Insurance

Government releases standard confirming how much P there needs to be in a property for it to be considered contaminated, and how you need to get rid of it

29th Jun 17, 11:10am

35

Government releases standard confirming how much P there needs to be in a property for it to be considered contaminated, and how you need to get rid of it

Jenée Tibshraeny questions whether Vero is being conniving or business savvy trying to prevent the competition watchdog from airing its concerns about the insurer's bid to buy Tower; Meanwhile Tower enters trading halt as it considers higher bid from Vero

26th Jun 17, 9:37am

1

Jenée Tibshraeny questions whether Vero is being conniving or business savvy trying to prevent the competition watchdog from airing its concerns about the insurer's bid to buy Tower; Meanwhile Tower enters trading halt as it considers higher bid from Vero

Auckland Mayor Phil Goff calls for the introduction of a building warranty or insurance scheme to avoid ratepayers forking out another $600m in a leaky homes saga; Govt to release paper on this soon

17th Jun 17, 8:18am

43

Auckland Mayor Phil Goff calls for the introduction of a building warranty or insurance scheme to avoid ratepayers forking out another $600m in a leaky homes saga; Govt to release paper on this soon

Andrew Hooker retells a horror story of how new Christchurch homeowners were left $200k out of pocket due to EQC errors made after the 2010/11 earthquakes & argues for a commission of enquiry

13th Jun 17, 2:29pm

22

Andrew Hooker retells a horror story of how new Christchurch homeowners were left $200k out of pocket due to EQC errors made after the 2010/11 earthquakes & argues for a commission of enquiry

Election 2017 - Party Policies - Housing - Insurance

27th May 17, 9:32am

Election 2017 - Party Policies - Housing - Insurance

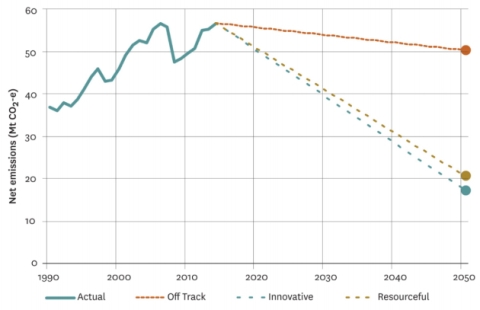

Allan Barber reviews a cross-party review of how to achieve climate targets, one that will entail a difficult transition for rural economies

19th Apr 17, 8:44am

1

Allan Barber reviews a cross-party review of how to achieve climate targets, one that will entail a difficult transition for rural economies

Revenue Minister Judith Collins says government yet to decide whether bank capital will be included in the crackdown on corporates' use of hybrid mismatches

6th Mar 17, 10:33am

Revenue Minister Judith Collins says government yet to decide whether bank capital will be included in the crackdown on corporates' use of hybrid mismatches

Insurance lawyer calls for playing field to be leveled in NZ so insurers suffer the same consequences as their customers if they tell porkies

22nd Feb 17, 7:57am

7

Insurance lawyer calls for playing field to be leveled in NZ so insurers suffer the same consequences as their customers if they tell porkies

Cameron Preston crunches the numbers to explore whether it is Tower or NZ's insurance system that is 'broken'

18th Feb 17, 7:30am

10

Cameron Preston crunches the numbers to explore whether it is Tower or NZ's insurance system that is 'broken'

ASB breaks the half billion dollar mark for six month profit; chief executive lauds 'strong momentum'

15th Feb 17, 10:05am

11

ASB breaks the half billion dollar mark for six month profit; chief executive lauds 'strong momentum'

Gareth Vaughan questions whether ANZ NZ will benefit from the ANZ group selling UDC, and would benefit from selling its KiwiSaver heavy wealth unit

1st Feb 17, 10:23am

6

Gareth Vaughan questions whether ANZ NZ will benefit from the ANZ group selling UDC, and would benefit from selling its KiwiSaver heavy wealth unit

How EQC has avoided being stung by rising land values; Cameron Preston has the back story to the legal action IAG and Tower have launched against EQC

28th Jan 17, 8:21am

4

How EQC has avoided being stung by rising land values; Cameron Preston has the back story to the legal action IAG and Tower have launched against EQC

EQC responds to accusations it blacklisted a vulnerable quake victim after wrongly accusing her of lying to get a free heat pump

