BNZ economists are now forecasting 'modest' falls in house prices but say a "large correction" can't be ruled out.

The economists also anticipate ongoing interest rate increases, constrained household spending and, "while a recession is possible it is not our central scenario, barring an external shock".

The BNZ economists join Westpac economists and prior to that the Reserve Bank (RBNZ) in forecasting outright falls in house prices. Other economists have forecast sharp falls in house price inflation from next year, but with house price growth on an annual basis just remaining positive. ANZ economists for example last week said they expected a few months of falling prices next year but the market would have a "soft landing"

In the latest BNZ Markets Outlook BNZ head of research Stephen Toplis notes that "with just one increase" in the Official Cash Rate from the RBNZ so far, raising it from 0.25% to 0.5%, bank lending rates "have moved dramatically".

He says there are "far too many people" saying the RBNZ can’t raise interest rates much because it would result in weak growth, an increase in the unemployment rate and, potentially, a significant fall in house prices.

"The Reserve Bank won’t say it so explicitly but this is the very point of increasing rates..."

Money markets have now priced in an OCR rising to 3.0% by July 2023, Toplis says.

"Some, but not all, of this is now being reflected in those lending rates," he says.

"The average two-year mortgage rate, for example, is up around 175 basis points."

Toplis says there are already the first, largely anecdotal, signs that this is starting to impact the housing market.

"Additionally, it is clear the banking system is starting to tighten lending criteria in light of the tighter prudential requirements (both already introduced and proposed) by the central bank, and as banks reassess their risk in a market that is looking increasingly fragile.

"All of this will inevitably lead to, at best, a stalling in house price appreciation. More probably we will see a modest correction in prices (which is our central forecast). A large correction cannot be ruled out."

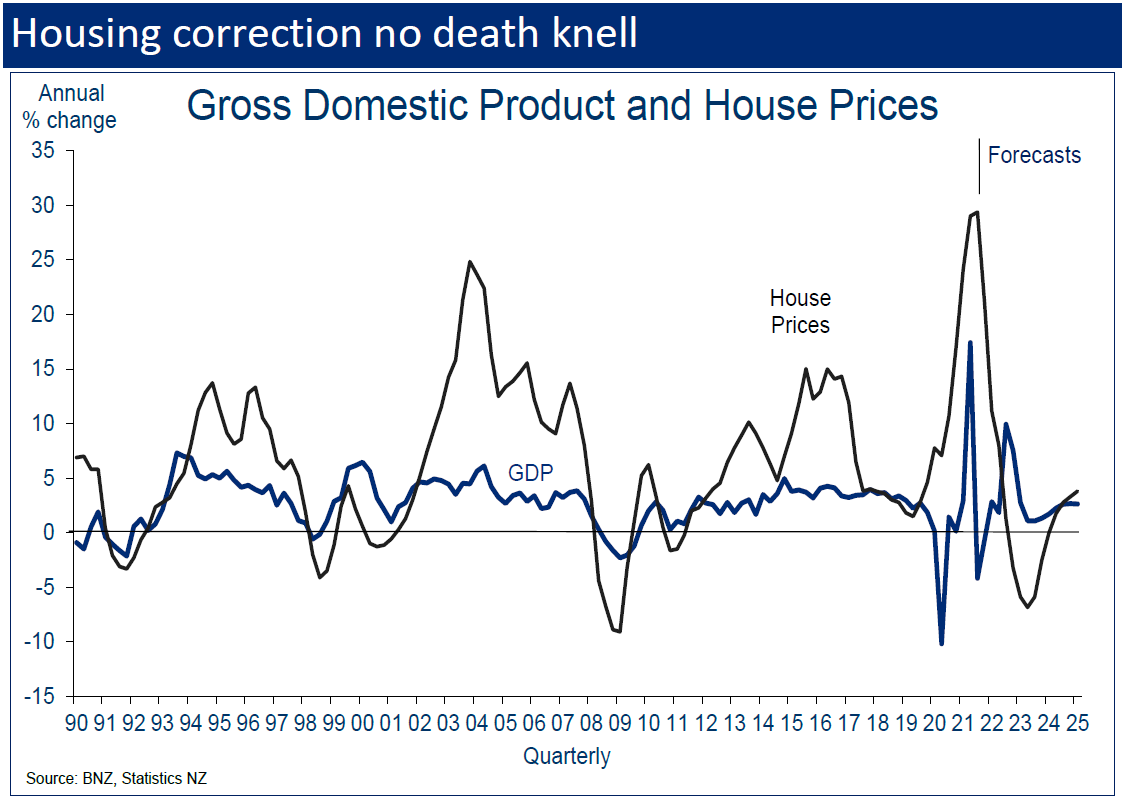

Toplis doesn't put figures on the likely size of the house price fall in the text of his article, but the accompanying graphs suggest a fall of perhaps 6%-7% at its fullest extent.

