Mortgages

Westpac NZ annual profit bounces back after major reversal in loan impairments

1st Nov 21, 10:23am

9

Westpac NZ annual profit bounces back after major reversal in loan impairments

CEO Antonia Watson says 'the confidence dial' needs to shift from home loan borrowers to business & agriculture borrowers to reverse the rise of housing lending as a percentage of ANZ NZ's total lending

29th Oct 21, 2:07pm

4

CEO Antonia Watson says 'the confidence dial' needs to shift from home loan borrowers to business & agriculture borrowers to reverse the rise of housing lending as a percentage of ANZ NZ's total lending

Volatility and a lack of liquidity causing ructions in local wholesale money markets, which isn't good news for people with home loans

29th Oct 21, 12:46pm

48

Volatility and a lack of liquidity causing ructions in local wholesale money markets, which isn't good news for people with home loans

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

28th Oct 21, 8:54pm

42

A whiff of instability and broken deal making stalks wholesale money markets, suddenly raising the stakes for indebted homeowners, especially those who need to roll over soon

BNZ to restrict investors and owner-occupiers from getting mortgages worth more than six times their income; ASB already using debt-to-income restrictions

28th Oct 21, 3:30pm

162

BNZ to restrict investors and owner-occupiers from getting mortgages worth more than six times their income; ASB already using debt-to-income restrictions

ANZ NZ's annual profit pushes above $1.9 billion helped by strong housing lending and lower loan provisions; 70% of total lending now housing lending

28th Oct 21, 10:03am

50

ANZ NZ's annual profit pushes above $1.9 billion helped by strong housing lending and lower loan provisions; 70% of total lending now housing lending

Latest Reserve Bank monthly figures show $6.9 billion of mortgages were advanced - which is just $400 mln short of a then record total recorded in September last year

27th Oct 21, 3:39pm

22

Latest Reserve Bank monthly figures show $6.9 billion of mortgages were advanced - which is just $400 mln short of a then record total recorded in September last year

Kiwibank economists say there's currently an 'imbalance' in the wholesale interest rate markets and they see more 'upside risk' for mortgage rates

26th Oct 21, 3:15pm

28

Kiwibank economists say there's currently an 'imbalance' in the wholesale interest rate markets and they see more 'upside risk' for mortgage rates

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

26th Oct 21, 9:21am

29

All the main banks have now moved fixed mortgage rates up so we can assess where they settled, who has the lowest, and note the non-rate inducements being offered by som

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

22nd Oct 21, 9:08am

37

More banks jump on the fixed mortgage rate rise bandwagon as background wholesale rates push up both locally and internationally

The Red Bank follows ANZ with a range of interest rate increases for both home loans and term deposits

21st Oct 21, 1:25pm

75

The Red Bank follows ANZ with a range of interest rate increases for both home loans and term deposits

Following the sharp wholesales rate rises, NZ's largest home loan lender takes fixed mortgage rates up to another level. It also raises term deposit rates

21st Oct 21, 8:36am

118

Following the sharp wholesales rate rises, NZ's largest home loan lender takes fixed mortgage rates up to another level. It also raises term deposit rates

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

15th Oct 21, 4:23pm

5

Not only are wholesale rates rising, but banks are coming out of a period where their mortgage margins have been suppressed. Expect the new round of rate hikes to do some catch-up

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

14th Oct 21, 12:29pm

21

Wholesale rate pressure has pushed one of our largest home loan lenders to raise some key fixed rates and setting their market offerings as the highest available

BNZ follows ANZ and raises its floating mortgage rate by less than the RBNZ OCR increase, completing adjustments from the main banks. But the challenger banks are all yet to follow

8th Oct 21, 10:46am

12

BNZ follows ANZ and raises its floating mortgage rate by less than the RBNZ OCR increase, completing adjustments from the main banks. But the challenger banks are all yet to follow

Westpac raises floating mortgage rates by 25bps and increases some savings rates too

7th Oct 21, 2:01pm

4

Westpac raises floating mortgage rates by 25bps and increases some savings rates too

David Hargreaves says all the language is around further interest rate rises - but his crystal ball is looking very murky when it comes to our now Covid-hit economy

6th Oct 21, 2:56pm

23

David Hargreaves says all the language is around further interest rate rises - but his crystal ball is looking very murky when it comes to our now Covid-hit economy

Some banks move quickly to raise their floating mortgage rates now the RBNZ has hiked the OCR. Here is where each bank stands

6th Oct 21, 2:40pm

7

Some banks move quickly to raise their floating mortgage rates now the RBNZ has hiked the OCR. Here is where each bank stands

The NZIER's latest 'Shadow Board' review ahead of this week's OCR decision shows businesses going cooler on interest rate rises

4th Oct 21, 11:31am

20

The NZIER's latest 'Shadow Board' review ahead of this week's OCR decision shows businesses going cooler on interest rate rises

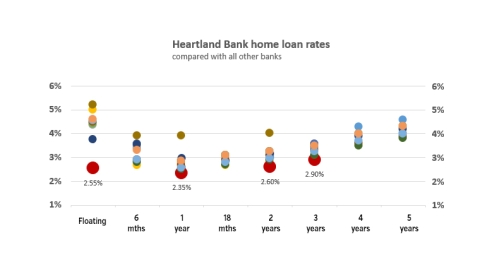

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

1st Oct 21, 10:38am

16

Heartland Bank raises all its home loan interest rates but still retains the claim to the lowest rates available from any bank. Home loan market awaits the RBNZ's signals next Wednesday

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

28th Sep 21, 6:40pm

26

ANZ moves to raise rates back up to levels first adopted by rival ASB, taking some longer term rates back closer to 5%

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

28th Sep 21, 1:30pm

1

Rising wholesale money costs are pressing banks to raise rates, but the pace of the rises vary among institutions. That means exploitable advantages are available for borrowers who need to fix now

Fairness issues raised over Reserve Bank's decision to close the door on first-home buyers who don't have deposits of at least 20%

27th Sep 21, 5:26pm

35

Fairness issues raised over Reserve Bank's decision to close the door on first-home buyers who don't have deposits of at least 20%

The Reserve Bank is widely expected to raise the Official Cash Rate to 0.5% from the current 0.25% next week

27th Sep 21, 2:52pm

11

The Reserve Bank is widely expected to raise the Official Cash Rate to 0.5% from the current 0.25% next week

ASB economists calculate that every one percentage point increase in mortgage interest rates would add $3.3 bln to NZ's household debt servicing costs

23rd Sep 21, 2:05pm

22

ASB economists calculate that every one percentage point increase in mortgage interest rates would add $3.3 bln to NZ's household debt servicing costs