POLS/HIST papers in the future.

"must have', not "must of"

Yvil You are throwing a tantrum again just calm down house price’s are crashing you have years of this to come if you are over leveraged sell what you can before you lose everything and stop making out all is well in housing market.

You're advocating house price perma-death, right?

Yvils not saying things are rosy, but if you're thinking this is some sort of financial or housing end of times, you might end up fairly under-whelmed.

With the US going large we have little choice but to follow.

How come the Australian Cash Rate is so low compared to ours? You are saying everyone must follow the U.S. - Australia is not.

The employment data from the household labor force survey is going to far less relevant in this environment. RBNZ needs to be getting live data from IRD for PAYE from the payday filings to spot early trends in income reductions. They have gone hard and early to make something happen. Its happening alright. But from up in the tower we all look like ants. Retail and Hospo workers have flex in their contracts. Many are working more than one job. One hour of work counts you employed in the survey. But if your employer cuts your rostered hours from 40 to 35 then you are taking home $83 per week less in the hand. The timing of when RBNZ makes the first rate cut is going to be more important than anything.

Higher, sooner is the better call, so 2 x 0.5% hikes is good, I don't believe 0.75% hike will happen though.

My money on .75 to 1.00. The reserve banks tend to work together (they did on the ways down) so we have every reason to expect a surprise.

Besides i think Grant threw him under the bus when rbnz asked for a conservative budget and grant dropped a monster. So orr might not mind to return the favor with a nice economic shot whilst labour support is dropping.

With the boarders will and truly re opened, you'll see a lot of money being spent off shore on flights and spending $$$.

Really feel for local retail and hospo..

where's the ANZ forecast versus reality chart?

The Reserve Bank is responsible for creating a flood of new money, via bank lending into the housing market at an Official Cash Rate of 0.25%. Ultra-expansionary policy caused a frenzy in the housing market, with many people borrowing heavily at record purchase prices.

The Reserve Bank is now actively destroying our debt-driven economy, causing economic collapse via aggressive rate hikes into a falling housing market.

The people who bought houses at record prices when the OCR was 0.25% were effectively advised to do so by the Central Bank. The Central Bank back then said they would keep interest rates low. Now, as the OCR is being raised sharply, the property market is crashing. Those home buyers now find themselves overindebted with their equity melting away. At the same time, servicing their mortgage becomes increasingly expensive as interest rates rise steeply.

There is no way that interest rate hikes can stop the devaluation of the Dollar, after years of COVID handouts, stimulus, quantitative easing, monetary expansion through low interest rates. The value of the Dollar is going, and it cannot be preserved by OCR hikes.

Instead, OCR hikes in our overindebted society will cause a liquidity crisis. This is already beginning, and it could soon spiral out of control: deflationary collapse, widespread bankruptcy, economic depression.

Are the Central Bankers mad, to continue this course of aggressive rate hikes into a falling housing market, or is this deliberate economic destruction? Some conspiracy theorists say that the 'powers that be' want to enslave everyone. Is this true, or are the Central Bankers just incompetent?

They're just incompetent

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.