Toplis says falling house prices and rising interest rates tend to have their biggest impact on private consumption (household spending) and residential construction.

"There is no reason to believe things will be any different this time around but there are reasons to hope that there is enough momentum elsewhere to keep the broader economy’s head above water."

While overall spending may hold up, durables spending is most at risk, he says and notes that:

- It is the sector that will be most affected by rising interest rates and falling asset prices;

- There appears to have been “overspending” in this sector;

- Durables goods spending tends to follow a replacement cycle – once you’ve bought a big ticket item you don’t need to replace it again for some time;

- New Zealanders will, again, start to travel, both domestically and offshore, diverting money that was spent on durables towards services;

- A softening housing sector has its greatest impact on durables spending.

"Of course, there is significant noise in all data at the moment so it is difficult to quantify anything but, on balance, we do think the combination of falling house prices and rising interest rates will meaningfully constrain private consumption over the medium term. This pressure is likely to be at its peak in late 2022, early 2023."

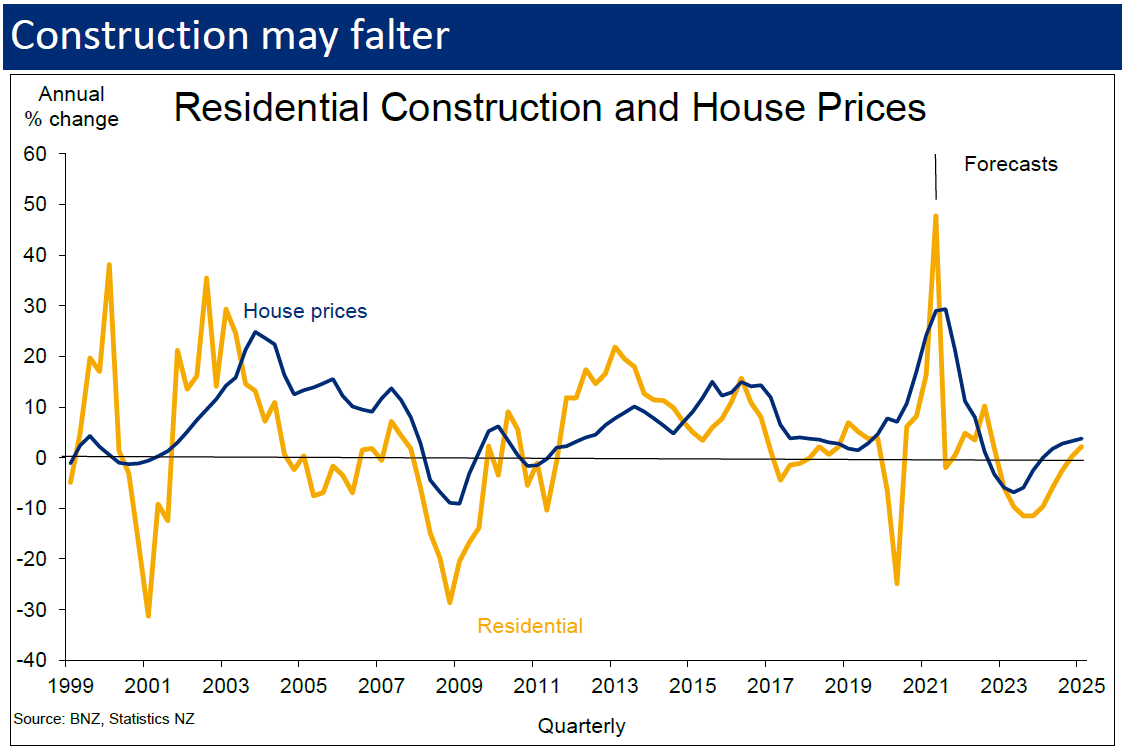

In terms of the outlook for the construction sector, Toplis says that, not surprisingly, house prices and residential construction also "cycle together".

"Falling house prices tilt affordability towards existing houses and away from newbuilds. This will be especially so given the rapid increase in construction costs that we are now seeing."

He says that, generally speaking, the combination of rising construction costs, higher interest rates, the current acceleration in supply (which is greater than the acceleration in demand) and falling house prices will lead to a reduction in residential construction activity.