25th Jan 17, 10:10am

9

EQC responds to accusations it blacklisted a vulnerable quake victim after wrongly accusing her of lying to get a free heat pump

EQC's 'unaccountable actions' see Christchurch woman 'wrongly' accused of fraud and left uninsurable, says Andrew Hooker

11th Jan 17, 4:29pm

30

EQC's 'unaccountable actions' see Christchurch woman 'wrongly' accused of fraud and left uninsurable, says Andrew Hooker

We look back on a big, successful year and reveal our most popular stories; announce expanded coverage for 2017

28th Dec 16, 5:02am

16

We look back on a big, successful year and reveal our most popular stories; announce expanded coverage for 2017

Local Tourism and primary production impacted; losses offset by reconstruction activity; national impact minor

6th Dec 16, 10:00am

Local Tourism and primary production impacted; losses offset by reconstruction activity; national impact minor

Insurance lawyer bites back at Tower chairman for slagging the litigation industry, he claims 'sprung up to agitate disenfranchised customers to demand not just fair resolution, but a windfall'

6th Dec 16, 5:02am

14

Insurance lawyer bites back at Tower chairman for slagging the litigation industry, he claims 'sprung up to agitate disenfranchised customers to demand not just fair resolution, but a windfall'

RBNZ says Kaikoura quakes could cost NZ$3-8 billion, including up to NZ$3 bln of Govt spend and up to NZ$5 bln of insurance; still confident on economy; says insurers can handle claims

30th Nov 16, 4:05pm

2

RBNZ says Kaikoura quakes could cost NZ$3-8 billion, including up to NZ$3 bln of Govt spend and up to NZ$5 bln of insurance; still confident on economy; says insurers can handle claims

RBNZ warns in Financial Stability Report that housing imbalances remain; Wheeler says won't use Debt To Income multiple restriction 'at this time'; RBNZ notes rising use by banks of 'hot' overseas funds

30th Nov 16, 9:18am

29

RBNZ warns in Financial Stability Report that housing imbalances remain; Wheeler says won't use Debt To Income multiple restriction 'at this time'; RBNZ notes rising use by banks of 'hot' overseas funds

Treasury publishes Long Term Fiscal Position forecasts; repeats 2013 warning that net debt will blow out to around 200% of GDP by 2060 without changes to NZ Super indexation and age

22nd Nov 16, 6:32pm

37

Treasury publishes Long Term Fiscal Position forecasts; repeats 2013 warning that net debt will blow out to around 200% of GDP by 2060 without changes to NZ Super indexation and age

Insurers put embargo on transferring home insurance from vendors to buyers from Rakaia to Masterton; Wellington deals frozen as mortgages impossible without insurance, say agents; Boom stopped dead in its tracks

17th Nov 16, 10:23am

43

Insurers put embargo on transferring home insurance from vendors to buyers from Rakaia to Masterton; Wellington deals frozen as mortgages impossible without insurance, say agents; Boom stopped dead in its tracks

Andrew Hooker on how to side-step the insurance problems experienced by Cantabs after the 2010/11 earthquakes

16th Nov 16, 5:02am

6

Andrew Hooker on how to side-step the insurance problems experienced by Cantabs after the 2010/11 earthquakes

Key says main road and rail route from Picton to Christchurch may need realignment or re-routing in long term at huge cost; English highlights damage to main transport links and says Govt finances can handle repair costs

15th Nov 16, 1:06pm

34

Key says main road and rail route from Picton to Christchurch may need realignment or re-routing in long term at huge cost; English highlights damage to main transport links and says Govt finances can handle repair costs

7.5 earthquake near Hanmer at 12.02 am damages Kaikoura; felt strongly in Wellington; reports of damage in Wellington buildings; Tsunami warning downgraded

14th Nov 16, 6:31am

66

7.5 earthquake near Hanmer at 12.02 am damages Kaikoura; felt strongly in Wellington; reports of damage in Wellington buildings; Tsunami warning downgraded

The Morgan Foundation accuses the Government of choosing a process that will violate both the Kyoto Protocol and the Paris Agreement for how we meet our climate change commitments

5th Nov 16, 9:10am

2

The Morgan Foundation accuses the Government of choosing a process that will violate both the Kyoto Protocol and the Paris Agreement for how we meet our climate change commitments