Kiwibank

Kiwibank unveils how much of its mortgage book is exposed to coastal flood risk, ahead of regulation around climate risk reporting and pricing ramping up

3rd Nov 21, 8:15am

19

Kiwibank unveils how much of its mortgage book is exposed to coastal flood risk, ahead of regulation around climate risk reporting and pricing ramping up

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

1st Nov 21, 7:16pm

67

Ahead of some major public policy set pieces, New Zealand's largest mortgage lender follows its rivals with higher rates, pushing its 3 year fixed rate to the highest of any bank for that term. ASB goes even higher

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

28th Oct 21, 8:54pm

42

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

BNZ raises its term deposit offers sharply, and is now the market-leading main bank, even offering a 3% rate for a five year term. These sharp moves might have an outsized impact on challenger banks

27th Oct 21, 10:31am

44

BNZ raises its term deposit offers sharply, and is now the market-leading main bank, even offering a 3% rate for a five year term. These sharp moves might have an outsized impact on challenger banks

Kiwibank economists say there's currently an 'imbalance' in the wholesale interest rate markets and they see more 'upside risk' for mortgage rates

26th Oct 21, 3:15pm

28

Kiwibank economists say there's currently an 'imbalance' in the wholesale interest rate markets and they see more 'upside risk' for mortgage rates

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

26th Oct 21, 9:21am

29

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

22nd Oct 21, 9:08am

37

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

The Red Bank follows ANZ with a range of interest rate increases for both home loans and term deposits

21st Oct 21, 1:25pm

75

The Red Bank follows ANZ with a range of interest rate increases for both home loans and term deposits

ANZ's term deposit rate increases are probably just for show because the resulting rate offers are far below inflation, and still meaningless to most savers, especially in a rising rate market

21st Oct 21, 10:22am

6

ANZ's term deposit rate increases are probably just for show because the resulting rate offers are far below inflation, and still meaningless to most savers, especially in a rising rate market

Following the sharp wholesales rate rises, NZ's largest home loan lender takes fixed mortgage rates up to another level. It also raises term deposit rates

21st Oct 21, 8:36am

118

Following the sharp wholesales rate rises, NZ's largest home loan lender takes fixed mortgage rates up to another level. It also raises term deposit rates

Labour market and inflation figures 'strongly demand a more aggressive approach by the Reserve Bank'

BNZ economists say the RBNZ is now 'well and truly behind the curve' as inflation heads to 'a number well above 5%'

18th Oct 21, 2:56pm

46

BNZ economists say the RBNZ is now 'well and truly behind the curve' as inflation heads to 'a number well above 5%'

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

15th Oct 21, 4:23pm

5

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

14th Oct 21, 12:29pm

21

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

'The rebound is looking less like last year’s Red bull-powered hill sprint, and more like a herbal tea inspired jog uphill'

12th Oct 21, 10:31am

9

'The rebound is looking less like last year’s Red bull-powered hill sprint, and more like a herbal tea inspired jog uphill'

BNZ follows ANZ and raises its floating mortgage rate by less than the RBNZ OCR increase, completing adjustments from the main banks. But the challenger banks are all yet to follow

8th Oct 21, 10:46am

12

BNZ follows ANZ and raises its floating mortgage rate by less than the RBNZ OCR increase, completing adjustments from the main banks. But the challenger banks are all yet to follow

Westpac raises floating mortgage rates by 25bps and increases some savings rates too

7th Oct 21, 2:01pm

4

Westpac raises floating mortgage rates by 25bps and increases some savings rates too

Some banks move quickly to raise their floating mortgage rates now the RBNZ has hiked the OCR. Here is where each bank stands

6th Oct 21, 2:40pm

7

Some banks move quickly to raise their floating mortgage rates now the RBNZ has hiked the OCR. Here is where each bank stands

NZIER Quarterly Survey of Business Opinion shows the building sector has gone from being the most optimistic to the most pessimistic sectors surveyed

5th Oct 21, 10:55am

4

NZIER Quarterly Survey of Business Opinion shows the building sector has gone from being the most optimistic to the most pessimistic sectors surveyed

The NZIER's latest 'Shadow Board' review ahead of this week's OCR decision shows businesses going cooler on interest rate rises

4th Oct 21, 11:31am

20

The NZIER's latest 'Shadow Board' review ahead of this week's OCR decision shows businesses going cooler on interest rate rises

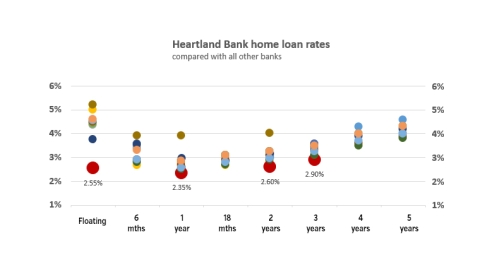

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

1st Oct 21, 10:38am

16

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

28th Sep 21, 6:40pm

26

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

28th Sep 21, 1:30pm

1

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

With wholesale interest rates on the rise as the markets expect an OCR rise soon, we check where term deposit rates are now and how they compare to Aussie rates, where no rate rises are on the horizon

19th Sep 21, 6:00am

18

With wholesale interest rates on the rise as the markets expect an OCR rise soon, we check where term deposit rates are now and how they compare to Aussie rates, where no rate rises are on the horizon

Economists see the very strong second-quarter GDP figures as providing a green light for the Reserve Bank to begin raising interest rates

16th Sep 21, 3:11pm

33

Economists see the very strong second-quarter GDP figures as providing a green light for the Reserve Bank to begin raising interest rates

ASB sets a new tone in the mortgage market with 30 basis points rate hikes for the most popular fixed home loan terms, takes 18 month and two year rates above 3%. Westpac has matched them

16th Sep 21, 9:30am

31

ASB sets a new tone in the mortgage market with 30 basis points rate hikes for the most popular fixed home loan terms, takes 18 month and two year rates above 3%. Westpac has matched them