"There is no reason to believe otherwise in the period ahead. Nonetheless, activity is likely to remain more elevated than might normally have been the case because of the severe backlog of work that currently exists, caused by extreme capacity constraints, and the starting point of undersupply."

"If we do get downward pressure on private consumption and residential construction, does it necessarily mean the economy will go into a broader recession? No.

"Indeed it is rare that New Zealand goes into recession without the influence of a major shock. In fact, even house prices have not corrected in recent history without the presence of an external event."

Toplis notes that "in the event things get a bit hairy" in the NZ economy, the government is well placed to provide support given that its relative debt position is "not threatening".

42 Comments

What?? It can't be, didn't the experts say housing price will be doubled every 10 years? It can not fall, our government and RBNZ won't allow it. Didn't Jacinda say she like to see housing price increase every year? If this happens, our government is not doing their jobs to keep the housing price up. No way!

A drop in price one year doesn't mean house prices can't double in value over a 10 year period.

That's the problem with that statement. It's vague. They tell you house prices doubles every 10 years but they don't tell you house price could drop during one period time and they don't tell you how much it drops and how long it will be like that. The question is, can you hold it to sit through it? Not even mentioning about which locations.

COH

Really?

I took your initial comment as being flippant (although not particularly clever) but pressing the point you seem to be showing a naivety.

The comment "They tell you house prices doubles every 10 years" is a simplistic throw away line. . . . usually used sarcastically on this site by DGMs and I wouldn't seriously be taking note of any such comment.

Like the share market, fluctuations in the property market are common - such as falls in Auckland in 2017, and nationally in early in the GFC.

I have posted a number of times that I have experienced three or four falls . . . . the key is that one usually owns property long term and short term fluctuations are irrelevant.

For those that own property, the important factor is being able to service the mortgage and with rising interest rates that currently has significance. For those who don't own property, well there could be some likelihood that there may be a fall in the market; however, trying to time the market - be it shares, investments, or property - is widely debunked by serious investment advisors and March 2020 is a classic case of that.

Is the market likely to show some correction? . . . most probably and as price rises are not sustainable I have been of that view and posted as such since November last year. Is the market likely to double by 2031? . . . personally, I think that properties are so highly over-valued that we are in for a prolonged relatively fat period (at least initially with some chance of some correction) so for FHB it is about a home and for investors it is about yield. The property party of significant CG are over for some time.

So sorry son, your comments shows little insight into property and really adds nothing.

Oh that's pretty judgemental. I was being sarcastic, not being naive. I think people who believe house price doubles every 10 years are naive. Again, this is my opinion. I didn't consider myself giving any insight into property, hence not even little. Why were you so fired up about me being sarcastic? Was there something I say that triggered you? If there was, I apologise. Anyway, everyone can give out opinions, even DGMs. You just need to make your argument to prove them wrong, which is more effective than labeling them DGMs in my opinions. What is a DGM anyway? If a person wants a recession to bring down interest rates to fuel his property price, would he be considered as DGM?

Very true.

Notwithstanding that, I personally think house prices doubling every 10 years is a thing of the past, for a host of reasons.

It's a magic number that 10 years eh? Cue the BLT ...

Sandwich?

How many have stopped to ask WHY house prices have outpaced incomes and “doubled every decade”.. in the past 50 years we have seen the compounding impact of:

1. A move to two income households as women entered the workforce

2. A considerable drop in the relative price of discretionary items (eg TVs, computers, furniture, clothes, airfares etc) - leaving more money for mortgage payments as we exported consumer inflation to China

3. A steady, albeit inconsistent, reduction in mortgage interest rates over time

4. Supply constraints due to the RMA and Building Act

5. Strong net migration

6. An unshakable belief in property investment - given memories of the 1987 share market crash and GFC finance company failures.

7. Etc etc

Question.. after all these items (and others) have compounded to create our current position - what is the next factor which will see prices double again??

You’d be a brave pundit to assume it’s an immutable law and not just the tail end of a 50 year period of good fortune :)

8. Tax advantage

9. It's policy - house price increases give us "wealth effect" and government, Treasury and RBNZ seem to like that.

10. It's policy to protect it from risk and price discovery - monetary policy, welfare subsidies etc.

When has a bubble ever popped modestly?

I find it cute how economists' graphs always forecast a brief stint in negative territory, followed by a quick reversion to the mean. Every time.

A bit like RBNZ inflation forecast graphs always land on 2% the following year

2009? Though wasn't really a popping, more of a leak quickly overcome by the connection to a large compressor...

Rastus, the answer to your question is in the article, read it. There's a graph which shows that what you call "the bubble" popped in 1992 by 3%, in 1999 by 5% and in 2009 by 10%

Was that a pop? Nah, that was just a small correction.

And we were not in anything like the international headline grabbing world famous property bubble NZ is now in.

There you go, you just answered your original question

A bubble is only a bubble if it one day explodes.

Increasing supply causing price decrease doesn't mean there's some sort of bubble burst, but I do believe we're in one.

A tightening of credit feeding onto itself is a bubble burst, and the price follows.

It's just a fancy word for, Correction.

Ahh, the Soft Landing.. "please assume the brace position. (Lean forward with your hands on top of your head and your elbows against your thighs. Ensure your feet are flat on the floor.) A life vest is located in a pouch under your seat or between the armrests...."

Place yer head between yer legs and k*ss yer *ss goodbye..

If my memory serves me right, BNZ have always taken a negative view of the housing market while the rest have had a positive view. I am curious of this pattern.

Any thoughts?

BNZ doesn't have a lot of skin in the housing market game. They do not lend a lot to housing. Their share of housing mortgage is very small compared to others.

Do do not worry guys. Keep buying and increasing house prices. I am counting on you all for my millions I will be making.

trust no economists.

NZ's wealth are held in housing and farm land.

Unless the US decides to suck that wealth, it would not shrink.

Real estate ….since hundreds and thousands years ago, nothing new apart from we’ve got the internet these days which accelerates thing up even more.

This type of announcement, which one sees a lot, is to influence RBNZ decision on OCR and possible DTI or any other measures that Mr Orr may consider (Though doubtful as he himself is in favour of supporting the economy = housing ponzi).

All data/information suggest that house prices are rising on a weekly basis that too after after appox 50% rise, so banks and many so called experts and economist are trying to fib a lie to influence Mr Orr, forgetting that Mr Orr needs no convincing as he too is in the same boat as them - ponzi.

Before anyone goes in believing this prediction or forecast, remember that they are always wrong as always announced with ulterior motive and tilted in support of ponzi. In March/April before the rbnz announcement were predicting that house price will rise growth will slow but it grow more than double digit in just few months. Can check before each rbnz announcement and decide for yourself.

you may well be correct. Peddling the negative narrative to give mr orr an excuse to not raise.

right on the back of John Key saying something similar last week

Its all part of the game

Other economists have forecast sharp falls in house price inflation

This is misleading to the untrained, some will skim read this and conclude sharp house prices are forecast when in fact, it simply means that house prices are expected to rise by a lot less than previously

Economists' predictions? I would put them into same basket as tarot card readers, astrologers, palmists, fortune tellers. They claim to be able to predict anything. EXCEPT when the next sucker will come along to pay for their lunch ticket.

If you were to do the exact opposite of what Toplis' suggest over the years posted on this site, you'll become a very rich man (or woman).

From telling people the stock market will collapse get out quick a few years ago, to telling people house price will fall almost every other year, this permabear has got it so wrong that making money is a matter of betting against him.

Be quick!

Ohh don't you worry fellow kiwis. Just keep buying houses in multiple of millions. This is just scare mongering. House prices will only go up in NZ. Don't read into the past. Past is history.

Just keep buying from each other and let's reach new heights in house prices.

Remember we all have to be multi millionaires even if it's only on paper. Feels so good.

Let's hope construction keeps up, we can never have too many houses, at least not in this country.

Mixed quality from Toplis. He's certainly the best bank economist.

He's right on falling construction, but not bearish enough. T Alexander is much more bearish and I think he will be right. Plenty of building companies have folded the past few months, and many more teetering.

Many working for Kainga Ora are on the edge- fixed price contracts and no room to wriggle.

I expect a construction sector led recession in the next 1-2 years that will see the OCR cut again.

There was a time when Tony = Ashley and vice versa but lately it's become increasingly apparent that Tony has gone cold turkey on the oneroof Kool Aid

Can anyone out there tell us how many ways there are for bank economists to hedge their bets?

Another year, another economist predicting house price declines. Forecasting house price declines in New Zealand is anyone's hill to doe on.

Barring external shocks?

- Hot China-Taiwan war

- $150/bbl oil

- Non tariff trade barriers

Commenters may think up more....

I am sure Toplis is a really good bloke, but I stopped paying attention to bank economists-indeed any economists-quite some time ago.

The overall accuracy of their forecasts is on a level with your average African witchdoctor.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.